Amazon.com Inc

Amazon.com, Inc. (NASDAQ: AMZN) provides a range of products and services to customers. The products offered through its stores include merchandise and content it has purchased for resale and products offered by third-party sellers. The Company’s segments include North America, International and Amazon Web Services (AWS). It serves consumers through its online and physical stores and focuses on selection, price, and convenience.

Recent Business and Financial Updates:

- com, Inc. (NASDAQ: AMZN) has disclosed its intention to convene a conference call to deliberate upon its financial outcomes for the first quarter of 2024. This event is scheduled to take place on Tuesday, April 30, 2024, commencing at 2:30 p.m. Pacific Time (PT) or 5:30 p.m. Eastern Time (ET).

- Fourth Quarter 2023: Remarkable Financial Performance: In the fourth quarter of 2023, the company demonstrated an exceptional financial performance, with net sales surging to USD 170.0 billion, marking a remarkable 14% increase from the previous year's USD 149.2 billion. Excluding the favorable impact of USD 1.3 billion from changes in foreign exchange rates, the net sales still exhibited a noteworthy 13% rise compared to the fourth quarter of 2022. Notably, the North America segment's sales soared by 13% year-over-year to USD 105.5 billion, while the International segment experienced a robust 17% increase to USD 40.2 billion, or 13% growth when excluding currency rate changes. The AWS segment also displayed resilience with a 13% year-over-year increase, reaching USD 24.2 billion. This surge in sales was accompanied by a substantial increase in operating income, which reached USD 13.2 billion, a significant rise from USD 2.7 billion in the fourth quarter of 2022.

- Striking Operational Turnaround: The operational landscape witnessed a striking turnaround, particularly in the North America segment, where operating income reached USD 6.5 billion, contrasting sharply with the USD 0.2 billion operating loss in the fourth quarter of 2022. Similarly, the AWS segment reported an impressive operating income of USD 7.2 billion, up from USD 5.2 billion in the previous year. However, the International segment still faced challenges, albeit showing improvement, with an operating loss narrowing to USD 0.4 billion compared to USD 2.2 billion in the fourth quarter of 2022. Despite these challenges, the company's net income surged to USD 10.6 billion in the fourth quarter of 2023, translating to USD 1.00 per diluted share, a substantial increase from USD 0.3 billion, or USD 0.03 per diluted share, in the same period of 2022. This remarkable improvement included a pre-tax valuation loss of USD 0.1 billion from the investment in Rivian Automotive, Inc., a significant turnaround from the USD 2.3 billion loss recorded in the fourth quarter of 2022.

- Full Year 2023: Sustained Growth Trajectory: The company's performance for the full year 2023 showcased sustained growth, with net sales reaching USD 574.8 billion, marking a solid 12% increase from USD 514.0 billion in 2022. Even after factoring in the unfavorable impact of USD 0.1 billion from changes in foreign exchange rates, the net sales exhibited a commendable 12% rise compared to the previous year. Notably, the North America segment's sales surged by 12% year-over-year to USD 352.8 billion, while the International segment reported an 11% increase to USD 131.2 billion. The AWS segment also maintained its upward trajectory with a 13% year-over-year increase, reaching USD 90.8 billion. Operating income for the full year soared to USD 36.9 billion, a significant rise from USD 12.2 billion in 2022. This was driven by the North America segment's impressive turnaround, recording an operating income of USD 14.9 billion from a USD 2.8 billion operating loss in 2022.

- Robust Cash Flow and Free Cash Flow Performance: In terms of cash flow, the company witnessed a substantial increase in operating cash flow for the trailing twelve months ending December 31, 2023, which reached USD 84.9 billion compared to USD 46.8 billion for the same period ending December 31, 2022. Free cash flow also saw remarkable improvement, with an inflow of USD 36.8 billion for the trailing twelve months, compared to an outflow of USD 11.6 billion in 2022. Moreover, free cash flow less principal repayments of finance leases and financing obligations demonstrated a significant improvement, reaching an inflow of USD 32.2 billion compared to an outflow of USD 19.8 billion in 2022. Similarly, free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations witnessed a substantial improvement, with an inflow of USD 35.5 billion compared to an outflow of USD 12.8 billion in 2022.

Technical Observation (on the Daily chart):

Amazon has been in an uptrend since last year, with the current price testing 21-period SMA. Furthermore, with the break of the USD 175.00-USD180.00 zone, the price is expected to correct further to next important support levels of USD 160. The 14-day Relative Strength Index (RSI), a momentum indicator, currently stands around the midpoint (downward sloping), indicating a negative outlook. Moreover, the stock's price being between both its 21-day and 50-day Simple Moving Averages (SMAs) suggests that this level may act as temporary resistance and support respectively soon. To forecast future price movements, it is essential to keep a close eye on these factors and their potential influence on the stock's performance.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Past performance is neither an indicator nor a guarantee of future performance.

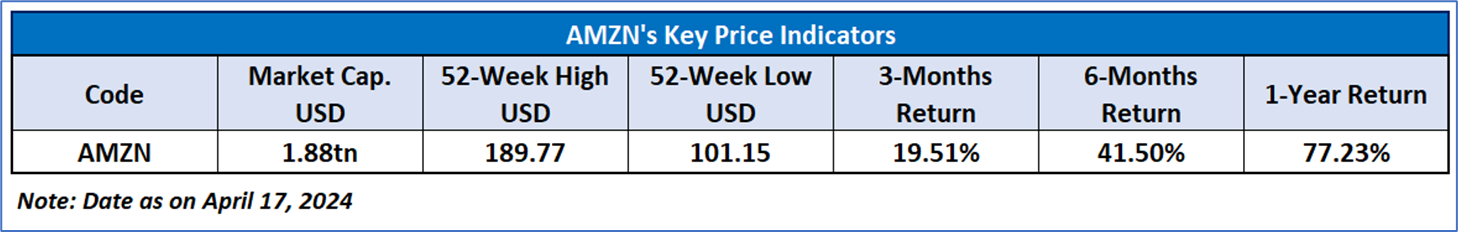

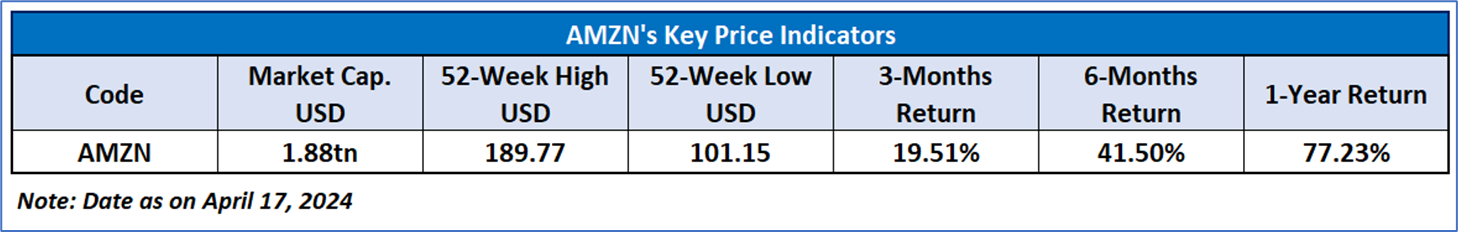

The reference date for all price data, currency, technical indicators, support, and resistance levels is April 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...