Arm Holdings PLC

Arm Holdings plc (NASDAQ: ARM) is a semiconductor intellectual property (IP) company. The Company develops and licenses IP for various devices worldwide, and it provides development tools that accelerate product development, from sensors to smartphones to servers. Its central processing unit (CPUs) and nomenclature for properties and units (NPUs) include Cortex-A, Cortex-M, Cortex-R, Neoverse, Ethos and SecurCore.

Recent Financial and Business Updates:

- Growth Drivers: Arm anticipates sustained growth driven by royalty revenue, expecting increased demand for compute as electronic devices become more complex. Market share gains in key sectors like automotive and cloud servers, coupled with higher royalty rates for advanced Arm technology, contribute to the positive trend. The adoption of Armv9 technology is notably boosting royalty revenue.

- Energy-Efficient Compute and AI Demand: The need for energy-efficient computing and AI capabilities is identified as another growth driver. Arm technology is in demand for AI applications across various platforms, from cloud to edge devices. High-performance processors, essential for generative AI and Large Language Models, operate efficiently within constrained energy and thermal budgets. Major players like NVIDIA, Google, Samsung, Vivo, and Xiaomi are leveraging Arm-based technology to advance AI capabilities in products like smartphones.

- Compute Subsystems and Design Efficiency: Arm plans to capitalize on the growing demand for AI by introducing Compute Subsystems ("CSS"), offering integrated and verified configurations targeting specific markets. CSS aims to address the challenges of scarce design resources and longer chip design cycles. Microsoft's announcement of the Arm Neoverse CSS-based cloud server chip, the Microsoft Cobalt 100, exemplifies the success of this strategy, reducing development time and engineering effort.

- Ecosystem Strength and Software Development: Arm's unique ecosystem of software and design partners, boasting over 15 million software developers, plays a pivotal role in its growth. Investments in software ecosystems like ArmNN, an optimized AI engine, enable developers to create AI applications for various devices. The Arm Total Design program further enhances the ecosystem, simplifying the delivery of custom chips based on Arm’s Neoverse CSS and attracting a broader customer base.

- Financial Highlights: Arm reports its highest-ever total revenue of USD 824 million, driven by record royalty revenue and robust licensing revenue growth. Royalty revenue, particularly from smartphones and AI-enabled Armv9-based handsets, contributed significantly. License and other revenue exceeded expectations, reaching USD 354 million, up 18% year-over-year. Non-GAAP operating profit increased by 17% to USD 338 million, resulting in a 41.0% non-GAAP operating margin. The company's Annualized Contract Value (ACV) stood at USD 1,160 million, reflecting a 15% year-over-year increase.

- Remaining Performance Obligations and Licenses: Remaining performance obligations (RPO) increased by 38% year-over-year, reaching USD 2,433 million. Arm signed five additional Arm Total Access agreements, bringing the total to 27. RPO is expected to be recognized as revenue over the next 12 months and beyond. The Arm Flexible Access program saw over 50 renewals and 14 new agreements, leading to six net additions, and the company's gross margin remained high at 96.7%.

- Financial Strength and Free Cash Flow: Arm's non-GAAP free cash flow for the quarter was USD 251 million, totaling USD 724 million for the trailing twelve months, marking a 63% year-over-year increase. The company's cash and cash equivalents, along with short-term investments, reached USD 2,401 million, demonstrating a 9% increase from the previous quarter and a 35% increase year-over-year. Arm's strong financial position positions it well for future growth.

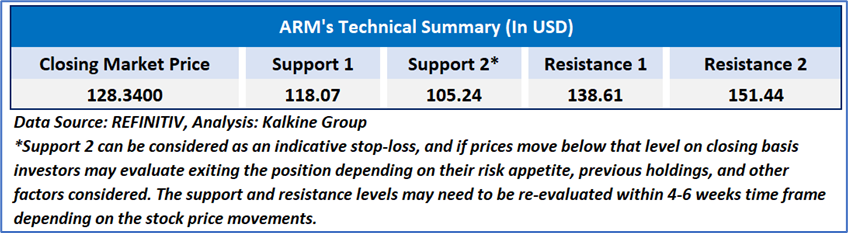

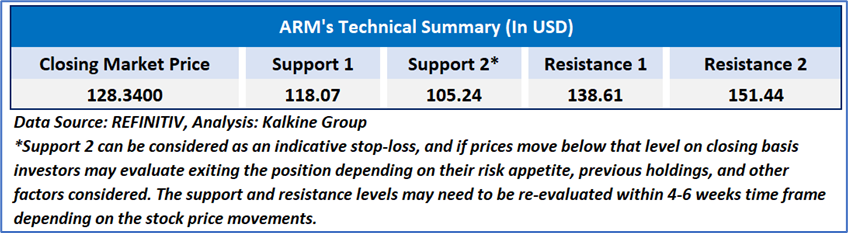

Technical Observation (on the daily chart)

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 67.47, currently correcting from over-bought zone, signifying the likelihood of either some consolidation or a healthy correction to next important support levels of USD 100-USD 110. Adding to this, the stock presently finds itself positioned above both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Arm Holdings plc (NASDAQ: ARM) at the closing market price of USD 128.34, as of February 16, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 16, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...