Nine Entertainment Co Holdings Ltd

.png)

NEC Dividend Details

Soft trading update but portfolio diversification via acquisitions: Nine Entertainment Co Holdings Ltd (ASX: NEC) continues to diversify its portfolio and agreed to acquire 9.99% of the shares in Southern Cross Media Group Limited (ASX: SXL) from Macquarie Group at a price of $1.15 per share. On the other side, NEC announced that advertising market in the March quarter remained subdued with Nine’s Summer of Cricket getting affected by weather and the standard of the competition. In fact, Nine’s Television revenues dipped 11% against Q3 FY15. The stock corrected over 24.84% (as of April 15, 2016) in the last four weeks.

.png)

Digital segment outperforming (Source: Company reports)

NEC further reduced its forecasts for market share and industry growth in FY16 with FY16 FTA TV ad market expected to be down by low single digits against previously flat to down marginal forecast and FY16 market share expected to be 37% against earlier announced 38%. However, the company mentioned that 1H16 trends in Digital have continued into 2H16. Any impact from media reforms, licence fee reduction and election-related ad spend is to be seen in the later part of the year. We rate the stock a "HOLD" at the current share price of $1.125

.PNG)

NEC Daily Chart (Source: Thomson Reuters)

Seven West Media Ltd

.png)

SWM Dividend Details

Strong dividend yield: Seven West Media Ltd (ASX: SWM) stock continued to rally since the last three months and generated over 36.49% (as of April 15, 2016) driven by its recovering performance after facing pressure last year. Accordingly, SWM reported its first half yearly 2016 financial results with profit after tax of $135.2 million compared to a loss of $993.6 million in year ago period even though the revenues decreased to $892.9 million against $943 million earlier.

.png)

Half year financial highlights (Source: Company reports)

Still, the group is trading at a strong dividend yield, and declared an interim dividend of 4 cents per share. We believe that SWM stock would continue to witness momentum in the coming months and hence recommend a "HOLD" rating at the current share price of $1.015

SWM Daily Chart (Source: Thomson Reuters)

Ten Network Holdings Ltd

.png)

TEN Details

Expandingmarket share: Ten Network Holdings Limited (ASX: TEN)recorded an advertising revenue growth driven by the Free TV Australia and accordingly reported a revenue rise by 13% to $359.7 million for the first half 2016.

Also, the company's market share during the period was up to 23.2% from 20.4% in year ago period, highest since June 2012. On the other hand, the declining FTA market in Australia has dragged the stock lower by 39.14% (as of April 15, 2016) in the last six months. The half year results till February 2016 are to be reported on April 21, 2016. We believe that the pressure in the stock would continue in the coming months and reiterate our "Expensive" recommendation at the current share price of $1.005

.PNG)

TEN Daily Chart (Source: Thomson Reuters)

