Quantum Computing Inc

Quantum Computing Inc. (NASDAQ: QUBT) is a quantum optics and nanophotonic technology company. The Company provides accessible solutions with real-world industrial applications, using nanophotonic-based quantum entropy that can be used anywhere and with little to no training, operates at normal room temperatures, low power and is not burdened with environmental requirements. Its core nanophotonic-based technology is applicable to both quantum computing as well as quantum intelligence, cybersecurity, sensing and imaging solutions.

Recent Business and Financial Updates

- Quantum computing stocks, including that of Quantum Computing Inc. (QUBT), saw a significant decline on Wednesday, halting a year-long rally, following remarks by Nvidia CEO Jensen Huang. Huang’s statement, suggesting that practical and widely useful quantum computers may be two decades away, dampened investor enthusiasm for the sector. This outlook, which implies a 15 to 30-year wait for meaningful advancements, particularly hit stocks like QUBT, which, along with other quantum computing companies, fell over 46%. The drop in stock prices reflects broader skepticism about the immediate potential of quantum computing, despite recent breakthroughs and growing interest in AI-driven applications.

- CEO's Commentary on Strategic Progress: William McGann, CEO of QUBT, highlighted the company’s strategic advancements during the third quarter of 2024. He emphasized the progress on the U.S.-based Thin Film Lithium Niobate (TFLN) foundry in Tempe, Arizona, which remains on track for completion. The commissioning phase is nearing completion, which marks a critical step in scaling QUBT's capabilities and entering new markets. Dr. McGann also noted the success of the company’s new leadership, which has driven tangible results, including securing offtake agreements for chips and orders for machines. He expressed confidence in the team’s ability to fulfill QUBT's vision of delivering scalable and affordable quantum solutions.

- Financial Overview for Q3 2024: For the third quarter of 2024, QUBT reported total revenues of approximately USD 101,000, a significant increase from USD 50,000 during the same period in 2023. However, the gross margin decreased from 52% to 9%, primarily due to the execution of a contract with Johns Hopkins University for a customized quantum LiDAR prototype. Despite the increase in revenues, the company faced a reduction in gross margin, reflective of the specific project’s nature.

- Operating Expenses and Losses: Operating expenses for QUBT totaled USD 5.4 million for the third quarter of 2024, marking an 18% decrease compared to the previous quarter’s expenses of USD 6.6 million. The decrease in operating expenses was attributed to the company’s disciplined approach in reducing general and administrative costs, including cuts in employee and consultant expenses. Despite this reduction in costs, QUBT reported a net loss of USD 5.7 million, or $(0.06) per share, compared to a net loss of USD 7.1 million, or $(0.10) per share, for the same period in 2023.

- Balance Sheet and Financial Position: As of September 30, 2024, QUBT's total assets amounted to USD 76.8 million, an increase from USD 74.4 million at year-end 2023. Cash and cash equivalents grew by USD 1.0 million to USD 3.1 million. The company also raised net proceeds of USD 7.0 million through secured convertible debt financing during the quarter. Total liabilities increased by approximately USD 5.3 million to USD 10.9 million, primarily due to the debt financing, but this was offset by the repayment of unsecured debt earlier in the year. Shareholders’ equity stood at USD 60.4 million as of September 30, 2024.

- Operational Developments in Q3 2024: QUBT made significant strides in its operational initiatives during the third quarter of 2024. The company extended its Cooperative Research and Development Agreement (CRADA) with Los Alamos National Laboratory (LANL), enabling further exploration of quantum optimization technologies. This partnership will support advancements in various sectors, including energy grid management and telecommunications. Additionally, QUBT reached the final phase of commissioning its TFLN chip foundry in Tempe, with production set to begin in early 2025, positioning the company as a leader in high-performance optical chips.

- Industry Engagements and Strategic Partnerships: QUBT actively participated in key industry events, including the Quantum World Congress 2024 and Quantum.Tech Europe. These engagements helped raise the profile of QUBT’s Dirac-3 platform, fostering new partnerships with both government and commercial stakeholders. Furthermore, the company continued to develop its Entropy Quantum Computing solutions, with promising benchmark studies conducted in collaboration with national laboratories such as Oak Ridge and Lawrence Berkeley. QUBT also secured a fifth task order from NASA, focusing on quantum remote sensing technology for spaceborne LiDAR missions, which supports cost reduction for climate-monitoring missions and enhances data collection capabilities.

Technical Observation (on the daily chart):

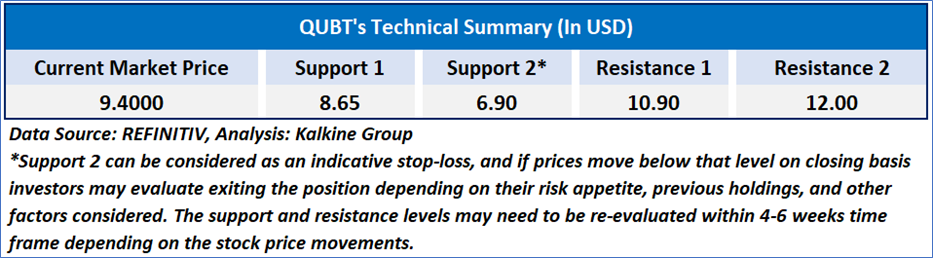

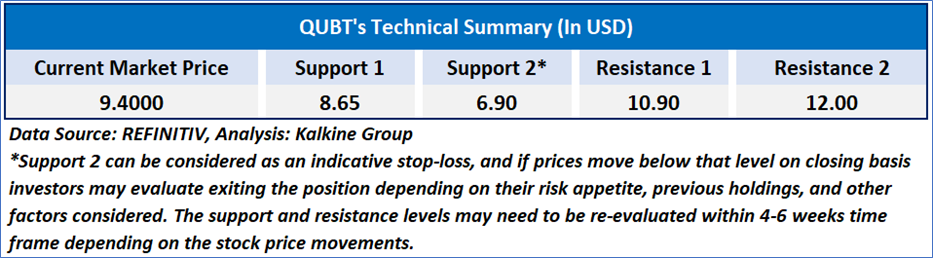

The Relative Strength Index (RSI) over a 14-day period stands at a value of 42.91, downward trending, with expectations of a consolidation or some upward momentum from the important support levels of USD 7.50-USD 8.50. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

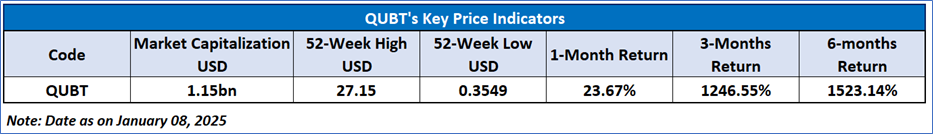

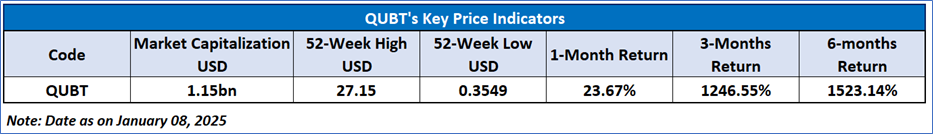

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given for Quantum Computing Inc. (NASDAQ: QUBT) at the current market price of USD 9.40, as of January 08, 2025, at 07:40 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 07, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...