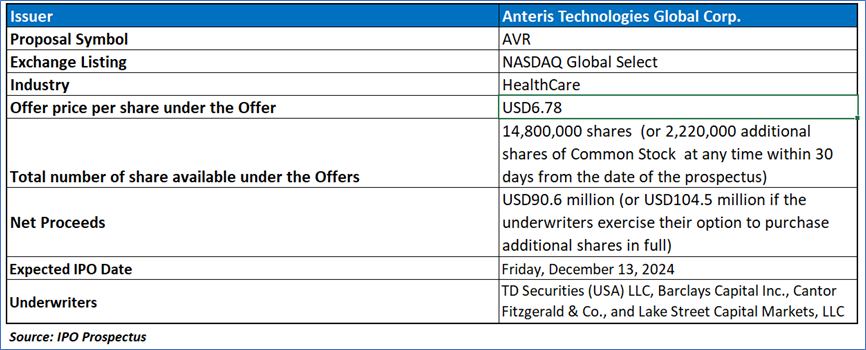

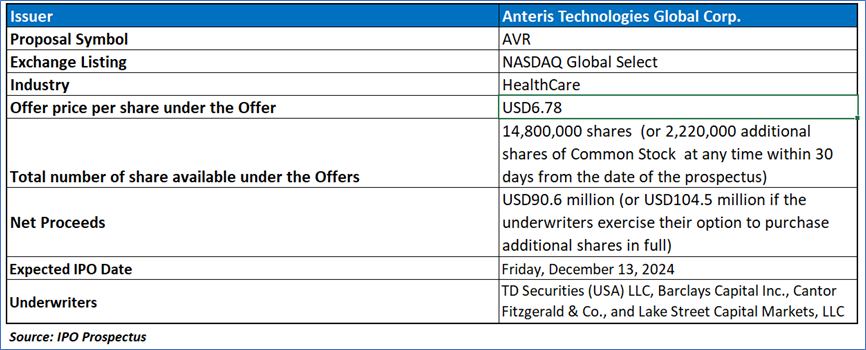

The Offer

Company Overview

Anteris Technologies Global Corp. is a structural heart company focused on improving the quality of life for patients with aortic stenosis through its innovative DurAVR® transcatheter heart valve (THV) system. This system features a single-piece biomimetic valve made with proprietary ADAPT® anti-calcification technology, clinically shown to remain calcium-free for up to 10 years and deployed via the precision-engineered ComASUR® balloon-expandable delivery system. Designed to replicate healthy human aortic valve function, the DurAVR® system aims to address limitations in current valve technologies, offering enhanced durability and hemodynamics for patients across all risk profiles, including younger, more active individuals. With promising clinical trial results and a forthcoming FDA-reviewed Pivotal Trial, Anteris seeks to establish DurAVR® as a superior alternative to traditional TAVR devices in treating severe aortic stenosis.

Key Highlights

Primary Offering:

The total number of ADS available under the offers includes 14,800,000 shares (or 2,220,000 additional shares of Common Stock at any time within 30 days from the date of the prospectus).

Use of proceeds:

- Net Proceeds Estimation:

- Estimated net proceeds from the offering: USD 90.6 million (assuming an IPO price of USD 6.78 per share).

- If underwriters fully exercise their option to purchase additional shares, net proceeds may increase to USD 104.5 million.

- Each USD 1.00 increase or decrease in the IPO price per share affects net proceeds by USD 13.6 million.

- Each 1.0 million share increase or decrease affects net proceeds by USD 6.2 million.

- Planned Use of Proceeds:

- Approximately USD 74.4 million for ongoing development of the DurAVR® THV system and the Pivotal Trial for severe aortic stenosis.

- Remaining funds for working capital, general corporate purposes, and repayment of Convertible Note Facility.

- Funding Sufficiency:

- Current net proceeds and cash reserves will not fully fund the DurAVR® THV development through regulatory approval.

- Additional capital will be required for the product's full development and commercialization.

Dividend policy:

Anteris Technologies Global Corp. has not declared or paid cash dividends on its capital stock and does not foresee doing so soon, as it intends to retain all available funds to support business operations and expansion. Any future decisions regarding dividend declarations will be at the discretion of the Board of Directors, based on various factors such as the company’s financial condition, operational results, cash flow requirements, expansion plans, and other considerations deemed relevant by the Board.

