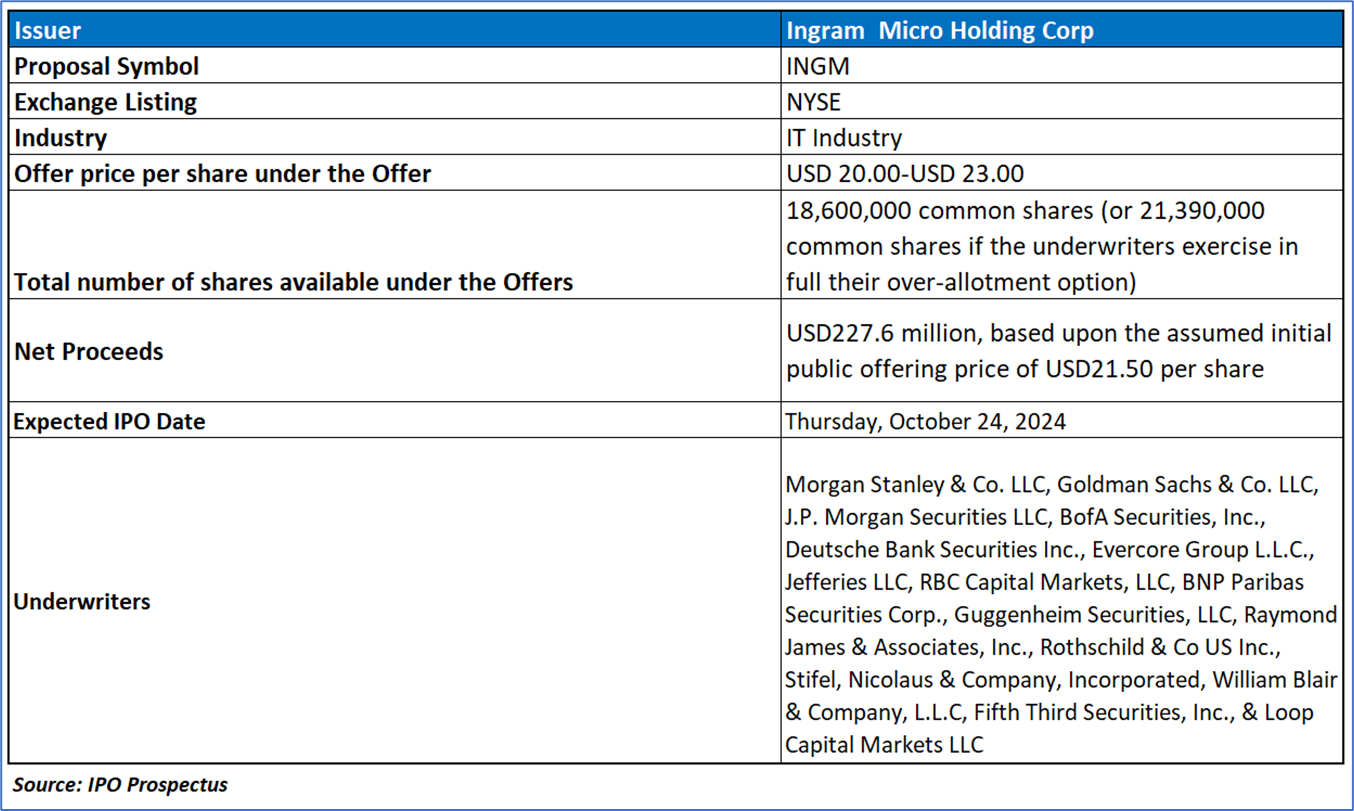

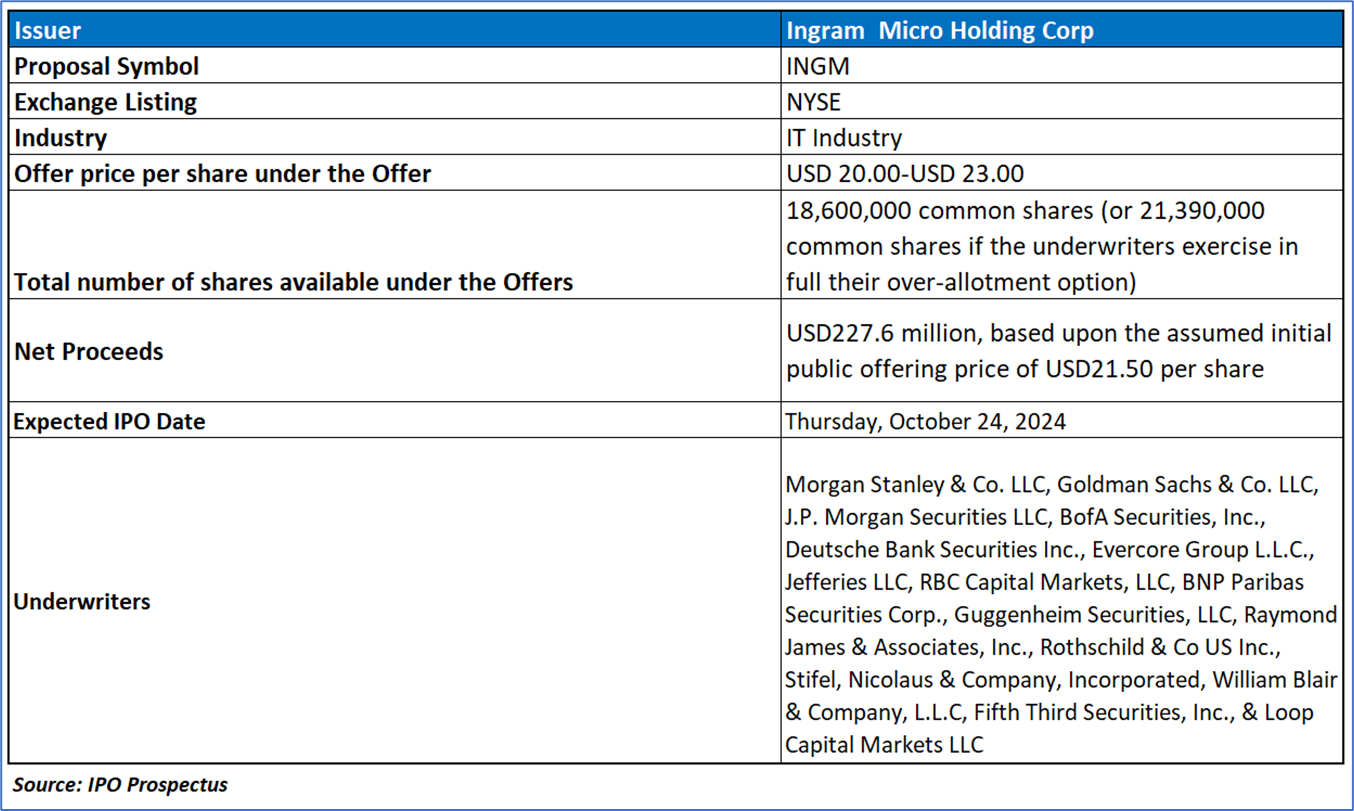

The Offer

Company Overview

Ingram Micro, (INGM) a leading global solutions provider in the IT ecosystem, empowers technology brands through a vast infrastructure focused on client and endpoint solutions, advanced offerings, and cloud-based services. By delivering customized solutions to vendors, resellers, and retailers, the company enables efficient market operations and superior business outcomes for its partners. Ingram Micro simplifies complex technology processes and maximizes the value of products through its extensive global network, reaching nearly 90% of the world’s population. With operations in 57 countries and 134 logistics centers, the company supports over 161,000 customers, offering broad product availability, technical expertise, and professional services such as data-driven insights, pre-sales engineering, post-sales integration, and financing solutions. Positioned at the forefront of technology megatrends like cloud migration, enhanced security, IoT, hybrid work, and 5G, Ingram Micro remains well-placed to benefit from continued global demand for innovative technology solutions.

Key Highlights

Primary Offering:

The total number of shares available under the offers includes 18,600,000 common shares (or 21,390,000 common shares if the underwriters exercise in full their over-allotment option).

Use of proceeds:

Ingram Micro anticipates net proceeds of approximately USD 227.6 million from the sale of 11,600,000 shares of Common Stock at an assumed initial public offering price of USD 21.50 per share, following deductions for underwriting discounts and expenses. These proceeds will be used primarily to repay outstanding indebtedness under the company's Term Loan Credit Facility. However, Ingram Micro will not receive any proceeds from the shares sold by the selling stockholder, who is estimated to generate net proceeds of approximately USD 142.2 million from the sale. Should the underwriters exercise their option to purchase additional shares, the selling stockholder's proceeds may increase to approximately USD 198.9 million.

