PureCycle Technologies Inc

PureCycle Technologies, Inc. (NASDAQ: PCT) is commercializing a patented purification recycling technology (the Technology), originally developed by The Procter & Gamble Company, for restoring waste polypropylene into resin with near-virgin characteristics, called ultra-pure recycled (UPR) resin. Its process includes two steps: Feed Pre-Processing (Feed PreP) and the use of the Technology for purification.

Recent Business and Financial Updates

- Management Overview: PureCycle CEO Dustin Olson highlighted the significant progress made during the third quarter, underscoring improvements in operational metrics, reliability, and product quality at the Ironton Facility. While further efforts are required to achieve nameplate capacity, Olson expressed confidence in the facility’s advancement and its role in driving PureCycle’s next phase of growth. The quarter also marked a turning point, with positive customer feedback and success in commercial trials bolstering demand across multiple market channels. The Company is focused on scaling production to meet this demand and anticipates meaningful sales growth entering 2025.

- Advancements at the Ironton Facility:

- The Ironton Facility achieved several critical production milestones in the third quarter, including processing one million pounds of feedstock within a week, 200,000 pounds in a single day, and achieving feed rates exceeding 10,000 pounds per hour. These milestones reflect enhanced reliability and operational efficiency, positioning the facility to move closer to nameplate capacity and further elevate product quality.

- The Company also completed upgrades to the co-product 2 (CP2) removal system, which is now fully operational and delivering improvements as designed. Moreover, the commissioning of a new 325,000-square-foot sorting facility in Denver, Pennsylvania, has enhanced polypropylene concentration in mixed bales from approximately 60–80% to 90–95%, further optimizing output and quality at Ironton.

- Commercial Expansion and Market Applications:

- PureCycle continued to address the industry’s growing demand for high-quality recycled materials. Customer feedback from product qualification trials has been overwhelmingly positive, and the Company is actively working to convert these trials into confirmed orders. The increased production at Ironton and expanded compounding efforts enabled the introduction of samples to new markets, facilitating further trials with prospective customers.

- During the quarter, PureCycle provided The Procter & Gamble Company (P&G) with compounded material to begin the approval process for recycled resin in various applications. Production for P&G is expected to commence by the second or third quarter of 2025. Additionally, PureCycle progressed its engagement with a leading global automotive manufacturer, focusing on recycled resin applications for both interior and exterior components, including products made entirely from recycled feedstock.

- Innovations in Fiber Market: The fiber market, an underserved segment for recycled polypropylene, saw significant developments during the quarter. PureCycle conducted trials with leading fiber manufacturers, successfully producing continuous filament and staple fibers with diverse product properties. These advancements pave the way for introducing recycled polypropylene into applications such as carpets, clothing, upholstery, and automotive interiors, expanding the Company’s market reach.

- Financial Position and Strategic Investments:

- PureCycle reinforced its financial position with successful capital-raising initiatives during the quarter. On August 7, 2024, the Company sold USD 22.5 million in Series A Southern Ohio Port Authority Revenue Bonds, generating USD 18 million in gross proceeds. Additionally, transactions with Sylebra Capital Management and Samlyn Capital, LLC in September raised USD 90 million.

- At the close of the third quarter, PureCycle reported a cash balance of USD 93.7 million, comprising both restricted and unrestricted funds. These resources are expected to support ongoing operational enhancements and strategic growth initiatives, enabling the Company to capitalize on expanding market opportunities.

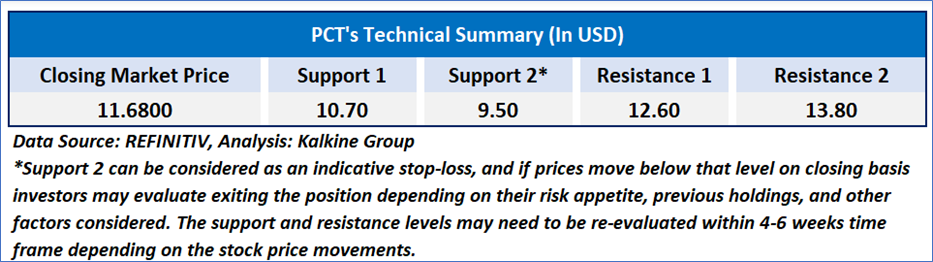

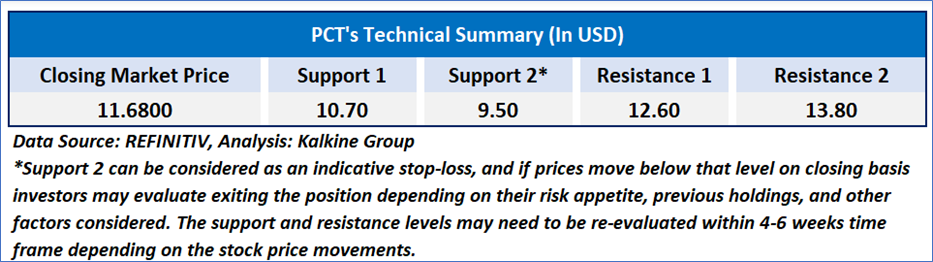

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 43.67, recovering from overbought zone and downward trending, with expectations of a consolidation. The price is presently confined within a range of USD 10.50 to USD 14.00, with anticipated momentum likely to develop in the direction of the eventual breakout from this zone. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance and support levels respectively.

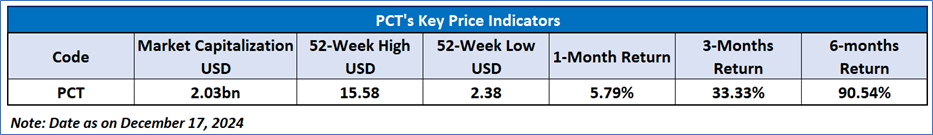

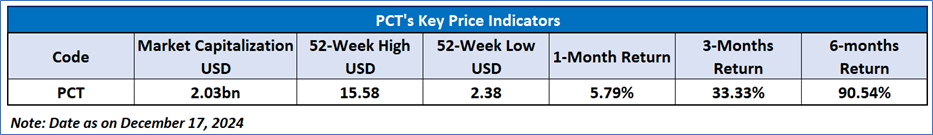

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for PureCycle Technologies, Inc. (NASDAQ: PCT) at the closing market price of USD 11.68 as of December 17, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

_12_18_2024_13_57_09_558189.jpg)

Please wait processing your request...

Please wait processing your request...