GameStop Corporation

GameStop Corp. (NYSE: GME) offers games and entertainment products through its stores and e-commerce platforms. The Company operates in four geographic segments: United States, Canada, Australia and Europe. Each segment consists primarily of retail operations, with the significant majority focused on games, entertainment products and technology.

Recent Business and Financial Updates

- Earnings Performance: In the first quarter of fiscal 2024, GameStop reported an adjusted loss per share of 12 cents, which was slightly below the Zacks Consensus Estimate of a 10-cent adjusted loss. This compares to an adjusted loss of 14 cents per share recorded in the prior-year quarter, indicating a slight improvement in the company's per-share loss performance.

- Net Sales Overview: GameStop's net sales for the quarter amounted to USD 881.8 million, falling short of the consensus estimate of USD 900 million and reflecting a 28.7% decrease from USD 1,237.1 million in the same quarter last year. This decline in net sales was due to lower sales across all product categories.

- Sales Mix Breakdown: Sales in the hardware and accessories category fell by 30.4% to USD 505.3 million, down from USD 725.8 million reported in the previous year. Software sales decreased by 29.1%, totaling USD 239.7 million compared to USD 338.3 million in the prior-year quarter. Additionally, sales in the collectibles unit declined by 20.9% to USD 136.8 million, compared to USD 173 million reported in the same period last year.

- Margins and Expenses: Gross profit decreased by 14.9% to USD 244.5 million from USD 287.3 million in the year-ago quarter. However, the gross margin expanded by 450 basis points year over year, reaching 27.7% for the quarter under review. Adjusted selling, general, and administrative (SG&A) expenses declined by 11.5% to USD 299.5 million from USD 338.5 million in the prior-year quarter. As a percentage of net sales, adjusted SG&A expenses rose to 34%, up 660 basis points from 27.4% in the previous year. The company reported an adjusted operating loss of USD 55 million, compared to an adjusted operating loss of USD 51.2 million in the same period last year.

- Financial Position: GameStop concluded the first fiscal quarter with cash and cash equivalents totaling USD 999.9 million, net long-term debt of USD 14.9 million, and stockholders’ equity amounting to USD 1.31 billion. Merchandise inventory stood at USD 675.8 million, down from USD 759.5 million at the end of the same quarter last year. During the 13 weeks ended May 4, 2024, the company reported a cash outflow from operations of USD 109.8 million, compared to an outflow of USD 102.7 million in the prior-year period. The free cash flow was negative USD 114.7 million, with capital expenditures amounting to USD 4.9 million for the same period.

