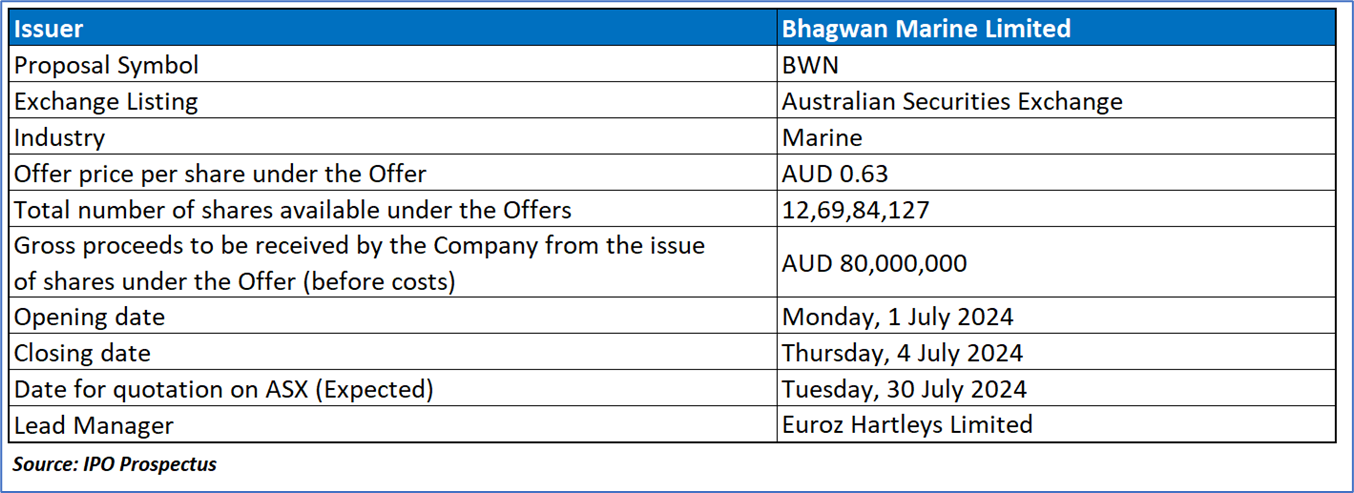

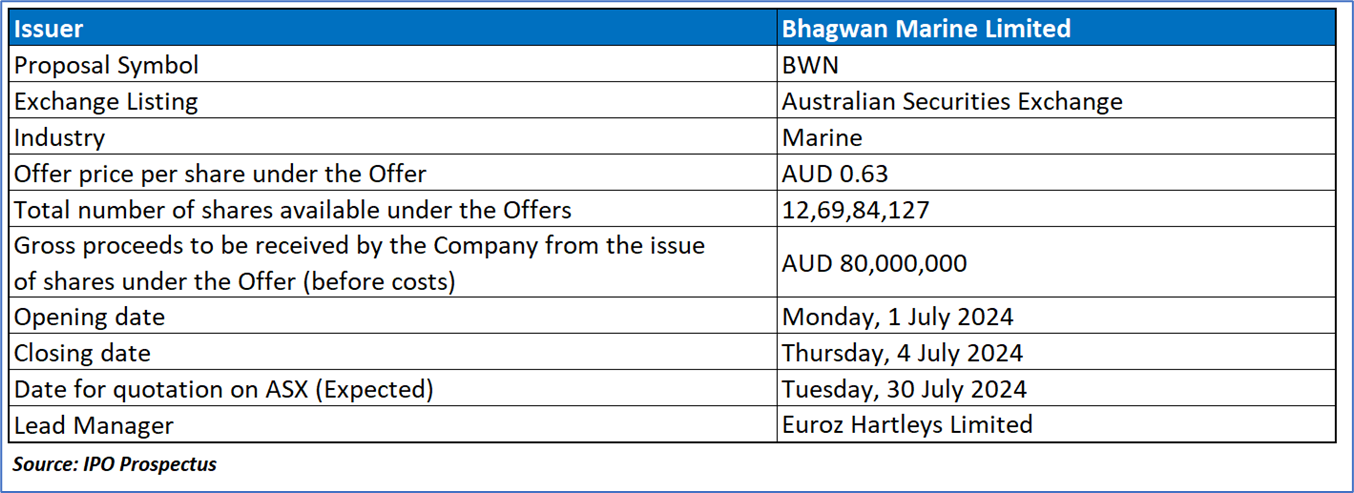

The Offer

Company Overview

Bhagwan Marine Limited is a national Australian marine services company that offers a diverse range of marine solutions in ports, nearshore, offshore, and subsea locations. The company provides extensive marine services across various industries, including oil and gas, subsea, port, civil construction, renewables, and defense. Bhagwan's operations are primarily based out of its major facilities in Dampier, Brisbane, Darwin, and Melbourne, strategically located near the assets and operations of its key clients throughout Australia.