The company has provided estimates of the potential changes in net proceeds if the offering price or number of shares offered varies. For instance, each USD 1.00 increase or decrease in the offering price would impact on the net proceeds by USD 11.0 million. Additionally, a change of one million shares in the offering could alter net proceeds by approximately USD 20.3 million. Nonetheless, Ingram Micro does not expect such changes to materially affect its intended use of the funds.

The proceeds from the offering will primarily be allocated toward repaying approximately USD 227.6 million of the outstanding USD 1.16 billion Term Loan Credit Facility, which matures in 2031. Several underwriters, including J.P. Morgan Securities, Jefferies LLC, Raymond James & Associates, and Stifel, Nicolaus & Company, are affiliated with lenders under the Term Loan Credit Facility, but none will receive more than 5% of the offering proceeds, thus avoiding conflicts of interest under FINRA regulations.

Industry Overview:

- Industry Growth Drivers: Technological innovation remains a pivotal force propelling growth and efficiency across various sectors, significantly impacting the global IT market. Despite occasional fluctuations in demand for specific technologies, the ongoing digital transformation underscores the necessity for organizations and consumers to invest in advanced technology and security solutions to enhance stakeholder interactions and optimize operational efficiencies. Key trends driving the industry include the sustained growth of cloud services, a heightened emphasis on information security due to increasing cyber threats, and the rapid expansion of connected devices and complex technology solutions. The anticipated rise in the number of Internet of Things (IoT) devices is expected to reach approximately 46 billion by 2025, generating vast amounts of data and further blurring the lines between devices, software, and services.

- Evolving Role of Distributors: As the complexity of technology solutions escalates, distributors are evolving into crucial integrators within the technology ecosystem. They provide a diverse array of services, including consultative sales, engineering support, trade credit, and logistics, which are essential for vendors to effectively aggregate demand and navigate market complexities. This strategic positioning enables distributors to deliver critical product information, multi-vendor expertise, and support services, thereby enhancing customer engagement. Additionally, as environmental concerns and regulatory requirements increase, the role of distributors in managing the safe disposal of IT products and ensuring data security becomes even more vital. By adapting to these dynamics, distributors not only support vendors in their go-to-market strategies but also position themselves as indispensable partners in addressing the evolving needs of end customers.

Ingram Micro’s Comprehensive Product Portfolio and Global Operations

- Comprehensive Product Offerings and Strategic Investments: Ingram Micro’s product, service, and solution offerings encompass Client and Endpoint Solutions, Advanced Solutions, Cloud-based Solutions, and Other categories. These offerings have been influenced by shifts in product mix, including the entry into new markets, the introduction of innovative products, and the exit from certain business areas. In recent years, the company has focused heavily on expanding its Advanced Solutions and Cloud-based Solutions globally. The increasing demand for complex, as-a-service solutions has accelerated growth in these areas, which now constitute more than one-third of the company’s net sales.

- Global Business Operations and Key Lines of Business: Ingram Micro's global presence spans four geographic regions, offering a comprehensive range of hardware, software, cloud services, and logistics expertise. The company operates through three primary lines of business: Technology Solutions, Cloud, and Other. Beginning in the second quarter of 2024, the Commercial & Consumer category was renamed Client and Endpoint Solutions to better reflect the nature of its products and services. Across its geographic segments, Ingram Micro provides a wide range of products tailored to its customers' needs under each of these business lines.

- Cloud-based and Other Specialized Offerings: Ingram Micro’s Cloud-based Solutions offer a diverse portfolio of third-party services and subscriptions, including business applications, security, communications, and infrastructure-as-a-service. This portfolio has expanded to include over 200 third-party services, reflecting the company's strategic move toward XaaS (Everything-as-a-Service). The CloudBlue business offers multi-channel catalog management and billing capabilities through a SaaS model. Additionally, Ingram Micro provides other offerings, such as IT asset disposition (ITAD), reverse logistics, and repair services, although these represent less than 10% of net sales.

Dividend policy:

Ingram Micro plans to begin paying a quarterly cash dividend of USD 0.074 per share on its Common Stock starting in the first quarter of 2025, amounting to approximately USD 70 million in total annual dividends. This represents an annual yield of 1.4% based on a price of USD 21.50 per share, the midpoint of the estimated offering price range. The declaration and payment of future dividends, however, remain at the discretion of the board of directors, considering factors such as the company's financial condition, economic environment, cash needs, and contractual restrictions. Dividends may be reduced or discontinued at any time if deemed necessary by the board.

