TransCode Therapeutics Inc

TransCode Therapeutics, Inc. (NASDAQ: RNAZ) is a clinical-stage oncology company focused on treating metastatic disease. The Company is focused on treating cancer through the design and delivery of ribonucleic acid (RNA) therapeutics based on its TTX nanoparticle platform. The Company’s lead therapeutic candidate, TTX-MC138, is focused on treating metastatic tumors which overexpress microRNA-10b, a unique, well-documented biomarker of metastasis.

Recent Business and Financial Updates

- TransCode Therapeutics Announces Reverse Stock Split: TransCode Therapeutics, Inc. (Nasdaq: RNAZ) has announced the implementation of a 1-for-33 reverse stock split, effective at 12:01 a.m. EST on December 4, 2024. The Company’s common stock will begin trading on a split-adjusted basis on the Nasdaq Capital Market under the existing ticker symbol “RNAZ” on the same date. The reverse split, approved by stockholders and the Board of Directors, aims to increase the stock’s per-share trading price to meet Nasdaq's minimum bid price requirement for continued listing. Following the split, the number of outstanding shares will be reduced from approximately 17.27 million to 696,233, including shares from a recent private placement. No fractional shares will be issued, and any fractional entitlements will be rounded up to the nearest whole share. Vstock Transfer LLC will serve as the exchange agent, ensuring a seamless transition for stockholders. Additionally, the Company’s CUSIP number will change to 89357L402 as of the effective date.

- TransCode Therapeutics Announces USD 8 Million Private Placement: TransCode Therapeutics, Inc. (Nasdaq: RNAZ) has entered into a securities purchase agreement with institutional investors to raise approximately USD 8 million in gross proceeds through a private placement. The Company will issue 21,220,160 shares of common stock (or pre-funded warrants), along with Series C and Series D warrants to purchase additional shares at an exercise price of USD 0.475. The Series C warrants will have a five-year term, while the Series D warrants will be valid for 2.5 years. The transaction, expected to close on November 29, 2024, is intended to support general corporate purposes and working capital. The Benchmark Company, LLC is acting as the exclusive placement agent. The securities are being offered in a private placement exempt from registration under the Securities Act of 1933, with the Company agreeing to file registration statements for the resale of the issued securities.

- TransCode Therapeutics Regains Compliance with Nasdaq Listing Requirements: TransCode Therapeutics, Inc. (NASDAQ: RNAZ) has received notice from Nasdaq confirming that the Company has regained compliance with Listing Rules 5550(a)(2) and 5550(b)(1), concerning the minimum bid price and shareholders' equity requirements. Additionally, the Company has resolved a violation of Listing Rule 5635 (Shareholder Approval Rule) through shareholder ratification of a July 2024 equity transaction. As a result, TransCode’s shares will remain listed on the Nasdaq Capital Market, subject to a Discretionary Panel Monitor until December 24, 2025. If the Company fails to maintain compliance during this period, it will not be granted additional time to rectify deficiencies and may face delisting, with an opportunity to request a hearing. Interim CEO and CFO Tom Fitzgerald stated that regaining compliance is an important step, positioning TransCode to advance its lead therapeutic candidate, TTX-MC138, in clinical trials and achieve key milestones in the coming year.

- TransCode Therapeutics Advances Phase 1 Trial with Third Cohort Dosing: TransCode Therapeutics, Inc. (NASDAQ: RNAZ) has dosed the first patient in Cohort 3 of its Phase 1 clinical trial for TTX-MC138, its lead RNA-based oncology candidate. The Safety Review Committee (SRC) approved the cohort's initiation based on positive safety and pharmacokinetic (PK) data from the first two cohorts, with no significant safety concerns or dose-limiting toxicities reported. Patients in Cohort 3 will receive a dose approximately double that of Cohort 2, and additional participants are scheduled for treatment. PK and pharmacodynamic (PD) analyses indicate that TTX-MC138 exhibits a profile consistent with preclinical and Phase 0 trials, including a 66% inhibition of miR-10b at 24 hours post-infusion. Enrollment continues under SRC oversight, with TransCode expressing confidence in the rapid completion of this course.

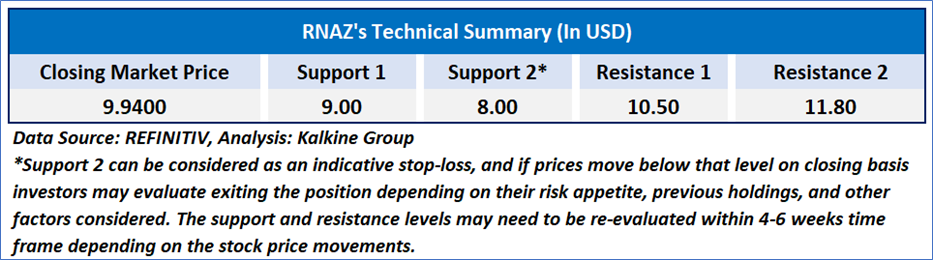

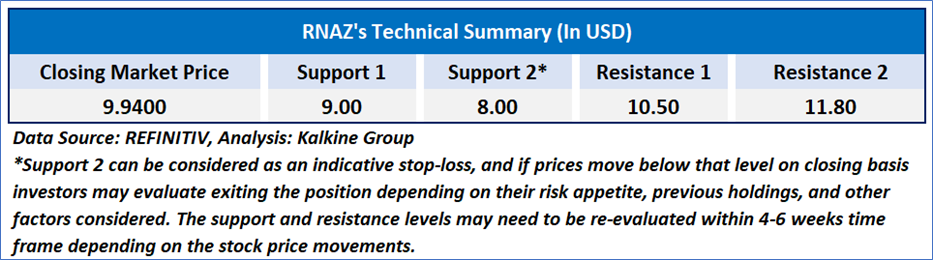

Technical Observation (on the daily chart):

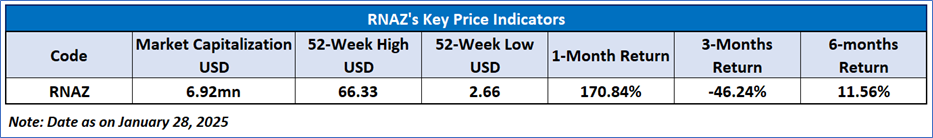

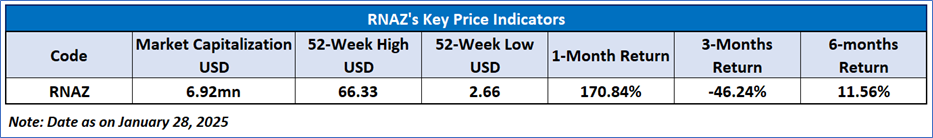

The Relative Strength Index (RSI) over a 14-day period stands at a value of 75.87, currently inside the overbought zone, with expectations of a consolidation or correction to next important support levels of USD 7.00 -USD 8.00. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support and resistance levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given for TransCode Therapeutics, Inc. (NASDAQ: RNAZ) at the closing price of USD 9.94, as of January 28, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 28, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...