The Offer

Company Overview

NVL is the leading producer of innovative, sustainable aluminum solutions and the world's largest recycler of aluminum, with a strong emphasis on providing low-carbon aluminum solutions. We operate a global network of 32 advanced facilities, including 14 recycling centers and 11 innovation centers, employing 13,190 people to serve diverse markets such as beverage packaging, automotive, aerospace, and specialties across North America, Europe, Asia, and South America.

Key Highlights

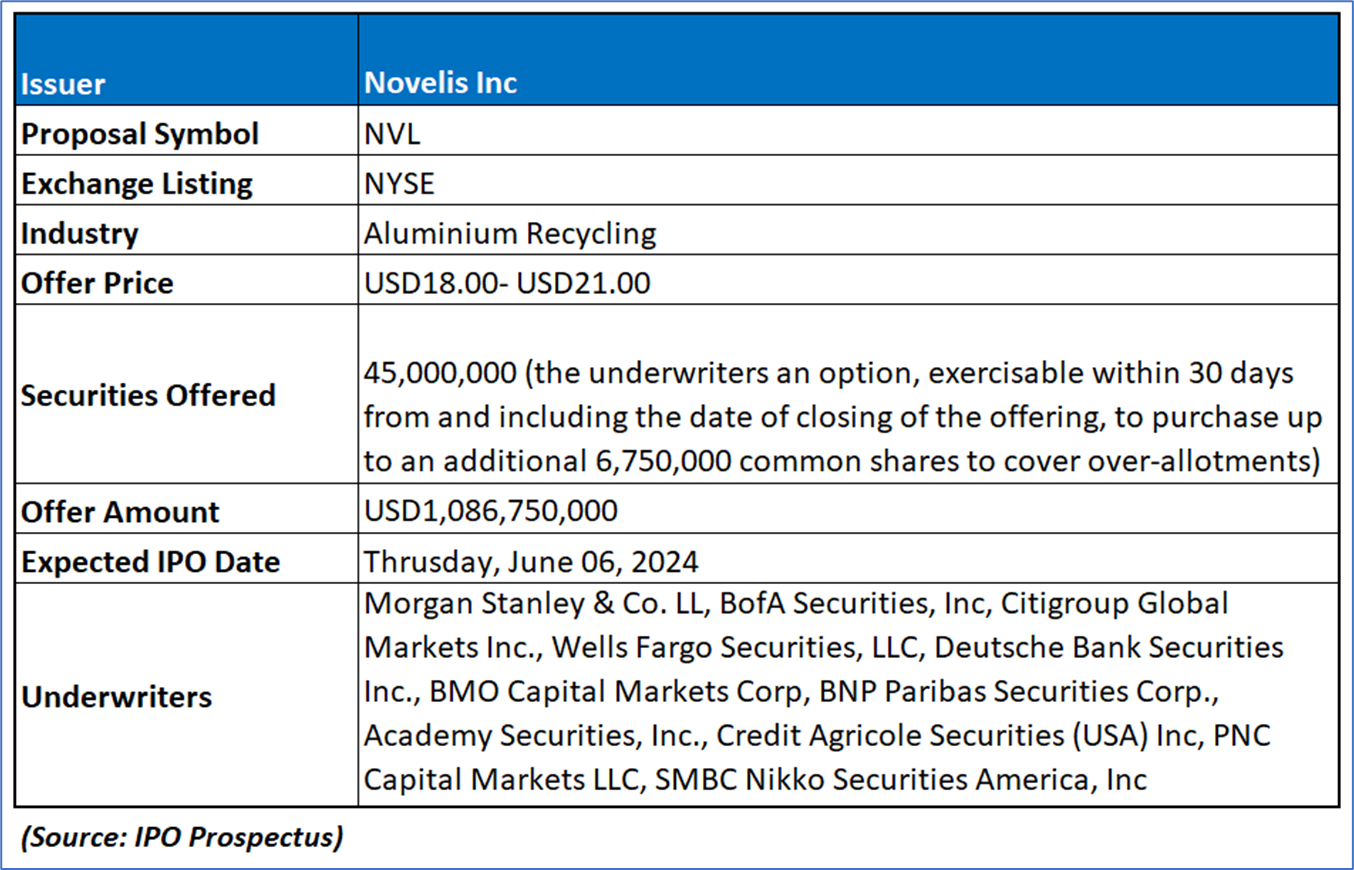

Primary Offering:

NVL’s shareholders anticipates issuing 45,000,000 shares (the underwriters an option, exercisable within 30 days from and including the date of closing of the offering, to purchase up to an additional 6,750,000 common shares to cover over-allotments)

Use of proceeds:

The selling shareholder is offering all the common shares, including any additional shares sold upon the exercise of the underwriters' option. Consequently, the selling shareholder will receive all net proceeds from this sale, and we will not receive any proceeds from the sale of our common shares in this offering.