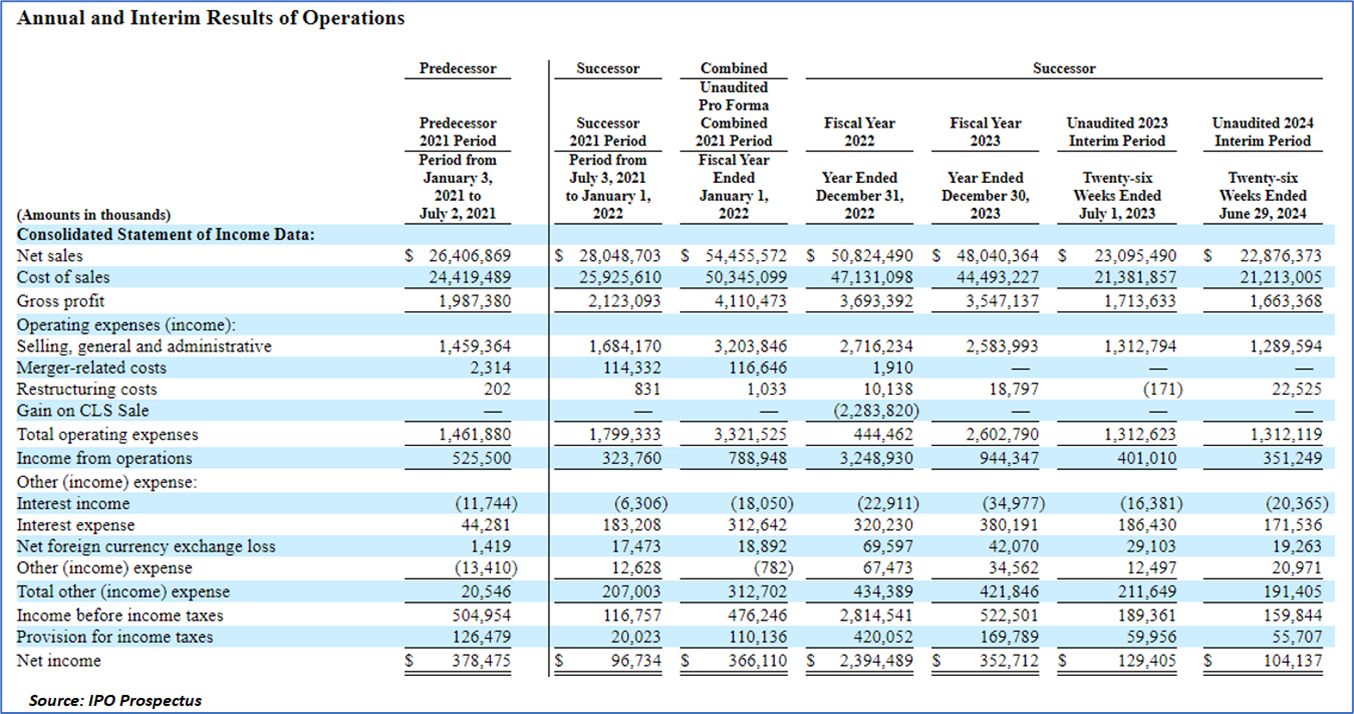

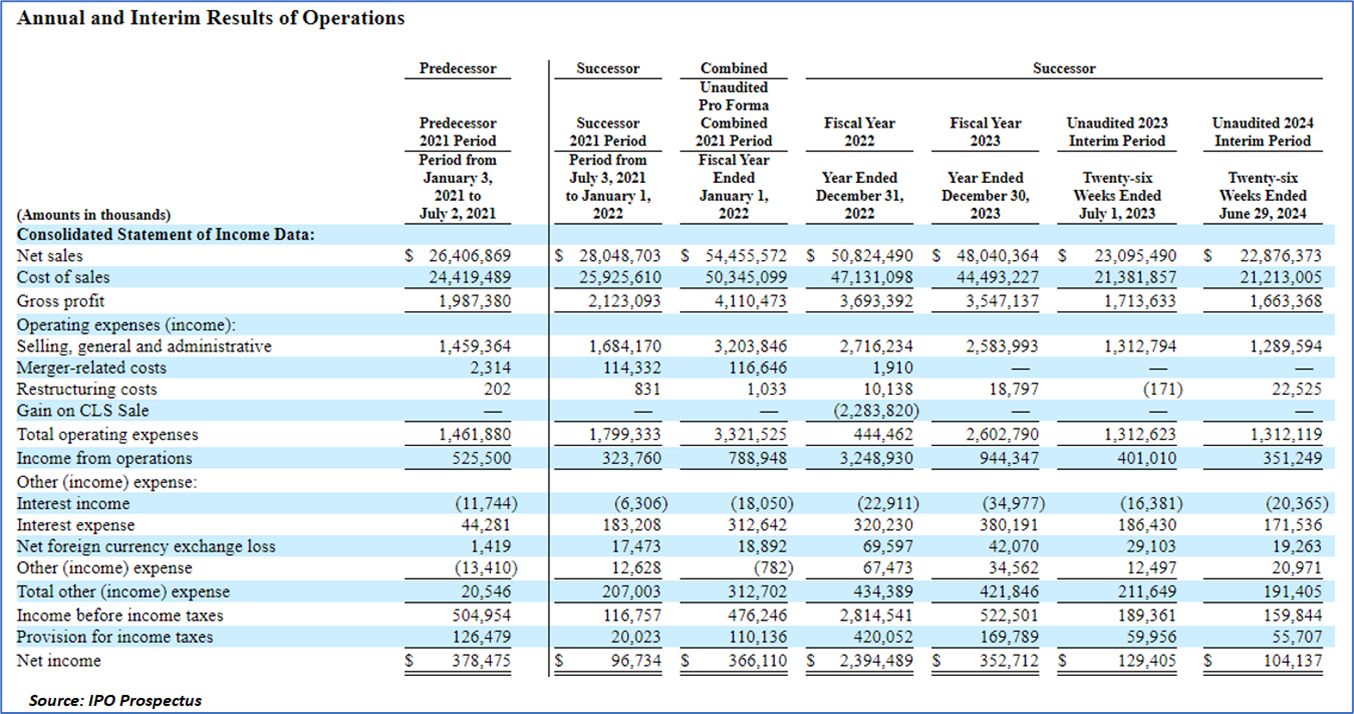

Financial Highlights (Results of Operations) (Expressed in USD)

- Consolidated Net Sales Overview: In the Unaudited 2024 Interim Period (Successor), consolidated net sales amounted to USD 22,876,373, marking a slight decline from the USD 23,095,490 reported in the Unaudited 2023 Interim Period (Successor). This decrease of 0.9% was primarily attributed to reduced sales across North America, EMEA, and Latin America, partially offset by growth in the Asia-Pacific region. The decline in volume, particularly within advanced solutions offerings, followed the fulfillment of significant product backlogs that had positively influenced net sales in the prior year. Advanced solutions offerings witnessed a global decline of 7%, while net sales of other services decreased by 2%.

- Regional Sales Performance: Sales in North America decreased by USD 690,396, or 7.6%, due to a 14% drop in advanced solutions offerings, primarily stemming from declines in networking solutions. EMEA experienced a net sales decline of USD 157,069, or 2.3%, influenced by a 9% reduction in advanced solutions offerings linked to decreased sales in key markets such as Germany and the UK. In contrast, the Asia-Pacific region achieved a substantial increase in net sales, rising by USD 669,963, or 12.6%, driven by double-digit growth across client and endpoint solutions, advanced solutions offerings, and cloud-based solutions. Latin America also experienced a decrease in net sales, down by USD 41,615, or 2.4%, primarily attributed to reduced mobility distribution.

- Gross Profit and Margin Analysis: Gross profit for the Unaudited 2024 Interim Period (Successor) was reported at USD 1,663,368, a decline from USD 1,713,633 in the prior year. The gross margin experienced a decrease of 15 basis points, primarily due to reduced net sales and a shift in the sales mix towards lower-margin offerings. The decline in gross profit was somewhat mitigated by a positive impact from foreign currency translation. Additionally, total selling, general, and administrative (SG&A) expenses decreased by USD 23,029, primarily driven by reductions in compensation, headcount costs, and professional services.

