Riley Exploration Permian Inc

Riley Exploration Permian, Inc., (NYSE: REPX) together with its subsidiaries is an independent oil and natural gas company. The Company is focused on the acquisition, exploration, development and production of oil, natural gas, and natural gas liquids. The Company focuses on horizontal drilling and completions applied to conventional formations in the Permian Basin.

Recent Business and Financial Updates

- Production and Financial Performance in Q2 2024: In the second quarter of 2024, Riley Permian achieved an average total equivalent production of 21.3 MBoe/d, with oil production reaching 14.7 MBbls/d. The company generated USD 51.6 million in operating cash flow, with USD 57.6 million recorded before adjustments for working capital. Total capital expenditure before acquisitions amounted to USD 21.4 million on an accrual basis and USD 19.3 million in cash expenditures. Free Cash Flow for the period totaled USD 38.3 million. Furthermore, Riley Permian distributed USD 0.36 per share in dividends, totaling USD 7.5 million, and reduced its outstanding debt by USD 20.0 million. The company also raised USD 25.4 million from an equity offering and closed an acquisition, adding 13,900 contiguous net acres in New Mexico to its asset portfolio.

- Management’s Strategic Overview: Bobby D. Riley, the company’s Chief Executive Officer and Chairman, expressed optimism about Riley Permian's continued execution of its annual strategic plan, citing overall positive results. Although it remains early to evaluate medium- to long-term well outcomes, the company is already seeing legacy well production outperforming internal forecasts. Additionally, favorable drilling and completion efficiencies have driven significant cost savings, contributing to improved free cash flow. One of the company’s primary objectives for 2024—smoothing development activity and expenditures—has also been successfully achieved, further supporting operational consistency and cost management.

- Q2 2024 Operational and Financial Highlights: For the quarter ending June 30, 2024, Riley Permian reported revenues of USD 105.4 million, with net cash provided by operating activities totaling USD 51.6 million and net income of USD 33.5 million, or USD 1.59 per diluted share. On a non-GAAP basis, Adjusted EBITDAX amounted to USD 73.3 million, while cash flow from operations before changes in working capital was USD 57.6 million. The company's Free Cash Flow was USD 38.3 million, and Adjusted Net Income reached USD 33.1 million, or USD 1.57 per diluted share. Riley Permian’s production included 14.7 MBbls/d of oil, with 21.3 MBoe/d of total equivalent production, comprising 69% oil and 86% liquids.

- Capital Expenditure and Operational Developments: During the second quarter, Riley Permian incurred capital expenditures of USD 21.4 million on an accrual basis and USD 19.3 million in cash expenditures. The company drilled two gross operated horizontal wells, completed eight, and brought four wells online for production. Additionally, Riley Permian contributed USD 9.5 million to its joint venture, RPC Power LLC, increasing its total investment to USD 21.0 million and ownership stake to 50%. The company also reduced its total debt by USD 20.0 million, comprising a USD 15.0 million reduction on its Credit Facility and USD 5.0 million on its Senior Notes. As of June 30, 2024, Riley Permian's total debt stood at USD 322.7 million, with USD 215.0 million available for future borrowing under its Credit Facility.

- Acquisition and Equity Offering Initiatives: On April 8, 2024, Riley Permian issued and sold 1,015,000 shares of common stock at USD 27.00 per share, raising approximately USD 25.4 million in net proceeds after deductions for underwriting fees and commissions. The company further expanded its asset base by acquiring oil and natural gas properties in Eddy County, New Mexico, on May 7, 2024. This acquisition, valued at approximately USD 17.6 million plus USD 0.5 million in transaction costs, added 13,900 total net acres to Riley Permian's New Mexico position, further strengthening its operational footprint.

- Forward Guidance for 2024 Operations and Investments: Riley Permian has reaffirmed its third-quarter and full-year 2024 activity guidance, based on the current development schedule and market conditions. For the third quarter, the company plans to drill 10 to 12 gross operated wells, complete 1 to 3 wells, and bring 4 to 7 wells online. Full-year 2024 guidance includes plans to drill 24 to 26 wells, complete 18 to 20, and turn 20 to 22 wells to sales. Net production is projected to range between 21.0 and 23.0 MBoe/d for Q3 2024, with oil production estimated at 14.8 to 15.3 MBbls/d. Full-year net production estimates stand between 21.0 and 22.5 MBoe/d, with oil production anticipated to range from 14.5 to 15.2 MBbls/d.