Key Highlights

Primary Offering:

The Public Offer entails the offering of 12,69,84,127 Shares at a price of AUD0.63 per Share, with the objective of generating AUD80,000,000 in funds (pre-expenses).

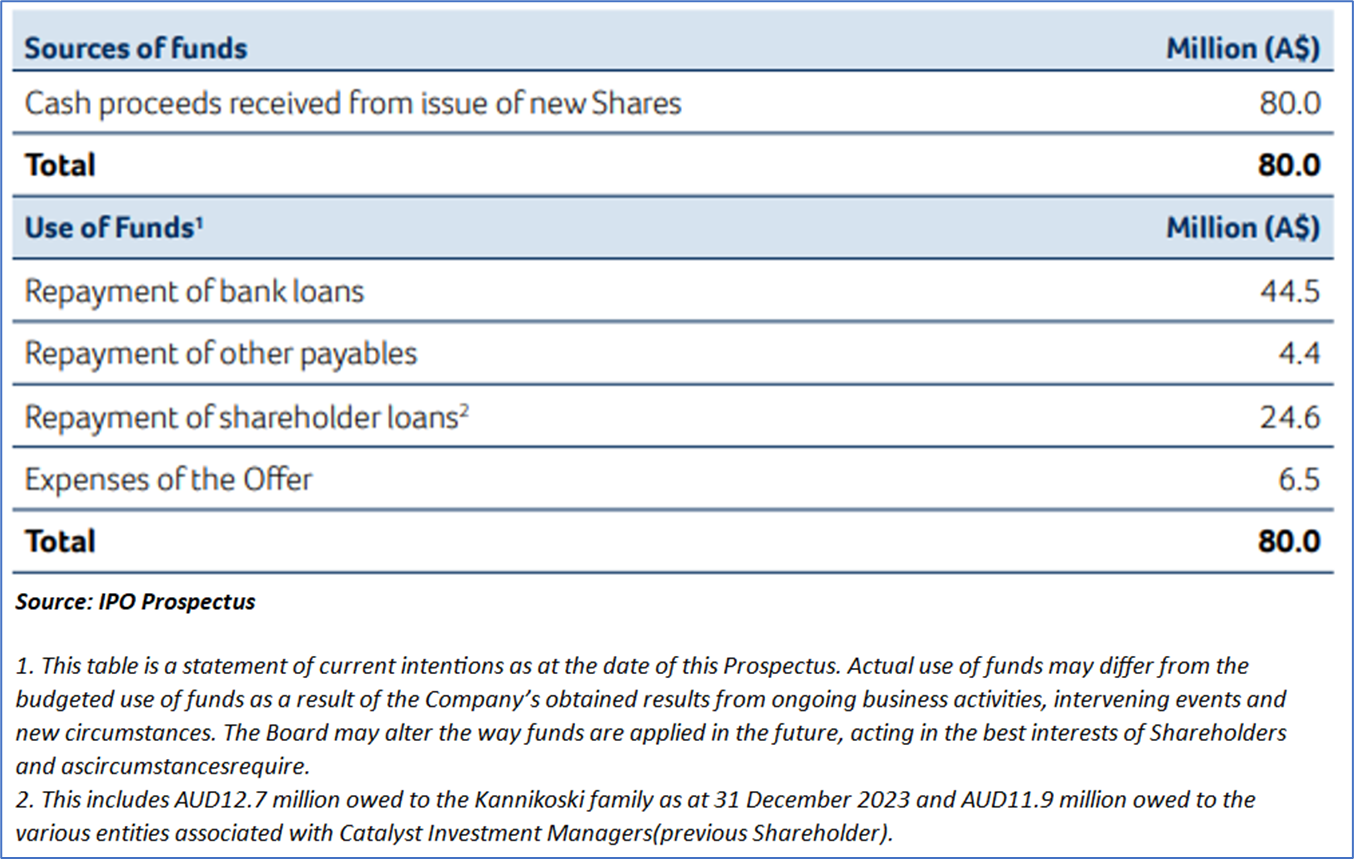

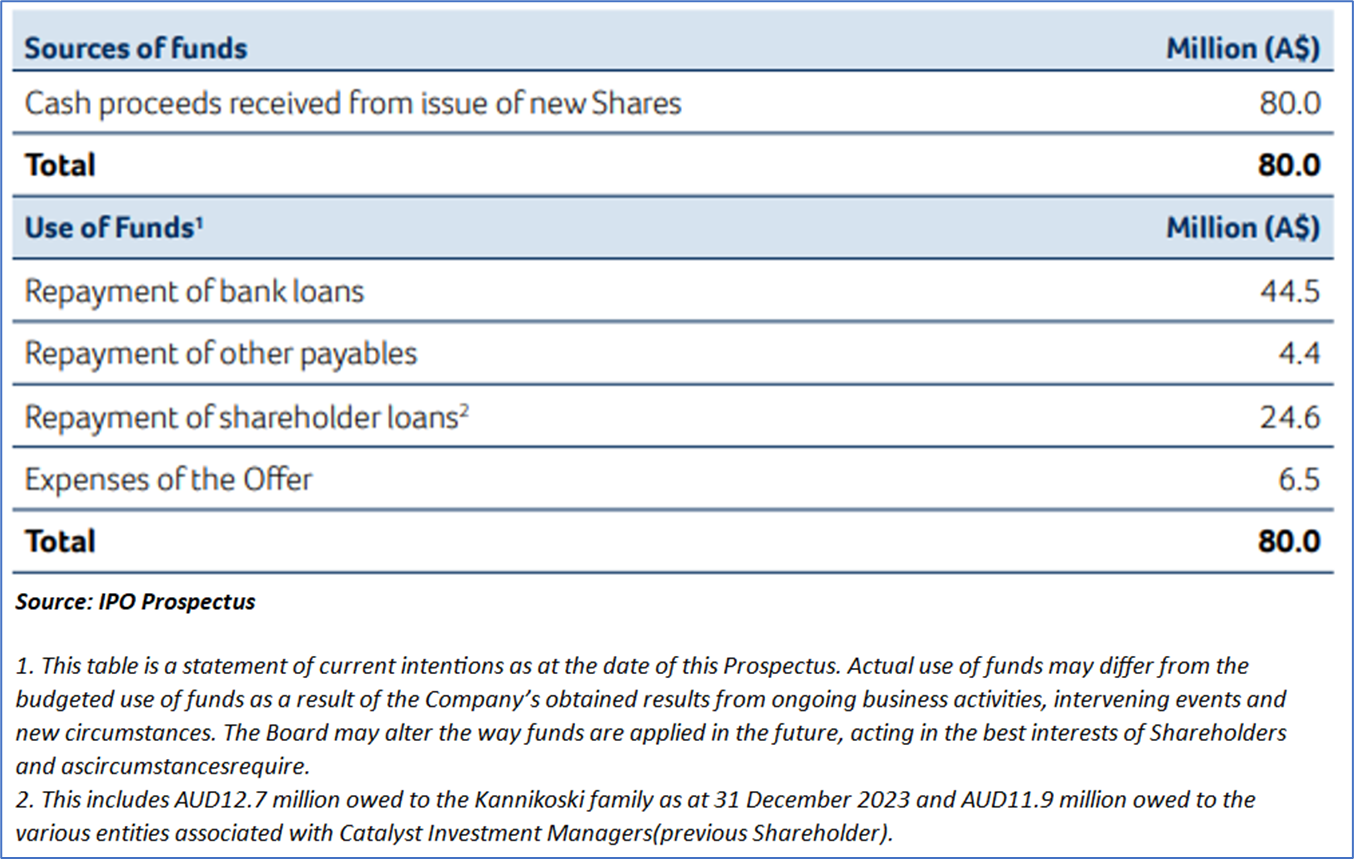

Use of proceeds:

Industry Overview:

Overview of the Key Markets for Bhagwan’s Marine Services

- Offshore Oil and Gas: Australia’s offshore oil and gas industry significantly contributes to the nation's economy, energy security, employment, and trade, with investments surpassing AUD 260 billion since 2007. This industry has not only fueled economic growth but also created numerous opportunities for marine services. Australia's success in attracting and expanding a world-class offshore oil and gas sector is evident in its adaptation to global demand and innovative technological advancements. As of June 30, 2022, the Australian Bureau of Statistics estimated employment in this sector at 17,000 individuals.

