BigBear.ai Holdings Inc

BigBear.ai Holdings, Inc. (NYSE: BBAI) is a provider of artificial intelligence (AI)-powered decision intelligence solutions for national security, supply chain management and digital identity. The Company is a technology-led solutions organization, providing both software and services to its customers. The Company operates through two segments: Cyber & Engineering, Analytics.

Recent Business and Financial Updates

- Awarded Contract for U.S. Army GFIM-OE: ai has secured a five-year production contract valued at USD 165.15 million, set to commence in the fourth quarter of 2024. The contract involves delivering the U.S. Army's Global Force Information Management - Objective Environment (GFIM-OE). This initiative builds upon the company’s prior phases of collaboration with the Army, transforming legacy systems into an intelligent automation platform aligned with the Secretary of the Army’s vision for data-centric force management.

- Technological Demonstrations and Industry Engagements: ai showcased its ConductorOS platform at the U.S. Department of Defense's (DoD) Rapid Defense Experimentation Reserve Technology Readiness Experimentation (RDER T-REX24-2) event. The platform demonstrated advanced capabilities in distributed AI orchestration and was recognized as a Tier 1 technology. Additionally, the company is participating in the U.S. Navy’s Mission Autonomy Proving Ground (MAPG) exercises, focusing on maritime domain awareness and multi-vendor AI deployment, with demonstrations continuing throughout 2024.

- Financial Performance in Q3 2024: In the third quarter of 2024, BigBear.ai achieved a 22.1% year-over-year revenue increase, reaching USD 41.5 million compared to USD 34.0 million in the same period in 2023. Gross margin also improved to 25.9%, up from 24.7%, attributed to a greater share of higher-margin commercial solutions. Despite these gains, the company reported a net loss of USD 12.2 million, primarily due to reduced benefits from changes in the fair value of warrants. Non-GAAP Adjusted EBITDA reached USD 0.9 million, reflecting improved margins and cost management.

- Strengthened Financial Position: ai reported a cash balance of USD 65.6 million as of September 30, 2024. The company utilized USD 1.9 million in net cash for operating activities during the third quarter. The backlog stood at USD 437 million, supported by continued demand for its offerings. Full-year revenue guidance for 2024 remains affirmed at USD 165 million to USD 180 million, including contributions from its acquisition of Pangiam earlier this year.

- Strategic Initiatives and Leadership Updates: ai continues to expand its footprint in key government and commercial sectors. Notable achievements include the implementation of its veriScan biometric boarding solution at Denver International Airport, enhancing the boarding process for over 46,600 international passengers. Additionally, the company earned a shared IDIQ contract with the Federal Aviation Administration (FAA) as a subcontractor, part of a USD 2.4 billion initiative to advance IT solutions. Furthermore, Carl Napoletano was promoted to Chief Operating Officer, leveraging his leadership experience to drive integration and strategic initiatives.

- Enhanced Positioning in Artificial Intelligence: ai received additional recognition from the DoD’s Chief Digital and Artificial Intelligence Office (CDAO) through the Tradewinds Solutions Marketplace. This status includes offerings such as Trueface, the company’s facial recognition software, and ORION, a decision-making platform for the U.S. Joint Staff. These advancements reinforce the company’s position as a leader in accelerating AI/ML and data-driven solutions within the defense sector.

- CEO's Vision and Outlook: Mandy Long, CEO of BigBear.ai, emphasized the company’s commitment to building a sustainable business amidst a cautious regulatory environment for artificial intelligence. Long highlighted the company's strong cash reserves, operational progress, and reliance on its technological expertise to navigate market challenges. She reiterated the company’s long-term vision, which aligns with its evolving role in the AI-powered decision intelligence sector.

Technical Observation (on the daily chart):

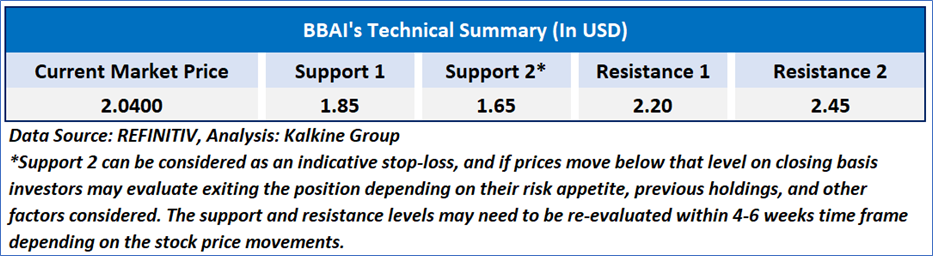

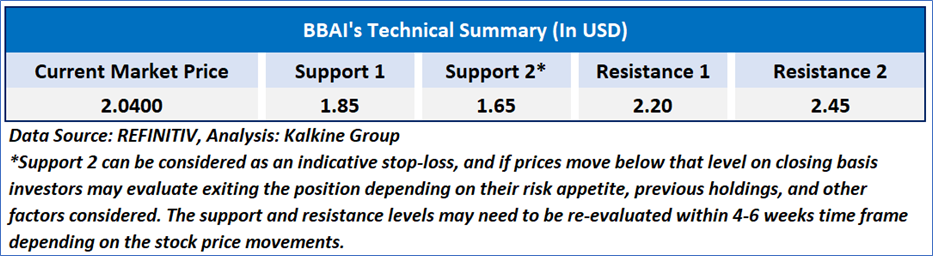

The Relative Strength Index (RSI) over a 14-day period stands at a value of 62.56, with expectations of a consolidation or an upward momentum if the price sustains above or around USD 2 resistance level. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

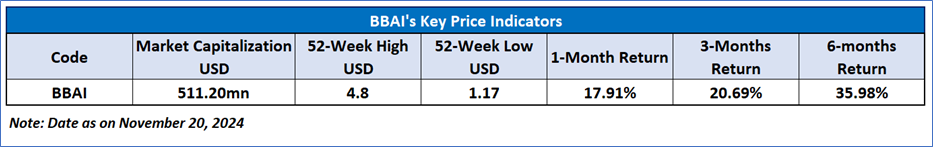

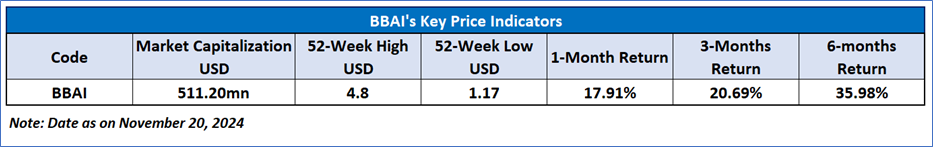

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for BigBear.ai Holdings, Inc. (NYSE: BBAI) at the current market price of USD 2.04, as of November 20, 2024, at 07:30 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 20, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

-Copy_11_20_2024_18_47_20_084058.png)

Please wait processing your request...

Please wait processing your request...