Ooh!Media Ltd

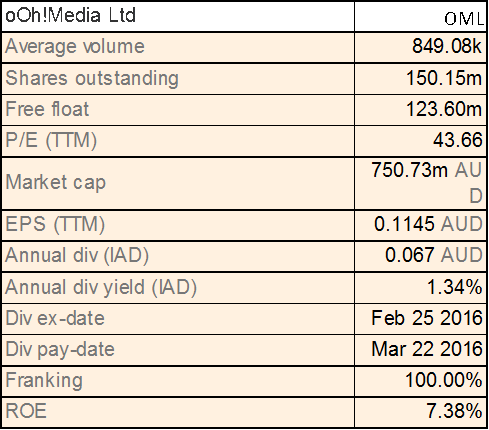

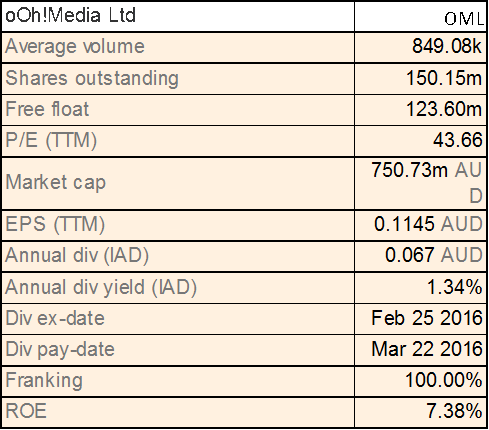

OML Dividend Details

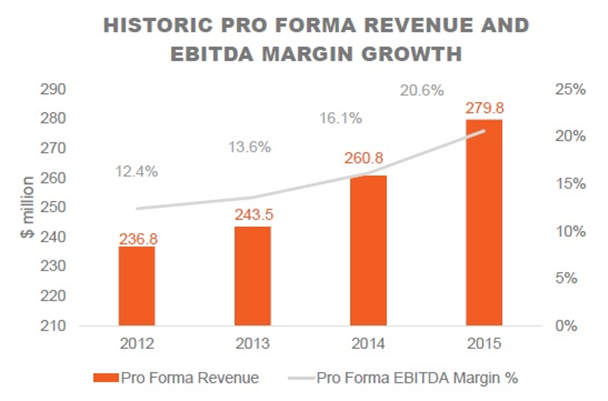

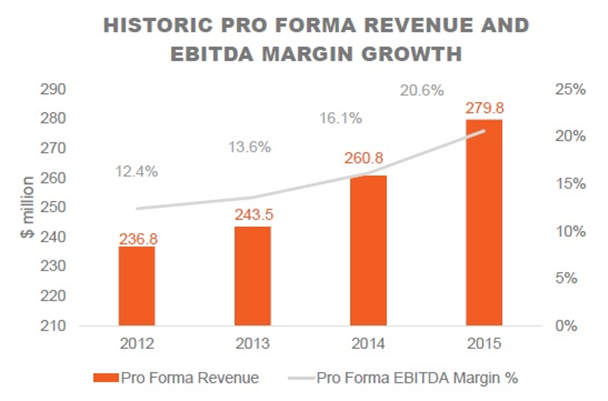

Better than estimated results: oOh!Media Ltd (ASX: OML) recorded strong growth in 2015 with pro forma revenue increasing 7.3% to $279.8 million from prior year and also exceeding prospectus forecast by 5%. Pro forma EBITDA was up 37.1% from prior year to $57.7 million and exceeding prospectus forecast by 18.8%. Pro forma adjusted net profit after tax rose 56.8% to $28.5 million, ahead from prospectus forecast.

Financial metrics (Source: Company reports)

Accordingly, the stock spiked over 60.26% in the last six months placing them at unreasonable valuations (as of April 15, 2016). The group has a high P/E ratio and a moderate dividend yield. We rate the stock "Expensive" at the current share price of $5.00

OML Daily Chart (Source: Thomson Reuters)

QMS Media Ltd

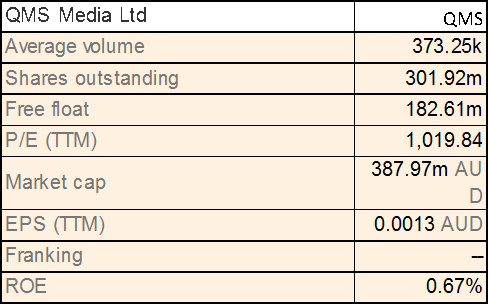

QMS Details

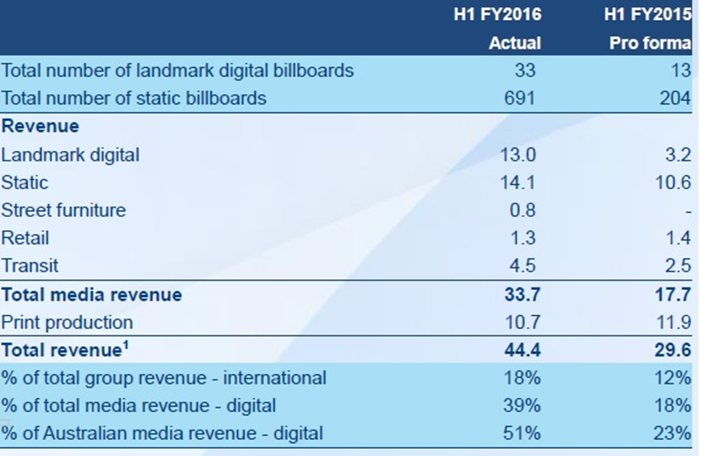

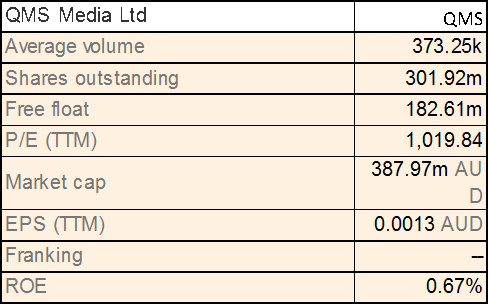

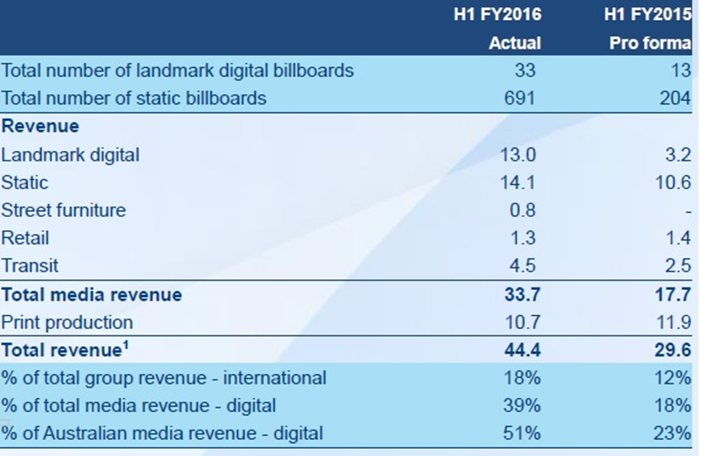

Strong digital segment performance: QMS Media Ltd (ASX: QMS) recorded strong earnings growth for the first half financial year 2016 mainly driven by digital segment. Statutory revenue rose 50% to $44.4 million while EBITDA stood at $9.9 million, including contribution from New Zealand acquisitions. The first half was driven by strong contribution from digital accounting for 51% of the Australian media revenue and 39% of total media revenue.