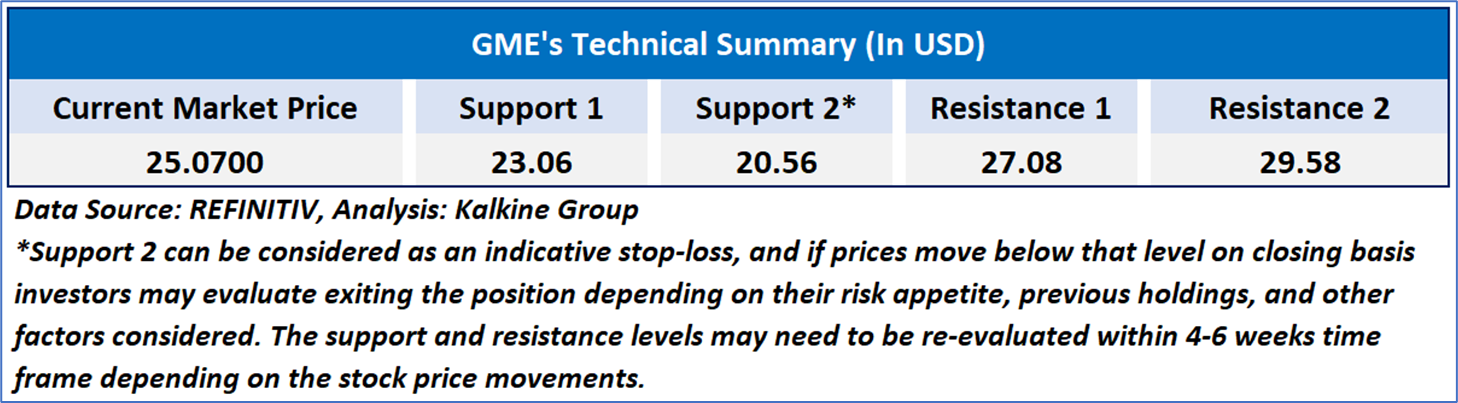

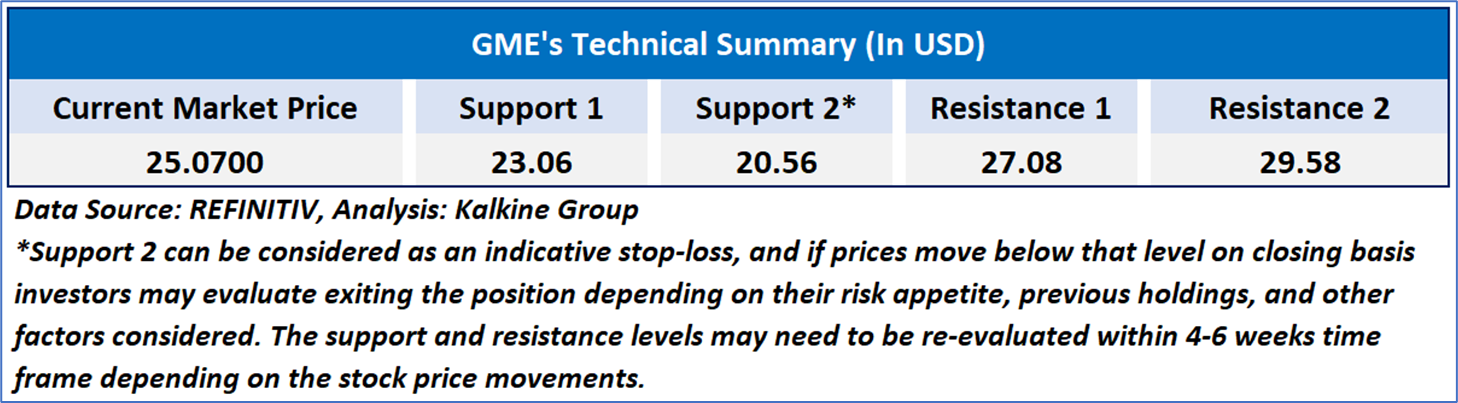

Technical Observation (on the daily chart):

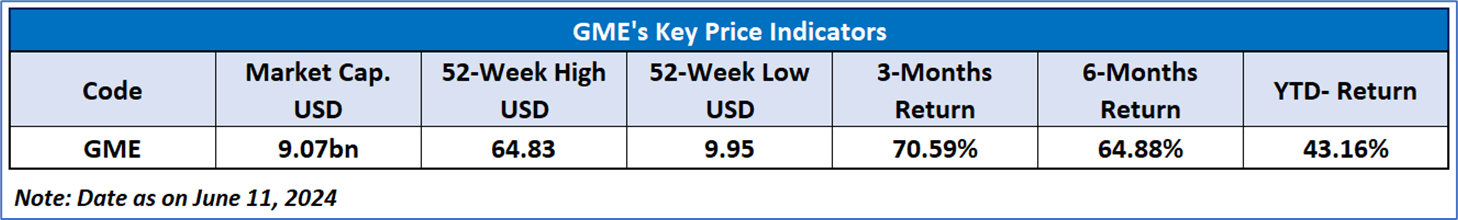

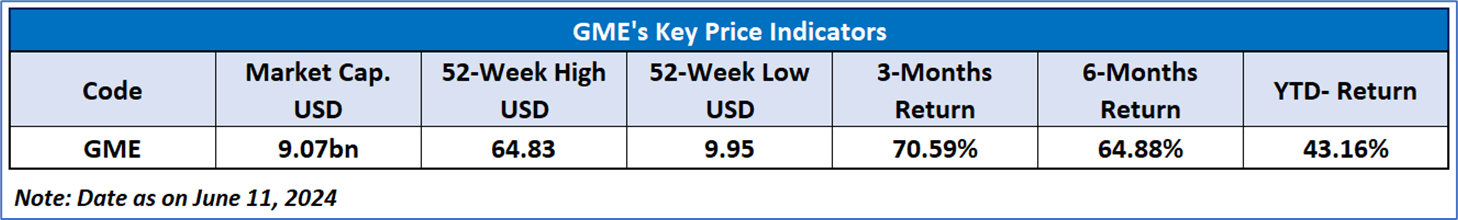

The Relative Strength Index (RSI) over a 14-day period stands with value of 50.60, with expectations of a consolidation. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is June 11, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...