Caltex Australia Ltd

.png)

CTX Dividend Details

Positive outlook: Caltex Australia Limited (ASX: CTX) issued a positive 2015 outlook and estimates a total year historic cost profit after tax of $560 million to $580 million, which comprises over $29 million after tax of significant items, as compared to a profit of $20 million in 2014. The group derived $29 million (gain after tax) in significant items from first half sale of surplus land. Caltex Australia also estimates a strong RCOP NPAT in the range of $615 million to $635 million during the year which excludes significant items.

.png)

Guidance (Source: Company Reports)

The Group expects a product and crude oil inventory loss of over $85 million after tax, on the back of declining Brent crude oil prices which offset the declining Australian dollar contribution. But, this loss is better as compared to the inventory loss of $361 million after tax during 2014.

CTX issued a forecast of 5% rise in underlying Supply & Marketing reaching to over $675 million EBIT. We believe CTX stock has the ability to deliver more upside and accordingly recommend investors to hold the stock at the current price of $35.25

.png)

CTX Daily Chart (Source: Thomson Reuters)

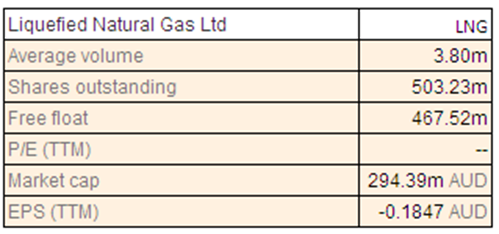

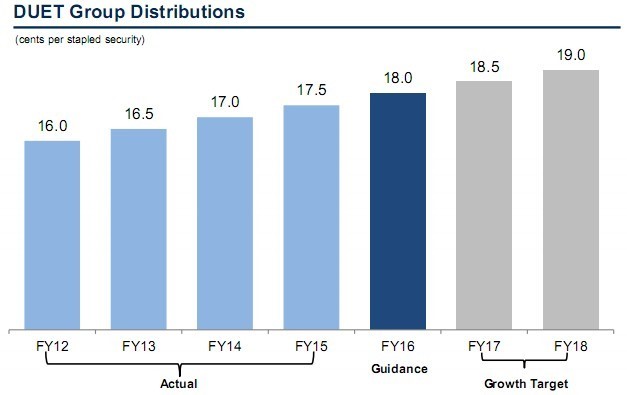

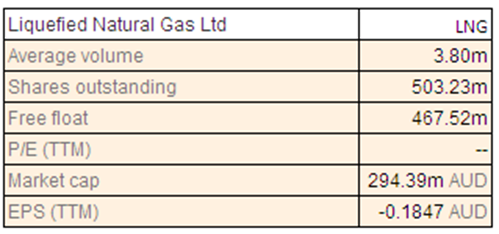

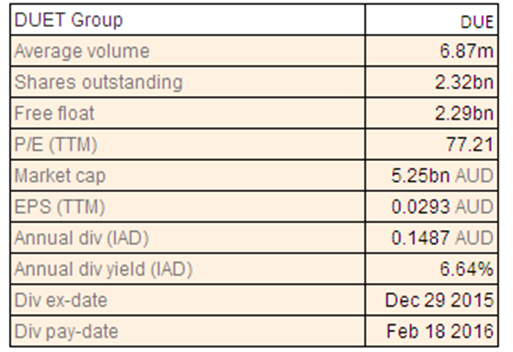

Liquefied Natural Gas Ltd

LNG Details

Strong capital position:Liquefied Natural Gas Ltd (ASX: LNG) stock has declined by more than 85.08% in the past six months (as of January 19, 2016) due to globally falling demand for petroleum and natural gas that has affected other major stocks in this sector. However, in 2015, the company has made some significant announcements indicating strategic boost. The company has continued its progress on the Magnolia LNG Project in the US. In addition to securing critical environment related approvals for the project, the company has also entered into major contracts with Meridian LNG for providing its liquification services. The company’s acquisition of Bear Head LNG project and securing all the required approval also strengthens a positive future outlook. In 2015, the company has also significantly improved its cash and asset position.

