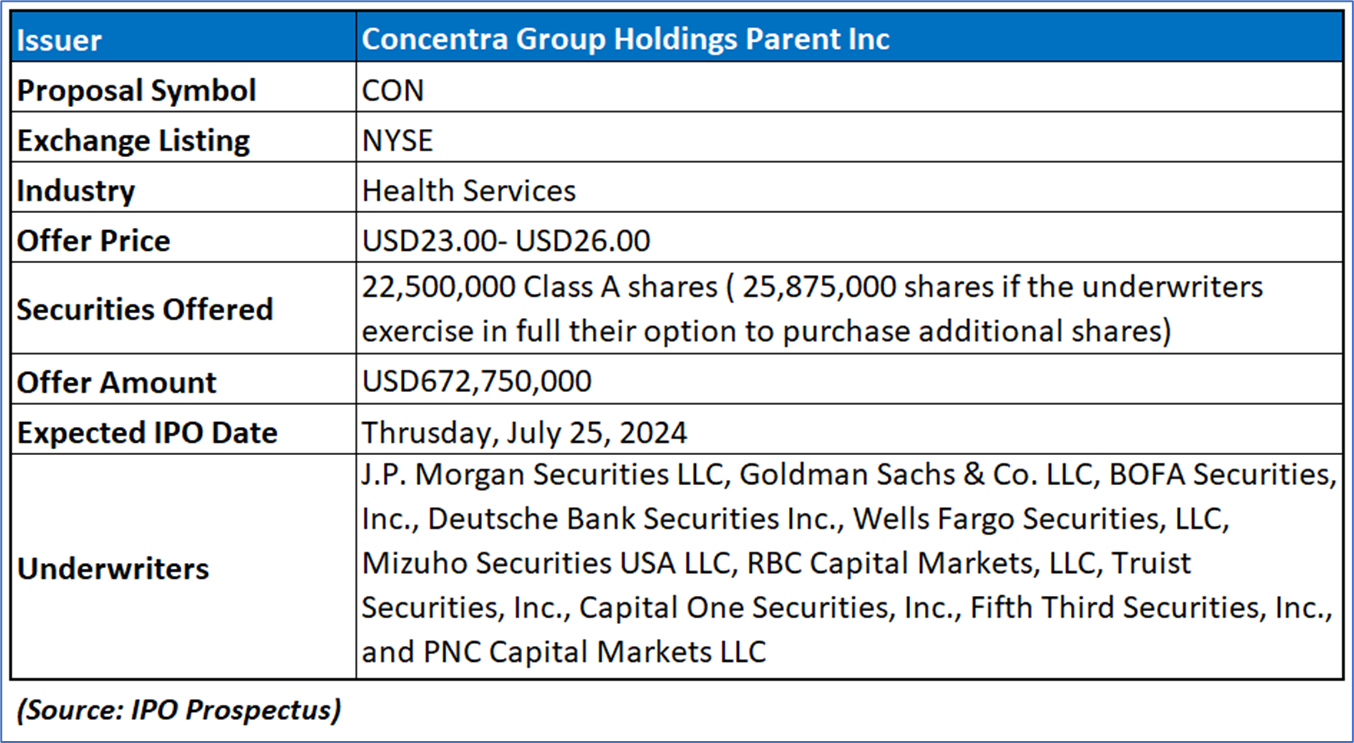

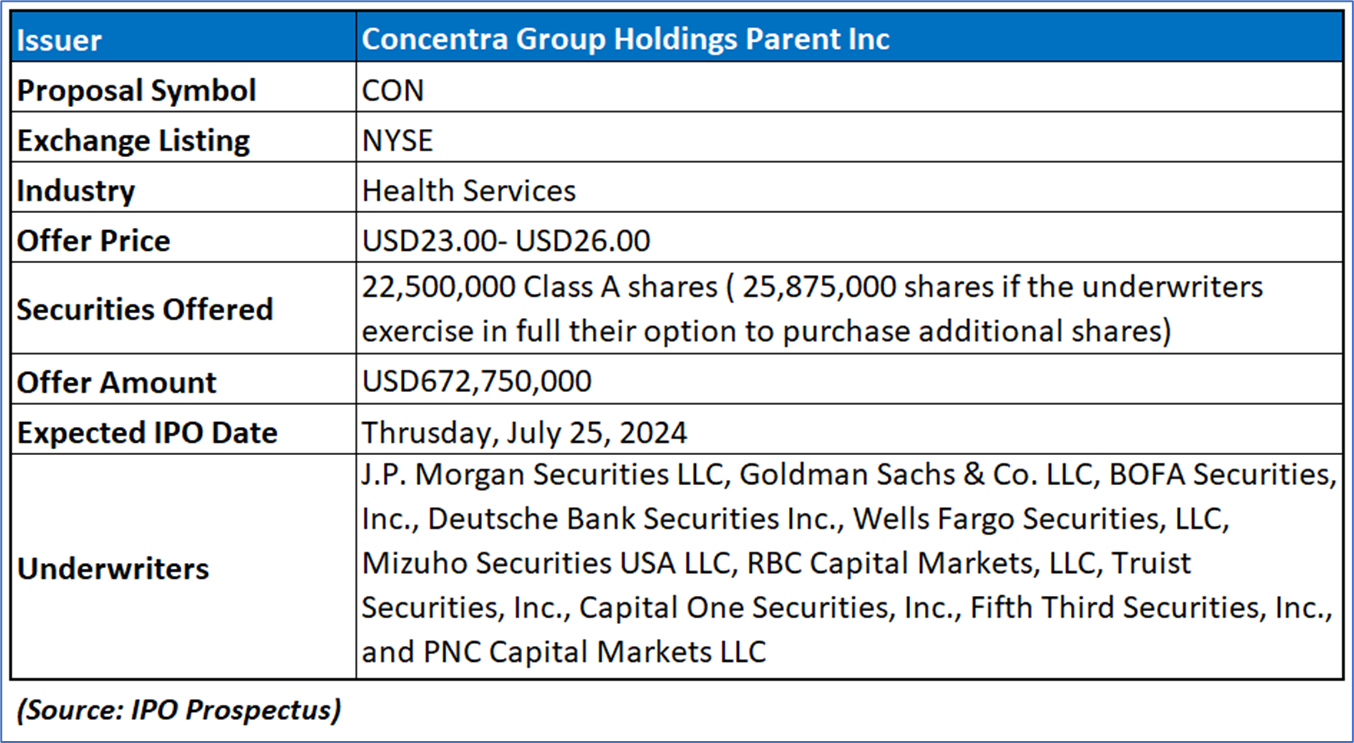

The Offer

Company Overview

Founded in 1979, CON has become the largest provider of occupational health services in the United States by number of locations, operating 547 health centers in 41 states and 151 onsite clinics at employer worksites in 37 states as of March 31, 2024. Additionally, CON's telemedicine program serves 43 states and the District of Columbia. With approximately 11,000 colleagues and affiliated clinicians, CON delivers a comprehensive suite of occupational and consumer health services to over 50,000 patients daily. The business is organized into three segments: Occupational Health Centers, Onsite Health Clinics, and Other Businesses, which includes Concentra Telemed, Concentra Pharmacy, and Concentra Medical Compliance Administration.

Key Highlights

Primary Offering:

CONs anticipate issuing 22,500,000 Class A shares (25,875,000 shares if the underwriters exercise in full their option to purchase additional shares).

Use of proceeds:

- The net proceeds from this offering are estimated to be approximately USD 513.6 million, potentially increasing to around USD 597.5 million if the underwriters fully exercise their option to purchase additional shares, assuming an initial public offering price of USD 24.50 per share, the midpoint of the price range stated in the prospectus.

- After deducting underwriting discounts, commissions, and offering expenses, the net proceeds will primarily be used to repay USD 470.0 million of an intercompany note held by SMC and USD 43.6 million of a promissory note issued to SMC as a dividend before the offering’s completion.

