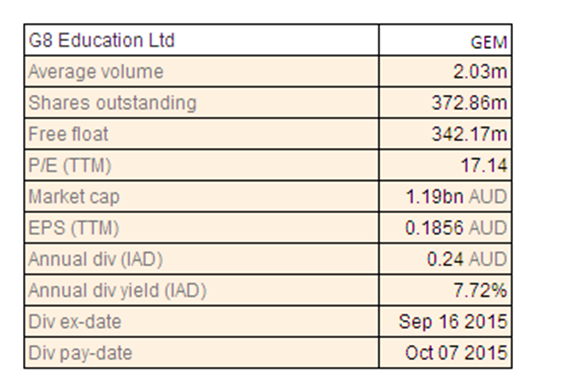

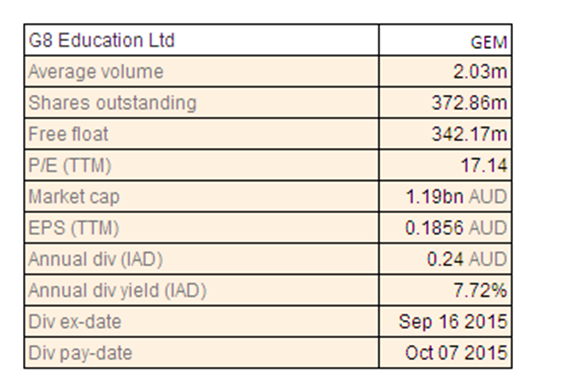

G8 Education Ltd

GEM Dividend Details

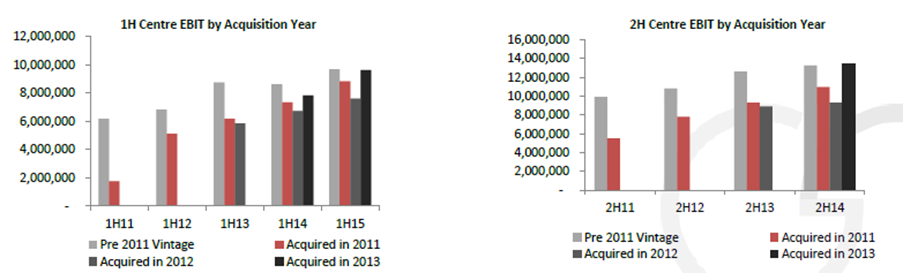

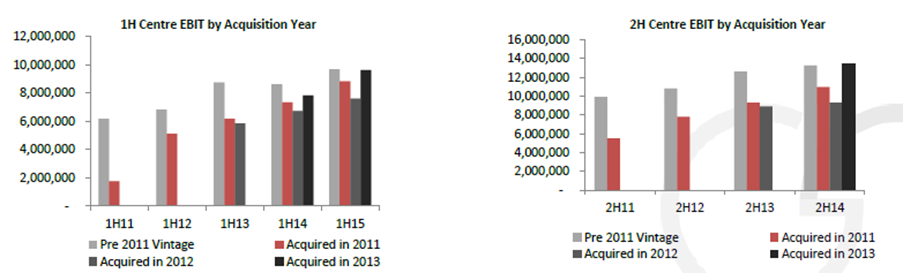

Targeting growth via acquisitions: G8 Education Ltd (ASX: GEM) fell over 25.35% (as of November 03, 2015) during this year to date on investors’ concerns over its Affinity takeover battle and the group’s heavy dependence on acquisitions to achieve growth. GEM was in talks with Affinity for a potential takeover, so that the group could boost its Australian childcare centers. However, the takeover panel ordered GEM to sell off the affinity shares acquired by the group from taxonomy in excess of 20% of the total voting power in Affinity. The panel also issued withdrawal rights to Affinity shareholders who accepted the GEM’s bid. On the other hand, Affinity Education agreed the terms of Anchorage Capital which bid for 92 cents per Affinity security, against the GEM’s recent cash offer of 80 cents for each Affinity share. However, investors need to note that G8 Education Ltd built a strong network of 457 centers in Australia and 18 centers in Singapore, after adding 21 new centers in first half of FY2015. GEM need to settle 17 more centers, and after this GEM expects to have 35,125 licensed places in Australia. G8 Education also delivered solid performance with a 5.6% year on year (yoy) revenue growth (for its 229 centers Like for Like growth) during the first half of fiscal 2015. The group’s underlying EPS soared 60% on a year over year basis during the same period, demonstrating its capabilities of deriving synergies through acquisitions.

