Moderna Inc

Moderna, Inc. (NASDAQ: MRNA) is a biotechnology company. The Company is focused on developing messenger ribonucleic acid (mRNA) therapeutics and vaccines. It is developing therapeutics and vaccines for infectious diseases, immuno-oncology, rare diseases, autoimmune and cardiovascular diseases, independently and with its strategic collaborators.

Recent Financial and Business Updates:

- 2023 Commercial Updates: In the third quarter of 2023, the Company reported USD 1.8 billion in sales of Spikevax® (COVID-19 vaccine), comprising USD 0.9 billion in U.S. sales and USD 0.8 billion in international sales. This brings the total vaccine sales for the year through the third quarter to USD 3.9 billion. Anticipating a U.S. market demand of at least 50 million doses for the fall of 2023, the Company projects total Spikevax sales for the year to reach at least USD 6 billion. Despite a later launch, the fall 2023 vaccination administration in U.S. retail pharmacies aligns with the 2022 fall season. Spikevax, available in leading pharmacies and points of care, has achieved a cumulative market share of 45% as of the most recent data in October, surpassing the 36% cumulative market share during the fall 2022 U.S. vaccination season. The Company remains committed to global vaccination efforts, conducting comprehensive marketing and awareness campaigns in the United States. Collaborating closely with vaccinators and stakeholders, efforts focus on fostering a robust vaccination season, engaging the medical community, supporting customers who deferred vaccination due to recent infections, and leveraging credible influencers.

- RSV Vaccine: The Company maintains its expectation for the 2024 launch of its RSV vaccine, mRNA-1345, demonstrating a potential best-in-class profile. Globally, marketing authorization applications have been submitted for the prevention of RSV-associated lower respiratory tract disease (RSV-LRTD) and acute respiratory disease (ARD) in adults aged 60 years or older. The Company expedited the review process by filing a Biologics License Application (BLA) with the FDA and utilizing a Priority Review Voucher (PRV). Regulatory submissions are supported by positive data from the pivotal ConquerRSV study, involving approximately 37,000 adults aged 60 years or older. The study successfully met both primary efficacy endpoints, achieving a vaccine efficacy (VE) of 83.7% (95.88% CI: 66.1%, 92.2%; p).

- Financial Highlights: The third quarter of 2023 saw revenues amounting to USD 1.8 billion, with the Company projecting 2023 revenues to reach at least USD 6 billion. Spikevax U.S. market share increased to 45% from 36% in 2022. Anticipating revenue of approximately USD 4 billion in 2024, the Company aims to return to growth in 2025. The strategic resizing of manufacturing capacity significantly improved the future cost of sales. A third-quarter net loss of USD 3.6 billion primarily stemmed from mostly non-cash charges of USD 3.1 billion related to resizing and a tax valuation allowance.

- Pipeline and Future Outlook: The Company's late-stage pipeline boasts six Phase 3 programs. Expecting to break even in 2026 through product launches and disciplined investment, the Company underscores its commitment to sustained growth and innovation.

Technical Observation (on the daily chart)

