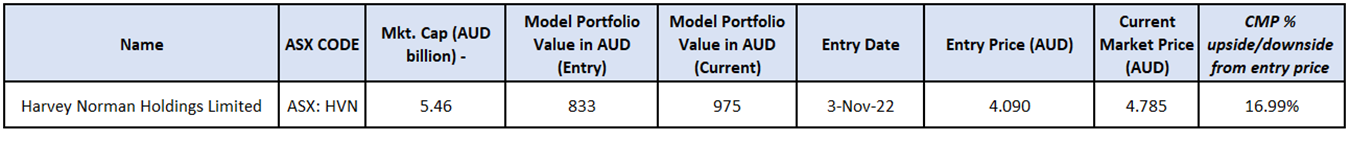

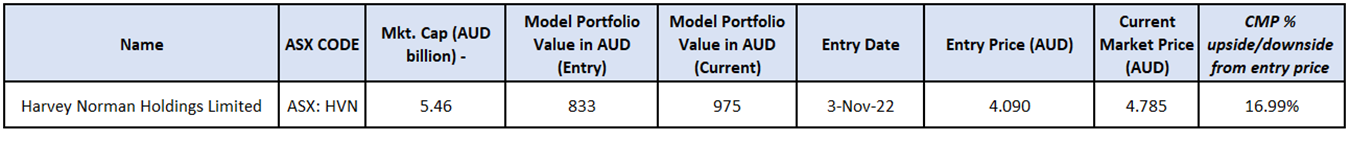

1. Exit Case: Harvey Norman Holdings Limited

Overview Harvey Norman Holdings Limited (ASX: HVN) is an integrated retail, franchise, property, and digital systems enterprise. It operates under a franchise system in Australia with Harvey Norman®, Domayne® and Joyce Mayne® brands providing products in categories including electrical goods, furniture, computerised communications, bedding, kitchen, and appliances, etc.

HVN has been a part of the ‘Value Model Portolio’ since 03 November 2022, however, considering the recent rally, trading near the resistance in the stock, support & resistance levels, and ~16.99% upside from the entry price, an ‘Exit’ is recommended from the stock near the resistance of AUD 4.79, as on (15th February 2024).

Harvey Norman Holdings Limited (ASX: HVN), part of Kalkine’s Value Model Portfolio, has reached near its resistance level around which an exit case emerges.

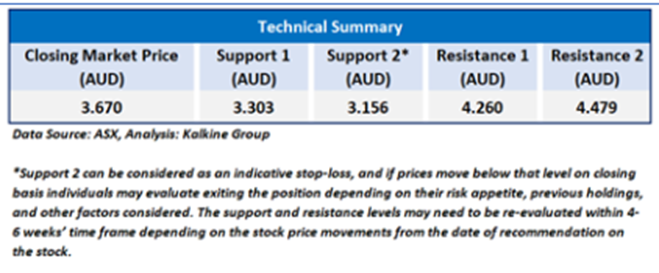

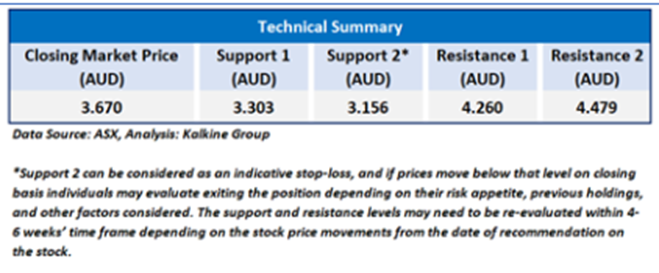

1.1 Support and Resistance Summary as provided in our last published report dated 20 July 2023.

1.2 Harvey Norman Holdings Limited (ASX: HVN)

One Year Technical Price Chart (as of 15th February 2024). Source: REFINITIV, Analysis: Kalkine Group

