The Offer

Company Overview

Kindly MD, Inc. (KDLY) is a Utah-based company established in 2019, specializing in healthcare data and dedicated to addressing holistic pain management and combating the opioid epidemic. Kindly MD provides integrated healthcare services to patients, combining prescription medicine and behavioral health interventions to mitigate opioid use among those suffering from chronic pain, aiming to prevent and alleviate addiction and dependence on opiates.

The company’s outpatient clinical services, available on a fee-for-service basis, encompass evaluation and management for chronic pain, functional medicine, cognitive behavioral therapy, trauma and addiction therapy, recovery support services, overdose education, peer support, limited urgent care, preventative medicine, medically managed weight loss, and hormone therapy. Utilizing an embedded model of prescriber and therapist teams, Kindly MD tailors patient-specific care programs with the objective of reducing opioid usage while effectively managing patients through non-opioid alternatives and behavioral therapy. Moreover, beyond patient treatment, Kindly MD collects comprehensive data on the motivations and mechanisms driving patients towards alternative treatments, aiding in individualized patient care and providing valuable insights for the Company and its investors. Kindly MD aspires to emerge as a leading resource for evidence-based guidelines, data, treatment paradigms, and educational initiatives in the battle against the opioid crisis in the United States.

Key Highlights

Primary Offering:

RBRK anticipates issuing 23,000,000 shares (or 26,450,000 shares, assuming the underwriters’ option to purchase additional shares of Class A common stock is exercised in full), with expected net proceeds totaling approximately USD632.6 million (or approximately USD729.3 million if the underwriters’ option to purchase additional shares is exercised in full), assuming an initial public offering price of USD29.50 per share, representing the midpoint of the estimated price range.

Use of proceeds:

KDLY anticipates receiving net proceeds from the offering of approximately USD6,154,999, after accounting for underwriting discounts, commissions, and estimated offering expenses, based on a per unit price of USD5.50. If the underwriters’ representative exercises the over-allotment option in full, the net proceeds would increase to approximately USD7,099,098. These funds are earmarked for various purposes, including capital expenditures, labor, real estate acquisition, marketing, sales, and technology development. Specifically, capital expenditures amounting to USD2,140,000 will facilitate the expansion of new clinic locations and potential acquisitions. Real estate acquisition, though not yet specified, is allotted USD500,000. Technology development, allocated USD1,000,000, aims to enhance data collection systems, refine data analysis, and bolster artificial intelligence capabilities. Additionally, a portion of the proceeds, USD584,999, will be used to repay amounts due under certain promissory notes. KDLY believes that these funds, combined with existing cash reserves and potential proceeds from warrant exercises, will sufficiently support operational expenses and capital requirements for at least the next 12 months. However, the final allocation of proceeds may be subject to management's discretion and dependent on various factors influencing business conditions. Any surplus proceeds not immediately utilized will be invested in short-term, interest-bearing instruments.

Dividend policy:

KDLY has abstained from distributing dividends throughout the three preceding fiscal years and currently holds no intentions to initiate dividend payments on its Common Stock. The company's current strategy entails retaining all earnings, if any, for reinvestment into its business operations.

