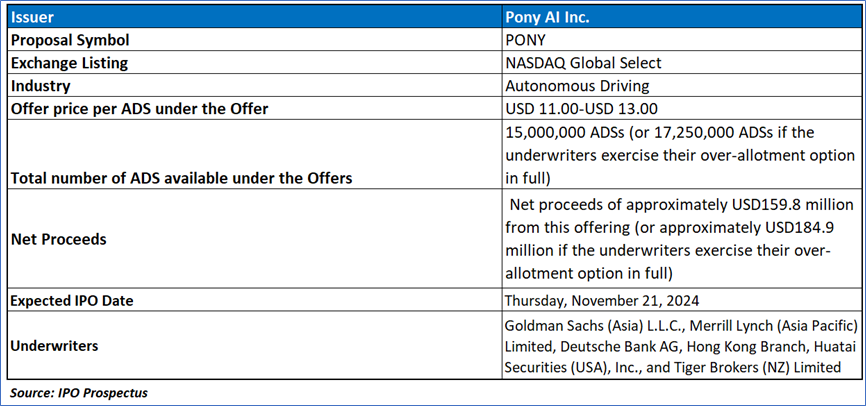

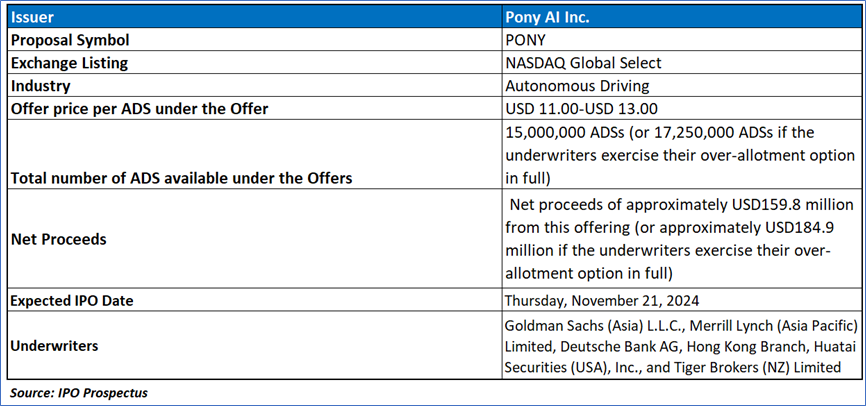

The Offer

Company Overview

Pony AI Inc (PONY) has emerged as a global leader in the large-scale commercialization of autonomous mobility, transforming science fiction into reality on the bustling streets of China. Its driverless robotaxis, hailed through the PonyPilot app, seamlessly integrate into daily life, offering a safe, intuitive, and eco-friendly commuting option. Equipped with advanced sensors, these vehicles navigate complex urban environments with precision, handling obstacles and inclement weather conditions autonomously. Passengers enjoy a smooth, driver-free journey, paying fares via the app, as the robotics depart to serve the next rider. Pony’s innovation is reshaping urban mobility and paving the way for a futuristic transportation ecosystem.

Key Highlights

Primary Offering:

The total number of ADS available under the offers includes 15,000,000 ADSs (or 17,250,000 ADSs if the underwriters exercise their over-allotment option in full).

Use of proceeds:

Based on an assumed initial public offering price of USD 12.00 per ADS, the company anticipates net proceeds of approximately USD 159.8 million from the offering (or USD 184.9 million if underwriters fully exercise their over-allotment option) and an additional USD 153.4 million from concurrent private placements, after deducting estimated expenses. The net proceeds will be allocated primarily to three areas: 40% (USD 125.3 million) to implement go-to-market strategies for the large-scale commercialization of autonomous driving technology, including robotaxi and robotruck services; 40% (USD 125.3 million) for further investment in research and development; and 20% (USD 62.6 million) for general corporate purposes and potential strategic acquisitions, although no specific opportunities have been identified yet.

The allocation of proceeds may change due to unforeseen events or shifts in business conditions. The company faces regulatory constraints under PRC laws, which limit funding to Chinese subsidiaries through loans or capital contributions unless specific governmental requirements are met, potentially impacting liquidity and expansion plans. Until deployment, the funds will be held in short-term, interest-bearing financial instruments or demand deposits.