- Net Income and Conclusion: Net income attributable to the Company’s common shareholders for the Unaudited 2024 Interim Period (Successor) was USD 226,578, or USD 0.65 per share, compared to USD 238,239, or USD 0.69 per share, in the prior year. The decline in net income was driven by lower income from operations, heightened restructuring costs, and increased interest expenses. Overall, while the Company faces challenges with declining net sales and profit margins, strategic initiatives aimed at cost management and efficiency improvements are expected to enhance operational performance in the future.

- Liquidity Overview: As of June 29, 2024, the company's cash and cash equivalents amounted to USD 928,762, indicating a decrease from prior periods. The organization predominantly funds its working capital requirements and business investments through net income, available cash, trade credit, and various financing facilities. Significant investments in working capital—especially in trade accounts receivable and inventory—are crucial for the company’s operations as a distributor. Generally, increases in sales volumes lead to heightened working capital investments, which can diminish cash flow from operating activities, while decreases in sales volumes typically result in reduced working capital investments, thereby enhancing cash flow.

- Cash Flow Dynamics: Operating activities reported a net cash outflow of USD 614,064 during the Predecessor 2021 Period, transitioning to a positive cash flow of USD 231,763 in the Successor 2021 Period. Cash flows varied in subsequent fiscal years, with net cash from operations reaching USD 300,918 during the Unaudited 2024 Interim Period, influenced by adjustments in working capital. Investing activities displayed fluctuations in cash flows across periods, with substantial cash usage driven by capital expenditures and acquisitions. Furthermore, financing activities showed net cash inflows primarily from credit facilities, particularly during the Successor 2021 Period, but also indicated net cash outflows in later fiscal years, reflecting strategic capital management amid evolving operational demands.

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “INGM” is exposed to a variety of risks such as:

- Fluctuations in Quarterly Results: The business experiences significant fluctuations in quarterly results due to various factors, including economic and geopolitical conditions, competitive pressures, and changes in purchasing behavior. Variability in vendor discounts, seasonal demand fluctuations, and shifts in product mix can all impact revenues and gross margins. Additionally, changes in operational expenses, foreign currency fluctuations, and the loss of key customers or vendors can exacerbate these fluctuations. As such, historical performance may not serve as a reliable indicator of future results, and stakeholders should exercise caution when interpreting quarterly performance.

- Challenges in Development and Integration: Ingram Micro is investing substantial resources into the development of Ingram Micro Xvantage, a digital platform designed to enhance customer experience. However, there are inherent risks associated with this initiative, including potential delays in development, challenges in integrating cybersecurity and data privacy protection, and the possibility of competitors introducing similar platforms. The need for significant capital investments to maintain competitiveness in technology, such as AI advancements, could adversely affect financial performance if not executed effectively. Consequently, any setbacks in the successful implementation of Ingram Micro Xvantage could negatively impact on overall business operations and financial health.

- Impact of External Events and Market Conditions: The company faces risks related to public health crises, such as the COVID-19 pandemic, which has previously disrupted operations and created supply chain challenges. Lockdowns in various countries have led to operational halts and significant logistical difficulties, affecting the ability to meet demand. While some impacts have eased, the potential for future disruptions remains, particularly concerning shipping, labor market conditions, and workforce health. Ongoing uncertainties may continue to adversely affect business operations, financial results, and overall market conditions, necessitating vigilant management and strategic planning to navigate these risks.

Conclusion

Ingram Micro (INGM) stands out as a leading global solutions provider within the IT ecosystem, underscoring its strategic alignment with critical technology trends such as cloud migration and enhanced cybersecurity, which are anticipated to drive sustained demand for innovative technology solutions. With a robust product portfolio and extensive operations spanning 57 countries, the company serves over 161,000 customers, positioning it to deliver tailored solutions that enhance operational efficiency and facilitate strong business outcomes for its partners. The proposed use of IPO proceeds to primarily repay debt demonstrates a commitment to bolstering financial stability, while the planned introduction of a quarterly cash dividend starting in 2025 reflects confidence in future profitability. Additionally, Ingram Micro's emphasis on advanced and cloud-based solutions, which currently constitute more than one-third of its net sales, positions the company advantageously to address the increasing complexity of technology solutions and the evolving role of distributors in the market. Despite the presence of challenges such as fluctuations in quarterly revenues and integration risks, Ingram Micro's proactive strategies and resilience in the marketplace indicate a positive outlook for the company's future endeavors.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Ingram Micro (INGM)” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...