Kalkine has a fully transformed New Avatar.

Macquarie Group Ltd (ASX: MQG)

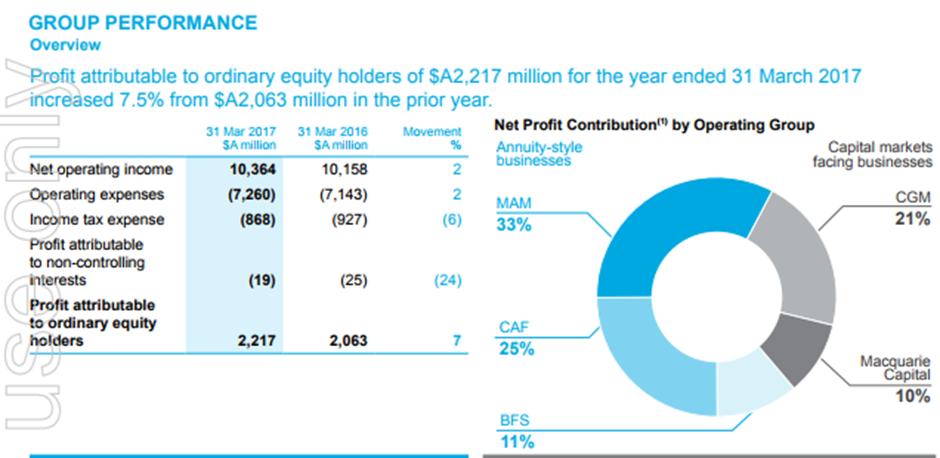

Higher Yield expected in 2018: Macquarie Group has recently issued 6,917 fully paid ordinary shares in the month of November. As on 30 November 2017, there were 81, 663 unlisted Exchangeable shares issued by Macquarie Capital Acquisition (Canada) Limited, a subsidiary of MQG pursuant to the retention agreements entered with key Orion Financial Inc. employees after Macquarie completed the acquisition of Orion.The group also elevated its interim dividend till 8% that was $2.05 per share on total earnings per share of $3.70. It achieved FY17 net profit of A$2,217 million for the year, which is an increase of 7.5% as compared to prior year; and reported an operating income of $A10,364 million, which is an increase of 2% on prior year. Moreover, the return on equity also increased by 14.7% as compared to prior year and now it is 15.2% The board has approved $1 billion for share buyback depending upon the market conditions; and as the stock prices are high, the bank’s management is confident that the stock still offers good medium-term value. Meanwhile, the group’s core asset management business once again proved to be a dominant performer, with high performance fees which lifted the total fee and commission income by 17%.

Macquarie Group was now found to be selling its 11.5% stake in ASX-listed toll-road company Macquarie Atlas Roads Group and announced a block trade. Macquarie was calling for the bids for 76 million shares starting from $5.80 per share to a maximum of $6.10 per share. This was due to the reason that Macquarie group is set to lose the rights to manage the toll-road company.

Meanwhile, it remains well positioned to deliver superior performance in the medium-term due to its deep expertise in major markets and its ability to adapt its portfolio mix to changing market conditions. MQG’s future results are forecasted to be in line with 2017 financial results. The market expects MQG to offer a yield of about 5% over 2018 if it lifts the 2018 final dividend to about $3 per share. Its acquisition of UK’ Green Investment Bank for £2.3 billion can be a catalyst for growth.

Performance Summary (Source: Company Reports)

Stock Performance: MQG has hit a record high level in the last six months with an increase of 7.86% in price and trades at a very high level. We give an “Expensive” recommendation at the current price of $96.88

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.