Project Portfolio (Source: Company Reports)

In the year, the company’s cash position and value of assets has improved by 269% and 284%, respectively.

This indicates that the company is in a good position for continuing the development of both the major projects and starting operations on schedule.Also the company’s focus on the US market and limited exposure to the Asian market ensures that the demand for its LNG will remain steady. The current low prices might be a good opportunity for long term investors betting on positive LNG demand outlook to move in. Accordingly, we give a buy recommendation on LNG at the current price of $0.555

LNG Daily Chart (Source: Thomson Reuters)

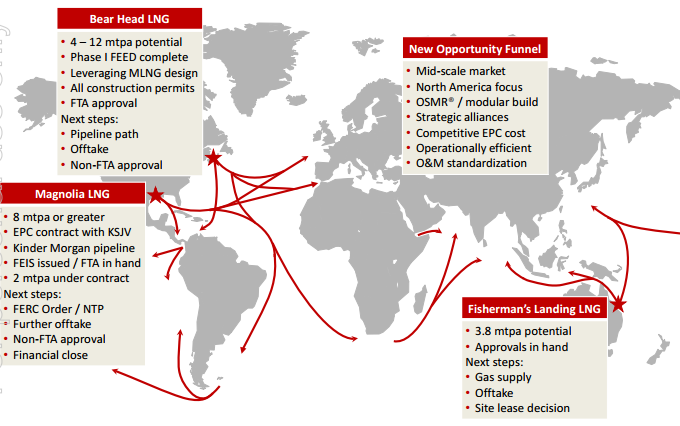

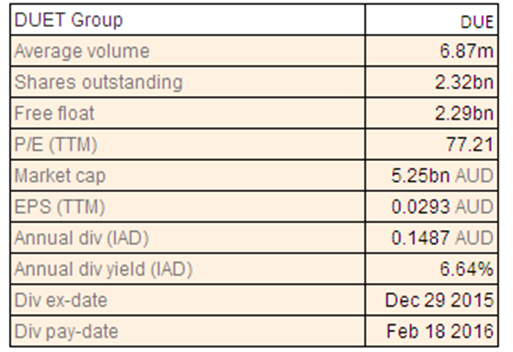

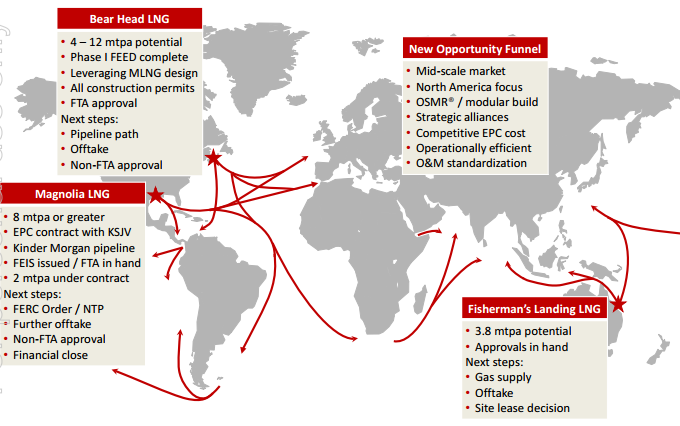

DUET Group

DUE Dividend Details

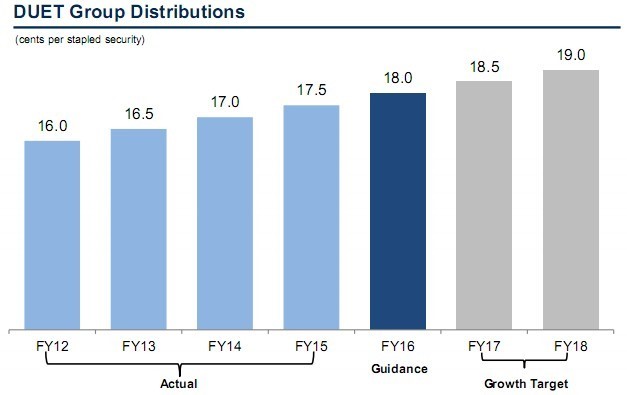

FY16 Distribution Guidance Reaffirmed: DUET Group (ASX: DUE), reaffirmed that its FY16 distribution guidance of 18 cents per stapled security does not change post the release of draft access arrangement decision for the Dampier to Bunbury Natural Gas Pipeline by the European Regulation Authority of Western Australia. The company reported that from the start of FY 2015 until the middle of November, the group has delivered a total shareholder return of 10% comprising of 3.4% for FY 2015 and 6.1% since the start of FY 2016. The securities are trading 16.3% to about the issue price of $ 2.02 in the recent capital raising and 4.4%, about the theoretical ex-rights price associated with the raising of $ 2.25.

