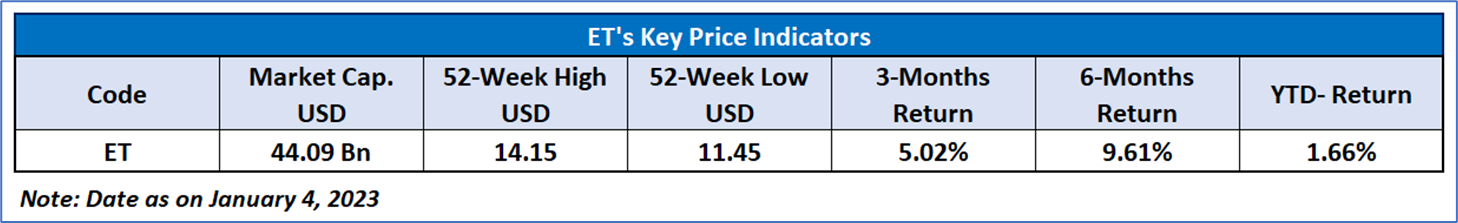

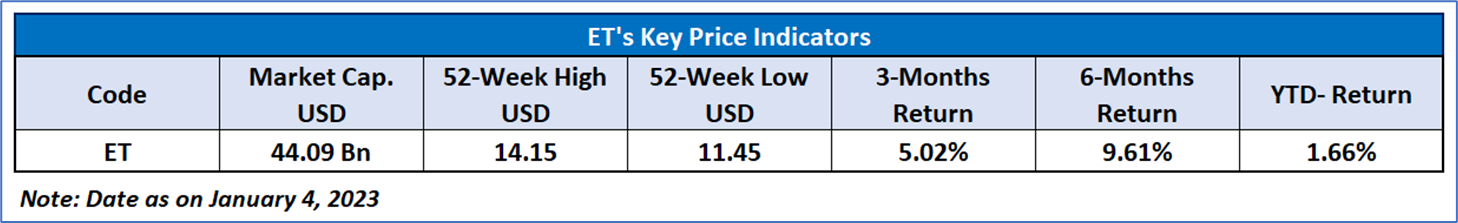

Energy Transfer LP (NYSE: ET)

Energy Transfer LP (NYSE: ET) offers services for the transportation and transmission of natural gas through various segments. These include Intrastate Transportation and Storage, Interstate Transportation and Storage, Midstream, NGL and Refined Products Transportation and Services, Crude Oil Transportation and Services, as well as investments in Sunoco LP and USAC. Additionally, there is a segment labeled "All Other."