- Consequently, none of the net proceeds will be allocated to business operations and development. The intercompany note accrues interest at Term SOFR plus 3% and matures when SMC or its affiliates no longer have an interest in Concentra. The promissory note, issued immediately before the offering's completion, will bear interest at the IRS's short-term Applicable Federal Rate and will mature upon the offering's closure or upon receipt of proceeds from the underwriters' option exercise.

- A USD 1.00 increase or decrease in the assumed IPO price would change the net proceeds by approximately USD 21.2 million, while a one million share change would impact the net proceeds by approximately USD 23.1 million.

Dividend policy:

The company plans to recommend a dividend framework for returning capital to stockholders, which the Board may implement post-offering, contingent on various factors including economic conditions and financial health. The Board, primarily composed of independent directors, will have the discretion to declare future dividends. However, dividend payments will be restricted by the company's Credit Facilities, which impose conditions such as maintaining a specific net leverage ratio and are subject to an "Available Amount" cap. Additionally, the company will be prohibited from declaring dividends during any event of default under these Credit Facilities.

Industry Analysis:

- Concentra's Claim Studies: Concentra conducted specific claim studies over a limited period, evaluating approximately 500,000 closed claims from 2020 to 2023 for a select number of customers, including employers and a workers’ compensation insurance carrier. It is important to note that these studies may not be representative of all industry claims. Of the 500,000 closed claims, approximately 412,000 were from non-Concentra health centers.

