Kalkine has a fully transformed New Avatar.

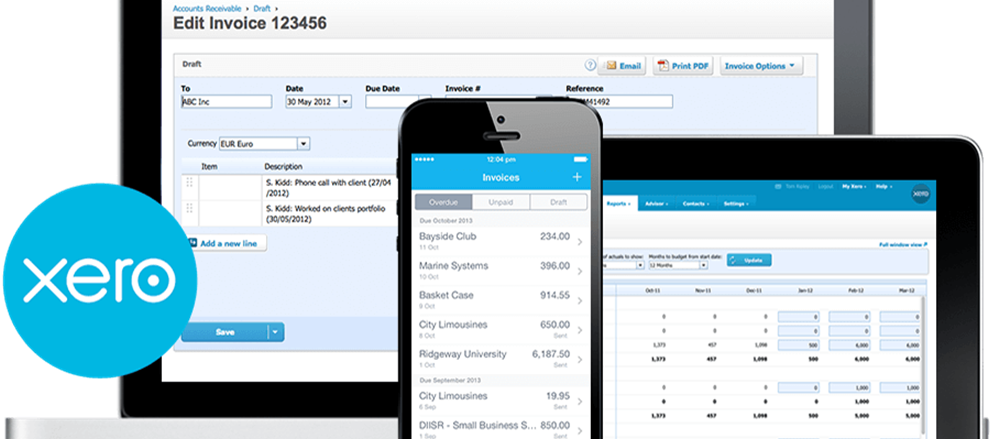

Xero Limited

Xero Limited’s (ASX: XRO) share plunged by 6.2% on 5 March 2018, as the company announced that Steve Vamos (former Microsoft Australia head) will replace Rod Drury as the new CEO of the company. Basically, XRO is New Zealand based software company that offers cloud-based accounting software for small and medium size businesses. The company has over one million subscribers in more than 180 countries that are integrated with more than 600 apps. The company has achieved cloud accounting market share leadership in New Zealand and Australia under Rod Drury’s guidance.

XRO is expanding its footprint into United Kingdom and United States and its total subscribers have grown to 1,199,000 as at September 2017. UK subscribers grew by 54% to 253,000 and American subscribers increased by 43% to 110,000 and rest of world subscribers rose by 62% to 47,000 in first half of the year as compared to previous year. The Group delivered operating revenues of $187.7 million that is 37% higher than prior corresponding year and positive EBITDA was reported at $5.4 million for the first time in the company’s history during 1H FY18. The primary reason for this improvement was sales growth and cost optimization strategy. Net loss came at 21.08 million in 1H FY18 from 43.92 million in 1H FY17. Moreover, the company has now completed the consolidation of its listing on the Australian securities Exchange (ASX). We expect that the company will continue to invest to expand its global products and platform across the regions, to help increase subscribers resulting into topline growth in years to come.

Meanwhile, the stock price rose by 39.8% in the past six months and by 3.85% in five days as on March 2, 2018. We give a “Hold” recommendation at the current market price of $30.85

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.