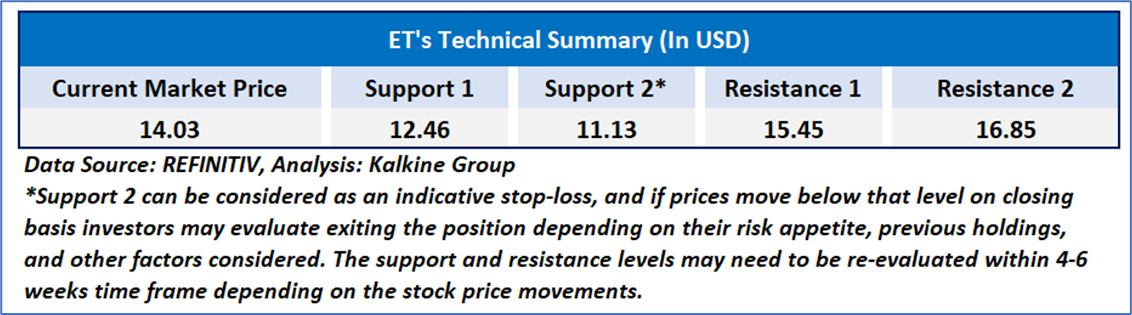

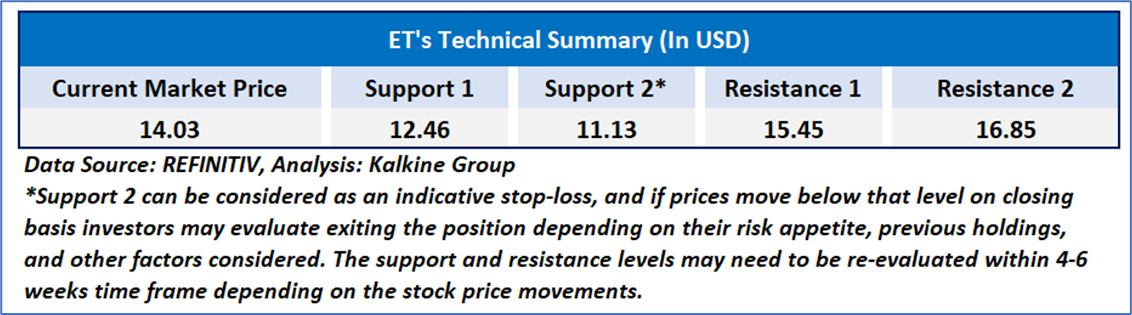

Technical Observation (on the daily chart):

The stock price of Energy Transfer (ET) is encountering resistance at the upper boundary of an ascending channel, signaling the potential for a downward movement. The 14-period Relative Strength Index (RSI) momentum indicator, registering at 64.31, implies a chance of profit-taking and a corrective decline. Nevertheless, the stock price is currently positioned higher than its 21-period and 50-period Simple Moving Averages (SMAs), offering provisional support in the near term.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Energy Transfer LP (NYSE: ET) at its current price of USD 14.03 as of January 4, 2024, 08:35 am PST.

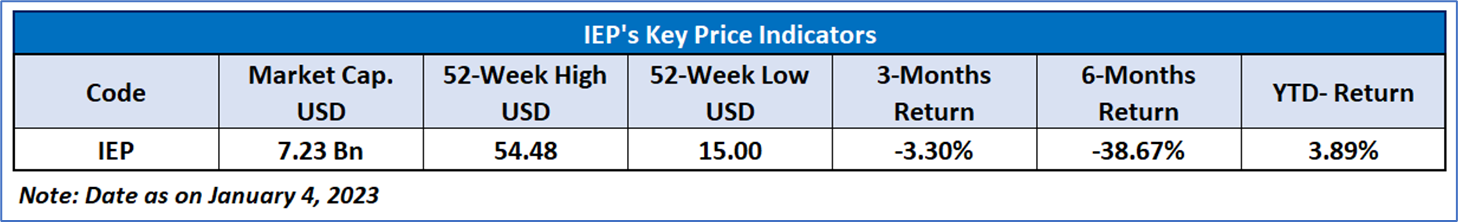

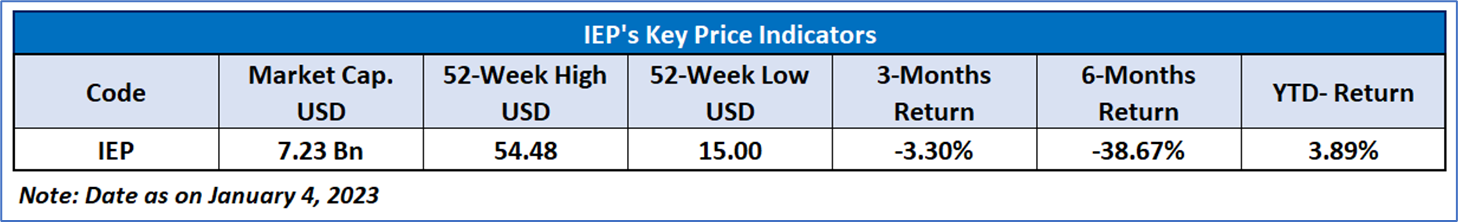

Icahn Enterprises LP (NASDAQ: IEP)

Icahn Enterprises LP (NASDAQ: IEP) functions as a holding company and is divided into eight business segments: Investment, Automotive, Energy, Food Packaging, Metals, Real Estate, Home Fashion, and Pharma.