- Gas Sector: Australia’s significant gas field discoveries have led to world-leading projects and first-class infrastructure developments. These projects often involve multiple offshore wells and supporting infrastructure. Offshore conventional reserves, primarily in Western Australia and the Northern Territory, constitute the majority of Australia’s gas reserves. According to the Australian Government's 2022 Global Resources and Strategy Commodity Report, Liquid Natural Gas (LNG) was the third-largest commodity export by value in 2020-21, with exports reaching 77.7 million tons worth AUD 30.5 billion. The forecast for LNG exports is expected to remain steady until 2029, driven by Australia's geographical proximity to Asia, stable investment environment, and role in providing lower carbon or carbon-neutral LNG and clean hydrogen.

- Oil Sector: Australia’s remaining oil resources are mainly condensate and liquefied petroleum gas (LPG) from offshore gas fields in the Browse, Carnarvon, and Bonaparte basins. Most of Australia's crude oil production, predominantly from Western Australia, is exported due to cost-effective transportation to larger Asian refineries. The 2023 Geoscience Australia Oil publication highlighted that 83% of domestically produced oil resources were exported in 2020-21. In 2022-23, Western Australia's condensate production was valued at AUD 8.6 billion, making it the second most valuable petroleum product after LNG. Despite a slight decline in production from previous years, Western Australia maintained a significant share of national production.

- Port Operations: Maritime trade is crucial to the Australian economy, with maritime exports valued at AUD 354.8 billion in 2020-21. Australia's ports are vital gateways for goods, influencing the nation’s productivity, living standards, and quality of life. Significant investments in port infrastructure continue, such as the Australian Government's AUD 7.1 billion commitment in the 2022-2023 Budget for transformational infrastructure projects. Western Australia's 2023-2024 State Budget also announced substantial funding for port projects. These investments create opportunities for marine service providers in civil construction and infrastructure projects, particularly in port areas.

- Subsea Services in Offshore Oil and Gas and Offshore Wind Energy: Subsea services, including inspection, repair, surveys, and oilfield construction, are essential for the offshore oil and gas and offshore wind energy markets. The global subsea services market was valued at USD 12.2 billion in 2022 and is projected to grow to USD 19.92 billion by 2031. Although specific estimates for Australia are unavailable, the industry trends indicate potential growth driven by offshore oil and gas activities and the development of an offshore wind energy industry. These subsea services are crucial at different stages of project life cycles, supporting continued industry activity and expansion.

Dividend policy:

The Board has the discretion to determine the payment of dividends by the Company, which will depend on various factors, many of which may be beyond the control of the Company and its Directors and Management and are not reliably predictable. These factors include the general business environment, the Company's operating results, cash flows, and financial condition, future funding requirements, capital management initiatives, taxation considerations, contractual, legal, or regulatory restrictions on dividend payments, and any other factors deemed relevant by the Directors.