Expanded platform driving revenue growth (Source: Company reports)

QMS stock surged 43.49% in the last six months (as of April 15, 2016) and has been added to All Ordinaries Index as per S&P Dow Jones Indices’ March quarterly balance. We believe the momentum would continue and hence rate the stock "Speculative Buy" at the current share price of $1.265

QMS Daily Chart (Source: Thomson Reuters)

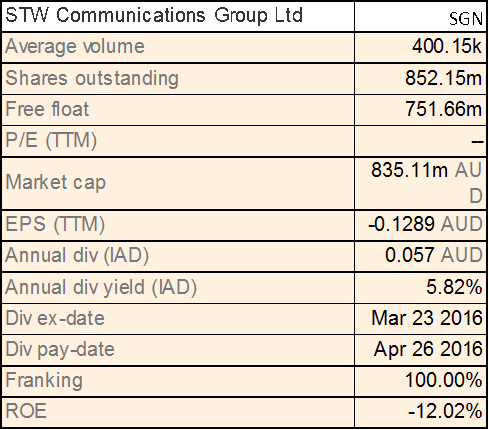

STW Communications Group Ltd

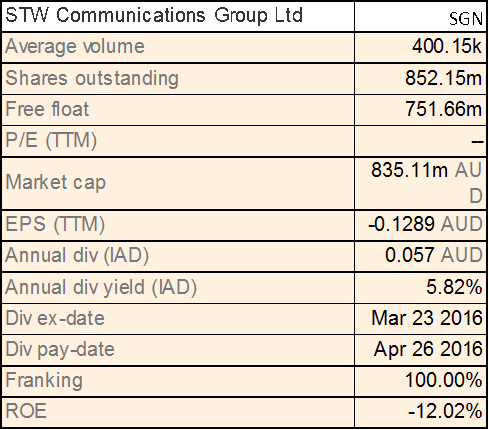

SGN Dividend Details

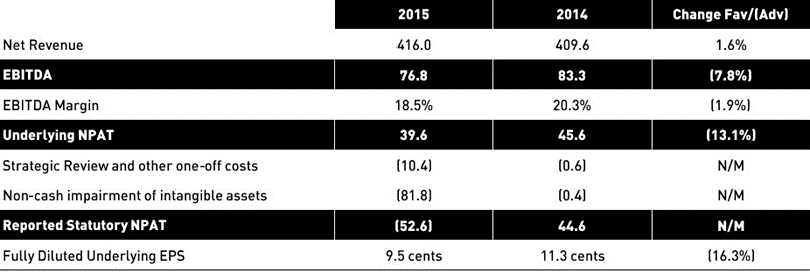

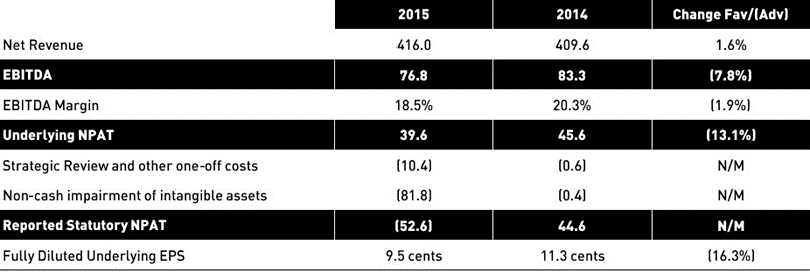

Strengthening capital position: STW Communications Group Ltd. (ASX: SGN) recently announced that it has agreed new debt facilities to refinance existing arrangements and provide ongoing working capital funding with regard to the proposed merger with the Australian and New Zealand businesses of WPP plc. Lately, the company announced for formal completion of the merger wherein the combined entity will be known as WPP AUNZ. The agreed and committed core debt facilities comprise AUD $547 million and NZD $3 million. On the other side, the group managed to deliver underlying net revenue of $416 million, an increase of 2% from previous year, for full year 2015.

Group profit & loss (Source: Company reports)

The company's stock price is touching its levels close to 52-week high and has rallied almost 32.43% in past three months (as of April 15, 2016). We recommend a "HOLD" rating on the stock at the current share price of $1.00

SGN Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.PNG)

.png)

.png)

.png)

.PNG)

Please wait processing your request...

Please wait processing your request...