Nu Holdings Ltd

Nu Holdings Ltd (NYSE: NU) is a Brazil-based holding company, which engages in the provision of digital banking services. The Company offers its customers products across the five financial seasons: spending, saving, investing, borrowing, and protecting.

Recent Business and Financial Updates

- Strong Financial and Operational Performance: Nubank's third-quarter 2024 results reflect the strength of its business model, achieving robust revenue growth and sustained profitability. The company reported USD 2.9 billion in revenue, a 56% year-over-year increase (FX neutral), driven by both customer acquisition and increased customer engagement through cross-selling, up-selling, and new product launches. Net income more than doubled to USD 553.4 million (YoY FX neutral), with a record return on equity (ROE) of 30%. Adjusted net income stood at USD 592.2 million, yielding an annualized adjusted ROE of 33%, underscoring the company's operational efficiency and financial resilience.

- Expansion of Customer Base: Nubank’s global customer base grew to 109.7 million as of September 30, 2024, reflecting a 23% year-over-year increase. The company added 5.2 million customers in Q3 alone, solidifying its position as one of the fastest-growing digital services platforms globally and the largest financial institution in Latin America by customer numbers. In Brazil, Nubank reached 98.8 million customers, with over 1.1 million new customers added monthly. Additionally, the company's international expansion continues to gain traction, with 8.9 million customers in Mexico and over 2 million in Colombia, driven by the success of deposit and product offerings in these markets.

- Enhanced Customer Engagement and Operating Efficiency: Customer engagement remains a cornerstone of Nubank's strategy. The Monthly Average Revenue per Active Customer (ARPAC) increased to USD 11.0 in Q3 2024, growing 25% year-over-year (FX neutral). More mature customer cohorts have reached an ARPAC of USD 25. The monthly activity rate rose sequentially to 84%, marking the twelfth consecutive increase. Despite growing customer numbers, Nubank maintained low operating costs, with a monthly average cost-to-serve of USD 0.7 per active customer. The efficiency ratio improved by 60 basis points quarter-over-quarter, highlighting the scalability of its business model.

- Strong Asset Quality and Revenue Growth: Nubank’s asset quality remains robust, with the 15-90 NPL ratio declining to 4.4% in Q3, a 10-basis-point improvement sequentially. Gross profit increased 67% year-over-year to USD 1.348 billion, with gross margins expanding to 46%. The company’s lending portfolio grew 97% year-over-year (FX neutral) to USD 5.7 billion, while total deposits reached USD 28.3 billion, up 60%. This growth reflects Nubank’s ability to scale its lending operations while maintaining a strong balance sheet.

- Focus on Profitability and Liquidity: Net interest income grew 63% year-over-year, with a 4% sequential increase (FX neutral) to USD 1.7 billion. Despite some compression in net interest margins (NIM) due to a strategic focus on lower-risk products and customer mixes, the risk-adjusted NIM expanded 110 basis points year-over-year, highlighting Nubank’s ability to optimize the lifetime value of its customer relationships. Liquidity remains strong, with an interest-earning portfolio of USD 11.2 billion and excess cash reserves of USD 2.4 billion at the holding level, enabling continued investments in products and geographic expansion.

- International Expansion and Future Prospects: Nubank’s success in Mexico and Colombia underscores its ability to replicate its business model in new markets. The company added 1.2 million new customers in Mexico during the quarter, reaching 8.9 million, supported by an effective deposit yield strategy. In Colombia, the launch of the Cuenta product has driven positive momentum, with the customer base surpassing 2 million. As Nubank consolidates its position in Latin America, the company is preparing to transition into a leading global digital services platform, aiming to extend beyond financial services into broader consumer solutions.

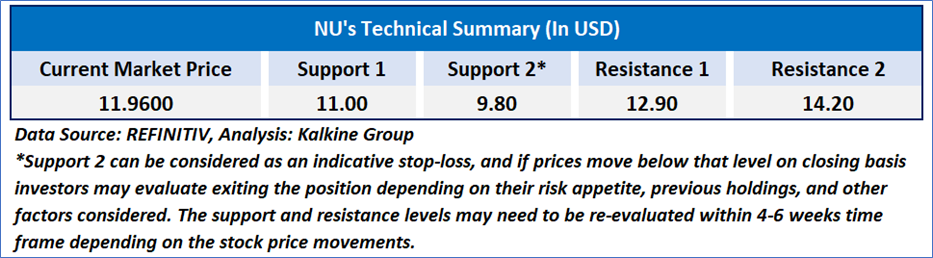

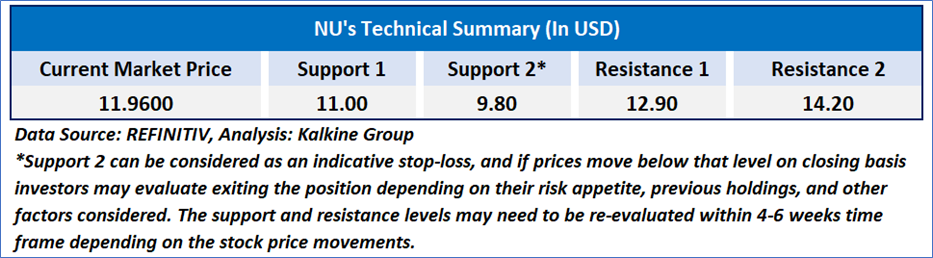

Technical Observation (on the daily chart):

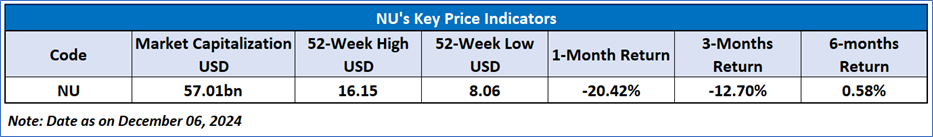

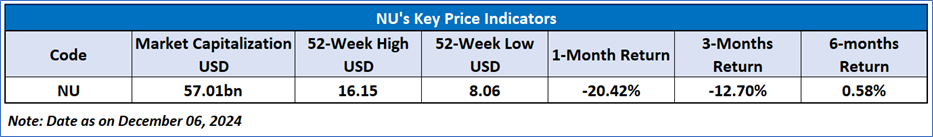

The Relative Strength Index (RSI) over a 14-day period stands at a value of 31.79, currently recovering from oversold zone, with expectations of a consolidation or an upward momentum if the price sustains above an important support of USD11-USD 12. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for Nu Holdings Ltd (NYSE: NU) at the current market price of USD 11.96 as of December 06, 2024, at 09:20 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 06, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...