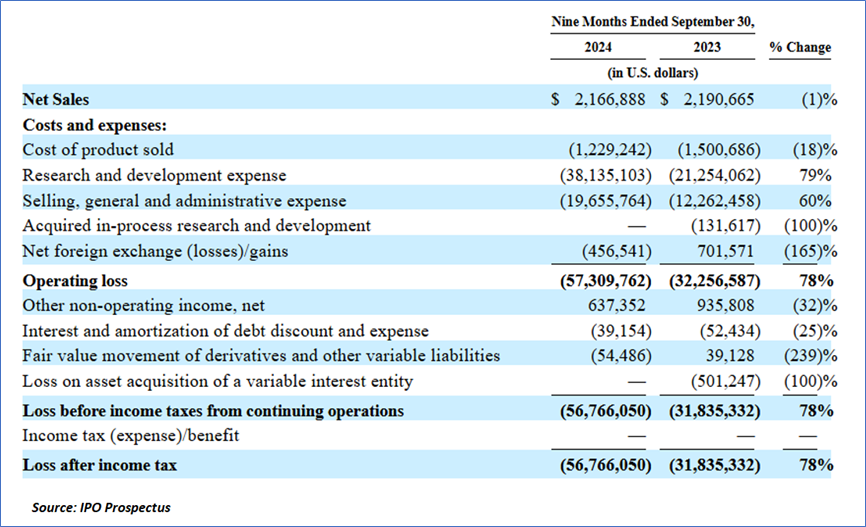

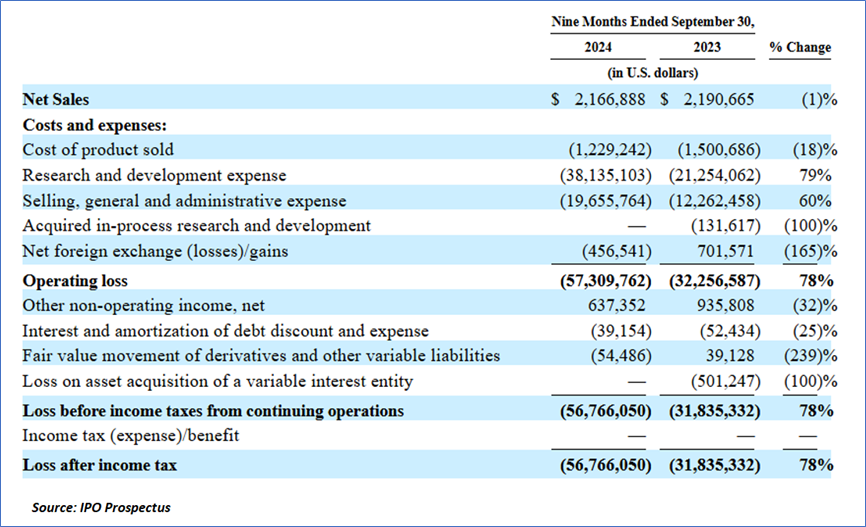

Financial Highlights (Results of Operations) (Expressed in USD)

- Net Sales: Modest Decline Due to Reduced Demand: For the first nine months of 2024, the company recorded net sales of USD 2.2 million, reflecting a modest decrease of USD 0.02 million (1%) compared to the same period in 2023. This decline was primarily attributed to a reduction in sales volumes of tissue products, driven by lower demand from customers such as LeMaitre and 4C.

- Cost of Products Sold: Significant Reduction in Costs: The cost of products sold during the first nine months of 2024 amounted to USD 1.2 million, a decrease of USD 0.3 million (18%) from the previous year. This decline was mainly the result of decreased product demand and a shift in the product mix sold.

- Research and Development Expense: Surge in Investment for Future Growth: Research and development expenses reached USD 38.1 million in the first nine months of 2024, marking an increase of USD 16.8 million (79%) from USD 21.3 million in the same period of 2023. The growth in expenses was driven by USD 12.0 million in preparatory activities for the Pivotal Trial, USD 2.6 million for expanding manufacturing capabilities, USD 1.8 million for v2vmedtech development, and USD 1.0 million in increased clinical costs. These increases were partially offset by a USD 1.0 million reduction in medical affairs expenses.