Dividend policy:

NVL plans to distribute quarterly dividends of approximately USD25 million to its shareholders on a pro-rata basis, subject to the discretion of the board of directors. These payments are contingent on factors such as NVL's financial resources, business cash flows, cash requirements, and restrictions under its debt agreements. In the fourth quarter of fiscal 2024, NVL paid a USD100 million return of capital to its common shareholder, with similar payments made in the second quarters of fiscal 2023 and 2022. However, past payments should not be construed as a guarantee of future dividends or returns of capital in the same amounts or at all.

Industry Analysis:

- Beverage Packaging: Can stock shipments represent the largest percentage of NVL's total rolled product shipments. According to CRU, global demand for can stock (excluding China) is expected to grow at a compound annual growth rate of approximately 4% from 2023 to 2031. However, NVL experienced reduced can sheet demand from mid-2023 to early 2024 due to the beverage packaging industry reducing excess inventory accumulated during the COVID-19 pandemic and low promotional activity at retailers. Demand has largely recovered as industry inventory levels normalized and promotional activities resumed.

- Automotive: NVL anticipates long-term growth in aluminum demand driven by increased adoption of electric vehicles (EVs), which utilize higher amounts of aluminum. Management estimates global automotive aluminum sheet demand will grow at a compound annual growth rate of 7% from 2023 to 2028. Ducker Carlisle projects North American automotive aluminum sheet demand to increase by approximately 40% from 2022 to 2030, aligning with NVL's growth estimates. Demand in Europe is expected to grow at a slightly higher rate, with the Asian market increasing at a steeper rate from a lower baseline in 2023. Easing supply chain challenges and pent-up consumer demand are supporting strong near-term demand for automotive aluminum sheet.

- Aerospace: Passenger air travel is increasing, facilitating a faster-than-anticipated recovery for the aerospace industry post-pandemic. NVL expects demand for aerospace aluminum plate and sheet to continue growing, driven by increased air traffic and the need for fleet modernization.

- Specialties: Specialties include diverse markets such as building and construction, commercial transportation, foil and packaging, signage, and commercial and consumer products. These industries are increasingly adopting aluminum due to its desirable characteristics. NVL believes these trends will sustain long-term demand, despite near-term economic headwinds affecting demand in building and construction and some industrial products.

- Business and Industry Climate: Approximately a decade ago, NVL launched a multi-year strategy to transform and improve business profitability through significant investment in new capacity and capabilities. As a global leader in the aluminum flat-rolled products industry, NVL leveraged new capacity, a global footprint, scale, and solid customer relationships to drive volumes and capture favorable supply and demand dynamics across all end-markets. This growth, along with improved pricing, increased scrap inputs, operational efficiencies, and high-capacity utilization rates, significantly improved profitability. NVL increased net income per tonne from (USD 12) in fiscal 2016 to USD 163 in fiscal 2024 and Adjusted EBITDA per tonne from USD 308 in fiscal 2016 to USD 510 in fiscal 2024, turning a net loss of USD 38 million into USD 600 million in net income. NVL believes global long-term demand for aluminum rolled products remains strong, driven by anticipated economic growth, material substitution, and sustainability considerations, including increased environmental awareness around PET plastics. While reduced can sheet demand was observed in the latter half of fiscal 2023 due to the beverage packaging industry adjusting to moderated demand post-COVID-19, inventory levels have largely normalized.

- Identified Organic Growth Investments: NVL has identified approximately USD 6.4 billion in debottlenecking, recycling, and new capacity capital investments to meet growing customer demand and align with sustainability commitments. These investments include approximately USD 4.7 billion in North America, USD 300-450 million in Europe, USD 450 million in Asia, and USD 850 million in South America. NVL currently has approximately USD 4.9 billion of investments under construction through 2027 to increase recycling and rolling capacity and profitability. In October 2021, NVL announced a USD 130 million investment in its Oswego, New York, plant to increase hot mill capacity by 124 kt and enhance batch annealing capabilities for automotive sheet. In January 2022, a USD 365 million investment was announced for a new recycling center in Guthrie, Kentucky, to reduce carbon emissions by over one million tonnes annually. A USD 65 million investment in a recycling and casting center at UAL joint venture in South Korea was announced in February 2022, expected to reduce carbon emissions by more than 420 kt annually. Additionally, in October 2022, NVL broke ground on a USD 4.1 billion greenfield rolling and recycling plant in Bay Minette, Alabama, to support beverage packaging and automotive aluminum sheet demand. NVL is also undertaking smaller debottlenecking projects, including a USD 150 million investment at its Logan JV plant for an additional 80 kt of rolling capacity, and a USD 50 million investment at its Pindamonhangaba, Brazil plant for an additional 70 kt of rolling capacity.

