.PNG)

FMG Details

Lowest cost seaborne supplier of iron ore for China against its peers: Fortescue Metals Group Limited (ASX: FMG) continues to focus on controlling debt given the ongoing strong cash flows generation driven by the rise in iron ore prices. As per November 2016 review by Metalytics Resource Sector Economics, FMG’s productivity and efficiency efforts positioned them to be the lowest cost seaborne supplier of iron ore into China, as compared to peers.

.png)

China’s 2016 Iron Ore Supply CFR Costs (Source: Company Reports)

Completed financing agreement for major ore carriers: The grouphas completed the agreement with the China Development Bank to finance eight of their Very Large Ore Carriers (VLOCs) which are under construction. China Development Bank is financing 85% of the VLOC cost for at least 12 years. With this Chinese financing deal, the group enhanced their debt maturity flexibility and boosted their capital structure. FMG has otherwise also reported about strengthening the balance sheet, and the group repaid US$700 million of debt and controlled their net debt to US$4.2 billion inclusive of US$1.8 billion cash and finance leases of US$0.5 billion as per their September quarter update. Net gearing fell to 33% while gross gearing is forecasted to fall below 40% during fiscal year of 2017. The group’s capital expenditure reached US$1.28 per wet metric tonne (wmt) during the September quarter while the group is targeting a full year sustaining capital to average US$2.00/wmt.

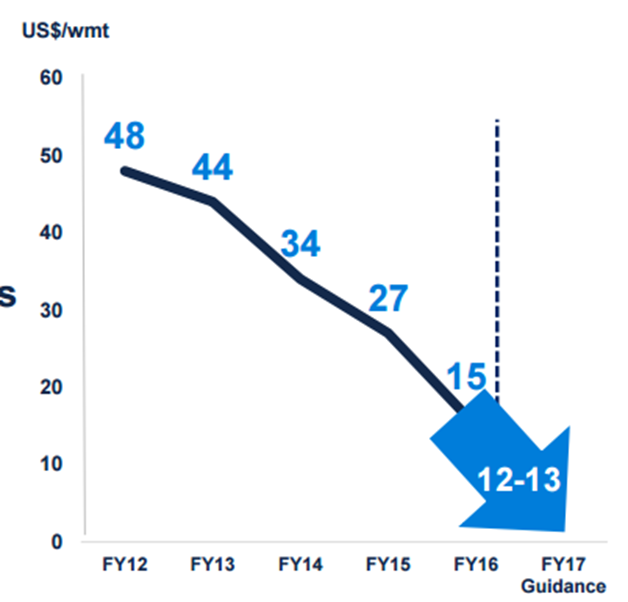

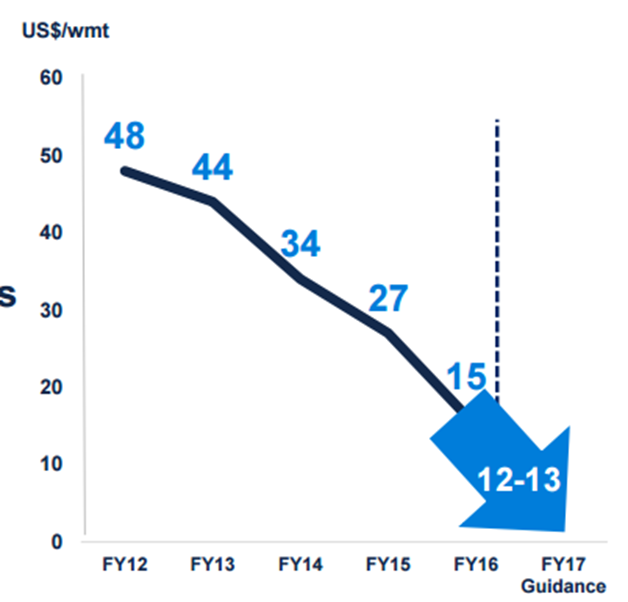

Delivered outstanding bottom line performance: FMG generated a strong fiscal year of 2016 NPAT performance, which rose over 212% year on year (yoy) to US$985 million. Underlying EBITDA enhanced 27% yoy to US$ 3,195 million for the year against the prior corresponding period. But, the group revenues fell over 17% to US$7,083 million for the year. However, FMG shipped 169.4mt during the year at C1 Cost $15.13/wmt, which is a decline of 43%. Moreover, FMG continues to maintain its competitiveness by further declining its C1 Cost to $13.55/wmt based on its recent quarter performance. The group is on track to reach its target of US$12-13/wmt C1 Cost. The group is currently taking up early stage, low cost exploration on copper-gold prospective tenements in New South Wales and assessing high potential, early stage exploration tenements in highly prospective areas of Ecuador.

Ongoing cost improvements (Source: Company Reports)

Higher levels: FMG stock generated an outstanding performance this year to date and rallied over 238.5% (as at 14 December 2016). But, this heavy spurt in the stock price placed them at high levels seen in last five years or so and this came at the back of iron ore price rebound. With some volatility now being seen in iron ore prices, we believe investors can leverage the heavy rise in the stock as a profit booking opportunity. We give a “Sell” recommendation on the stock at the current price of – $ 6.29

.png)

FMG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.PNG)

.png)

.png)

Please wait processing your request...

Please wait processing your request...