- Claims Sample and Data Validation: The sample includes workers’ compensation injuries from all states and jurisdictions where the customers operate. This data was obtained through the customers' claims/risk management information systems. For data validation and quality control, approximately 7% of the initial 536,000 claims were excluded. These excluded claims consist of those with no medical payments (1.6%), claims with medical expenses under USD 100 (0.5%), and claims with total medical payments exceeding USD 100,000 (5.0%). This process ensures a comparable claims universe for analysis.

Financial Highlights (Results of Operations) (Expressed in USD)

- Revenue Growth and Performance: For the three months ended March 31, 2024, revenue increased by 2.5% to USD 467.6 million, up from USD 456.3 million for the same period in 2023. This growth was largely due to a rise in revenue per visit. Patient visits totaled 3,155,655, a decrease from 3,217,945 in the previous year, and the total volume of visits per day (VPD) decreased slightly to 49,307 from 50,280. Notably, workers' compensation VPD increased by 2.6% to 22,392, while employer services VPD declined by 5.8% to 25,926, and consumer health VPD rose by 4.0% to 989. Revenue per visit increased by 4.4% to USD 139.09, driven by higher reimbursement rates for workers' compensation visits, increased employer service rates, and a higher proportion of higher-revenue workers' compensation visits.

- Cost of Services and Administrative Expenses: The cost of services for the three months ended March 31, 2024, was USD 337.0 million, representing 72.1% of revenue, compared to USD 328.1 million or 71.9% of revenue for the same period in 2023. This expense encompasses all direct and indirect costs related to providing services to customers. General and administrative expenses were USD 36.9 million, or 7.9% of revenue, for the three months ended March 31, 2024, up from USD 34.7 million, or 7.6% of revenue, for the same period in 2023. This increase includes USD 2.0 million in separation transaction costs.

- Depreciation, Amortization, and Operating Income: Depreciation and amortization expenses amounted to USD 18.5 million for the three months ended March 31, 2024, compared to USD 18.3 million for the same period in 2023. Additionally, the company reported other operating income of USD 0.3 million for the three months ended March 31, 2024. For the previous year, equity in losses of unconsolidated subsidiaries was USD 0.5 million due to the write-down of an investment.

- Interest Expenses and Taxation: Interest expense on related party debt with Select was USD 10.0 million for the three months ended March 31, 2024, a decrease from USD 11.1 million for the same period in 2023, attributed to lower average outstanding borrowings. Interest expense remained at USD 0.1 million for both periods. Income tax expense was USD 15.1 million for the three months ended March 31, 2024, reflecting an effective tax rate of 23.1%, compared to USD 16.2 million and an effective tax rate of 25.4% for the same period in 2023.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “CON” is exposed to a variety of risks such as:

- Decline in Work-Related Injuries: A significant risk to the company’s operations is the potential decline in work-related injuries and illnesses. Improvements in workplace safety, increased access to health insurance, and the transition from a manufacturing-based to a service-based economy have led to healthier, less injury-prone employees. This trend, coupled with enhanced employer-sponsored wellness programs, may result in fewer workers' compensation claims, adversely impacting the company’s business, financial condition, and results of operations.

- Adverse Changes in Key Relationships: The company faces risks associated with adverse changes in relationships with significant employer customers, third-party payors, and workers’ compensation or employer services networks. The loss of major customers or the impact of acquisitions within these networks could significantly affect the company’s profitability and operating performance. Changes in market conditions or competitive pressures might also lead to the discontinuation of key relationships, potentially resulting in a decline in revenue and overall business performance.

- Regulatory and Compliance Challenges: Operating in a heavily regulated industry exposes the company to risks from changes in regulations or enforcement practices. The healthcare sector is subject to extensive federal, state, and local regulations concerning licensure, financial relationships, and patient information safeguarding. Non-compliance with these regulations could lead to fines, penalties, or loss of licensure and accreditation. Additionally, heightened enforcement efforts and potential future investigations could increase operational costs, reduce revenue, or lead to significant operational changes.

Conclusion

CON, the largest provider of occupational health services in the U.S., represents a compelling IPO opportunity due to its extensive operational footprint, including 547 health centers and 151 onsite clinics across 41 states. With a robust telemedicine program serving 43 states and a solid track record of serving over 50,000 patients daily, CON offers a diverse suite of services. The company’s recent revenue growth, increasing revenue per visit, and a strategic plan to utilize IPO proceeds to reduce significant debt highlight its commitment to financial health. Moreover, CON's sector-leading position and ability to adapt to evolving healthcare needs underscore its strong market potential. While facing risks like regulatory challenges and fluctuating worker compensation trends, CON's expansive infrastructure and diversified services present a promising investment opportunity.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Concentra Group Holdings Parent Inc (CON)” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...