Group Distributions (Source: Company Reports)

The group has also delivered on its distribution guidance of 17.5 cents per stapled security and, following the announcement of the proposed acquisition of EDL, the FY 2016 distribution guidance was upgraded to 16 cents per stapled security and this has now been reaffirmed. The EDL acquisition is expected to enhance the growth profile of the group given its list of prospective growth opportunities, mostly in the expansion of capacity at existing sites and the installation of new capacity at other sites owned by the existing customers.

As a result, a further increase in the guidance to distribution to $ 0.19 per stapled security is expected in FY 2018. Based on the future prospects of the group and a good dividend yield, we would rate the security as a Hold at the current price of $2.26

.png)

DUE Daily Chart (Source: Thomson Reuters)

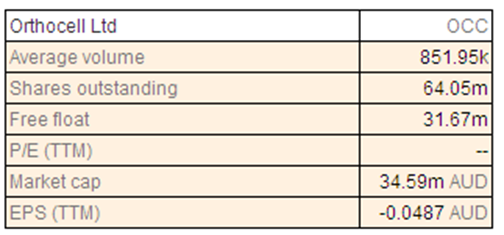

Orthocell Ltd

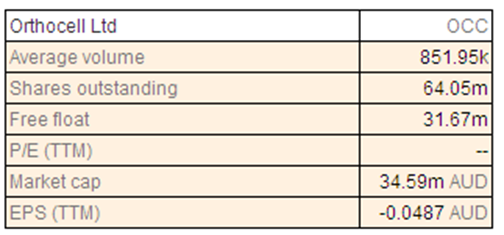

OCC Details

Growth underpinned by grant of patents: Orthocell Ltd (ASX: OCC), a regenerated medicine company that develops cellular therapies and collagen scaffolds for the treatment of human tendons, ligaments and defects in soft tissue, corrected 14.29% in the last three months but surged 54.29% in the last one month (as at January 19, 2016) in view of the recent grant of a patent in the US for cell-factory derived bioactive molecules for the generation of tissue specific growth factors to enhance tissue regeneration. The company has also announced for the approval of human tendon study using Celgro™ SMRT Graft™ collagen scaffold for the treatment and augmentation of rotator cuff tendon surgeries of the shoulder.

The company could also get the tenocytes containing bio-scaffold patent in Canada. OCC stated that it is well positioned for growth with approved treatments with strong clinical evidence and the first tendons and ligaments regeneration product in a major market. The TGA approved manufacturing facility in Australia has already been approved for commercial production. We have no doubt that the company is doing good a pioneer in its chosen field, but consider that the stock is expensive and overpriced at the current price $0.55

OCC Daily Chart (Source: Thomson Reuters)

