Arqit Quantum Inc

Arqit Quantum Inc. (NASDAQ: ARQQ) is a United Kingdom-based company, which is engaged in supplying encryption software services. The Company’s encryption software service, which makes the communications links of any networked device, cloud machine or data at rest secure against both current and future forms of attack on encryption, even from a quantum computer. Its products & services include Arqit SKA Platform, Arqit NetworkSecure Adaptor, Encryption Intelligence, TradeSecure, and WalletSecure.

Recent Business and Financial Updates

- Operational Overview for Fiscal Year 2024: Arqit generated a revenue of USD 293,000 for fiscal year 2024, with contracts executed for 13 customers. These contracts primarily involved limited licenses for demonstration and integration testing of Arqit’s symmetric key agreement (SKA) software, with the company observing an increase in the number of customers engaging in these contracts, signaling positive momentum in product adoption. Notably, Arqit secured a multi-year enterprise license contract in the EMEA region for a government end user, anticipated to contribute seven figures in annual recurring revenue. This contract, finalized before the end of the fiscal year, is expected to generate revenue in the current fiscal period.

- Strategic Partnerships and Developments: Arqit continued to expand its collaborations, particularly with Sparkle, a major global telecommunications service operator. Sparkle successfully demonstrated a fully automated on-demand MEF Internet Access Service secured by post-quantum cryptography, marking the second Network-as-a-Service (NaaS) quantum-safe internet use case involving Arqit’s technology. This builds upon Sparkle’s initial deployment of a quantum-safe international VPN. As Sparkle rolls out its quantum-safe NaaS offerings, Arqit’s SKA software will be crucial, contributing to the company’s revenue growth. Additionally, Arqit engaged with eight telecom network operators in the second half of the fiscal year, further reinforcing its market presence.

- Expanding Collaborations and Industry Recognition: In September 2024, Arqit joined the Intel Partner Alliance, strengthening its position in the market and broadening its reach to multi-vertical customers, including those in telecommunications, enterprise, and government sectors. This collaboration is expected to enhance Arqit’s go-to-market efforts. Moreover, Arqit’s innovations in post-quantum cryptography were acknowledged when it was named a 2024 International Data Corporation (IDC) Innovator. This recognition underscores Arqit’s role in addressing the growing cybersecurity risks posed by quantum computing.

- Leadership Changes: In a strategic move to drive the company’s growth, Arqit appointed Andy Leaver as Chief Executive Officer (CEO) in September 2024. Mr. Leaver brings extensive leadership experience from notable software companies and has a proven track record in scaling businesses. Additionally, Arqit appointed Nicola Barbiero as a Class I Director in November 2024, bringing nearly two decades of investment management and financial operations expertise. These leadership changes are expected to position the company for continued expansion and success.

- Cost Management and Financial Position: Arqit implemented cost reduction initiatives during fiscal year 2024, reducing its average monthly operating costs to USD 2.3 million for the last quarter of the fiscal year. Projections for fiscal year 2025 suggest an additional reduction, with expected average monthly operating costs of USD 2.15 million. Furthermore, Arqit raised USD 13.6 million in gross proceeds through a registered direct offering of 5,440,000 ordinary shares, with additional warrants issued to purchasers. This capital raise strengthens the company’s financial position as it advances its strategic initiatives.

- Financial Results and Outlook: Arqit’s revenue for fiscal year 2024 was USD 293,000, down from USD 640,000 in the previous year, primarily due to the shift from perpetual licenses to operational licenses, which, while generating lower upfront revenue, are expected to result in growing annual recurring revenue. The company’s administrative expenses were reduced to USD 23.5 million compared to USD 55.2 million in fiscal year 2023, reflecting lower share-based compensation, employee expenses, and legal fees. Despite a decrease in revenue, the company’s operational losses narrowed, from USD 54.5 million in fiscal year 2023 to USD 24.6 million in 2024. Arqit concluded fiscal year 2024 with USD 18.7 million in cash and cash equivalents, a decline from USD 44.5 million at the end of fiscal year 2023. The company’s focus for fiscal year 2025 is on executing existing contracts, converting demonstration engagements into full contractual relationships, and capitalizing on its market momentum.

Technical Observation (on the daily chart):

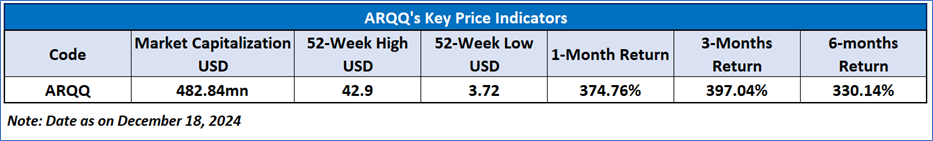

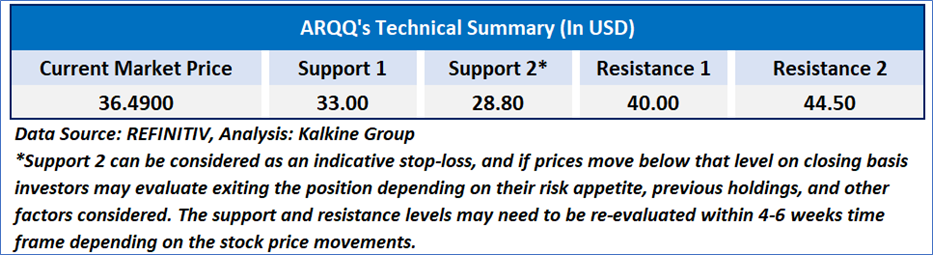

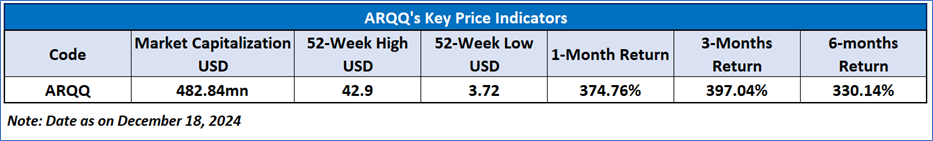

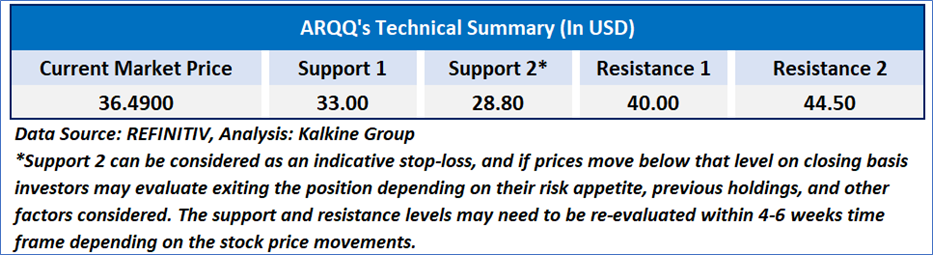

The Relative Strength Index (RSI) over a 14-day period stands at a value of 80.31, inside the overbought zone, with expectations of a bearish divergence and downward momentum from the near important resistance zone of USD 42-USD 45. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for Arqit Quantum Inc. (NASDAQ: ARQQ) at the current market price of USD 36.49 as of December 18, 2024, at 10:15 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

_12_18_2024_21_30_09_188493.jpg)

Please wait processing your request...

Please wait processing your request...