- Selling, General, and Administrative Expenses: Rising Costs Reflect Strategic Expansion: Selling, general, and administrative expenses for the first nine months of 2024 totaled USD 19.7 million, an increase of USD 7.4 million (60%) from USD 12.3 million in 2023. This increase was primarily due to USD 2.8 million in costs related to the company's plans for re-domiciliation, its NASDAQ listing, and initial public offering (IPO), USD 1.8 million for additional stock option grants, and USD 1.9 million for a 25% increase in headcount across various corporate departments to support the company's growth.

- Liquidity and Capital Resources: Navigating Operational Losses with Strategic Financing: As of September 30, 2024, the company’s cash and cash equivalents stood at USD 10.6 million, down from USD 21.1 million at the end of 2023. Despite facing recurring operating losses and negative cash flows, the company has financed its operations through a combination of capital stock issuances, convertible notes, regenerative tissue product sales, and Australian R&D tax incentives. The company has capital commitments, including USD 1.6 million for property leases, but no material capital expenditure commitments or contingent liabilities as of September 2024.

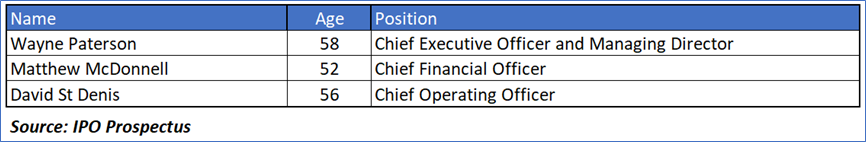

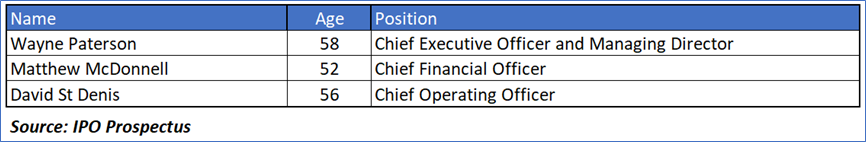

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “AVR” is exposed to a variety of risks such as:

- Risks Related to Business: The company faces considerable challenges in achieving profitability due to substantial operating losses and negative cash flow since its inception. These losses are primarily driven by significant investments in product development, marketing, and regulatory efforts. The company expects its operating expenses to increase as it continues to develop and commercialize products like DurAVR® THV, with the risk that none of its products may reach the market. The company’s ability to sustain profitability is uncertain, and continued capital investment is required to support its operations.

- Risks Related to Operating History and Financial Position: The company’s history is marked by recurring losses, raising doubts about its ability to continue as a going concern. With an accumulated deficit of USD257 million as of September 30, 2024, the company faces significant financial challenges. Although the company aims to attract additional capital, there is no guarantee of success. Failure to secure sufficient funding may force the company to scale back operations or liquidate assets, leading to potential losses for investors.

- Risks Related to the Industry: The company operates in an industry with significant risks, particularly in regulatory approval and clinical trials. Clinical trials may encounter delays, suspensions, or failures, impacting product development timelines. Furthermore, geopolitical events such as the war in Ukraine pose risks to ongoing studies and supply chains, potentially delaying product commercialization. Volatile market conditions and financial instability may also hinder the company’s ability to raise capital and impact the success of its clinical trials.

Conclusion

Anteris Technologies Global Corp. presents a promising investment opportunity through its innovative DurAVR® transcatheter heart valve (THV) system, which aims to improve the treatment of aortic stenosis with enhanced durability and superior hemodynamics. The system’s unique design and promising clinical results position it as a potential alternative to traditional TAVR devices. The IPO offers an estimated net proceeds of USD90.6 million, primarily for further development and clinical trials of the DurAVR® system. Despite facing financial challenges, including recurring losses and the need for additional capital, the company’s strategic investments in R&D and expansion indicate long-term growth potential. The focus on regulatory approval and upcoming pivotal trials further solidifies its prospects in a high-risk, high-reward market.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Anteris Technologies Global Corp. (AVR)” IPO seems “Attractive" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...