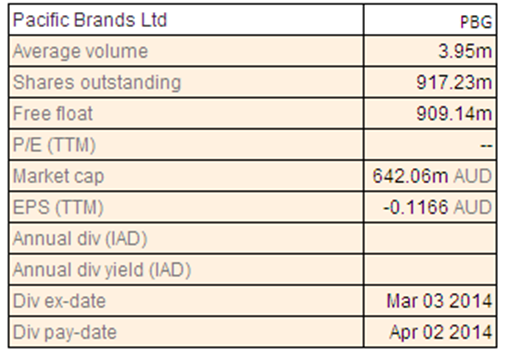

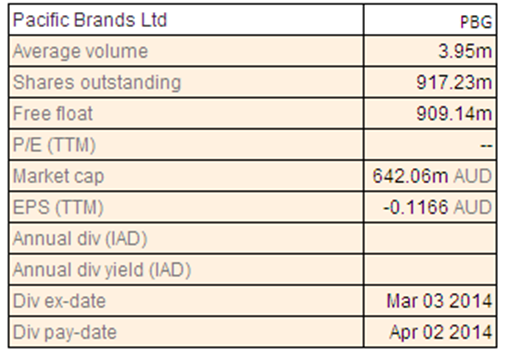

Pacific Brands Ltd

PBG Details

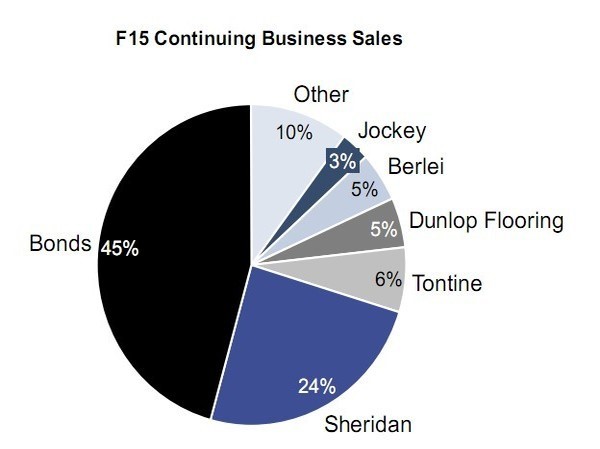

Efforts towards cost reduction: Pacific Brands Ltd (ASX: PBG) rose 60.92% in the last six months (as at January 19, 2016). The company updated about the completion of the strategic review while simplifying the brand portfolio post divestments. The two biggest brands Bonds and Sheridan contribute to 70% of group sales and the six key brands represent a combined total of 90%. Each of the key brands hold the number one position in their respective categories. In addition, about $ 25 million of costs is expected to be removed or offset through various cost-saving initiatives.

F15 Continuing Business Sales (Source: Company Reports)

The group results for FY 2015 depicted 5.4% growth in sales, with the Bonds and Sheridan brands up by 13% and 15% respectively, given the retail performance and strong comparable store growth. Thus, the lower wholesale sales which were affected by changes in the discount department store could be managed well. However, EBIT before significant items was down by 4.8% to $ 64.2 million because of lower wholesale margins. Net loss after tax of $ 98 million was largely due to the non-cash impairment charges in respect of the carrying value of certain assets. The balance sheet is strong and the focus on working capital management delivered strong cash conversion while doubling to 119% compared to the previous year. We note the improvement in the performance, but consider the stock to be

expensive at the current stock price.

PBG Daily Chart (Source: Thomson Reuters)

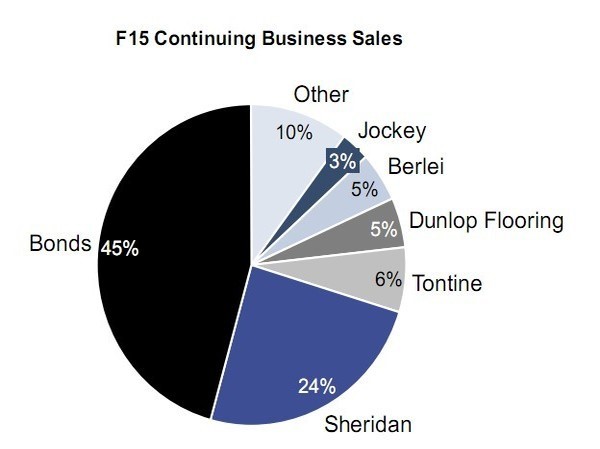

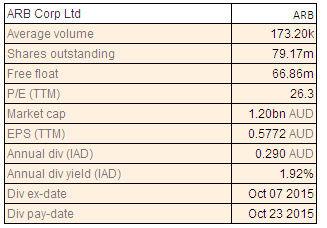

ARB Corp Ltd

ARB Dividend Details

Strong performance: ARB Corp Ltd (ASX: ARB) reported that results for FY 2015 depicted sales revenue of 10.7% to $ 329.8 million, profit before tax of 4.8% to $ 60 million and net profit after tax of 3.6% to $ 44.1 million. The company has declared a final fully franked dividend of 16 cents per share, resulting in total dividend for the year to $ 1.29 per share fully franked. Over the past 10 years, ordinary dividends per share have grown steadily and special dividend were paid in 2009/10 and 2014/15. Sales growth for FY 2015 has been 7.6% for the Australian Aftermarket, 17.8% for exports, 18.5% for Australian Original Equipment and 17.6% for off-road accessories Thailand, making up the total of 10.7%. In the case of new vehicle sales, the largest group of customers use 4WD utilities while large and medium SUV's also provide a strong market for accessories in Australia.

