Ten Network Holdings

Mixed Result and Partnership with Foxtel: Ten Network Holdings Limited (ASX: TEN) reported better television revenues during fiscal year of 2015 which improved by 4.6% year on year (yoy) to $629.3 million, against $601.7 million in the prior corresponding period. Ten Network was also able to decrease its television costs (ex-selling costs) by 6.5% yoy during the year and accordingly the group’s television EBITDA loss reached $12.0 million during the period, from a loss of $79.3 million in fiscal year of 2014. But, ten Network reported a non-recurring items of $262.9 million for the year as the group reported a heavy television license impairment of $251.2 million in April 2015. Therefore, Ten Network reported a loss of $312.2 million in FY15 and has a net debt of $131.4 million. Recently, Australian Communications and Media Authority as well as Australian Competition and Consumer Commission permitted the strategic engagements between TEN and Foxtel Management.

.png)

Ten Network performance over the years (Source: Company Reports)

The group also declared a fully underwritten entitlement offer of up to $77 million at $0.15 per share in view of capital raising. Foxtel would become a major shareholder in TEN through the issuance of new ordinary shares. The group would receive over $154 million gross proceeds through the issuance of new ordinary shares to Foxtel. Consequently, Ten Network’s cash position would be boosted to $14.6 million (pro-forma as at August 2015), which TEN intends to utilize to repay its debt. Meanwhile, the group would acquire about 24.99% shareholding in Multi-Channel Network as well as has the option to become a 10.0% shareholder in Presto.

Long term pressure: The group estimates its gross advertising revenue to improve by at least 10% during the first three months of the fiscal year of 2016. On the other hand, management reported that the overall television advertising market remains “short” in terms of forward bookings, leading to ongoing earnings performance pressure in the coming periods. We believe that the stock would continue to be under pressure in the coming months given the ongoing decline of TV advertising revenues and accordingly give an “Expensive” recommendation to the stock at the current price of --

TEN Daily Chart (Source: Thomson Reuters)

Bank of Queensland

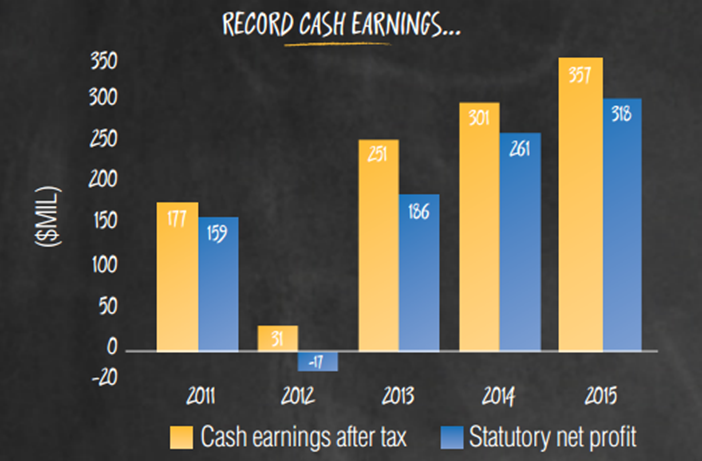

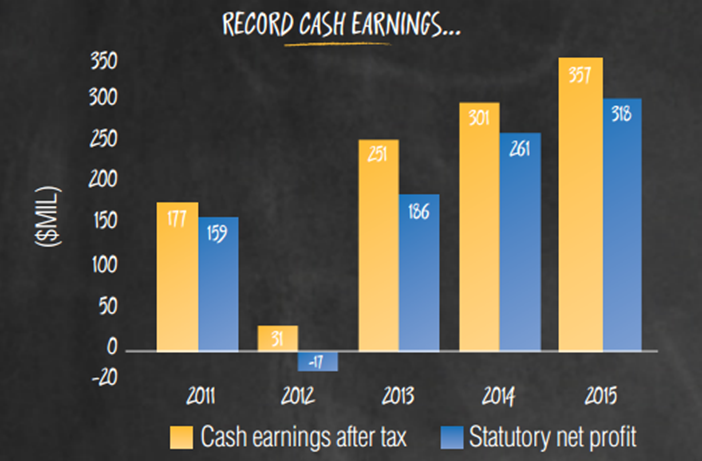

Ongoing solid performance: Bank of Queensland Limited (ASX: BOQ) continued to maintain its solid performance for fifth consecutive half, and delivered a statutory profit after tax rise of 22% year on year (yoy) to $318 million. Bank of Queensland has improved its margins and asset quality during the year as the group’s strategy efforts paid off. Particularly, the specialist bank business that witnessed growing margins and low impaired assets enabled BOQ steer through strongly. BOQ cash earnings surged by 19% yoy to $357 million in FY15 while there was an improvement in dividends by 12% leading to total dividends to 74 cents per share during the year. Bank of Queensland was able to deliver a better total return to shareholders of 6.3% in FY15 as compared to group’s peer banks. Bank of Queensland is now focusing on its niche segments by developing a better customer banking relationship.

Improving performance (Source: Company Reports)

Stock Performance: Based on the Independent Roy Morgan research, BOQ was able to deliver solid levels of customer satisfaction wherein it’s Net Promoter Score improved by 36.7 points over the last 2.5 years. Bank of Queensland’s efforts to offer on-balance sheet mortgages to BOQ specialist customers is generating better results than forecasted, which would further boost BOQ’s performance. The bank recently priced A$550 million of 3.5 year floating rate Notes at a margin of 115 basis points over the 3 month Bank Bill Swap Rate. Earlier, BOQ also raised over $150 million by issuing Wholesale Capital Notes at a margin of 4.35% over the 6 month Bank Bill Swap Rate. The bank delivered a return on equity and return on tangible equity of 10.7% and 14.4% respectively during fiscal year of 2015. The shares of Bank of Queensland generated over 15.92% in the last four weeks alone (as of Oct 27, 2015) and we believe the positive momentum in the stock would continue in the coming months. BOQ also has a decent annual dividend of 5.4%. Based on the foregoing, we give a “BUY” recommendation to the stock at the current price of $13.51.

BOQ Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

Please wait processing your request...

Please wait processing your request...