Comstock Resources Inc

Comstock Resources, Inc. (NYSE: CRK) is an independent energy company. The Company is engaged in the acquisition, exploration, development and production of oil and natural gas in the United States. The Company operates through the exploration and production of North American oil and natural gas segment. The Company primarily operates in the Haynesville shale, a natural gas basin located in North Louisiana and East Texas, with economic and geographical proximity to the Gulf Coast markets.

Recent Business and Financial Updates

- Comstock Resources Q4 2024 Earnings Release and Conference Call: Comstock Resources, Inc. (NYSE:CRK) will announce its fourth quarter 2024 financial results on February 18, 2025, after market close. The company will host a conference call on February 19, 2025, at 10:00 a.m. CT to discuss these results. Interested participants must register online to receive the necessary dial-in information and personal PIN for accessing the call.

- Third Quarter 2024 Highlights: Comstock Resources, Inc. reported its financial performance for the third quarter of 2024, significantly affected by persistently low natural gas prices. Total revenues from natural gas and oil sales, including realized hedging gains, reached USD 305 million. The company generated an operating cash flow of USD 152 million, or USD 0.52 per diluted share, and reported an adjusted EBITDAX of USD 202 million. Despite these figures, Comstock experienced an adjusted net loss of USD 48.5 million, equivalent to USD 0.17 per share.

- Operational Activities: During the quarter, the company reduced its completion activities, bringing eight operated wells (5.4 net) online. These wells achieved an average initial production rate of 21 MMcf per day. A notable achievement was the successful completion of Comstock's first horseshoe Haynesville well, which recorded an initial production rate of 31 MMcf per day. The company continued to expand its presence in the Western Haynesville exploratory play, increasing its acreage to 453,881 net acres. Additionally, Comstock managed to lower well costs to approximately USD 2,814 per completed lateral foot.

- Financial Performance: The average realized price for natural gas during the third quarter was USD 1.90 per Mcf before hedging and USD 2.28 per Mcf after hedging. Despite a 2% increase in production, total natural gas and oil sales decreased to USD 305 million due to lower prices. The company reported an operating cash flow of USD 152.3 million, alongside a net loss of USD 25.7 million or USD 0.09 per share. This included gains from hedging contracts and asset sales. Excluding these items, the adjusted net loss stood at USD 48.5 million or USD 0.17 per share.

- Cost and Margin Analysis: Production costs averaged USD 0.77 per Mcfe, encompassing expenses related to gathering, transportation, lease operations, production taxes, and administrative costs. The unhedged operating margin was 60%, which improved to 67% after factoring in hedging gains. Over the nine months ending September 30, 2024, Comstock's total sales from natural gas and oil amounted to USD 919.1 million. During this period, the company reported an adjusted net loss of USD 121.3 million, or USD 0.42 per share.

- Exploration and Development: Operationally, Comstock drilled eight horizontal Haynesville/Bossier shale wells during the quarter, with an average lateral length of 12,034 feet. The company successfully turned 11 operated wells to sales. In its Western Haynesville play, the thirteenth well is currently undergoing flowback, with five additional wells expected to become operational between late 2024 and early 2025.

- Financial Position: Comstock's borrowing base of USD 2.0 billion was reaffirmed during the quarter. Furthermore, the company secured amendments to its financial covenants under the USD 1.5 billion revolving credit facility, which were approved on October 30, 2024. These developments provide Comstock with greater financial flexibility as it continues its exploration and development activities.

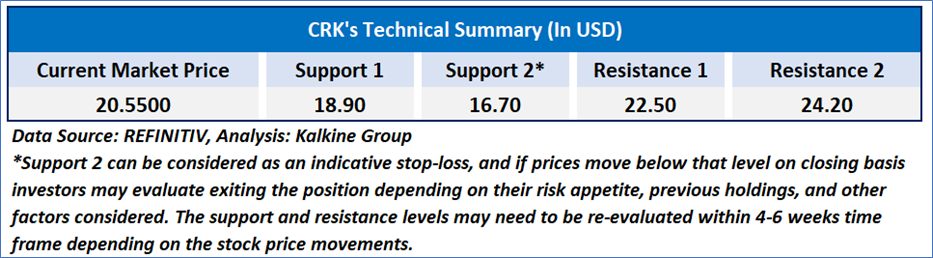

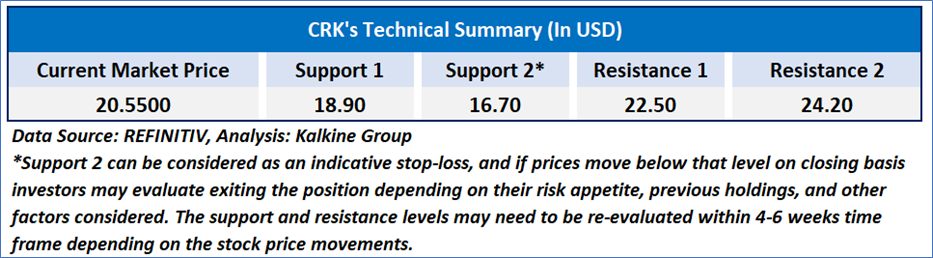

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 72.76, upward trending and currently inside the overbought zone, with expectations of a consolidation or correction towards the next important support level. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

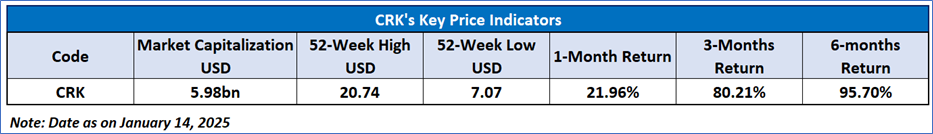

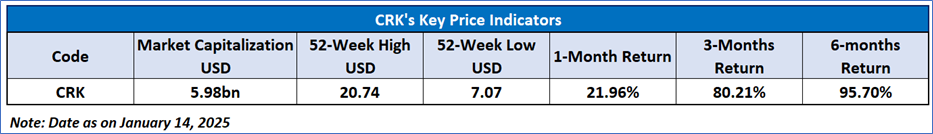

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given for Comstock Resources, Inc. (NYSE: CRK) at the current market price of USD 20.55, as of January 14, 2025, at 09:05 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 14, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...