Many other markets around the world have grown in a manner similar to Australia, including the USA. We also note that annual sales revenue for ARB has grown at an average annual compound rate of 11.3% over the past 10 years and net profit after tax is grown at an average annual compound rate of 12.1% over the same period. However, at the current stock price which is close to the 52-week high value with a low dividend yield, we consider the stock to be expensive at the current price of$15.19

ARB Daily Chart (Source: Thomson Reuters)

IOOF Holdings Ltd

.png)

IFL Dividend Details

Cost Management and Integration of SFG: IOOF Holdings Ltd (ASX: IFL) clarified the misleading assertion in various media articles that the company managing director Christopher Kelaher, "cashed in on more than $ 17 million worth of IOOF shares in a sell down of his sizeable holding". The share transfers in question were made off market pursuant to a Family Court order and disclosed appropriately. Mr Kelaher has not cashed in and remains fully committed to the company. Meanwhile, for FY 2015, underlying profit after tax was up 41% to $ 174 million and this increased profit accompanied by increased cash flows enabled the board to declare a total dividend of 53 cents per share fully franked. The strong performance was reflected with all segments reporting an increase in profit on the previous year.

The value of funds managed for clients grew by 29% to $ 124 billion and, while this includes the impact of the SFG acquisition, the underlying organic growth was 8% showing that the businesses benefitted from a range of products initiatives introduced during the year and higher service levels for clients. Tight control was also maintained over costs. The successful integration of SFG was a key ally and ongoing synergies of at least $ 20 million are expected as a result of the acquisition in the current financial year. We accordingly rate the stock as a buy at the current price of $8.11

IFL Daily Chart (Source: Thomson Reuters)

Metcash Ltd

.png)

MTS Details

Transformation program is contributing to the bottom line performance: Metcash Ltd (ASX: MTS) stock surged over 41.85% (as of January 19, 2016) in the last six months, driven by its better than first half of 2016 performance despite pressure on its core food and grocery segment growth. As a result, the group delivered a profit after tax increase of 20.0% year on year (yoy) to $122 million in the first half of 2016, even though sales revenues rose only 1.4% yoy to $6.6 billion. On the other hand, the management reported that its strategic initiatives in Food & Grocery coupled with favourable ALM and Hardware performance might not entirely offset its Food & Grocery growth pressure. But, MTS is exploring all options to get back on growth track. Metcash’s improved its Competitive pricing strategy to over 1,280 stores in first half of 2016 as compared to over 1,100 stores in FY15, wherein the Price Match is implemented in over 920 stores against 600 stores in FY15. The Price Match sales momentum enhanced by over 350 basis points in like for like warehouse sales. The group launched over 120 new mid-tier private label products during the period leading to the Private Label warehouse sales increase by 4.5%. Moreover, Metcash started exporting its Australian products directly to consumers in China via the Alibaba’s online Tmall platform, further boosting its sales growth.

.png)

First half financial performance (Source: Company Reports)

MTS is also focusing on its balance sheet and accordingly decreased its net debt to $435.3 million in 1H16, against $667.8 million in FY15. Metcash continues to enhance its productivity efficiency across the segments and forecasts a gross pre-tax savings run rate of over $100 million in the coming three years (till FY19). We believe the group’s growth efforts would continue to drive the stock higher in the coming months, and accordingly place a hold on this stock at the current price of $1.60

.png)

MTS Daily Chart (Source: Thomson Reuters)