Industry Overview:

- The Evolution of Autonomous Driving: Road transportation remains integral to daily life, with over 1.4 billion vehicles worldwide. Despite improvements in infrastructure, challenges such as safety risks, high costs, and inefficiencies persist. Advances in electric vehicles and artificial intelligence are driving significant progress in autonomous driving, promising to revolutionize mobility. Autonomous vehicles offer enhanced safety by reducing human error, lower operational costs through the elimination of driver-related expenses, and greater efficiency by optimizing traffic flow and resource allocation. These benefits position autonomous driving as a transformative force in transportation.

- Market Drivers and Advancements: Autonomous driving technology is propelled by rising consumer interest, advancements in electric vehicles, and technological progress in sensors and computing systems. Consumers increasingly favor automation for its safety and efficiency, encouraging the automotive industry to develop advanced software and hardware. Electric vehicles, with superior control precision and redundancy systems, provide an ideal platform for autonomous driving. Recent innovations in automotive-grade sensors and chipsets enable more accurate vehicle perception, prediction, and control, laying the groundwork for the commercialization of driverless vehicles. Collaborative efforts among industry stakeholders, including vehicle manufacturers and technology providers, further accelerate development by integrating autonomous systems during production.

- Opportunities in Driverless Technology: Driverless vehicles, defined as Level 4 and Level 5 autonomous systems, are poised to revolutionize transportation in sectors such as passenger mobility (robotaxi) and freight logistics (robotruck). The robotaxi market is set to benefit from advancements in safety, cost reduction, and urban traffic optimization. Similarly, robotruck services leverage standardized logistics networks to enhance freight transport efficiency. Regulatory endorsements worldwide, including in China, the United States, and Europe, are fostering a supportive environment for commercialization, moving driverless vehicles from testing phases to large-scale deployment.

- Growth of Robotaxi Services: Robotaxi services, characterized by fully autonomous Level 4/5 technology, are emerging as a cost-effective, safer alternative to traditional shared mobility. The global robotaxi market, projected to grow from USD 0.29 billion in 2025 to USD 352.6 billion by 2035, is driven by technological advancements and declining hardware costs. Robotaxis are expected to reshape urban traffic systems, reduce public parking needs, and contribute to smarter city development. By 2030, widespread adoption will make robotaxis a mature component of urban transportation, attracting users from the private car sector.

- China’s Role in Robotaxi Market Growth: China, with its large population and advanced shared mobility market, is positioned to lead the global robotaxi sector. Regulatory support and investments in R&D are expected to enable large-scale robotaxi deployment by 2026. By 2035, China is projected to capture over half of the global robotaxi market, valued at USD 179.4 billion, with extensive deployment across Tier-1 and Tier-2 cities. The robotaxi fleet is forecasted to surpass traditional taxis, reshaping passenger mobility and solidifying China's leadership in autonomous vehicle technology.

Dividend policy:

Pony has not previously declared or paid dividends in cash or kind and does not plan to do so in the near future, as it intends to retain available funds and earnings to support business operations and expansion. As a Cayman Islands holding company, Pony relies primarily on dividends from its PRC subsidiaries to meet cash requirements, including potential shareholder dividends. However, PRC regulations may limit these subsidiaries’ ability to distribute dividends, posing potential risks to its operations. Dividend declarations are subject to the discretion of the board of directors and compliance with Cayman Islands law, which permits dividend payments only from profits, retained earnings, or share premium, provided it does not impair the company’s ability to meet debt obligations. Any future dividends will depend on various factors, including operational performance, financial condition, and contractual obligations, and would be distributed to ADS holders via the depositary under the terms of the deposit agreement.