- Projected Costs and Financial Expenditure Outlook: For the third quarter of 2024, Riley Permian projects lease operating expenses, including workover expenses, to range between USD 8.50 and USD 9.50 per Boe. Production taxes are estimated at 6% to 8% of revenue, with cash general and administrative (G&A) expenses expected to be USD 3.00 to USD 3.50 per Boe. Interest expenses are projected to range between USD 8.5 and USD 9.5 million, while income tax cash payments for the quarter are anticipated to be USD 5 to USD 7 million. Full-year income tax cash payments are estimated at USD 22 to USD 25 million.

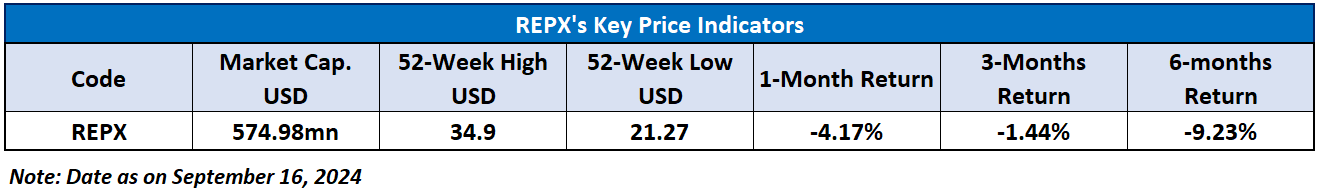

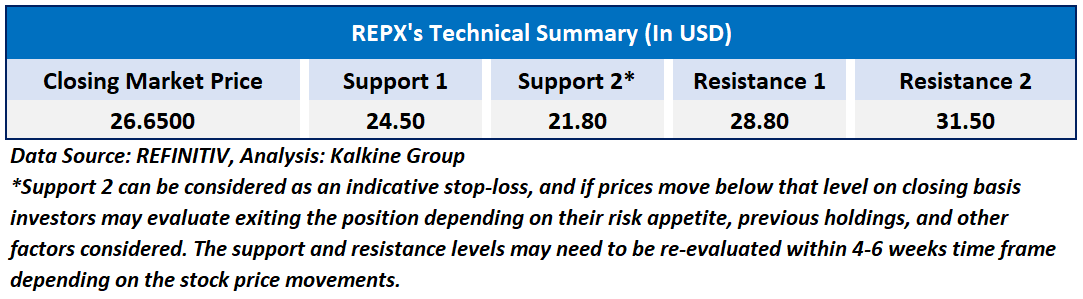

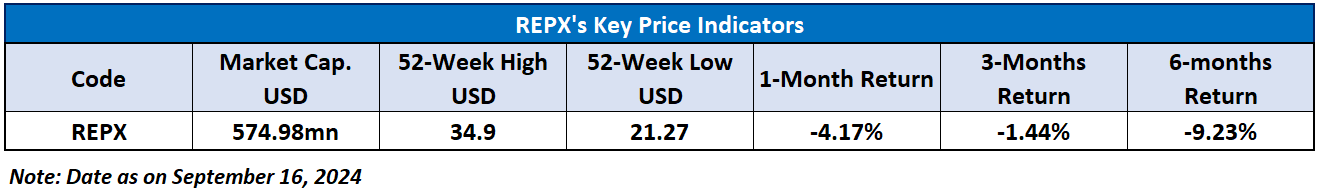

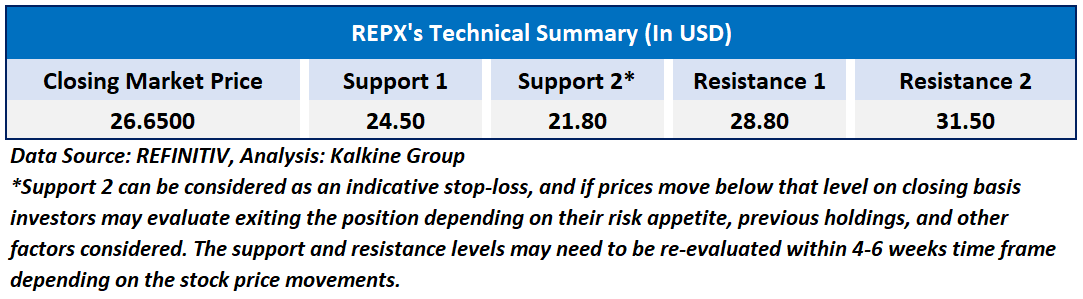

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 49.10, currently near 50 levels, with expectations of a consolidation or an upward momentum if the important resistance of USD27-USD29 is broken. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Riley Exploration Permian, Inc., (NYSE: REPX) at the closing market price of USD 26.65 as of September 16, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 16, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...