ORIX Corp

ORIX Corp (NYSE: IX) is a Japan-based company mainly engaged in the provision of diversified financial services. The Company operates through ten business segments: Corporate Sales/Maintenance Lease, Real Estate, Banking and Credit, Business Investment/Concession, Environmental Energy, Insurance, Banking and Credit, Transportation Equipment, ORIX USA, ORIX Europe, and Asia/Australia.

Recent Business and Financial Updates

- Strategic Three-Year Plan and Recovery Initiatives: In May 2022, ORIX unveiled its Medium-term Outlook, a comprehensive three-year strategic plan aimed at enhancing financial performance by March 2025. The plan was developed in response to the significant impact of the COVID-19 pandemic, which had reduced profits for two consecutive years. However, ORIX managed to recover its net income to ¥300.0 billion by March 2022. As part of the new plan, ORIX set ambitious goals, targeting a net income of over ¥400.0 billion, with key growth areas identified in Private Equity (PE) Investment, Environment and Energy, Real Estate, and expansion in asset management in the U.S. and Europe. The recovery of sectors severely impacted by the pandemic, such as Aircraft, Ships, airport concessions, and real estate operations, was also anticipated as a major contributor to future growth.

- Challenges and Performance in Fiscal Year 2023: Despite initial optimism, unforeseen global economic challenges emerged, including heightened geopolitical risks, inflation, and persistently high interest rates. These factors negatively affected ORIX’s overseas business operations, particularly in the United States. As a result, non-Japanese segment performance fell below expectations during fiscal year 2023. However, the company experienced a strong recovery in Japan, especially in the tourism sector, which benefited from increased inbound traffic. Financial businesses, including Banking and Insurance, also provided stability. Consequently, ORIX recorded a net income of ¥290.3 billion for the fiscal year ending March 2023 (after accounting adjustments), demonstrating resilience. By March 2024, the company achieved a record-high net income of ¥346.1 billion, with a return on equity (ROE) of 9.2%, highlighting the success of its diversified portfolio amidst volatile market conditions.

- Financial Performance and Adaptability in 2024: ORIX’s core strength lies in its ability to adapt to shifting market conditions by rotating profit drivers across its diverse portfolio. For the fiscal year ending March 2024, the company reported a 19% increase in net income, reaching ¥346.1 billion, marking a new record. ROE improved to 9.2%, and total segment profits rose by 25%, amounting to ¥561.5 billion. However, non-Japanese operations saw a decline in profits of ¥16.4 billion due to higher funding costs resulting from elevated U.S. dollar and euro interest rates. This decline was also influenced by a cautious approach to new deals in the U.S. market, reflecting a more conservative risk management strategy. Nevertheless, the Aircraft and Ships businesses showed profit growth, benefiting from the recovery in aircraft leasing.

- Expansion and Investment Strategies: In line with its investment strategies, ORIX pursued new business opportunities, including a business succession deal with Japanese shipowner Santoku Senpaku and additional acquisitions across Asia and Australia. Japanese operations demonstrated a significant profit increase of ¥129.4 billion, fueled by the recovery of real estate facility operations and a resurgence in tourism. Additionally, ORIX saw growing profits in concessions and expanded investments in the insurance sector. The company’s strategic focus on capital recycling—investing and reinvesting in promising areas—further reinforced its financial performance.

- Ambitious Targets for Fiscal Year 2025: Looking ahead, ORIX has set ambitious targets for fiscal year 2025, aiming for a net income of ¥390.0 billion, which would represent another consecutive year of record earnings. The company also targets a nearly double-digit ROE of 9.6%. This growth is expected to be driven by enhanced profitability across its core categories: Finance, Operations, and Investments. In the Finance segment, ORIX anticipates a ¥20.3 billion profit increase, supported by rising yen interest rates and expanded income from lending, leasing, and life insurance. In Operations, the company projects continued profit growth, particularly from hotel and inn operations, concessions, and the aircraft leasing sector, with a boost from the upcoming Osaka-Kansai Expo in 2025. Investments will focus on capital recycling and expanding assets under management (AUM) from ¥69 trillion in March 2024 to ¥100 trillion as quickly as possible.

