Twist Bioscience Corporation

Twist Bioscience Corporation (NASDAQ: TWST) is a synthetic biology and genomics company that has developed a deoxyribonucleic acid (DNA) synthesis platform to industrialize the engineering of biology. The Company's platform's core is a proprietary technology that develops manufacturing synthetic DNA by writing DNA on a silicon chip.

Recent Business and Financial Updates

- Revenue Growth in Fiscal 2024: Twist Bioscience achieved a notable 28% increase in total revenue for fiscal 2024, reaching USD 313.0 million compared to USD 245.1 million in fiscal 2023. This growth was driven by strong performance across segments, including a 26% increase in SynBio revenue to USD 123.5 million and a 37% increase in NGS revenue to USD 169.1 million. However, biopharma revenue experienced a slight decline, registering USD 20.3 million compared to USD 23.2 million in the prior fiscal year.

- Improved Margins and Operational Efficiency: The company reported an enhanced gross margin of 42.6% in fiscal 2024, up from 36.6% in fiscal 2023, reflecting improved operational efficiency. Despite this, the cost of revenues rose to USD 179.6 million from USD 155.4 million. Research and development expenses decreased to USD 90.9 million, while selling, general, and administrative (SG&A) expenses increased to USD 218.4 million, aligning with efforts to support growth initiatives.

- Order Growth and Adjusted EBITDA Improvement: Orders for fiscal 2024 grew significantly, reaching USD 344.2 million compared to USD 263.8 million in fiscal 2023. Adjusted EBITDA improved notably to USD (93.5) million from USD (147.3) million in the previous fiscal year, signaling progress in operational stability. However, the net loss remained consistent at USD 208.7 million, or USD 3.60 per share, compared to the same loss per share in fiscal 2023.

- Strong Fourth-Quarter Performance: The fourth quarter of fiscal 2024 showcased a 27% revenue increase, totaling USD 84.7 million compared to USD 66.9 million in the same period last year. Segment-wise, SynBio revenue grew by 28%, NGS revenue by 23%, and biopharma revenue rose to USD 5.3 million. Gross margin for the quarter improved to 45.1%, while net loss decreased to USD 34.7 million from USD 46.2 million in Q4FY23. Adjusted EBITDA for the quarter also showed improvement, reaching USD (17.0) million compared to USD (26.4) million in the prior year.

- Operational and Sustainability Milestones: Twist made significant strides in operational capabilities, shipping products to over 3,562 customers and delivering approximately 772,000 genes, a 22% increase year-over-year. Key product launches included extended-length Gene Fragments, a joint enzyme screening kit with bitBiome, and the FlexPrep™ Ultra-High Throughput Library Preparation Kit. On the sustainability front, Twist achieved LEED certification for its Wilsonville facility and significantly reduced the carbon footprint of its NGS panel manufacturing process compared to industry norms.

- Fiscal 2025 Outlook: For fiscal 2025, Twist projects revenue growth of 17% to 20%, with total revenue expected to range between USD 367 million and USD 377 million. SynBio revenue is anticipated to grow by 15% to 18%, NGS revenue by 20% to 24%, and biopharma revenue by 5% to 8%. Gross margin is forecasted to reach approximately 48%, with sequential quarterly improvements culminating in a 50% gross margin in Q4FY25. Adjusted EBITDA is projected to improve further, ranging from USD (60) million to USD (65) million.

- First Quarter Fiscal 2025 Guidance: In the first quarter of fiscal 2025, Twist expects total revenue of approximately USD 87 million, with SynBio and NGS segments growing by 26% and 22% year-over-year, respectively. Biopharma revenue is projected at USD 5 million, and adjusted EBITDA is anticipated at approximately USD (20) million, reflecting continued progress towards operational and financial improvement.

Technical Observation (on the daily chart):

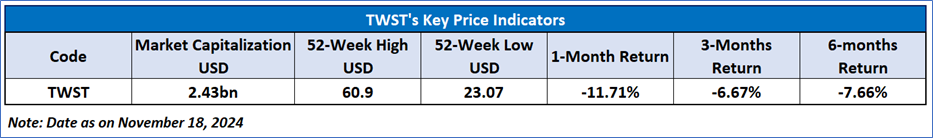

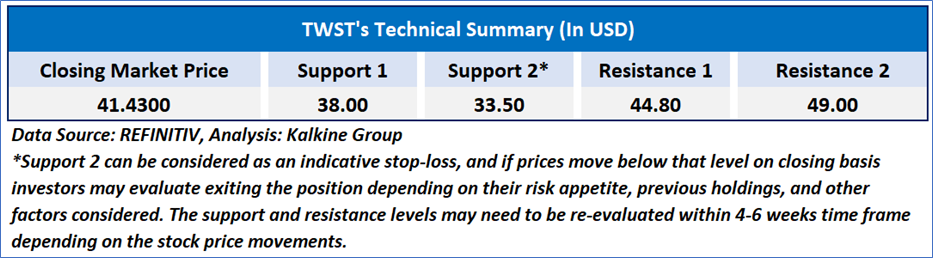

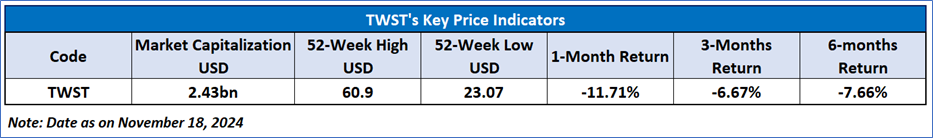

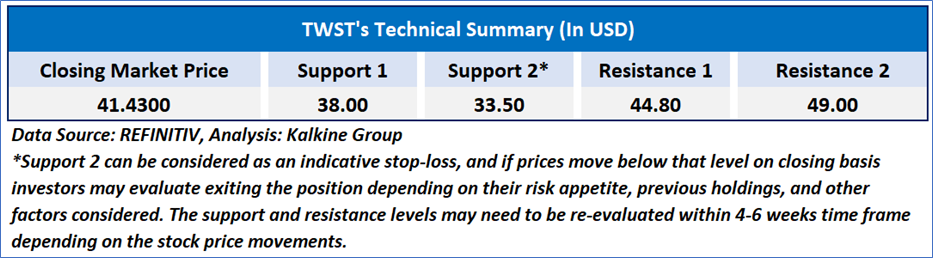

The Relative Strength Index (RSI) over a 14-day period stands at a value of 46.66, with expectations of a consolidation or an upward momentum if USD 48-USD 50 resistance level breaks. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for Twist Bioscience Corporation (NASDAQ: TWST) at the closing market price of USD 41.43, as of November 18, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

_11_19_2024_13_32_55_974784.jpg)

Please wait processing your request...

Please wait processing your request...