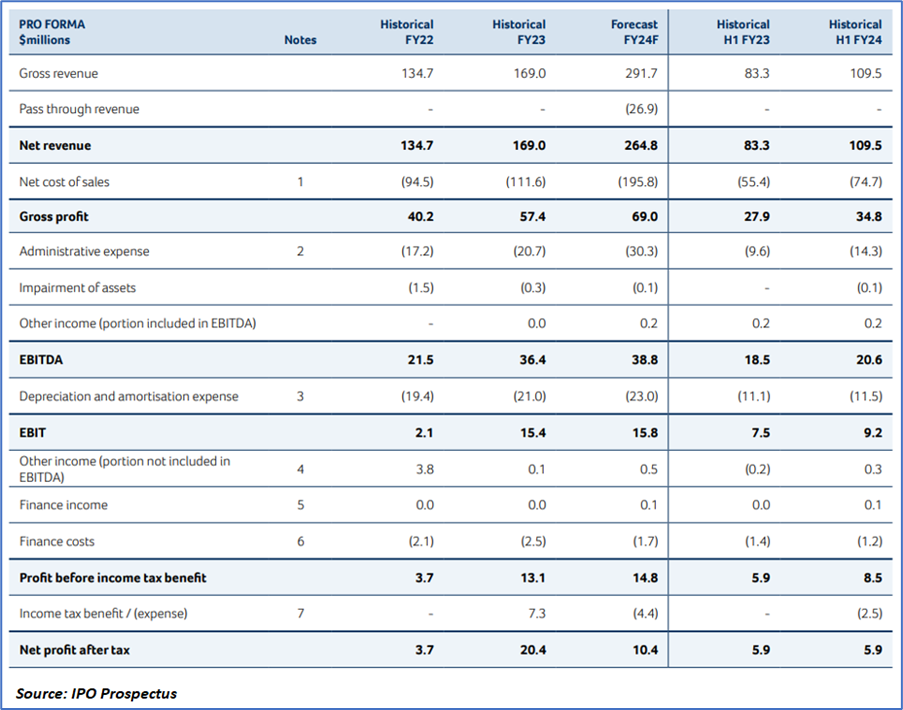

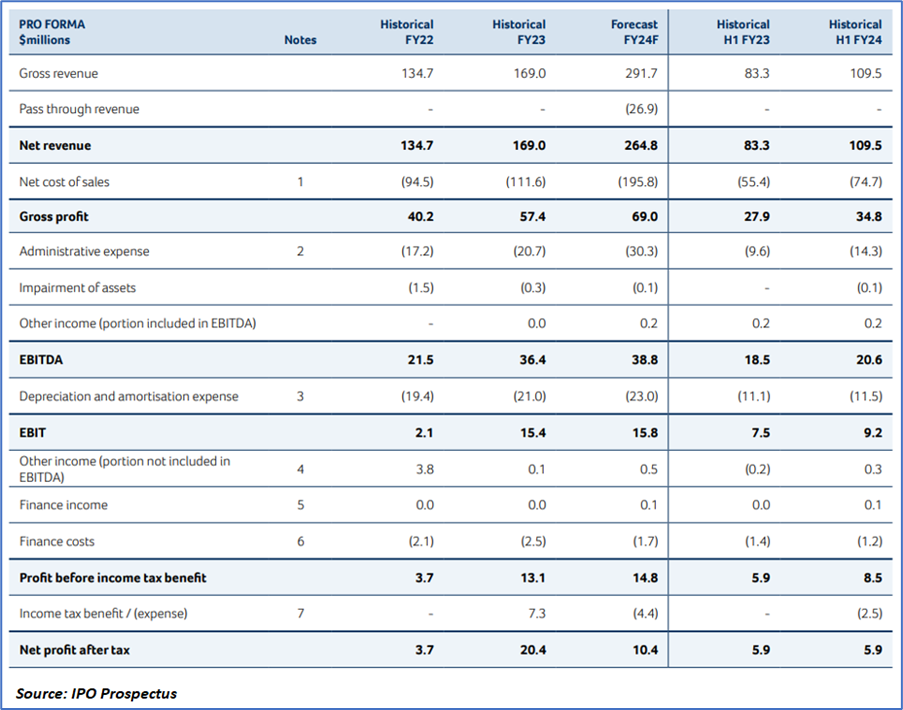

Financial Highlights (Pro Forma Income Statement) (Expressed in AUD):

