Sonic Healthcare Limited

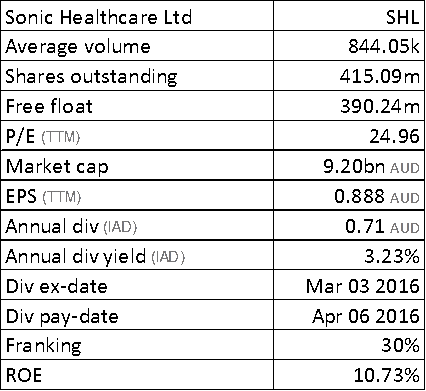

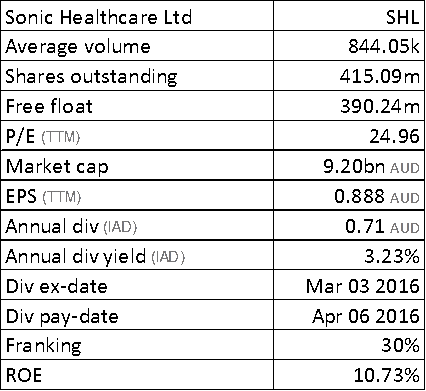

SHL Details

·

Met fiscal year of 2016 guidance: Sonic Healthcare Limited (ASX: SHL) stock surged over 6.1% on August 17, 2016 as the group came up with a solid fiscal year of 2016 results. The group met its FY2016 guidance and generated a revenue growth of 20% to A$5.1 billion. Earnings per share rose 27% driven by Europe and the USA. The group’s positive guidance also pleased investors which expects ongoing EBITDA growth in FY2017. Meanwhile, SHL’s integration of acquisitions, Medisupport in Switzerland and KLD in Belgium have been completed this year and SHL expects further synergies in 2017. The group’s UK joint venture, Health Services Laboratories, is positioning for further NHS outsourcing contracts. On the other hand, management reported that they are slowing investments this year. Moreover, with the recent Brexit, the group’s UK outcome might face pressure. Meanwhile, SHL stock already delivered over 23.3% during this year to date (as of August 16, 2016). We recommend investors to leverage the current rise as an exit opportunity in the stock.

· Recommendation: We give an “Expensive” recommendation on the stock at the current price of $23.51

.png)

Fiscal year of 2016 performance (Source: Company Reports)

Fletcher Building Limited

.png)

FBU Details

·

Decent FY16 results drove the stock: Fletcher Building Limited (Australia) (ASX: FBU) stock surged over 4.9% on August 17, 2016 as the group generated net earnings of $462 million for the year ended 30 June 2016, against $270 million in prior corresponding year. Net earnings before significant items were 5% more at $ 418 million. Operating earnings (earnings before interest and tax) were $719 million, against $503 million last year. FBU Cash flow from operations performance was pleasing which rose over 15% to $660 million as compared to $575 million in the prior year. This increase was on the back of better operating earnings and decline in working capital. FBU declared a final dividend of 20 cents per share leading to a total dividend for the year to 39.0 cents per share. FBU reported that the favorable results were mainly due to 29% better operating earnings from Fletcher Building’s Australian businesses. On the other hand, FBU stock already rallied over 43.1% in the last six months (as of August 16, 2016).

Recommendation: We feel the stock is “Expensive” at the current price of $9.58

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

Please wait processing your request...

Please wait processing your request...