SEEK Limited

.png)

SEK Details

Stable valuations & growing international business: SEEK Limited (ASX: SEK) recently announced that its New York Stock Exchange listed subsidiary Zhaopin Limited (NYSE: ZPIN) has received a preliminary non-binding proposal from a consortium comprising Sequoia China Investment Management LLP and certain executives of Zhaopin. The proposal to acquire all outstanding Class A ordinary shares and Class B ordinary shares of the company indicates a premium of 12.17% to the volume weighted average price during last 30 trading days and 14.33% premium from last 30 trading days. SEK believes that privatization would allow the company to invest heavily for the future and compete effectively in the fast changing China market without worrying about short term gains. The group also delivered a solid first half 2016 financials, reporting a 22% growth in revenue and 15% growth in EBITDA as compared to same period a year ago. In its recent interim report, the board raised the dividend by 10.5% to 21 cents per share. With earnings growth set to continue, it is likely that the dividend may rise at a steady pace supported by high operating margins and significant cash flows.

.png)

Stable financials (Source: Company reports)

Meanwhile, SEK stock price recorded 18.3% in the last three months (as of May 20, 2016) in the past one month performance. We believe that this performance in the stock would continue in the coming months given its attractive valuations and strong growth in its international market operations. Thus, we recommend investors to "HOLD" the stock at the current stock price of $15.73

SEK Daily Chart (Source: Thomson Reuters)

REA Group Limited

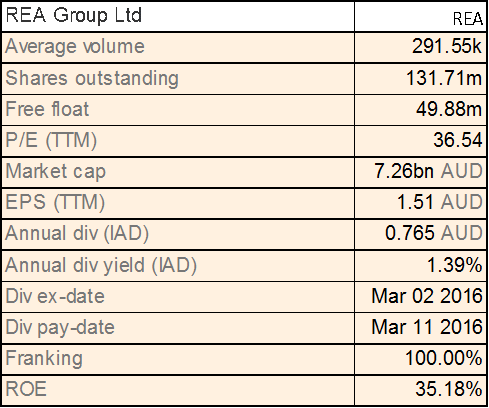

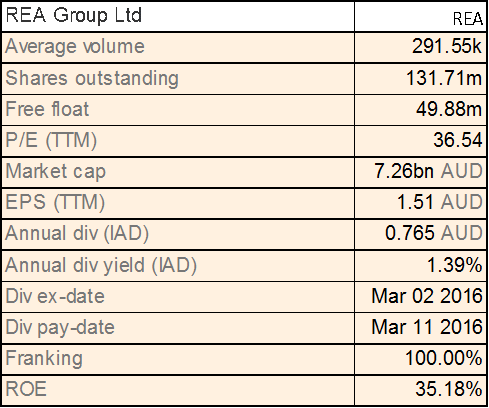

REA Details

Market leading position: For third quarter financial year 2016, REA Group Limited (ASX: REA)continued to deliver solid performance and reported a 20% year-over-year growth in its revenue to $147 million mainly driven by the continued success of product strategy. As a result, the group’s Australian residential depth revenue grew 22% yoy for the same period. Segment EBITDA rose 18% to $77 million while operating expenses were higher by 21% mainly due to marketing spend and strategic initiatives by REA. The company stands cash rich with free cash flow surging by 31% yoy to $41 million. Looking ahead, the company believes that the rate of full year revenue growth will exceed the rate of cost growth. Recently, REA acquired Flatmates.com.au Pty Ltd, the market leader player in share accommodation in Australia, for a purchase consideration of $25 million plus potential earn out payments for next two years depending on financial performance of Flatmates.

.png)

Financial Performance (Source: Company reports)

REA recorded a 6.70% growth in its stock price for the past three months while rose over 0.09% in the last five days alone (as of May 20, 2016). We believe that the company's stock price has more room for growth based on recently reported strong financials coupled with contribution from acquisitions. Based on the foregoing, we give the stock a "HOLD" at the current stock price of $54.79

.PNG)

REA Daily Chart (Source: Thomson Reuters)

Retail Food Group Limited

.png)

RFG Details

Improving consumer confidence to drive growth: Retail Food Group Limited (ASX: RFG)being a master franchisor of brands like Gloria Jean’s, Donut King, and Michel’s Patisserie is likely to be benefitted from consumers being more confident about the economy and spending patterns. Broadly watched Westpac - Melbourne Institute Index of Consumer Sentiment released in this week indicated that consumer confidence soared 8.5% to 103.2 index points in May from April levels, strongest since January 2014. Moreover, for first half financial year 2016, RFG recorded an increase of 27% in its net profit after tax to $32 million led by increase in same-store sales and average transaction value of 1.7% and 3.7%, respectively. The company’s new outlet growth over the first half is significant with 69 domestic outlet commissioned, up 12 on 1H15, and 73 international outlet commissioning representing an increase of 55 above 1H15.

.png)

First half highlights (Source: Company reports)

For the second half of 2016, RFG plans to grow its store network of 2,509 outlets by a further 250 outlets which could well prove to be an attractive return on investment. For FY16, underlying net profit after tax is seen growing 20% from prior year.

The shares of RFG also delivered strong returns since the last three months and rose over 23.3% (as of May 20, 2016). We believe investors should "HOLD" this dividend yield stock at current share price of $5.31

RFG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.png)

.PNG)

.png)

.png)

Please wait processing your request...

Please wait processing your request...