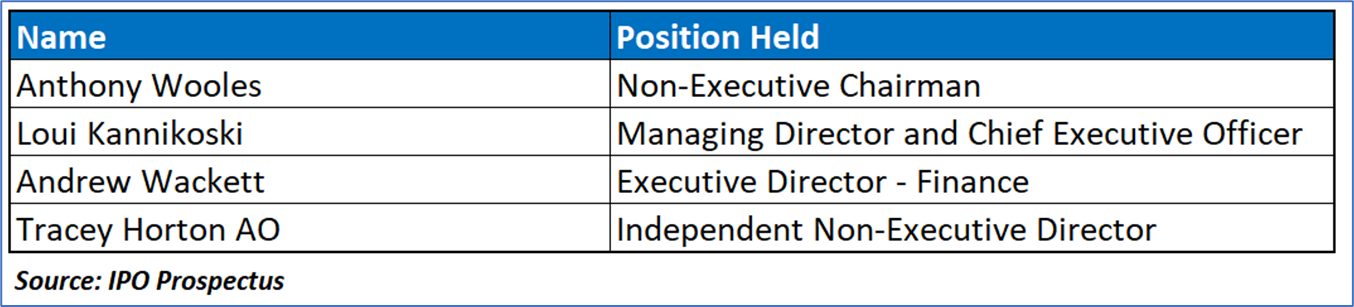

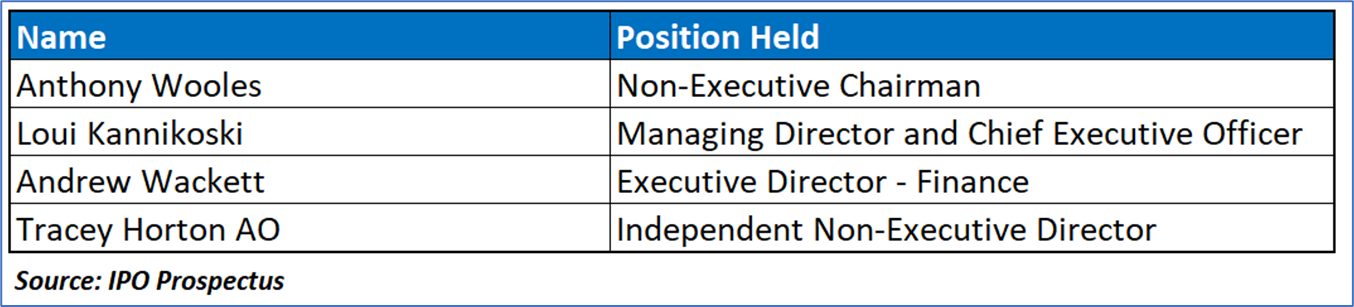

Key Management Highlights

Risk Associated (High)

Reliance on Resources and Oil and Gas Exploration, Development, Production, and Decommissioning Activity: Bhagwan's performance and future growth heavily depend on the activity levels in the resources and oil and gas industries. The demand for Bhagwan’s services, including port services, civil construction, and offshore services, is directly influenced by the level of resource and oil and gas exploration, development, production, and decommissioning activities. A decline in these activities can significantly impact Bhagwan’s revenue, particularly in areas where it operates. Various factors such as economic growth, commodity prices, and energy demand affect these industries, and any prolonged period of low activity could materially and adversely affect Bhagwan’s business, financial position, and growth prospects.

Reliance on Key Clients: Bhagwan derives a significant portion of its revenue from a small number of key clients, with approximately 40% of its FY23 revenue coming from three key clients. These clients provide revenue through various services such as civil construction, subsea, offshore, and port services. Although these clients are contracted under Master Service Agreements (MSAs), services are often provided on a project, on-demand, or ad hoc basis, with no minimum revenue requirements. The termination of these contracts, reduction in client activity, or failure to meet client expectations can adversely impact Bhagwan’s revenue and financial performance.

Failure to Renew Existing Contracts or Win New Contracts: Bhagwan's ability to maintain and grow its business relies on renewing existing contracts and winning new ones. Contracts vary in length and are subject to competitive tender processes. Factors such as service quality, pricing, location of key personnel, and competition affect Bhagwan’s ability to secure contracts. A significant portion of Bhagwan’s projected revenue growth depends on large contracts, such as a major decommissioning contract contributing to 22.9% of FY24F revenue. Failure to consistently secure similar contracts, retain existing clients, or expand service offerings could negatively impact Bhagwan’s financial performance and growth prospects in various industry segments, including the offshore wind and defense sectors.

Conclusion

Bhagwan Marine Limited is a leading Australian marine services company, offering a wide range of solutions across ports, nearshore, offshore, and subsea locations, with strategic facilities in Dampier, Brisbane, Darwin, and Melbourne. The IPO aims to raise AUD 80,000,000 by offering 12,69,84,127 shares at AUD 0.63 per share, which will support further expansion. Bhagwan Marine plays a critical role in the thriving Australian offshore oil and gas sector, which has seen investments exceeding AUD 260 billion since 2007. The company is well-positioned to capitalize on ongoing and future investments in Australia's maritime trade and port operations, supported by substantial government funding. Additionally, Bhagwan Marine's capabilities in subsea services for both offshore oil and gas and emerging offshore wind energy markets present significant growth opportunities. Despite the inherent risks associated with reliance on the oil and gas sector and key clients, Bhagwan Marine's strategic positioning and diversified service offerings make it a decent company in the marine services industry.

Hence, given the financial performance of the company, incurred net losses, company’s product, and associated risks “Bhagwan Marine Limited” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...