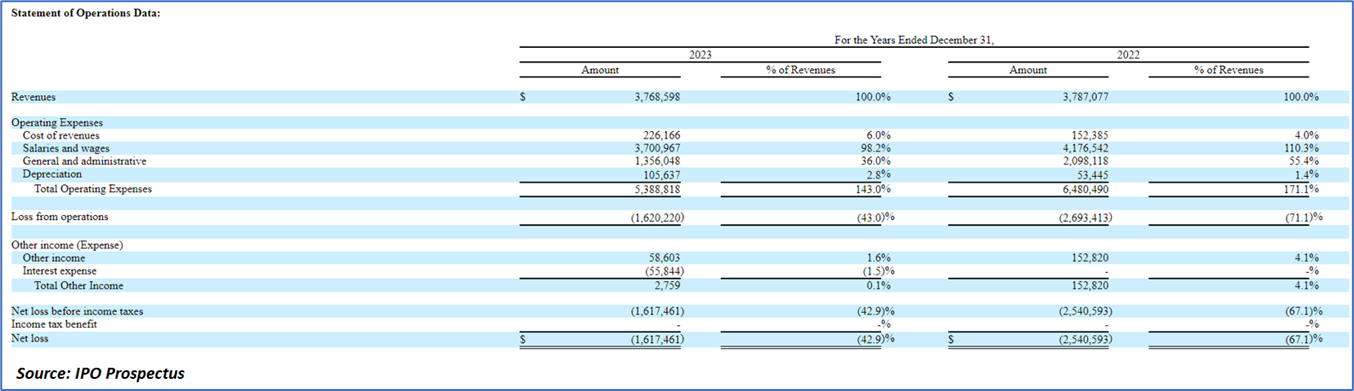

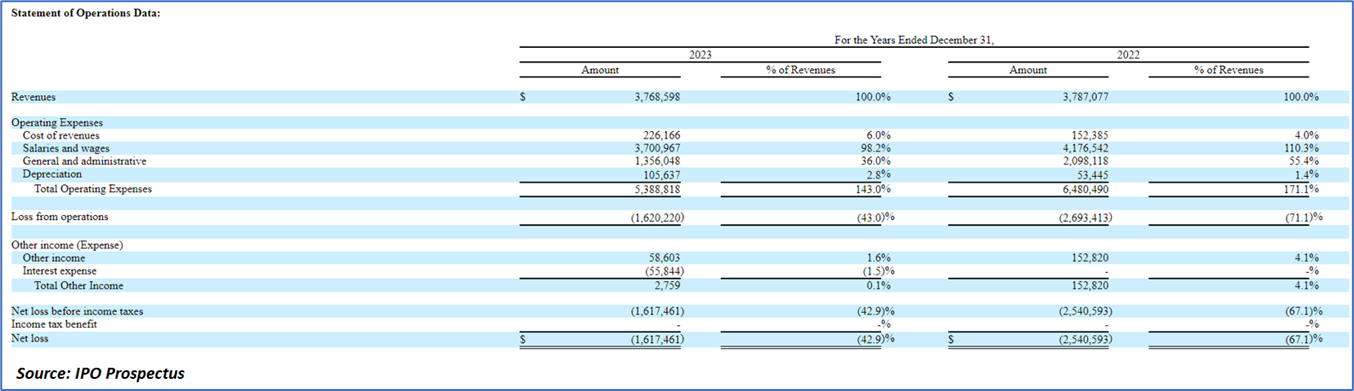

Financial Highlights (Results of Operations) (Expressed in USD)

- Revenue and Net Loss Analysis: In the fiscal year ending December 31, 2023, the Company recorded revenues of USD 3,768,598, representing a slight decrease from the previous year's figure of USD 3,787,077, with a decrease of USD 18,479, or 0.5%. This decrease can be primarily attributed to increased discounts offered on patient care services throughout 2023. However, the net loss per share showed significant improvement, decreasing by USD 1.20, or 76.9%, to USD (0.36) for the year ending December 31, 2023, from USD (1.56) for the corresponding period in 2022. This positive shift is chiefly due to enhancements in general and administrative expenses as well as personnel expenses during 2023. Management remains committed to capitalizing on these operational efficiencies to drive sales growth in the forthcoming fiscal years.

- Liquidity and Capital Resources: As of December 31, 2023, the Company's total assets amounted to USD 1,099,202, marking a notable increase of USD 152,204, or 16.1%, compared to the prior year's total assets of USD 946,998. This growth primarily stems from an augmentation in cash and cash equivalents, albeit offset by decreases in property and equipment and right of use assets depreciation. Conversely, total liabilities as of December 31, 2023, stood at USD 1,207,614, reflecting an increase of USD 641,630, or 113.4%, from USD 565,984 recorded on December 31, 2022. The surge in liabilities is mainly attributed to the issuance of notes payable, an increase in derivative liability, and accounts payable and accrued expenses, partially offset by the settlement of related party debt. Despite this, the Company asserts it possesses ample resources to sustain its operations without additional expansion, anticipating positive cash flows from operations to cover operating expenses for the subsequent twelve months following this filing. Additionally, the total stockholders' deficit as of December 31, 2023, amounted to USD (108,412), depicting a decrease of USD 489,426, or 128.5%, from the stockholders' equity of USD 381,014 recorded on December 31, 2022.

- Cash Flow Analysis: During the fiscal year ended December 31, 2023, the Company reported a net cash used in operating activities of USD 449,489, compared to USD 140,383 in the previous year. This change primarily resulted from a decrease in stock-based compensation, substantially offset by a decrease in net loss. Meanwhile, net cash used in investing activities decreased to USD 14,420 in 2023 from USD 317,388 in 2022, primarily due to increased utilization of existing resources. Net cash provided by financing activities amounted to USD 802,491 in 2023, up from USD 550,000 in 2022, mainly attributed to the financing of unsecured debt. Consequently, the Company's net cash increased by USD 338,582, or 181.1%, from USD 186,918 as of December 31, 2022, to USD 525,500 as of December 31, 2023.

