BigBear.ai Inc.

BigBear.ai Holdings Inc. (NYSE: BBAI) is actively involved in achieving decision superiority for the national defense and intelligence sectors. They implement artificial intelligence and machine learning on a large scale through their comprehensive data analytics platform. Utilizing their exclusive AI/ML technology, the company aids its clients in enhancing their decision-making procedures and providing effective solutions that perform well even in intricate, authentic, and less-than-ideal data situations.

Recent Financial and Business Updates:

- ai (NYSE: BBAI), has declared its intention to unveil its first-quarter earnings release on Thursday, May 02, 2024, expectedly around 4:15 pm ET.

- Completion of Pangiam Acquisition:ai has successfully concluded the acquisition of Pangiam Intermediate Holdings, LLC (Pangiam), marking a pivotal move in the realm of Vision AI for global trade, travel, and digital identity sectors. Finalized on February 29, 2024, this strategic transaction underscores BigBear.ai's commitment to providing clarity for complex decisions across national security, supply chain management, and digital identity domains. The integration of Pangiam's expertise in facial recognition, image-based anomaly detection, and advanced biometrics with BigBear.ai's proficiency in computer vision and predictive analytics establishes one of the industry's most comprehensive Vision AI portfolios.

- Strengthening Financial Position: ai has bolstered its financial position with approximately USD 54 million in cash proceeds, before fees, generated from warrants exercised in the first quarter of 2024. This infusion of liquidity enhances the company's balance sheet, reinforcing its financial resilience and positioning it for future growth opportunities.

- Improved Performance Metrics: Despite challenges, BigBear.ai has demonstrated notable improvements in its financial performance metrics. The net loss for the fourth quarter of 2023 narrowed to USD 21.3 million, reflecting an USD 8.6 million enhancement compared to the corresponding period in 2022. Moreover, the company achieved its second consecutive quarter of positive adjusted EBITDA, totaling USD 3.7 million, signaling operational efficiency and sustained progress.

- Positive Financial Outlook: ai anticipates continued growth momentum with a revenue outlook of USD 195 million to USD 215 million for the year ending December 31, 2024. This projection encompasses the anticipated contributions from Pangiam following the acquisition's completion.

- Detailed Financial Highlights: In the fourth quarter of 2023, BigBear.ai registered a 0.5% increase in revenue, totaling USD 40.6 million, compared to USD 40.4 million in the same period of the previous year. Additionally, the company reported a gross margin of 32.1%, reflecting an improvement from 29.2% in the fourth quarter of 2022. Noteworthy factors contributing to this enhancement include improved Federal margins on major fixed-price contracts and a shift away from lower-margin projects, such as EPASS.

- Impactful Developments: In addition to the financial highlights, BigBear.ai has unveiled several significant developments in its operational landscape. These include strategic acquisitions, partnerships with industry leaders such as Amazon Web Services Professional Services (AWS ProServe), and continued participation in high-profile events such as the US Army's GFIM Phase 2 Prototype extension and the Navy's AI Task Force exercises.

Technical Observation (on the daily chart)

The Relative Strength Index (RSI) over a 14-day period stands at 34.41, and is currently taking support from oversold zone, with expectations of a consolidation or some upward recovery. Additionally, the stock's current positioning is below the 21-period SMA and 50-period SMA, which may serve as dynamic short-term resistance level, but once broken upside will provide a decent momentum.

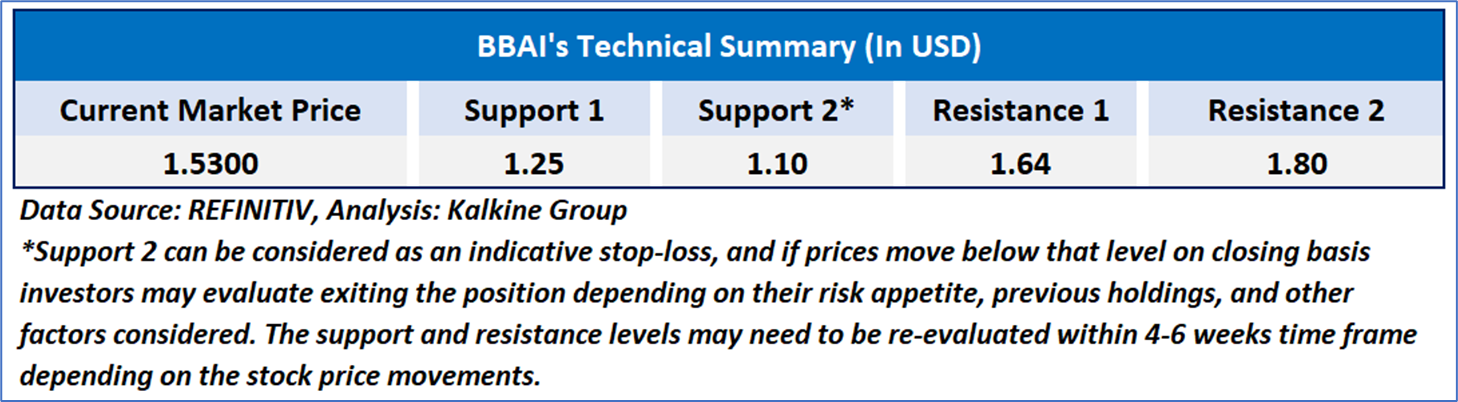

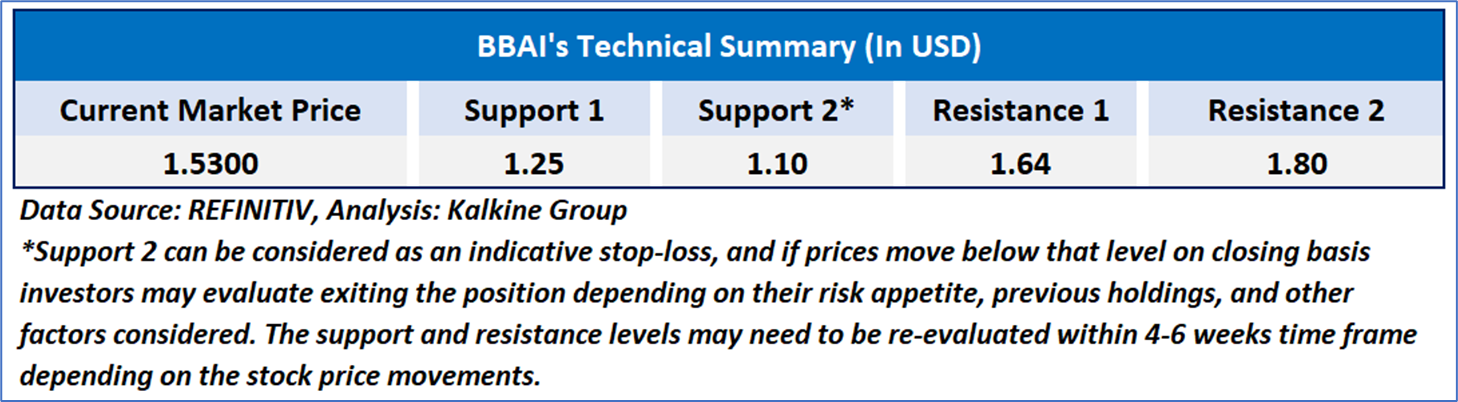

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The reference date for all price data, currency, technical indicators, support, and resistance levels is April 22, 2024. The reference data in this report has been partly sourced from REFINITIV.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating the stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...