Kalkine has a fully transformed New Avatar.

FuelCell Energy, Inc.

FCEL Details

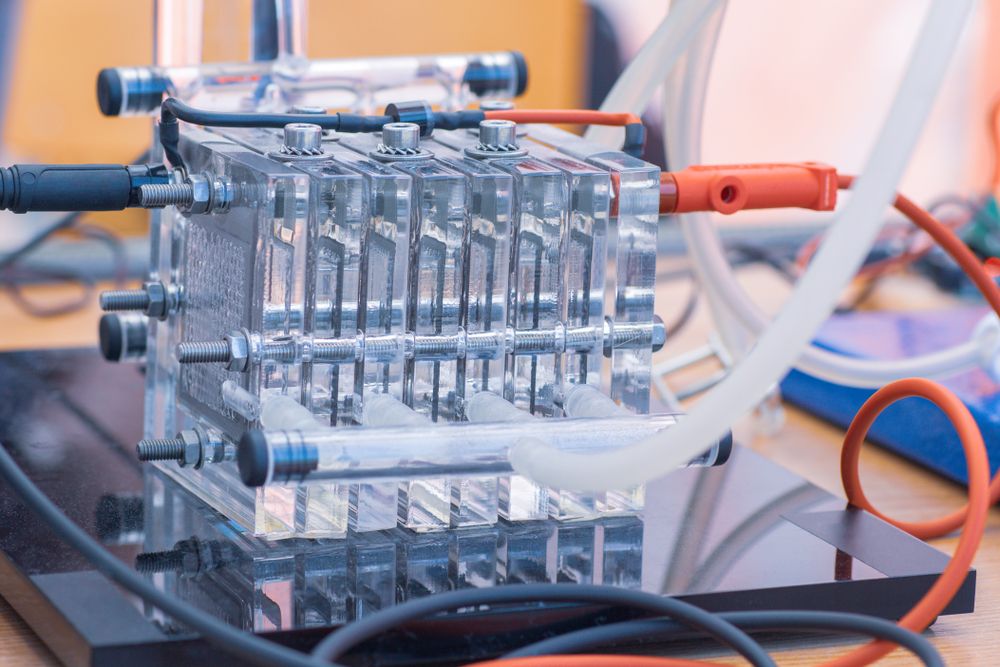

FuelCell Energy Inc (NASDAQ: FCEL) is one the leading companies in fuel cell technology striving to utilize fuel cell platforms to provide clean energy. As of 12th March 2021, the company’s market capitalization stood at ~USD 5.86 billion.

Possibility of favorable regulation: The company is expected to benefit from favorable changes in the regulatory landscape in the near-term. Specifically, it is expected that the current system of short-term tax credits targeting the wind and solar industries will be replaced with permanent technology-neutral subsidies for green energy in general. Such a change would imply the participation of fuel cell companies too in the subsidies that were previously available to only solar and wind sectors.

Funding from Government Bodies: On 17th September 2020, the company announced receiving funding support from the U.S Department of Energy (DOE) for USD 3 million. These proceeds are being used towards the development and commercialization of the company’s reversible oxide fuel cell (RSOFC) system. On 9th October 2020, the company received a further funding award of USD 8 million from the DOE, in collaboration with the Office of Nuclear Energy, to support the design and manufacture of an electrolysis platform capable of producing hydrogen.

FY20 Results: The company reported revenue growth of 17% YoY to USD 70.9 million in FY20 as compared to USD 60.8 million in FY19 on account of expanded activities in Generation and Advanced Technologies business lines. The net loss from operations for FY20 was at USD 89.1 million Vs. USD 76.4 million in FY19 including the negative impact of USD 37.1 million change in fair value of common stock warrant liability.

FY20 Results Snapshot (Source: Company Press Release)

Key Risks: The company’s long-impending litigation proceedings, particularly against POSCO Energy, expose it to the risk of incurring significant legal costs or an adverse judgment. These could also result in limited, hindered, or delayed access to South Korean and Asian markets for FCEL.