- Risk Management and Capital Efficiency: ORIX’s financial strategy emphasizes prudent risk management and maintaining capital efficiency. By the end of March 2024, the company held ¥8.5 trillion in Finance assets, ¥4.2 trillion in Operations, and ¥2.7 trillion in Investments. Its debt-to-equity ratio (excluding deposits) was 1.6 times, demonstrating a balanced approach to financial leverage. ORIX’s capital management policy centers on maintaining an appropriate level of financial leverage to support sustainable growth. The company has implemented robust asset-liability management (ALM) practices to mitigate interest rate and exchange rate risks. Additionally, ORIX is focused on raising its return on equity (ROE) above 10% to increase its price-to-book ratio (PBR) to over 1.0 times. Regular share buybacks further support this goal, enhancing earnings per share (EPS) while ensuring capital adequacy.

- Commitment to Shareholder Returns and Investor Relations: ORIX places a strong emphasis on maintaining transparent and proactive communication with shareholders and institutional investors. During the fiscal year ending March 2024, the company held approximately 570 investor meetings, engaging with a balanced mix of domestic and international institutional investors, as well as individual shareholders. For fiscal year 2025, ORIX has committed to a shareholder return policy that allocates 39% of net income to dividends, with ¥50 billion set aside for share buybacks. The remainder will be reinvested into the company to support growth initiatives. ORIX has maintained stable or increasing dividends for the past 13 years and has consistently conducted share buybacks since 2020. The total return ratio for fiscal 2025 is projected to reach 52%, demonstrating ORIX’s dedication to delivering value to its shareholders while continuing to invest in its future.

Technical Observation (on the daily chart):

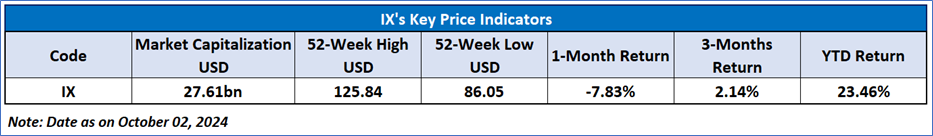

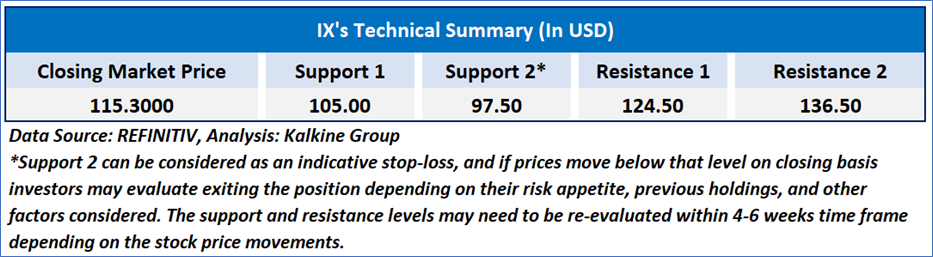

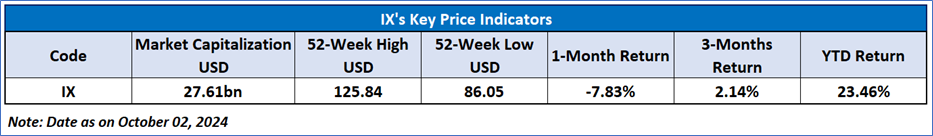

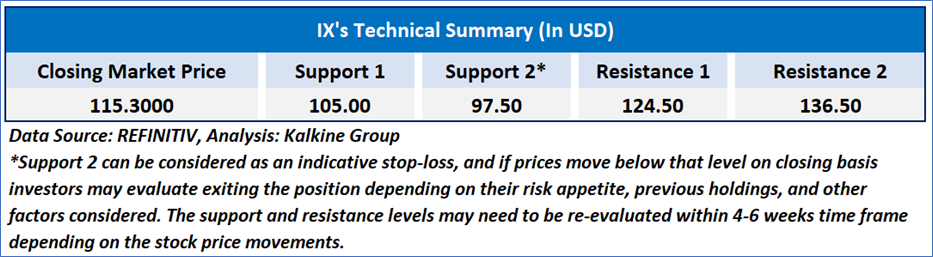

The Relative Strength Index (RSI) over a 14-day period stands at a value of 41.94, currently downward trending, with expectations of a consolidation or an upward momentum in case of the current support levels of USD 100.00-USD 110.00 hold. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance and support levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to ORIX Corp (NYSE: IX) at the closing market price of USD 115.30 as of October 02, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 02, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...