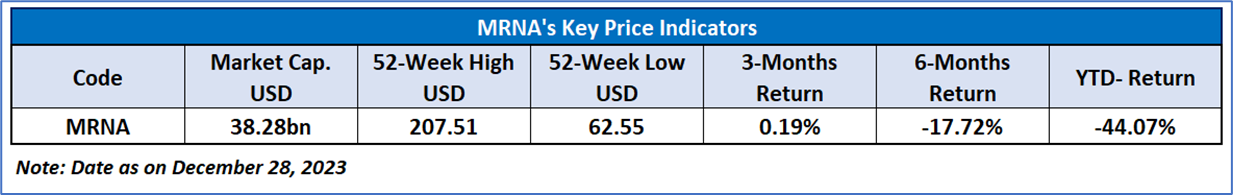

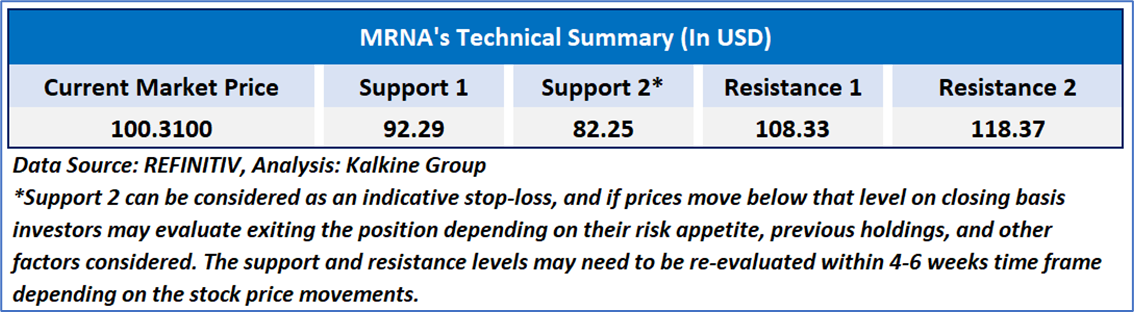

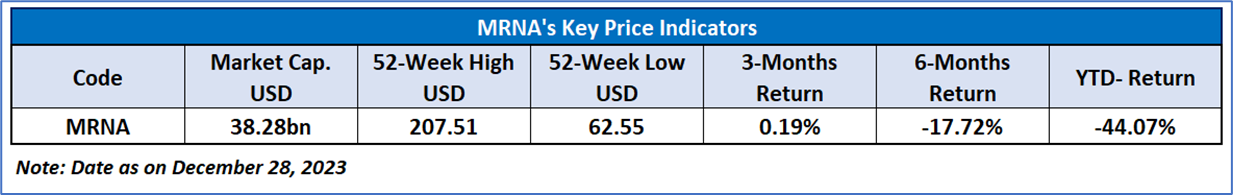

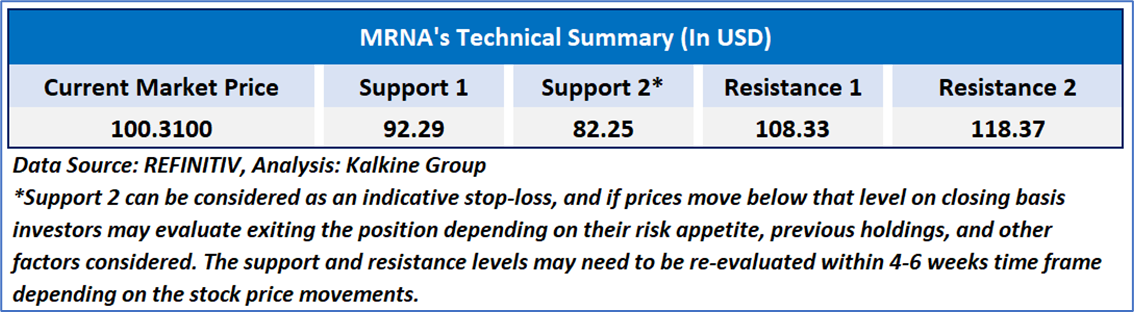

Presently, the stock has corrected by approximately 53.67% since reaching its highest point in the past 52 weeks, which occurred on January 18, 2023. The Relative Strength Index (RSI) over a 14-day period stands at 73.81, indicating a state of potential consolidation or a heathy correction before the continuation of the current upward trend. This correction might take the stock closer to a decent support level at USD 80.00-USD 90.00. Additionally, the stock's current positioning is above both the 21-day Simple Moving Average (SMA) and the 50-day SMA, which may serve as dynamic short-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Moderna, Inc. (NASDAQ: MRNA) at the current market price of USD 100.31 as of December 28, 2023, at 07:15 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 28, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

Please wait processing your request...

Please wait processing your request...