Trump Media & Technology Group Corporation

Trump Media & Technology Group Corp. (NASDAQ: DJT) is a social media and technology-focused company. The Company’s social media platform, TruthSocial, provides an outlet outside of Big Tech that encourages open global conversation without discriminating against political ideology. The Company is also focused on developing a subscription-based video streaming service, TMTG+, which intends to include access to non-woke entertainment, news, documentaries, podcasts and more.

Recent Business and Financial Updates

- Financial Performance and Strong Balance Sheet: Trump Media and Technology Group Corp. (TMTG) has announced its second-quarter financial results for the period ending June 30, 2024, following a review by its accounting firm, Semple, Marchal & Cooper, LLP. As of the quarter’s end, TMTG held a cash balance of USD 344 million and reported zero debt, demonstrating a robust balance sheet. This financial strength is expected to facilitate the development and expansion of its new streaming platform, Truth+, which launched on TMTG’s custom-built content delivery network (CDN) in August 2024.

- Strategic Infrastructure and Platform Development: In alignment with its long-term growth strategy, TMTG completed the development of its custom CDN and launched TV streaming across Truth Social’s iOS, Android, and web platforms. With its new CDN operational, the company can proceed with securing its source code and expand Truth+ with advanced streaming capabilities. According to TMTG’s CEO, Devin Nunes, the company has successfully built a self-reliant infrastructure, enhancing Truth Social’s resilience and independence from Big Tech while positioning Truth+ for further expansion through mergers and acquisitions.

- Financial Highlights and Operational Expenditures: TMTG recorded a GAAP net loss of USD 16.4 million in Q2, primarily driven by legal expenses of USD 8.3 million associated with the merger with Digital World Acquisition Corp., completed in March 2024. Additional expenses included USD 3.1 million for IT consulting and software licensing, with notable fees also incurred for SEC registration, accounting, and streaming service setup. Revenue for the quarter was USD 837,000, complemented by USD 2.3 million in interest income, indicating early-stage monetization efforts as the company focuses on building out its ecosystem to drive sustainable revenue in the future.

- TV Streaming Platform and Future Plans: Following the quarter, TMTG introduced Truth+, its TV streaming service, across all Truth Social platforms. This service operates on TMTG’s dedicated CDN, powered by a newly established data center with plans for further expansion. The custom infrastructure includes proprietary servers, routers, and software, designed to ensure full control over streaming operations and minimize dependency on external technology providers. Upcoming enhancements will include interactive guides, DVR capabilities, on-demand content, and apps compatible with in-home TV sets.

- Long-Term Growth Outlook: With its debt-free, cash-strong position, TMTG is equipped to sustain and expand its product offerings, including targeted programming focused on news, Christian content, and family-friendly shows. As the streaming rollout advances, TMTG will continue beta testing and gathering user feedback to optimize Truth+. The company’s strategic vision is to cultivate an independent, high-performance media ecosystem that supports both user engagement and future revenue growth.

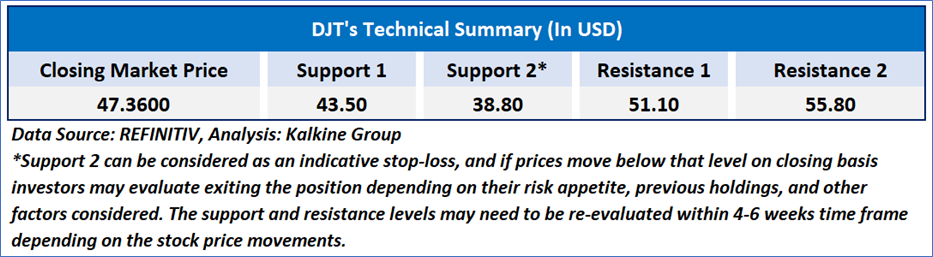

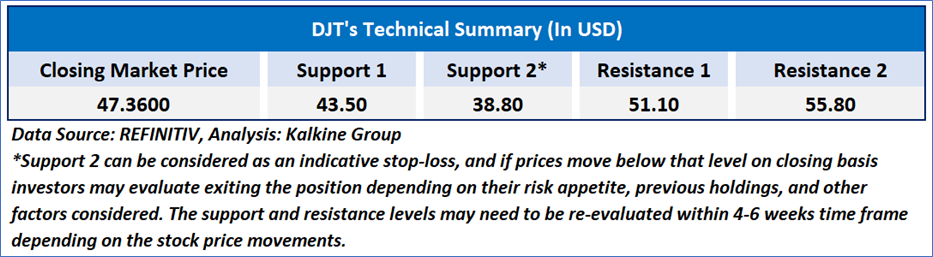

Technical Observation (on the daily chart):

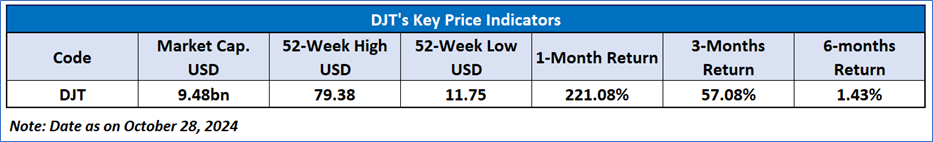

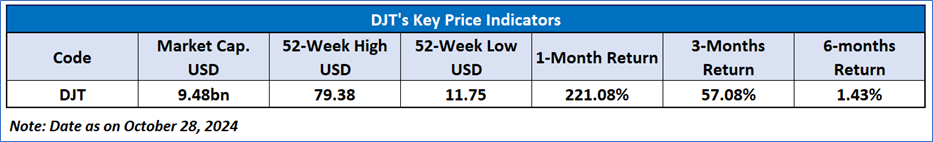

The Relative Strength Index (RSI) over a 14-day period stands at a value of 82.69, upward trending with the price near an important range of USD 55-USD 60, with expectations of momentum on the upper side if these levels break. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Trump Media & Technology Group Corp. (NASDAQ: DJT) at the closing market price of USD 47.36 as of October 28, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 28, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...