Bristol-Myers Squibb Company

Bristol-Myers Squibb Company (NYSE: BMY) is a biopharmaceutical company engaged in the discovery, development and delivering advanced medicines that help patients prevail over serious diseases. It offers products for various therapeutic classes, which includes oncology, hematology, immunology, cardiovascular and neuroscience.

Recent Business and Financial Updates:

- First Quarter Highlights: Bristol Myers Squibb demonstrated robust performance in the first quarter, achieving revenues of USD 11.9 billion, marking a 5% increase (or 6% adjusting for foreign exchange) from the previous year. The company's Growth Portfolio revenues reached USD 4.8 billion, growing by 8% (or 11% adjusting for foreign exchange), bolstered by strategic transactions including the completion of Karuna Therapeutics, RayzeBio, Mirati Therapeutics, and SystImmune. Despite a one-time net impact of acquired IPRD charges and licensing income, resulting in GAAP loss per share of USD 5.89, the non-GAAP loss per share stood at USD 4.40.

- Key Financial Insights: In the first quarter of 2024, Bristol Myers Squibb saw notable revenue growth, primarily driven by key products like Eliquis, Reblozyl, and Opdualag, offsetting declines in Opdivo and Revlimid. While U.S. revenues surged by 7% to USD 8.5 billion, international revenues remained relatively flat at USD 3.4 billion, attributed to lower average net selling prices. Gross margin decreased on both GAAP and non-GAAP bases, primarily due to product mix, while marketing, selling, and administrative expenses increased due to the timing of spend and recent acquisitions. Research and development expenses also rose, reflecting the impact of recent acquisitions and portfolio support costs.

- Outlook and Guidance: Despite reporting a net loss attributable to Bristol Myers Squibb of USD 11.9 billion on a GAAP basis, the company is committed to reinforcing its long-term growth trajectory. Initiatives include executing a strategic productivity initiative to achieve approximately USD 1.5 billion in cost savings, with the majority to be reinvested in innovation and growth. The company updated its 2024 non-GAAP EPS and line-item guidance to reflect the impact of recent transactions, demonstrating proactive measures to navigate evolving market dynamics.

- Product Revenue Highlights: The company's Growth Portfolio saw substantial revenue growth, reaching USD 4.8 billion, fueled by increased demand for Reblozyl, Opdualag, Yervoy, Camzyos, and Sotyktu. Conversely, Legacy Portfolio revenues stood at USD 7.1 billion, driven by a 9% increase in Eliquis worldwide revenues, partially offset by declines in Revlimid revenues.

Technical Observation (on the daily chart):

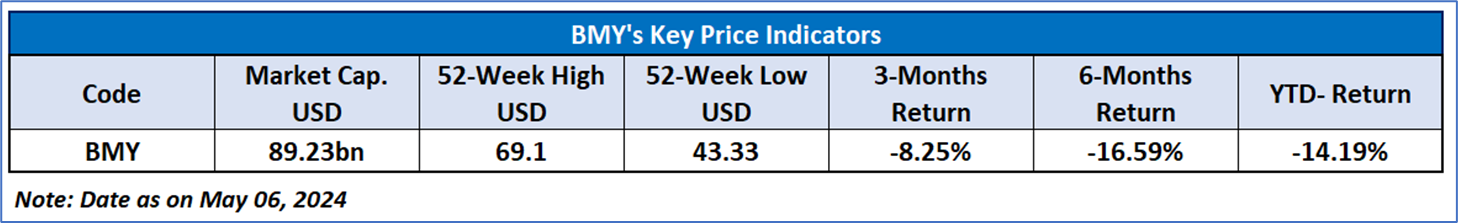

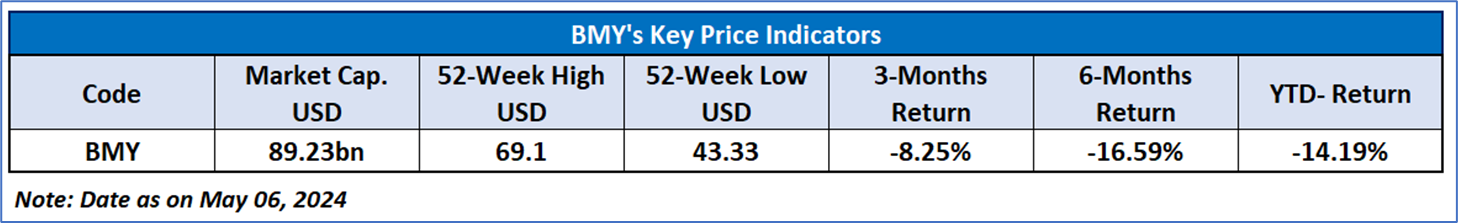

The Relative Strength Index (RSI) over a 14-day period stands inside oversold levels with a value of 25.99, and is currently consolidating, with expectations of a consolidation or an upward momentum in the stock price. Additionally, the stock's current positioning is below the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term resistance levels. The price is currently near important support levels of USD 40 - USD 44, with expectations of a reversal from these levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Bristol-Myers Squibb Company (NYSE: BMY) at the current market price of USD 44.02 as of May 06, 2024, at 06: 55 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is May 06, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...