Reddit Inc

Reddit, Inc. (NYSE: RDDT) operates a social platform, Reddit. The Company operates mobile applications and a website that allows users to form communities and create and share content. Reddit is focused on bringing community, belonging, and empowerment to everyone in the world. Reddit is a global, digital city where anyone can join a community to learn from one another, engage in authentic conversations, explore passions, research new hobbies, exchange goods and services, create new communities and experiences, share a few laughs, and find belonging.

Recent Business and Financial Updates

- Significant Growth in User Engagement and Financial Metrics: In the third quarter of 2024, Reddit, Inc. (NYSE: RDDT) reported a remarkable increase in user engagement and revenue. Daily Active Uniques (DAUq) rose by 47% year-over-year, reaching 97.2 million, indicating strong community engagement and site traffic. Additionally, the company achieved robust revenue growth, posting a 68% increase to USD 348.4 million compared to the same period last year. This growth was driven by increased advertising revenue, which rose by 56% to USD 315.1 million, and substantial gains in other revenue streams, which soared by 547% to USD 33.2 million.

- Achieving Profitability and Enhanced Margins: Reddit attained GAAP profitability this quarter with a net income of USD 29.9 million, translating to a net margin of 8.6%. The gross margin improved by 280 basis points to reach 90.1%, reflecting effective cost management and operational efficiency. Adjusted EBITDA also demonstrated significant improvement, reaching USD 94.1 million, with a margin of 27.0%, up from a loss of USD 6.9 million in the previous year. This financial success highlights Reddit's strengthened ability to generate revenue while managing operational costs effectively.

- Positive Cash Flow and Capital Allocation: The company reported positive operating cash flow of USD 71.6 million, reflecting an increase of USD 79.3 million from the prior year, showcasing enhanced cash management. Free Cash Flow stood at USD 70.3 million, underscoring the company’s ability to generate surplus cash, which was allocated toward strategic investments, including USD 66 million to net settle 1.2 million employee shares. Capital expenditure remained minimal, representing less than 1% of revenue, signifying efficient capital allocation.

- Geographic Revenue Distribution: Reddit’s revenue growth was strong across regions, with U.S. revenue increasing by 70% to USD 288 million and international revenue growing by 57% to USD 60.4 million. These figures illustrate Reddit's expanding market reach and effectiveness in monetizing both domestic and international audiences.

- Financial Outlook for Q4 2024: Looking ahead to the fourth quarter of 2024, Reddit anticipates revenue between USD 385 million and USD 400 million and projects Adjusted EBITDA to be within the range of USD 110 million to USD 125 million. This outlook demonstrates Reddit’s confidence in sustained revenue growth and operational efficiency, although it acknowledges significant risks and uncertainties that could impact future performance.

- CEO Statement on Company Milestones: Reddit's CEO, Steve Huffman, highlighted the company’s recent accomplishments, noting Reddit’s position as one of the most visited and trusted platforms globally. He expressed enthusiasm for future growth opportunities, particularly in user engagement, revenue expansion, and profitability, underscoring the platform’s continued commitment to community and innovation.

Technical Observation (on the daily chart):

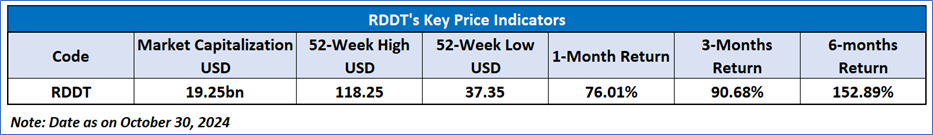

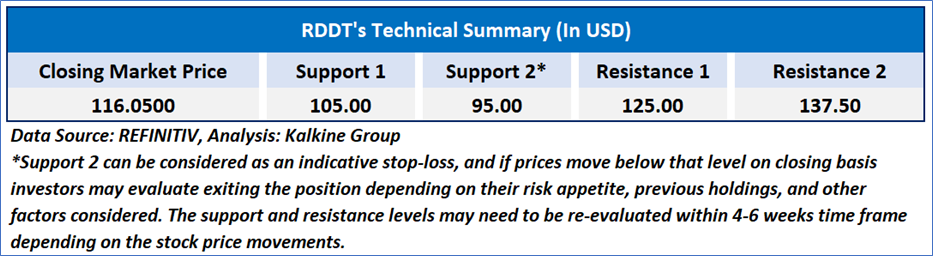

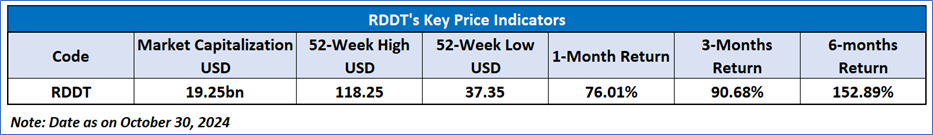

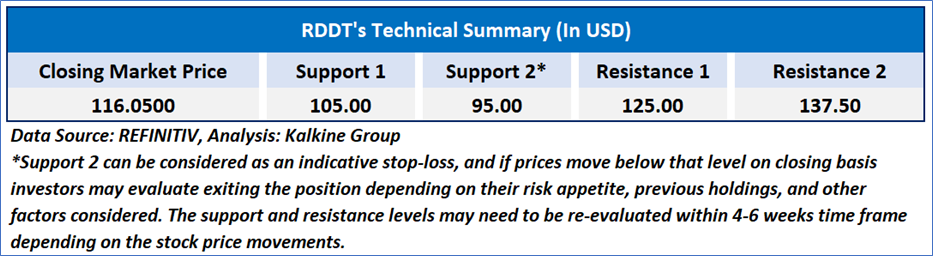

The Relative Strength Index (RSI) over a 14-day period stands at a value of 88.13, currently inside the overbought zone, with expectations of a consolidation or a downward momentum after a 41.97% increase after the Q3FY24 results announcement. Additionally, the stock's current positioning is above the 50-period SMA, which may serve as dynamic short to medium-term support level.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Reddit, Inc. (NYSE: RDDT) at the closing market price of USD 116.05 as of October 30, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 30, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...