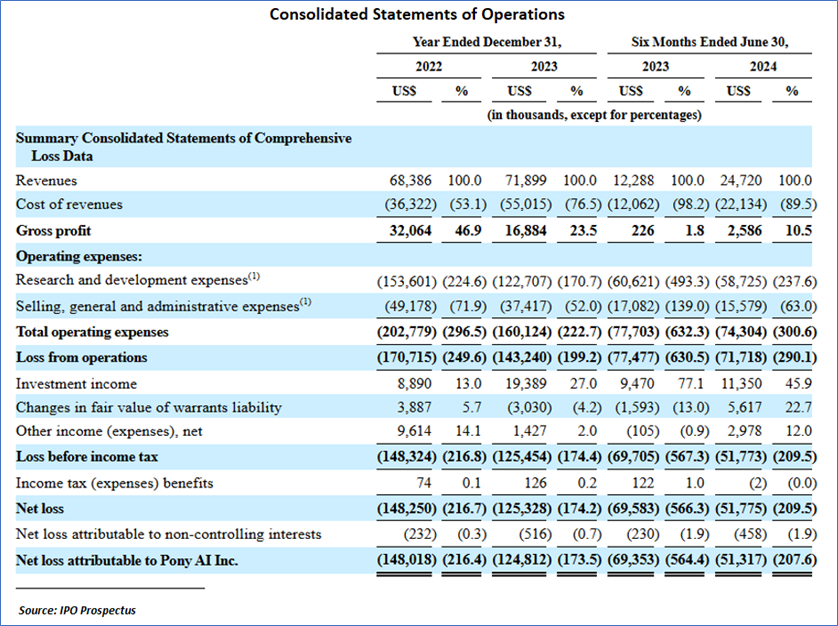

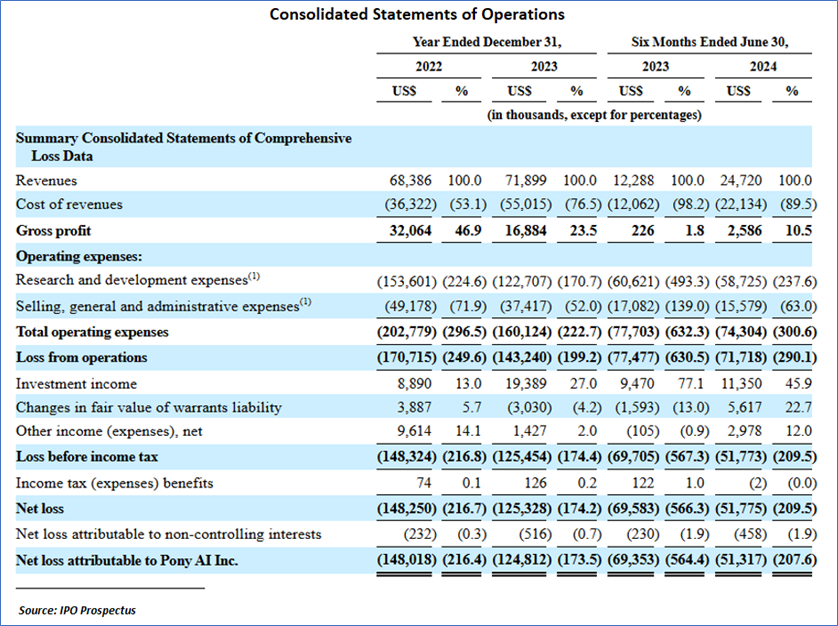

Financial Highlights (Results of Operations) (Expressed in USD)

- Revenue Growth and Composition: For the six months ended June 30, 2024, total revenues experienced a significant growth of 101.2%, increasing from USD 12.3 million in 2023 to USD 24.7 million. This growth was primarily driven by robust performance across three key segments: robotaxi services, robotruck services, and licensing and applications. Robotaxi revenues grew by 86.0%, attributable to enhanced service fees from AV engineering solutions and increased passenger fares in Tier-1 Chinese cities. Robotruck revenues rose by 62.4%, reflecting expanded operations of Cyantron, which increased its fleet and geographical reach. Licensing and applications revenues surged from USD 0.6 million to USD 5.5 million, underpinned by contracts with new large-scale customers and contributions from V2X business and POV intelligent solutions.

- Costs and Profitability: The cost of revenues increased by 83.5%, reaching USD 22.1 million in 2024, primarily due to higher fleet operation expenses, increased personnel costs, and direct material expenses linked to licensing projects. Despite higher costs, gross profit rose from USD 0.2 million to USD 2.6 million, while gross margin improved to 10.5% from 1.8%, driven by the favorable margin profiles of licensing projects. Operating expenses declined by 4.4% to USD 74.3 million, with reductions in research and development (down 3.1%) and selling, general, and administrative expenses (down 8.8%) due to decreased depreciation costs and focused marketing efforts.

- Liquidity and Investments: As of June 30, 2024, the company’s total cash, short-term investments, and restricted cash decreased to USD 473.3 million, primarily due to operational funding and a shift toward long-term investments. Short-term investments reduced by USD 25.3 million, while long-term investments rose to USD 89.3 million, reflecting a strategic realignment to enhance capital efficiency. The company maintained a diversified cash management approach to minimize risks, with 26.1% of liquid assets denominated in Renminbi.