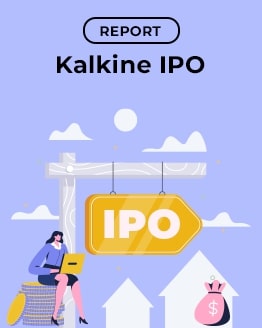

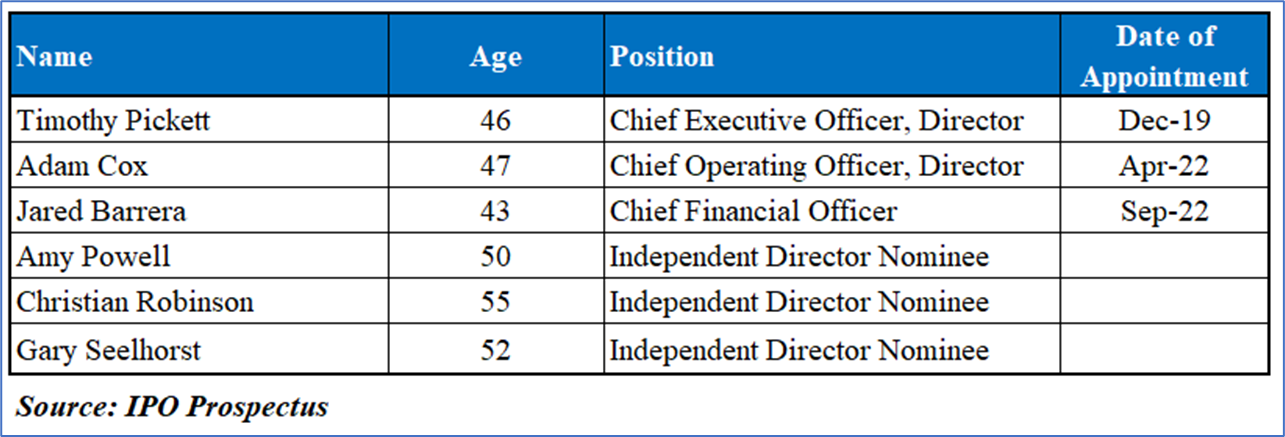

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “KDLY” is exposed to a variety of risks such as:

Volatility in Revenue and Profitability: KDLY's business strategy may subject it to substantial fluctuations in revenues, losses, and earnings. As KDLY focuses on a limited number of business initiatives at a time, its success hinges on the market acceptance of these initiatives, potentially leading to variable profitability. Economic conditions and market dynamics may further impact KDLY's revenues and profitability, posing additional risks to its financial performance. Moreover, KDLY's ability to generate positive cash flow and sustain profitability may be influenced by changes in the market for its products and services, as well as general economic risks that could affect its operational results and financial stability.

Risk of Insufficient Capital and Going Concern Uncertainty: There is a risk that KDLY may not secure adequate capital to sustain its operations and pursue business development activities. While KDLY plans to raise additional capital through the sale of Common Stock, there is no guarantee of success in these endeavors. The anticipated nature of KDLY's services makes it challenging to accurately forecast revenues and operating results, which may fluctuate due to various factors such as capital availability, sourcing strong opportunities, managing liquidity requirements, and competition. Additionally, KDLY's ability to attract and retain qualified personnel is crucial for its success, and any limitations in this regard could adversely affect its operations. The lack of available and cost-effective directors and officer's insurance coverage further compounds these risks, potentially impeding KDLY's ability to attract and retain talented executives and hinder its business development efforts.

Conclusion

KDLY, a Utah-based company established in 2019, specializes in healthcare data, focusing on holistic pain management and combating the opioid epidemic through integrated healthcare services. The company plans to issue 23,000,000 shares in its IPO, expecting net proceeds of approximately USD 632.6 million for various purposes, including capital expenditures and technology development. Despite a slight decrease in revenue in fiscal year 2023, attributed to discounts on patient care services, KDLY saw a significant improvement in net loss per share, indicating operational efficiencies. Additionally, KDLY's commitment to addressing the opioid crisis and its comprehensive data collection efforts underscore its long-term dedication to innovation and patient care. The company's strategic allocation of funds for technology development reflects its forward-thinking approach to improving healthcare outcomes and staying ahead in a rapidly evolving industry. However, investing in KDLY's IPO entails risks, including the impact of revenue volatility, insufficient capital, and talent retention challenges due to the lack of insurance coverage.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Kindly MD, Inc. (KDLY)” IPO seems “Neutral" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services. Please note past performance is neither an indicator nor a guarantee of future performance.

Please also read our Terms & Conditions and Financial Services Guide for further information.

Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...