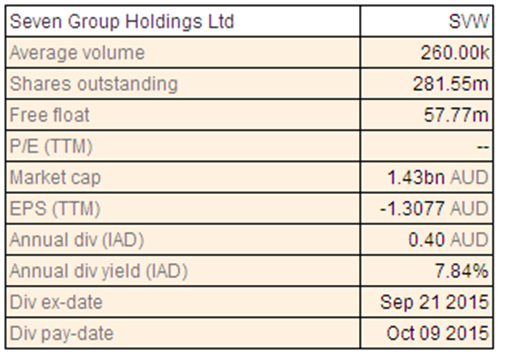

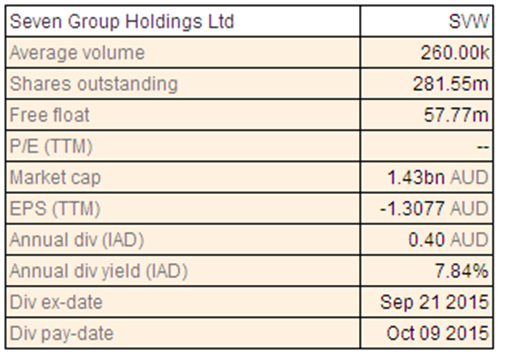

Seven Group Holdings Ltd

SVW Dividend Details

Efforts to enhance operational efficiency: Seven Group Holdings Ltd (ASX: SVW) delivered a solid support revenue at WesTrac Australia in fiscal year of 2015, rising by 13% against last year, driven by strong resource production volumes which led to maintenance opportunities for the installed CAT equipment base. The group’s major focus to generate a strong operating cash flow via efficient working capital management paid off, as they maintained an underlying EBITDA cash conversion of 99% in line with FY14. However, SVW’s underlying EBIT fell by 14.7% to $315 million during fiscal year of 2015, which is the lower end of the group’s 2015 guidance. The group also issued an underlying EBIT of over 10% decrease in FY16 as compared to FY15 due to tough market conditions. On the other hand, seven group is making efforts to improve its bottom line and accordingly cut its FTE count by 330 in WesTrac Australia, WesTrac China and AllightSykes while FTE count in Coates Hire was decreased by 68. SVW undertook initiatives to enhance its technician productivity and service profitability within WesTrac and even enhanced system which would further contribute to the group’s operating benefits. Meanwhile, the Phase 1 of WesTrac ERP upgrade (financial and reporting modules) would also contribute to the benefits while Phase 2 upgrade is expected by mid of this year (operations, sales, marketing, CRM) which would lead to a further efficiency in the group’s service and support offerings.

SVW is also seeking to maintain its market dominance with CAT mining equipment population of over 6,000 units which are now in operation at WA and NSW accounting 60% of the market share. We believe that SVW’s ongoing buyback program, efforts to further enhance market share, as well as operation efficiency efforts would give a momentum and hence, we give a buy recommendation at the current price of $4.98

SVW Daily Chart (Source: Thomson Reuters)

WorleyParsons Ltd

.png)

WOR Dividend Details

Won Major contracts: WorleyParsons Ltd (ASX: WOR) stock had been under pressure and plunged over 58.77% in the last six months (as at January 19, 2016) given its performance pressure. On the other hand, the group won major contracts recently contributing to the group’s performance in the long term. WorleyParsons got a Master Engineering and Procurement Services Agreement from Canada based Exploration and Production Company for a five year term. WOR would offer consulting, engineering, procurement and project delivery services to the client’s projects across Canada. Moreover, Botswana Metals Limited also applied for an extension of PL 110/94, PL 111/94 and PL 54/98 before their expiry in March, with WOR being appointed by the JB partners to finish the Pre-Feasibility Study ahead of a decision to proceed to a Technical Study and an Environmental Impact Assessment. Meanwhile, Bahrain Petroleum Company B.S.C, (BAPCO) gave a Project Management Contractor (PMC) contract to WOR for its Modernization Program (BMP).

With this contract, the group forecasts an A$120 million revenue. WOR’s joint venture with Broadspectrum for Transfield Worley Power Services Pty Limited TWPS project also got a five and a half year contract with AGL Loy Yang, and the forecasted revenue to TWPS from this contract is $200 million. Given the above, we continue to be bullish on WOR and reiterate buy recommendation at the current price of $3.66

WOR Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...