Financial Highlights (Results of Operations) (Expressed in USD)

- Disciplined Investment Strategy Fuels Profitability: NVL has consistently invested in strategic growth opportunities. The company allocated USD2.8 billion between 2012 and 2022 for capital expenditures and the Aleris acquisition, significantly expanding its rolling, recycling, and automotive finishing sheet production capacity. Currently, NVL is engaged in a new phase of organic investments (fiscal years 2023-2027) with a planned USD4.9 billion to further enhance recycling, rolling capacity, and profitability. As of fiscal 2024, USD1.2 billion has already been deployed.

- Strategic Initiatives Drive Performance Metrics:

- Net Income Growth: A significant increase in net income, from a loss of USD38 million in fiscal 2016 to a profit of USD600 million in fiscal 2024, translating to a per-tonne improvement of USD175.

- Flat-rolled Products Shipment Growth: Increased flat-rolled product shipments from 3,123 kt in fiscal 2016 to 3,673 kt in fiscal 2024.

- Adjusted EBITDA Expansion: A substantial rise in Adjusted EBITDA, from USD963 million in fiscal 2016 to USD1,873 million in fiscal 2024.

- Consistent Adjusted EBITDA per Tonne Improvement: Continued growth in Adjusted EBITDA per tonne, from USD308 in fiscal 2016 to USD510 in fiscal 2024.

- Strong Cash Flow Generation Supports Growth and Capital Allocation: NVL boasts robust cash flow generation, demonstrated by USD8.2 billion in net cash provided by operating activities and USD3.3 billion in Adjusted Free Cash Flow since fiscal 2016. This strong cash flow allows for flexible capital allocation, including funding internal projects, R&D, maintaining a strong balance sheet, and returning capital to shareholders.

- Financial Leverage Reduction Alongside Growth: Despite significant investments in growth initiatives, both organic and inorganic, NVL has successfully reduced its financial leverage. The company's financial leverage ratio, which measures debt relative to Adjusted EBITDA, has improved from 4.7x in March 2016 to a much healthier 2.3x in March 2024.

- Liquidity Position: NVL believes it has sufficient liquidity to manage its business amidst dynamic metal prices. As of March 31, 2024, NVL's cash, cash equivalents, and availability under committed credit facilities totaled USD 2.3 billion. The company prioritizes capital spending on maintenance for its operations and strategic capacity expansion projects. NVL is prudently phasing transformational organic investment spend and anticipates capital expenditures to rise to approximately USD 1.8 to 2.1 billion for fiscal 2025, with around USD 300 million allocated for expected maintenance.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “NVL” is exposed to a variety of risks such as:

- Dependency on Significant Customers: NVL's revenue is highly dependent on a few major customers, with the top 10 customers accounting for 48%-54% of total net sales from fiscal 2022 to fiscal 2024. Disruptions or changes in the business or financial health of these significant customers could negatively impact NVL's operations and cash flow. Customer consolidation and changes in contractual terms may also lead to reduced demand or lower revenues.

- Intense Market Competition: NVL operates in highly competitive markets, facing competition on price, quality, product range, and other factors. Competitors with more efficient technologies or lower costs may gain market share. Increased competition or new market entrants could lead to loss of customers or pressure to reduce prices, adversely affecting NVL's financial performance.

- Material Substitution Risk: NVL's products compete with alternative materials like steel, plastics, composites, and glass. Changes in customer preferences towards these substitutes due to price or performance advantages could decrease demand for aluminum products, impacting NVL’s business and financial results.

- Uncertain Returns on Strategic Investments: NVL has made significant investments in capacity expansion and recycling. However, if production levels and margins do not meet expectations or if competing investments outperform, NVL may not realize the anticipated returns. Risks include higher costs, project delays, or failure to achieve expected synergies.

Conclusion

NVL, the leading producer of sustainable aluminum solutions, presents a compelling investment opportunity with its global network of advanced facilities and diversified market presence across North America, Europe, Asia, and South America. With a strong emphasis on low-carbon aluminum solutions and a focus on sectors like beverage packaging, automotive, aerospace, and specialties, NVL is well-positioned to capitalize on long-term industry growth trends. The company's disciplined investment strategy has fueled profitability, evidenced by significant net income growth, increased product shipments, and consistent expansion of Adjusted EBITDA per tonne. Moreover, NVL's strong cash flow generation supports growth initiatives and capital allocation priorities, including strategic investments to meet growing customer demand and sustainability commitments. Despite risks associated with customer dependency, market competition, material substitution, and uncertainty in returns on strategic investments, NVL's robust financial performance, reduced financial leverage, and prudent liquidity management underscore its resilience and potential for sustained growth in the global aluminum market.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Novelis Inc (NVL)” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.