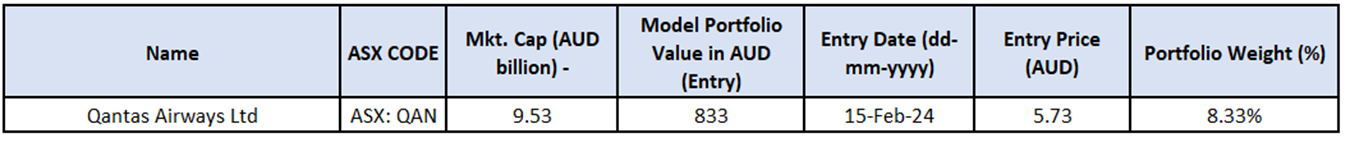

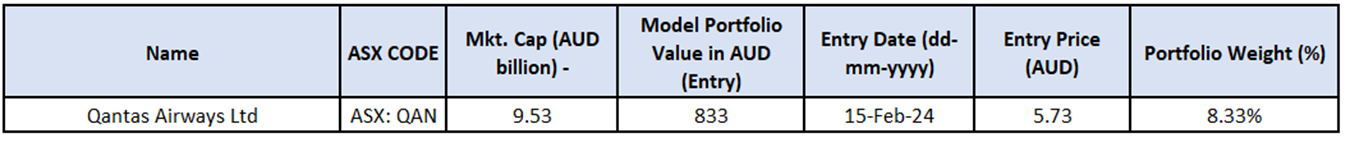

2. New Entry Case: Qantas Airways Ltd.

3. Overview: Qantas Airways Ltd is engaged in the operation of international and domestic air transportation services.

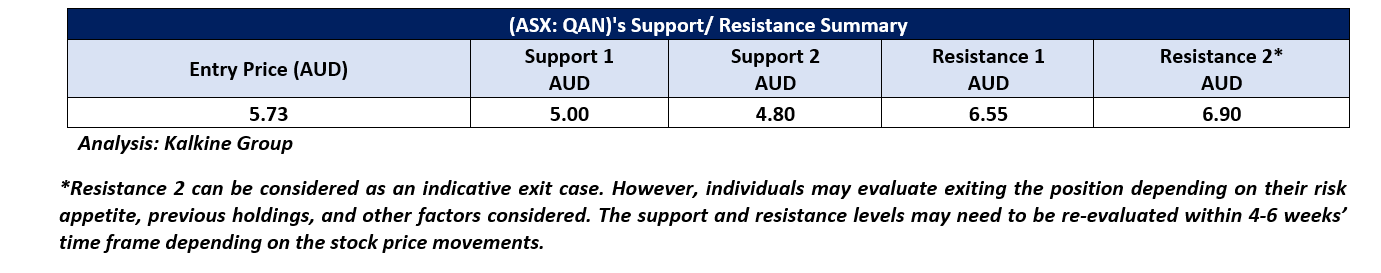

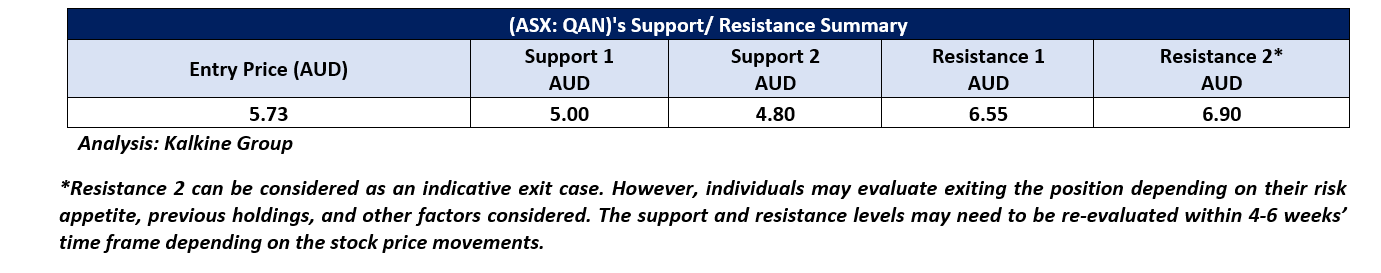

Technical Analysis: On the daily chart, QAN prices are trading above the horizontal trendline support zone and trading above the trendline. Moreover, the momentum oscillator RSI (14-period) is showing a reading of ~63.42 level. Further, the prices are trading above the trend-following indicator 21-period SMA, which may act as a support zone. An important support level for the stock is placed at AUD 5.00, while the key resistance level is placed at AUD 6.55.

Considering the above mentioned factors, technical analysis, support and resistance levels, key risks and outlook an ‘Entry’ is recommended in the ‘Value Model Portfolio’ at the current market price of AUD 5.73, as on (15th February 2024).

Source: REFINITIV as on 15th February 2024

Qantas Airways Ltd. has been identified as the new entry to our Value Model Portfolio.

2.1 Support and Resistance Summary as on 15th February 2024

2.2 One Year Technical Price Chart (ASX: QAN)

One Year Technical Price Chart (as of 15th February 2024). Source: REFINITIV, Analysis: Kalkine Group

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency as of (15th February 2024 ).The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings.

Disclaimer

This information should not be relied upon as personal financial advice by Kalkine on (i) the stocks or (ii) the use or suitability of the model portfolios. Only an investor knows about their circumstances to make an investment decision.

Model Portfolio has been prepared for illustrative purpose only and does not take into account the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Past performance is not necessarily indicative of future performance results. Actual investment returns will vary, and the value of investments can go up or down.

AU

Please wait processing your request...

Please wait processing your request...