Green Dot Corporation

Green Dot Corporation (NYSE: GDOT) is a financial technology and bank holding company. The Company offers a set of financial services to consumers and businesses, including debit, checking, credit, prepaid, and payroll cards, as well as robust money movement services. Its segment includes Consumer Services, Business to Business (B2B) Services, and Money Movement Services.

Recent Business and Financial Updates

- CFO's Statement on Quarterly Performance: Jess Unruh, Chief Financial Officer of Green Dot, reflected on a solid quarter, attributing success to efforts in improving the cost structure, supporting existing customers, and launching new partnerships such as PLS. Despite the retail division's performance falling short of expectations, which has impacted the financial guidance for the rest of the year, Unruh expressed optimism. He highlighted that the revised guidance still indicates improved momentum as the company moves towards the year's end.

- Updated 2024 Financial Guidance: Green Dot has revised its financial outlook for 2024, based on several key assumptions. These include the current macroeconomic conditions, the impact of inflation and interest rates, the effect of non-renewal of certain partnerships, the strategic shift towards GO2bank, and ongoing investment in compliance and strategic initiatives. The outlook excludes costs related to the civil money penalty and associated expenses from the consent order previously disclosed.

- Non-GAAP Financial Metrics: Green Dot anticipates its full-year non-GAAP total operating revenues to range between USD 1.65 billion and USD 1.70 billion, reflecting a 13% year-over-year increase at the midpoint. The adjusted EBITDA is projected to be between USD 164 million and USD 166 million, marking a 3% decrease year over year at the midpoint. Non-GAAP earnings per share (EPS) are expected to be between USD 1.33 and USD 1.36, indicating a 17% decline year over year at the midpoint.

- CEO's Outlook on Strategic Initiatives: George Gresham, Chief Executive Officer, emphasized the launch of the embedded finance brand, Arc by Green Dot, as a significant step towards tapping into a market with substantial long-term growth potential. Although the GAAP net loss was higher than the previous year, Gresham highlighted the return to adjusted EBITDA growth, showcasing progress towards predictable financial performance and operational excellence.

- Consolidated Results Summary: Green Dot reported a 16% increase in total operating revenues for Q3 2024, reaching USD 409.7 million compared to USD 353.0 million in Q3 2023. However, the company recorded a net loss of USD 7.8 million, reflecting a 25% increase from the net loss of USD 6.3 million in the same period last year. Non-GAAP total operating revenues rose by 16% to USD 406.0 million, while adjusted EBITDA improved by 19% to USD 28.3 million. The non-GAAP net income for Q3 2024 stood at USD 7.0 million, a 6% decrease from the prior year.

- Key Business Metrics: The company's key business metrics showed variations across different segments. Gross dollar volume and purchase volume saw significant movements across the quarters, reflecting both growth and strategic shifts in consumer services and B2B services. Notably, the number of active accounts in consumer services showed a decline, while B2B services demonstrated stability. The money movement segment reported fluctuations in the number of cash transfers and tax refunds processed, indicating seasonal trends and business adjustments.

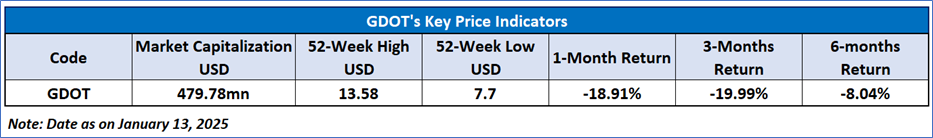

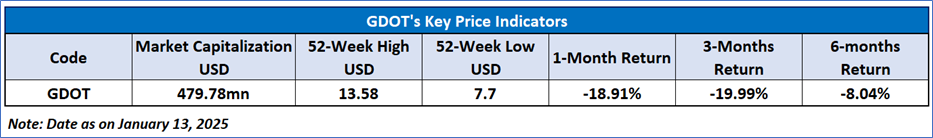

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 27.50, downward trending currently near oversold levels, with expectations of a consolidation or support from 52- week low support level. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given for Green Dot Corporation (NYSE: GDOT) at the closing market price of USD 8.92, as of January 13, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 13, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...