Canopy Growth Corporation

Canopy Growth Corporation (NASDAQ: CGC) is a cannabis company. It delivers innovative products with a focus on premium and mainstream cannabis brands, including Doja, 7ACRES, Tweed, and Deep Space, in addition to category-defining vaporizer technology made in Germany by Storz & Bickel. The principal activities of the Company are the production, distribution and sale of a diverse range of cannabis and cannabinoid-based products for both adult-use and medical purposes under a portfolio of distinct brands in Canada.

Recent Business and Financial Updates

- Canopy Growth Announces Q1 FY2025 Financial Results: Canopy Growth Corporation has published its financial results for the first quarter of fiscal year 2025, ending June 30, 2024. The company reported significant improvements in several key financial metrics, with a notable 67% increase in gross profit compared to the same period in the prior year. Canopy Growth continues its focus on profitable revenue generation, despite experiencing a decline in consolidated net revenue. The company also successfully extended the maturity of its senior secured term loan to December 2026, with the option for a further extension.

- Financial Performance Overview: In Q1 FY2025, Canopy Growth achieved a gross profit of USD 23 million, representing a substantial 67% year-over-year growth. This was achieved despite a 13% decrease in net revenue, which amounted to USD 66.2 million. The company improved its gross margin by 1,700 basis points (bps), reaching 35%, driven by its cost savings program and a shift toward higher-margin medical sales. Operating loss from continuing operations improved by 47%, amounting to USD 29 million. Additionally, Canopy Growth saw a 77% year-over-year improvement in its adjusted EBITDA loss, which narrowed to USD 5 million.

- Cost Reductions and Cash Position: Canopy Growth made considerable progress in reducing its operating costs during Q1 FY2025. The cost of goods sold (COGS) decreased by 31%, and selling, general, and administrative (SG&A) expenses were reduced by 24%, amounting to USD 48 million. The company reported a cash and short-term investments balance of USD 195 million as of June 30, 2024, compared to USD 203 million at the end of March 2024. Free cash outflow improved by 49% compared to the previous year, despite increased capital expenditures.

- Strategic Loan Management and Interest Savings: As part of its strategy to strengthen its financial position, Canopy Growth successfully amended its credit agreement. The company reduced its senior secured term loan principal by USD 100 million through a repayment of USD 97.5 million, with the option to repay an additional USD 97.5 million. These actions will result in significant interest savings, reducing annual interest payments by USD 14 million for each USD 100 million repayment. The company extended the maturity date of the loan to December 2026, with an option to further extend it to September 2027.

- Canada Cannabis and Product Launches: The company's Canada cannabis segment reported net revenue of USD 38 million for Q1 FY2025, representing a 6% year-over-year decline. Despite lower adult-use cannabis sales, medical cannabis net revenue increased by 20%, driven by strong demand for high-margin Spectrum Therapeutics products. During the latter half of the quarter, Canopy Growth launched a range of new products in the Canadian adult-use market, including 7ACRES Ultra Jack flower and Tweed Sugar-Free Cola beverage, targeting key market segments to drive future growth.

- International Markets and Storz & Bickel Performance: In the international markets, Canopy Growth reported a 1% decline in net revenue for Q1 FY2025, with growth in high-margin Poland offset by lower sales in Australia. Gross margins in the international markets improved by 200 bps, reaching 36%. In Germany, the company maintained a top four market share in the medical cannabis market, with strong demand following the legalization of cannabis. The Storz & Bickel division saw a 2% revenue increase, driven by growth in Germany and strong sales of its Mighty vaporizer, with additional opportunities anticipated in the Australian medical channel following regulatory changes.

- Expansion in the U.S. Market through Canopy USA: Canopy USA, LLC, a subsidiary of Canopy Growth, made several key acquisitions during Q1 FY2025, including the purchase of approximately 75% of the shares of Lemurian, Inc. ("Jetty") and two Wana entities. Wana Brands expanded its edible product line in Connecticut and New York, while Jetty launched new vape products in California and New York. The company also exercised its option to acquire all outstanding shares of Acreage Holdings Inc., with the acquisition expected to be completed in the first half of 2025, further strengthening Canopy Growth’s presence in the U.S.

