BlackBerry Limited

BlackBerry Limited (NYSE: BB) is a Canada-based company, which provides intelligent security software and services to enterprises and governments worldwide. The Company leverages artificial intelligence (AI) and machine learning to deliver solutions in the areas of cybersecurity, safety, and data privacy and specializes in the areas of endpoint management, endpoint security, encryption, and embedded systems. It operates in three segments: Cybersecurity, IoT, and Licensing and Other.

Recent Business and Financial Updates

- Exceptional Third Quarter Performance: BlackBerry Limited (NYSE: BB, TSX: BB) achieved remarkable financial results in the third quarter of fiscal year 2025, ending November 30, 2024. The company exceeded revenue guidance for both its Cybersecurity and Internet of Things (IoT) divisions, raising the lower end of its full-year IoT revenue forecast. Total revenue amounted to USD 162 million, with a gross margin of 74%. BlackBerry also accomplished significant financial milestones, including delivering positive adjusted EBITDA and adjusted earnings per share (EPS) above guidance, alongside attaining positive operating and free cash flow ahead of schedule.

- Business Segment Performance: The IoT division demonstrated outstanding growth, with revenue increasing 13% sequentially to USD 62 million and gross margins rising to 85%. Adjusted EBITDA for the segment surged by 38% sequentially to USD 18 million. The Cybersecurity division also posted robust results, with revenue increasing by 7% sequentially to USD 93 million and gross margins improving to 67%. Cybersecurity ARR rose to USD 281 million, marking a 1% sequential increase, while DBNRR climbed for the fifth consecutive quarter to 90%. Licensing revenue surpassed expectations, contributing USD 6 million to adjusted EBITDA.

- Strategic Business Advancements: BlackBerry made significant strides in its strategic transformation, announcing a definitive agreement for the sale of Cylance endpoint security assets to Arctic Wolf. This transaction is anticipated to enhance the company’s profitability post-sale. Additionally, BlackBerry's QNX embedded technology has now been integrated into over 255 million vehicles globally. The company also introduced a software-defined functional safety platform in collaboration with Intel for industrial automation and achieved advancements in critical event management with BlackBerry AtHoc, which is on track to achieve FedRAMP high authorization.

- Cybersecurity Leadership and Global Initiatives: Reinforcing its global cybersecurity efforts, BlackBerry collaborated with the Government of Canada to enhance cyber resilience in Southeast Asia through the Malaysia Cybersecurity Center of Excellence. Furthermore, the company strengthened its leadership by appointing Lisa Bahash, an experienced automotive industry executive, to its Board of Directors. These initiatives highlight BlackBerry’s dedication to addressing emerging threats and driving innovation in the cybersecurity space.

- Forward-Looking Financial Guidance: BlackBerry has issued optimistic guidance for the fourth quarter and the full fiscal year 2025, reflecting the expected results of its ongoing operations post-Cylance divestiture. Full-year revenue is projected to range between USD 517 million and USD 526 million, with IoT revenue expected to reach USD 230 million to USD 235 million. Total company adjusted EBITDA is forecasted at USD 60 million to USD 70 million, while non-GAAP basic EPS is anticipated to range from a loss of USD 0.02 to breakeven. This outlook underscores BlackBerry's focus on sustained profitability and strategic growth.

- Insights into Threat Intelligence: In parallel with its financial achievements, BlackBerry released its Global Threat Intelligence Report, providing critical insights into the evolving cybersecurity landscape. Between July and September 2024, the company’s cybersecurity solutions detected 600,000 attacks targeting critical infrastructure, with 45% aimed at the financial sector. An additional 430,000 attacks were identified against commercial enterprises, emphasizing the persistent risks to these key industries.

- Emerging Threat Trends and Regional Analysis: The report highlighted emerging threats, including Lynx ransomware, the Coyote banking trojan, and activities from groups such as RansomHub and Hunter's International. North America and Latin America emerged as the most targeted regions globally, followed by Asia-Pacific (APAC) and Europe, the Middle East, and Africa (EMEA). Deepfake technology continues to rise as a significant threat, prompting regulatory responses such as the U.S. No AI Fraud Act. The report also flagged geopolitical cybercrime risks, including the use of cyberattacks in human trafficking in Southeast Asia and North Korean operatives exploiting deepfake technology to infiltrate Western IT companies. BlackBerry’s comprehensive report provides actionable insights for organizations to strengthen their defenses amid these evolving threats.

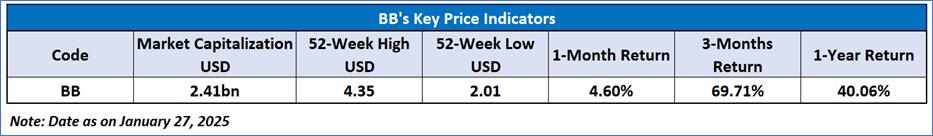

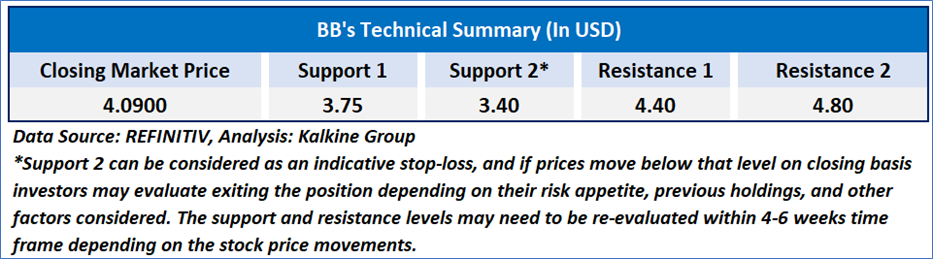

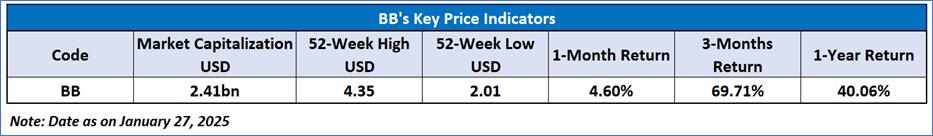

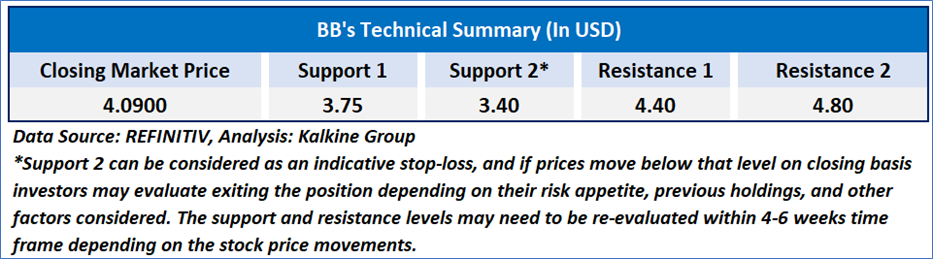

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 62.31, with expectations of a consolidation or downward momentum if the important support of USD 3.60-USD 4.00 is broken on the downward side. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 27, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...