NVIDIA Corporation

NVIDIA Corporation (NASDAQ: NVDA) is a full-stack computing infrastructure company. The Company is engaged in accelerated computing to help solve the challenging computational problems. The Company’s segments include Compute & Networking and Graphics.

Recent Business and Financial Updates

- NVIDIA Announces Conference Call for Q3 Fiscal 2025 Results: NVIDIA has scheduled a conference call for Wednesday, November 20, 2024, at 2 p.m. PT (5 p.m. ET) to discuss its financial results for the third quarter of fiscal year 2025, which ended on October 27, 2024. The call will be webcast live in listen-only mode on investor.nvidia.com. The session will include prepared remarks followed by a question-and-answer segment, exclusively for financial analysts and institutional investors. Additionally, CFO commentary will be provided in writing ahead of the call.

- Record Quarterly Revenue and Growth: NVIDIA reported an exceptional performance for the second quarter of fiscal 2025, achieving a record revenue of USD 30.0 billion. This represents a 15% increase from the previous quarter and a staggering 122% growth compared to the same quarter last year. A significant driver of this success was the company’s Data Center business, which posted record revenue of USD 26.3 billion, marking a 16% rise from the prior quarter and an impressive 154% increase year-over-year. These figures underscore NVIDIA's dominance in the rapidly evolving field of accelerated computing and generative AI.

- Earnings Performance and Profitability: In addition to the record revenue, NVIDIA reported substantial growth in earnings. GAAP earnings per diluted share reached USD 0.67, reflecting a 12% increase from the prior quarter and a remarkable 168% rise from the same quarter in the previous year. Non-GAAP earnings per diluted share amounted to USD 0.68, up 11% sequentially and 152% year-over-year. This impressive earnings growth was driven by strong demand for NVIDIA’s AI-driven solutions, including its Hopper and Blackwell architectures.

- Shareholder Returns and Capital Allocation: NVIDIA continued to prioritize shareholder returns, repurchasing USD 15.4 billion worth of shares and distributing cash dividends in the first half of fiscal 2025. As of the end of the second quarter, the company had USD 7.5 billion remaining under its share repurchase authorization. Furthermore, NVIDIA's Board of Directors approved an additional USD 50.0 billion in share repurchase authorization, without any expiration date, demonstrating the company’s confidence in its long-term growth prospects.

- Outlook for Q3 Fiscal 2025: Looking ahead, NVIDIA provided an optimistic outlook for the third quarter of fiscal 2025, with projected revenue of approximately USD 32.5 billion, plus or minus 2%. The company also expects its GAAP and non-GAAP gross margins to be around 74.4% and 75.0%, respectively. Operating expenses for the third quarter are forecasted to be around USD 4.3 billion on a GAAP basis and USD 3.0 billion on a non-GAAP basis. NVIDIA anticipates a continued strong demand for its products, particularly in the AI and data center sectors.

- Advancements in AI and Data Center Technologies: NVIDIA's leadership in the AI and data center markets was further solidified with several key developments. The company’s H200 Tensor Core and Blackwell architecture B200 Tensor Core processors achieved top rankings in the latest MLPerf benchmark results for inference. NVIDIA also expanded its AI platform with the introduction of the Spectrum-X Ethernet networking platform and the launch of NVIDIA NIM microservices. These innovations are driving widespread adoption across various industries, including cloud service providers, enterprises, and AI developers.

- Expanding AI, Gaming, and Professional Visualization: In the gaming sector, NVIDIA saw continued growth, with second-quarter gaming revenue reaching USD 2.9 billion, up 9% from the previous quarter and 16% from the prior year. The company introduced NVIDIA ACE, a suite of generative AI technologies, and expanded its gaming offerings with new titles and the growth of GeForce NOW, which surpassed 2,000 games. In professional visualization, NVIDIA’s revenue reached USD 454 million, reflecting a 20% increase year-over-year. The company also made significant strides in the automotive and robotics sectors, with new partnerships and product launches further expanding its AI and automation capabilities.

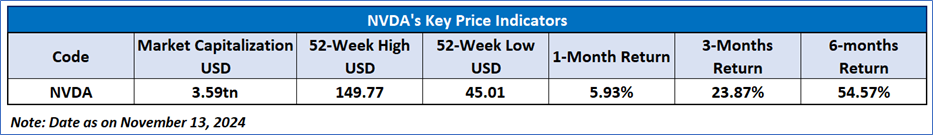

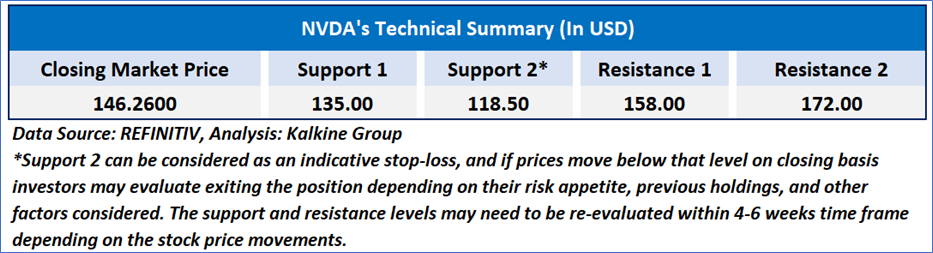

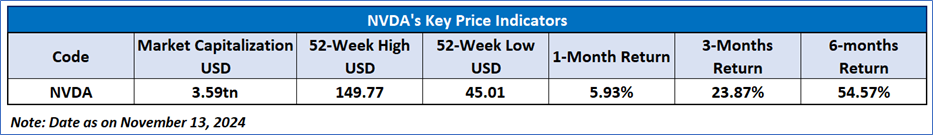

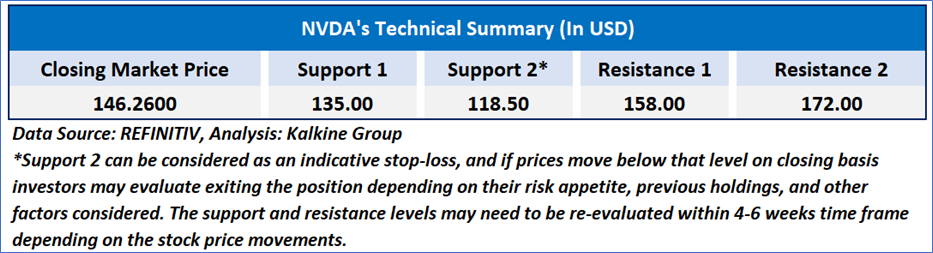

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 60.87, recovering a bit from overbought levels, with expectations of a consolidation or an upward momentum if USD 150 resistance level breaks. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for NVIDIA Corporation (NASDAQ: NVDA) at the closing market price of USD 146.26 as of November 13, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 13, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

-Copy_11_14_2024_15_29_55_456553.jpg)

Please wait processing your request...

Please wait processing your request...