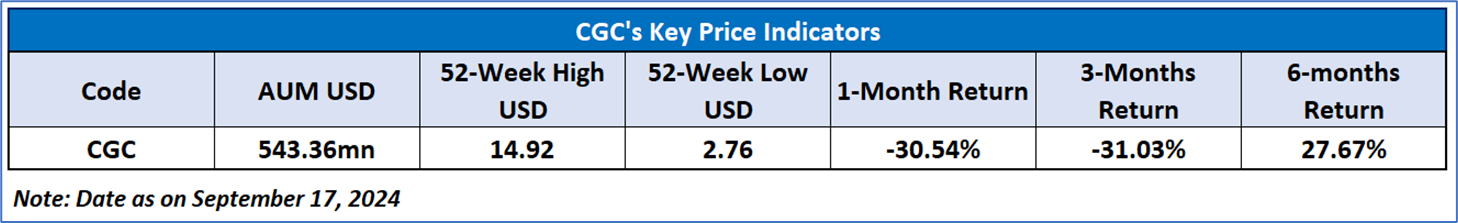

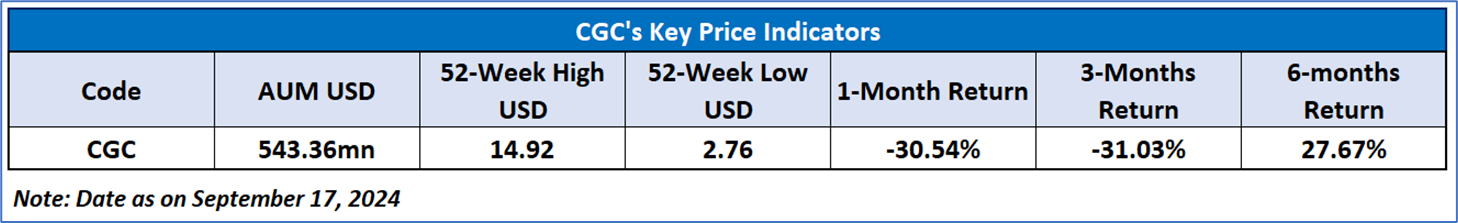

Technical Observation (on the daily chart):

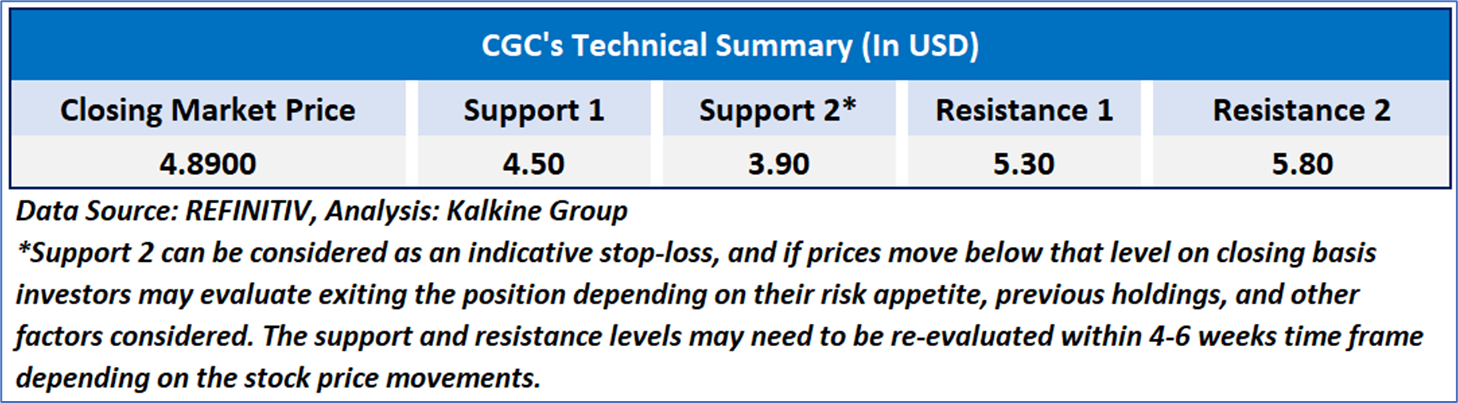

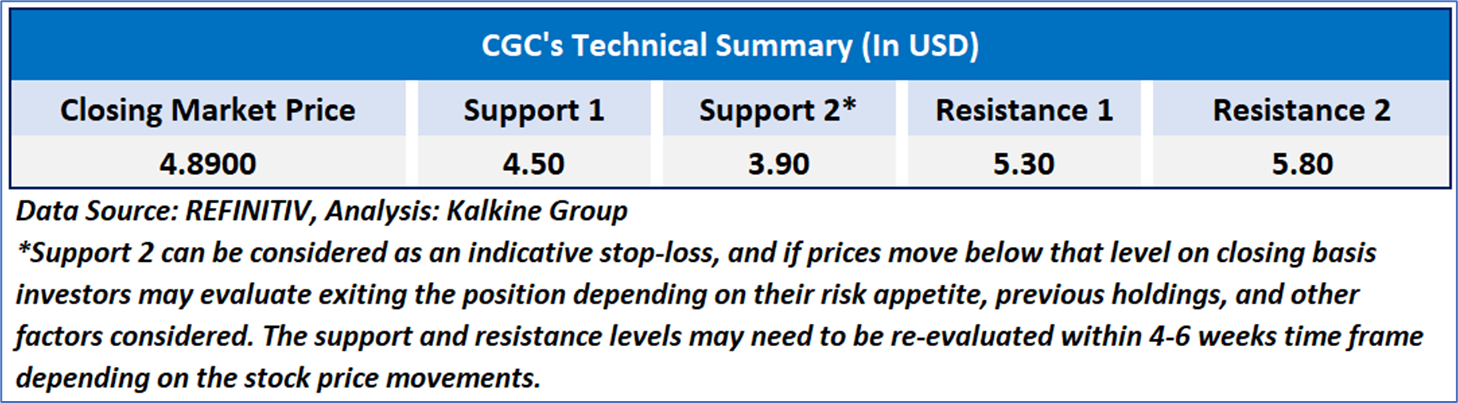

The Relative Strength Index (RSI) over a 14-day period stands at a value of 36.49, currently recovering from oversold zone, with expectations of a consolidation or an upward momentum if the important resistance of USD6.00 - USD7.00 is broken. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Canopy Growth Corporation (NASDAQ: CGC) at the closing market price of USD 4.89 as of September 17, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...