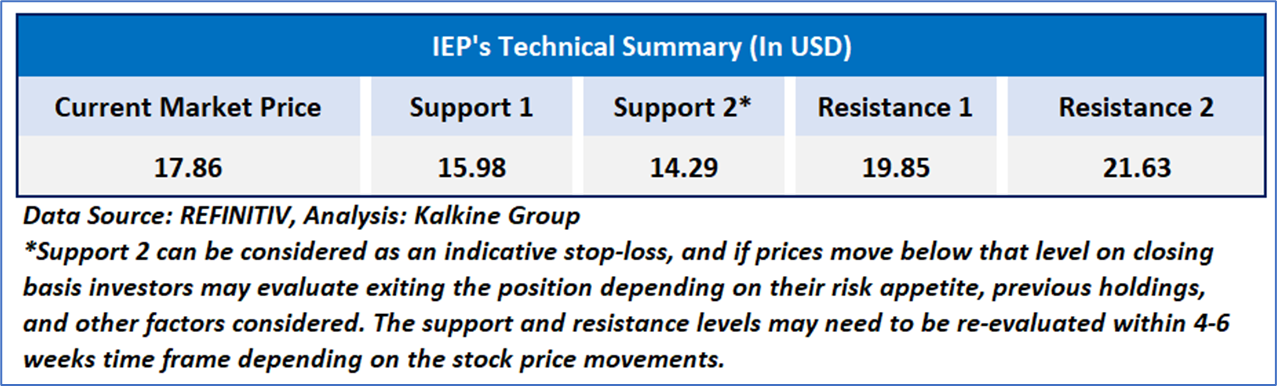

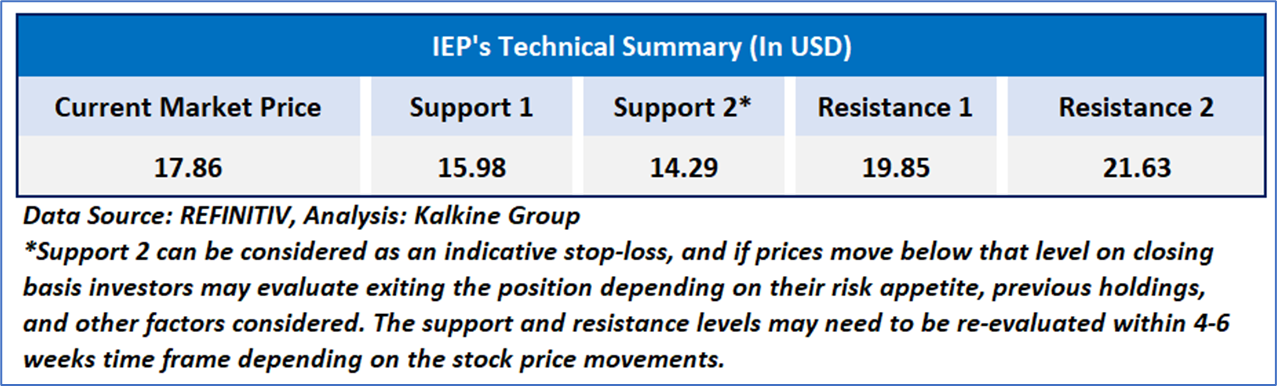

Technical Observation (on the daily chart):

The price of Icahn Enterprises LP (IEP) is meeting resistance at a long-term downward-sloping trendline, indicating the possibility of a downward shift. The 14-period Relative Strength Index (RSI) momentum indicator, with a reading of 60.48, suggests that the RSI has stretched and may be entering a corrective phase. However, despite this, the stock price is presently above its 21-period and 50-period Simple Moving Averages (SMAs), providing temporary support in the short term.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Icahn Enterprises LP at its current price of USD 17.86 as of January 4, 2024, 08:35 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is January 4, 2024, 08:35 am PST. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note: Trading decisions require a thorough analysis by individual. Technical reports in general chart out metrics that may be assessed by individuals before any stock evaluation. The above are illustrative analytical factors used for evaluating stocks; other parameters can be looked at along with additional risks per se. Past performance is neither an indicator nor a guarantee of future performance.

AU

Please wait processing your request...

Please wait processing your request...