Like for Like center EBIT growth for acquisitions by year (Source: Company Reports)

Moreover, to encourage both the parents to work, over $3.5 billion worth of government’s federal budget was allotted to childcare. This move by the government would also boost GEM’s centers’ growth and subsequently drive the group’s price per child revenue. GEM also has an outstanding dividend yield of over 7.55% (which looks sustainable given low finance and regulatory related risks to the company) and is trading at a reasonable valuation with a P/E of 16.93x. We continue to have our bullish stance on the stock and reiterate our BUY recommendation at the current price of $3.29

Vita Group Ltd

.png)

VTG Dividend Details

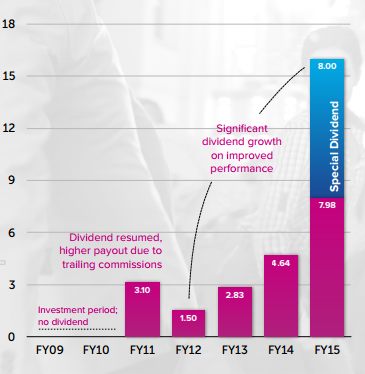

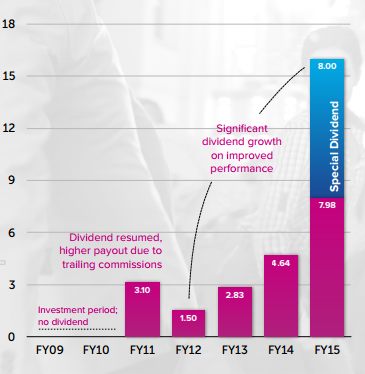

Solid telecom retail growth drove overall performance: Vita Group Limited (ASX: VTG) reported a solid revenue growth of 34% yoy to $601.4 million during fiscal year of 2015, driven by the outstanding telecom retail performance by 43% yoy to $541.5 million. The group investments in the telecom segment paid off with SMB, Enterprise and Sprout improving by 79%, 60% and 77%, respectively, with respect to revenue growth while the like for like stores generated 26% increase. Vita opened 5 Telstra stores and 4TBCs leading to 137 points of presence of its telecom retail in FY15. Meanwhile, Vita reported a 45% yoy increase in its underlying EBITDA to $39.2 million, driven by the group’s cost control efforts in retail. Accordingly, Vita also rewarded shareholders by improving its total ordinary dividend by 72% to 7.98 cents per share in FY15 as compared to 4.64 cents per share in FY14. The group also enhanced its operating cash flows to $35.3 million in FY15 from $17.6 million in FY14.

.png)

Optimizing portfolio to revamp growth (Source: Company Reports)

Stock Outlook: Vita has a history of rewarding shareholders with dividends, but the shares of Vita corrected over 19.53% (as of November 03, 2015) in the last three months, as investors were uncertain over the group’s ability to deliver dividends on the back of uncertain market conditions.

Dividend (Source: Company Reports)

On the other hand, the group reported a solid FY15 performance and even declared additional special dividends of 2 cents per share apart from its earlier special dividends of 6 cents per share. The group even delivered solid operational efficiency during the fiscal year and intends to continue its focus on its physical portfolio optimization. Vita continues to expand its product offerings and will further invest on its people programs. The stock is trading at attractive valuations with a cheaper P/E of 9.94x as well as has a decent dividend yield of 4.61%. Based on the foregoing, we give a BUY recommendation on the stock at the current price of $1.67

Retail Food Group Ltd

.png)

RFG Dividend Details

Targeting international coffee and franchise market penetration via strategic acquisitions to generate growth: Retail Food Group Limited (ASX: RFG) made strategic acquisitions during fiscal year of 2015 to enhance its global presence through Cafe2U which is a mobile coffee van franchise, Gloria Jean’s Coffees Group and Di Bella Coffee. Accordingly, RFG’s domestic brand systems EBITDA surged over 16.6% yoy to $66 million in FY15, while its international brand systems EBITDA delivered outstanding performance during the period rising by 619% yoy (includes coffee & allied beverage sales to brand systems franchisee) to $15.1 million. Coffee wholesale EBITDA surged to $7.7 million during the fiscal year from $0.4 million in FY14. The group now has over 2,500 franchised outlets across the globe. The group’s underlying Net Profit after Tax increase by 49.3% yoy to $55.1m million in FY15 and it further reported an increase of 5.7% yoy of total dividends to 23.25 cps.

.png)

Network highlights (Source: Company Reports)

Stock Outlook: The group is already leveraging its expanded network and launched its Brand Systems in several international markets and even started international distribution hubs and coffee roasting facilities worldwide.

.png)

Dividend, EPS and Payout Ratio (Source: Company Reports)

With the acquisition business contributing over $19.8 million to the RFG’s FY15 underlying EBITDA, the group estimates a better FY16 for acquisition assets which might contribute over $35 million in underlying EBITDA. The shares of RFG generated over 5.88% (As of November 03, 2015) in the last four weeks and we believe that the positive momentum in the stock would continue to grow given its better FY16 outlook and long term potential. The stock also has a decent dividend yield of 4.97%. Accordingly, we give a BUY recommendation on the stock at the current price of $4.65

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...