Stock Recommendation: FCEL stock has jumped 130.46% in the past three months. On the technical analysis front, the stock has a support level of ~USD 13.65 and a resistance level of ~USD 20.02. On a TTM basis, the stock is trading at an EV/Sales multiple of 9.74x, higher than the industry mean of 2.65x. We opine that the news regarding anticipated positive changes in the regulatory environment has already been factored in at the current price level. Considering the current valuation, risks, and outlook for the business, we give an “Expensive” rating on the stock at the closing price of USD 18.16, down by 1.09% as of 12th March 2021.

FCEL Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Vaxart, Inc.

VXRT Details

Vaxart, Inc Common Stock (NASDAQ: VXRT) is a clinical-stage biotechnology company focused on developing oral recombinant vaccines (administered in tablet form) designed to generate systemic immune responses that protect against a wide range of infectious diseases, including COVID-19. As of 12th March 2021, the company’s market capitalization stood at ~USD 793.75 million.

Vaxart Vaccine Pipeline (Source: Company Presentation, March 2021)

A Long Way to the market for a Key Product: The company’s Covid-19 vaccine (VXA-CoV2-1) showed mixed results under the Phase 1 trial. The key point to note is the vaccine candidate did not neutralize the antibody production. But T-cells induced via vaccine killed the virus’s spike protein (S-protein) and its nucleoprotein. The potent cellular immune responses alone may offer sufficient protection against severe COVID-19 illness. The company is hence advancing its Covid vaccine program with a Phase2 study planned in 2Q21

FY20 Results: The company reported a steep fall in revenue by 59% to USD 4.1 million in FY20 as compared to USD 9.9 million in FY19. The decrease was principally due to a reduction in royalty revenue related to Inavir (a single dose product to prevent or treat influenza infection) sales in Japan due to abnormally low incidences of seasonal influenza in 2020, compared to higher-than-average incidences in 2019. The company reported a 145% rise in general and administrative expenses from USD 6.2 million in FY19 to USD 15.2 million in FY20. Subsequently, the net loss grew by 73% to USD 32.2 million in FY20 as compared to USD 18.6 million in FY19. VXRT had a strong cash balance of USD 126.9 million at the end of FY20.

Key Risks: The company’s portfolio is concentrated around a few vaccines, the Covid-19 vaccine and Inavir being prominent ones. Most products are in early-stage clinical trials, and as of now, it is not clear whether they will transition to the commercialization stage. Also, the company is a party to various legal proceedings and is also being investigated by a shareholders rights firm Bragar Eagel & Squire over breach of fiduciary duties by the directors towards investors. Further, the company is being investigated by the US Securities and Exchange Commission (SEC) and Department of Justice (DoJ) for insider trading and inaccurate statements regarding its role in Operation Warp Speed (OWS).

Outlook: The company is sufficiently funded to run clinical trials for its products in the pipeline. It has restarted its norovirus vaccine program which is targeting a USD 10.6 billion market in the USA. The results from the Phase 1b trial are expected to be published during the first half of 2021. Along with the Norovirus vaccine, the company’s Covid Vaccine VXA-CoV2-1 is also advancing with its clinical trials. These vaccines could be fortune changers for the company going forward.

Stock Recommendation: The company has a strong balance sheet and liquidity position and is also progressing with further trials of its Covid-19 vaccine candidate. However, mixed results on its Phase 1 trials push back the visibility of the product's commercialization. The legal/regulatory challenges could also weigh on the stock sentiment and the company's financials. The stock is currently inclined towards the lower end of its 52 weeks’ range of USD 1.08-USD 24.90. On the technical analysis front, the stock of VXRT has a support level of ~USD 5.57 and a resistance level of ~USD 7.93. Considering the current trading levels and outlook for the business, we reiterate an "Avoid" rating on the stock at the current market price of USD 6.74, down by 2.74% as of 12th March 2021.

VXRT Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.