Kalkine has a fully transformed New Avatar.

Desktop Metal, Inc.

Desktop Metal, Inc. (DM) Details

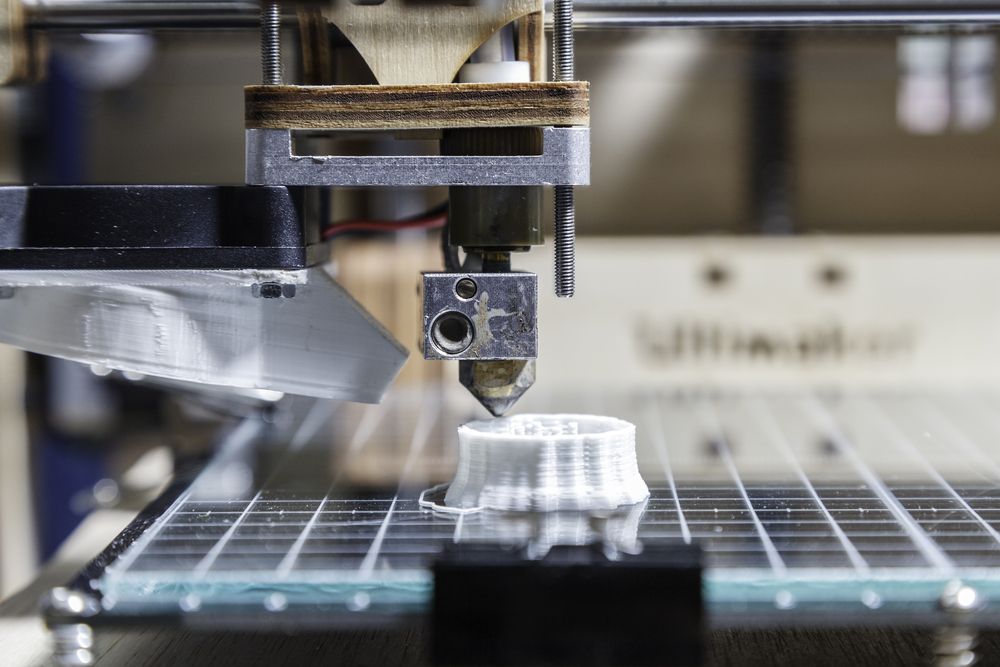

Desktop Metal, Inc. (NYSE: DM) was formerly known as Trine Acquisition Corp. and is engaged in developing additive manufacturing technologies for end-use parts. The company also offers metal 3D printing technology.

Trine Acquisition Corp completed the business combination with Desktop Metal Inc and began trading as a combined entity on the New York Stock Exchange under the ticker symbol "DM" from 10 December 2020. Therefore, the earlier given recommendation on the delisted entity-Trine Acquisition Corp was closed at the closing price on the last trading day i.e., 9 December 2020 at $24.77, as per data from the secondary sources.

DM Rides in Acquisition Synergies from Aerosint Buyout:

DM Adds PhonoGraft™ Platform to ITS Technology Portfolio: On July 7, 2021, DM informed the market that it has added the PhonoGraft™ platform to its technology portfolio. PhonoGraft technology used for repairing damaged eardrums, its minimal invasive and reduce the procedure time for patients and hence aids in hearing.

Key Highlights from 1QFY21 Results:

Revenue Highlights; Source: Analysis by Kalkine Group

Key Risks:

Outlook: For FY21, the company expects more than $100 million of revenue, exiting the year with an annualized revenue run rate of $160 million. Adjusted EBITDA loss is expected to be in the range of $60-$70 million for FY21.

Valuation Methodology: EV/Sales Multiple Based Relative Valuation (Illustrative)

Source: Analysis by Kalkine Group

*% Premium/(Discount) is based on our assessment of the company’s NTM trading multiple after considering its key growth drivers, economic moat, stock's historical trading multiples versus peer average/median, and investment risks.

Stock Recommendation: Over the last three months, the stock went down by ~29.1%. The stock made a 52-week low and high of $9.93 and $34.94, respectively. We have valued the stock using an EV/Sales multiple-based illustrative relative valuation method and arrived at a target price of an upside of high single-digit (in percentage terms). We believe that the company can trade at a slight discount as compared to its peer’s average considering changes in customer preferences, COVID-19 led headwinds, and increasing losses. For the purpose, we have taken peers like Hyliion Holdings Corp (NYSE: HYLN), Ouster Inc (NYSE: OUST), Cognex Corp. (NASDAQ: CGNX), to name a few.

Considering the increase in top-line in 1QFY21, acquisition synergies, robust product adoption, decent outlook, current trading levels, valuation and expected 2QFY21 results on 10 August 2021, we give a “Hold” recommendation on the stock at the closing price of $9.8, down by ~3.92% on 13 July 2021.

.png)

DM Daily Technical Chart, Data Source: REFINITIV

Note 1: The reference data in this report has been partly sourced from REFINITIV.

Note 2: Investment decision should be made depending on the investors’ appetite on upside potential, risks, holding duration, and any previous holdings. Investors can consider exiting from the stock if the Target Price mentioned as per the Valuation has been achieved and subject to the factors discussed above.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.