Mediwound Ltd

Mediwound Ltd (NASDAQ: MDWD) is an Israel-based biopharmaceutical company that develops, manufactures and commercializes novel, cost effective, bio-therapeutic solutions for tissue repair and regeneration. Company's portfolio is focused on next-generation protein-based therapies for burn and wound care and tissue repair and includes products such as, NexoBrid, a concentrate of proteolytic enzymes enriched in bromelain, which is an easy to use, topically-applied product that removes eschar in four hours without harming the surrounding healthy tissues.; EscharEx biological drug candidate for the debridement of chronic and other hard-to-heal wounds; MW005 a topically applied biological drug candidate for the treatment of non-melanoma skin cancers, based on the same API of NexoBrid and EscharEx products, a concentrate of proteolytic enzymes enriched in bromelain.

Key Business & Financial Updates

- Completion of New NexoBrid® Manufacturing Facility: MediWound Ltd. has successfully completed the construction of its state-of-the-art, GMP-compliant manufacturing facility for NexoBrid®. This facility will address the increasing global demand for the product and is expected to commence operations by 2025. The completion of this project marks a significant milestone for the company, enhancing its production capacity sixfold, positioning MediWound to meet its strategic goals, including accelerating NexoBrid’s revenue growth.

- Strategic Investment and EIC Funding: The company secured EUR16.25 million in funding from the European Innovation Council (EIC) to expedite the development of EscharEx® for diabetic foot ulcers, expanding the product's market reach. This funding will advance MediWound’s Phase III clinical trial for venous leg ulcers (VLUs) scheduled to commence in the second half of 2024. Additionally, a USD 25 million strategic investment led by Mölnlycke Health Care demonstrates confidence in MediWound’s innovative solutions and strengthens the company’s financial stability.

- Product Developments: NexoBrid® and EscharEx®: MediWound's product NexoBrid® continues to gain traction, with Vericel's successful launch in the U.S. resulting in a notable increase in hospital orders and a 76% rise in revenue. The U.S. NexoBrid Expanded Access Protocol (NEXT) reaffirmed the product’s safety and efficacy in eschar removal, reducing the need for surgical procedures in burn patients. Moreover, the company anticipates FDA approval for the pediatric indication in the third quarter of 2024. For EscharEx®, the Phase III trial for VLUs remains on track, while the EIC funding accelerates development for diabetic foot ulcers.

- Corporate Developments and Financial Performance: MediWound strengthened its corporate positioning by securing USD 25 million in a private investment in public equity (PIPE) led by Mölnlycke Health Care. The company was also included in the Russell 3000® Index as part of the 2024 Russell indexes annual reconstitution. These developments reflect growing investor confidence in MediWound’s market potential and innovative product pipeline.

- Second Quarter 2024 Financial Highlights: In the second quarter of 2024, MediWound reported revenue of USD 5.1 million, up from USD 4.8 million in the same period of 2023. However, gross profit declined to USD 0.4 million due to changes in the revenue mix and nonrecurring production costs. The company reported an operating loss of USD 4.5 million and a net loss of USD 6.3 million for the quarter, primarily driven by financial expenses related to the revaluation of warrants. Adjusted EBITDA showed a loss of USD 3.4 million, reflecting the ongoing investments in product development.

- Year-to-Date Financial Overview and Balance Sheet: For the first half of 2024, total revenue reached USD 10.0 million, an increase from USD 8.6 million in the first half of 2023. Gross profit decreased to USD 1.1 million, primarily due to nonrecurring costs. Despite this, MediWound maintained control over its expenses, with R&D and SG&A costs decreasing year-over-year. As of June 30, 2024, the company held USD 29.7 million in cash and equivalents, down from USD 42.1 million at the end of 2023. Following a successful PIPE offering in July 2024, MediWound remains well-positioned to fund its strategic initiatives.

