Analysis

-

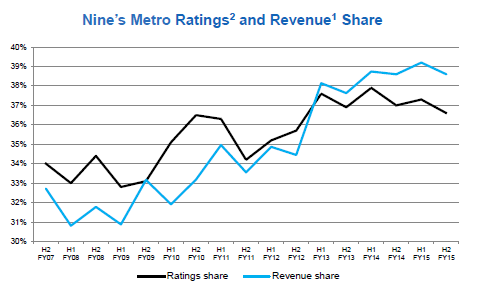

Poor FY15 performance pressure, but in line with estimates: Nine Entertainment Co Holdings Ltd (ASX: NEC) reported a 2.6% yoy increase in revenues to $1.6 billion for the fiscal year of 2015. As per the business segments, NEC’s network revenues fell 1.1% yoy to $1.2 billion, impacted by the weakening FTA market. But, FTA Metro advertising revenue share improved to 38.9%, against 38.7% in the corresponding earlier year. The group’s digital business improved by 33.2% yoy to $163.4 million, as compared to $122.7 million in the pcp, driven by the double digit growth in both Search and Video revenue. However, the EBITDA fell 7.6% yoy to $287 million, affected by the rising TV costs, but this was in line with the guidance. The net profit after tax tumbled 2.9% yoy to $140.1 million, before the $732 million specific item during the period.

The group’s metro ratings and revenue performance over the years (Source: Company Reports)

-

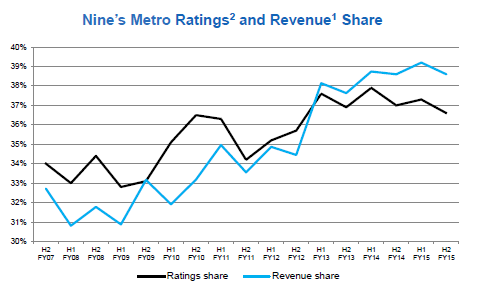

Balance sheet Highlights: The group improved its operating cash flow by 9.4% to $297.3 million, against $271.9 million in 2014 fiscal year and accordingly the operating free cash flow conversion rose to 103% in FY15, from 87% in pcp. Nine Entertainment is a solid dividend player, and also enhanced its dividends per share to 9.2 cents per share in FY15, as compared to 4.2 cents per share in FY14. Meanwhile, NEC also improved its net debt to $524.3 million as at June 2015, against $537.5 million as at June 2015, in spite of $62 million of on-market share buy-back. Interest cover increased to 10.8x during the period against 5.7 x in the pcp, due to decrease in interest costs post debt refinancing at June 2014.

.png)

Balance sheet performance (Source: Company Reports)

-

Initiatives to offset the declining revenues: NEC is focusing on the seamless content and audience experience, to offset the pressure coming from the TV advertising market. The group launched Coach, Honey and Pickle content brands during the year. Nine Entertainment is also performing well in the Australia’s video on demand market, and was able to generate 345 million streams. NEC also acquired stake in youth publisher website Pedestrian.tv. Meanwhile, Stan has more than 300,000 gross subscribers (households), having around 800,000 users of the service since its launch. Nine Entertainment intends to reach the range of 300,000 to 400,000 active subscribers by this ending of the year. Accordingly, Stan is continuously adding premium content and is enhancing its availability across the devices and distribution partnerships. Nine Entertainment also finished the sale of 100% of its Nine Live business to funds, as advised by Affinity Equity Partners (Affinity). The company received over $600 million post costs and tax. Accordingly, Nine Entertainment intends to use these funds to decrease its debt as well as use for its capital management activities.

-

-

Improving Outlook: Despite the challenging market conditions, Nine Entertainment witnessed a decent growth in the months of July and August and intends the similar trend for the fiscal year of 2016. However, the Programming costs are estimated to grow by 2% in FY16 (before the benefit of FY15 Specific Item provisioning), on the back of higher contracted costs related to the NRL and cricket. The ongoing digital segments growth is also estimated to boost the market further.

-

Remain Bullish: The shares of Nine Entertainment have been performing well since our “BUY” recommendation last month, and has generated over 6.8% in the last four weeks alone. In fact the stock jumped 10.3% on Aug 28, boosted by a positive outlook by the management despite posting a weak fiscal 2015 year performance. Nine Entertainment managed to improve the market share wherein the revenues from Metro FTA rose by 0.2 percentage points to 38.9% although the market declined by 1.5%. Growing online advertising market has impacted the FTA advertising due to which the stock crashed over 21.4% in the last three months alone. However, the group’s recent win of National Rugby League (NRL) broadcast rights would offer the firm some support for the coming years. Management also remains positive on its performance ahead, with its loss making international programs nearing expirations while the group has a flexible balance sheet. Given the decent growth opportunities ahead, the correction of the stock price over the last few months have placed it at an attractive valuation. The stock has a P/E of 13.3x, which is better as compared to its peers and has a solid dividend yield of 6.1%. Accordingly, we remain bullish on the stock and investors can initiate fresh buying at the current price of $1.655.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

Please wait processing your request...

Please wait processing your request...