- Asset Base and Capital Resources: The carrying value of property, equipment, and software declined to USD 12.8 million in 2024 due to depreciation. Liquidity was supported by previously raised funds through preferred share issuances, with the majority of cash held in U.S. dollars by subsidiaries in Hong Kong and the U.S. These assets were managed prudently to ensure operational stability and mitigate risks associated with cash management.

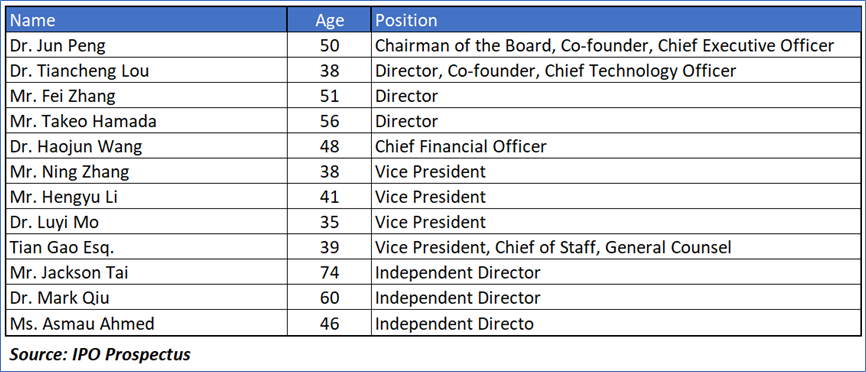

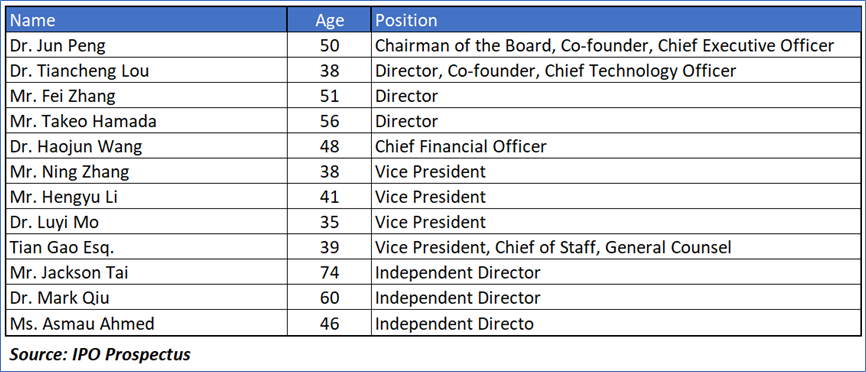

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “PONY” is exposed to a variety of risks such as:

- Dependency on PRC Subsidiaries for Cash Flow: As a holding company incorporated in the Cayman Islands, PONY relies heavily on dividends and other distributions from its subsidiaries in the People's Republic of China (PRC) to meet its operational and financing requirements. PRC regulations and policies regarding foreign exchange controls and dividend distribution may restrict the ability of these subsidiaries to transfer funds, which could adversely affect the company’s liquidity and ability to conduct its business effectively.

- Challenges in Commercializing Autonomous Vehicle Technology: PONY's growth strategy is heavily reliant on the commercialization of its autonomous vehicle (AV) technologies, including robotaxi and robotruck services. However, the commercialization process is still in its early stages and faces significant challenges, including regulatory approvals, safety concerns, and market adoption. Any delays or inability to achieve meaningful commercial success could materially impact the company’s revenues and growth prospects.

- High Dependence on Key Partnerships and Market Concentration: The company's success in segments like robotruck services is significantly tied to partnerships, such as Cyantron's collaboration with Sinotrans. Any disruption in these partnerships or inability to diversify its customer base and geographical presence could expose the company to market concentration risks and reduce its operational resilience in the face of competitive or regulatory challenges.

Conclusion

Pony’s IPO offers an opportunity to invest in a global leader in autonomous mobility, leveraging its robotaxi and robotruck services to drive revenue growth and reshape urban transportation. The company’s focus on commercialization, supported by advancements in AI and electric vehicle technologies, positions it well within a rapidly evolving market projected to grow significantly. However, several risks must be considered, including heavy reliance on its PRC subsidiaries for cash flow amid stringent regulations, challenges in achieving large-scale commercialization of its technologies, and dependency on key partnerships for market penetration. Financially, the company demonstrates strong revenue growth and improved gross margins, but profitability remains constrained by high operating costs and capital investment requirements.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Pony AI Inc (PONY)” IPO seems “Neutral" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...