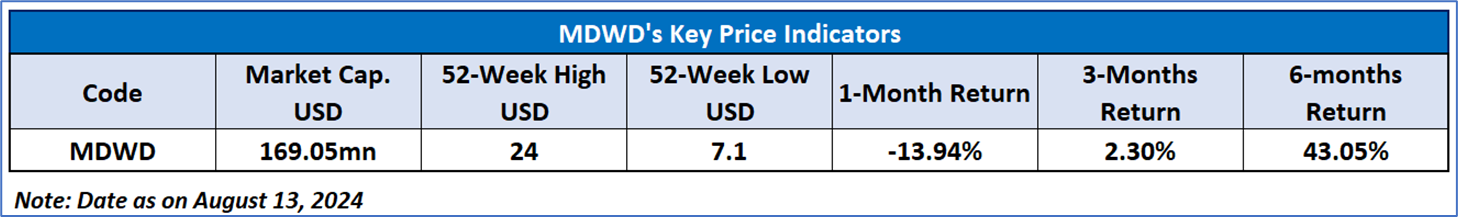

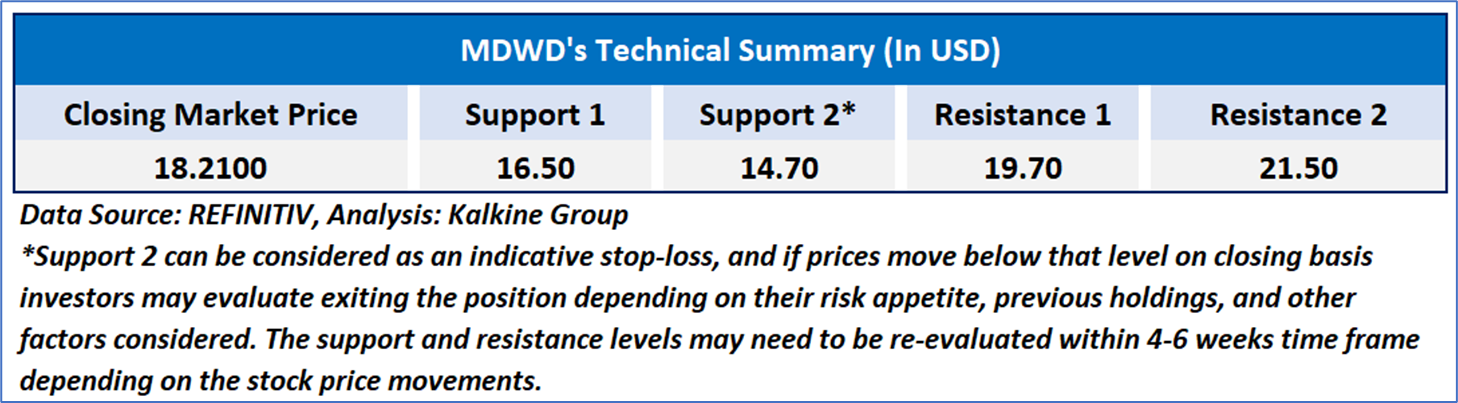

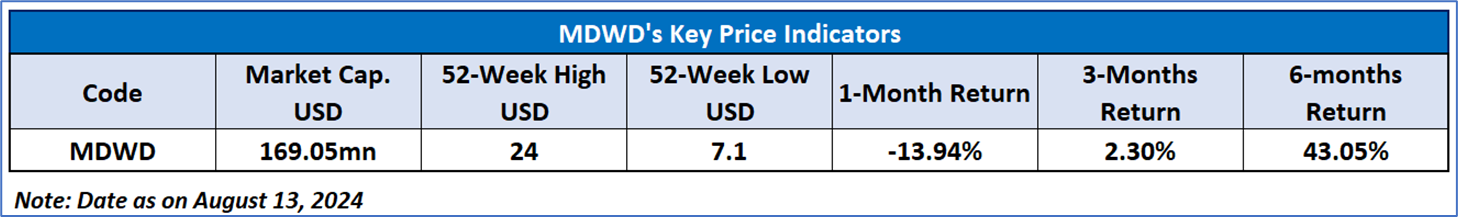

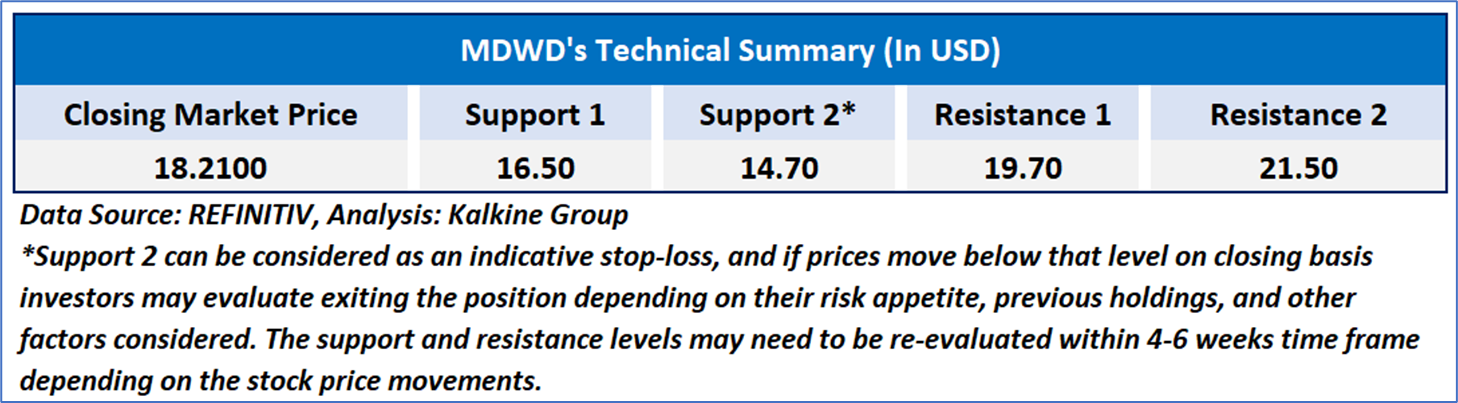

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 50.84, upward trending, with the price taking reversal from an important support zone of USD 15.00-USD 16.00, with expectations of some support if these levels sustain. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘WATCH’ rating has been given to Mediwound Ltd (NASDAQ: MDWD) at the closing market price of USD 18.21 as of August 13, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 13, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...