Company Overview: Fortescue Limited (ASX: FMG) engages in the exploration, development, production, processing, and sale of copper, gold, and lithium deposits, and rare earth elements, which owns and operates the Chichester Hub and the Solomon Hub mining projects located in the Hamersley ranges of Pilbara, Western Australia. This Report covers the Price Action, Technical Indicators Analysis along with the Support Levels, Resistance Levels, and Recommendations on this stock.

Recent Updates:

Fortescue Ltd. (ASX: FMG), earlier known as Fortescue Metals Group Ltd, changed its name following shareholders' approval in the AGM conducted on 21 November 2023. On 21 November 2023, the company informed that its Board approved a Final Investment Decision (FID) on the Phoenix Hydrogen Hub, USA, the Gladstone PEM50 Project in Queensland, Australia, and a Green Iron Trial Commercial Plant in Western Australia (WA).

In the September quarter, FMG's iron ore shipments totalled 45.9 million tonnes (Mt), 3% lower than the prior corresponding period and in line with Q1 FY22. Its cash balance stood at USD 3.1 bn and net debt was USD 2.2bn at 30 September 2023, after payment of the final dividend of USD 2bn in the quarter. Its guidance for FY24 for total shipments, C1 cost and capital expenditure was unchanged as mentioned below:

- Iron ore shipments of 192 - 197Mt, including approximately 5Mt for Iron Bridge (100% basis).

- C1 cost for Pilbara Hematite of USD 18.00 - USD 19.00/wmt.

- Metals capital expenditure of USD 2.8 - USD 3.2 billion.

In the September quarter, the company achieved a milestone of exporting two billion tonnes of iron ore from Fortescue’s Pilbara Operations since it was established. Also, the company signed a memorandum of understanding with the Puutu Kunti Kurrama and Pinikura (PKKP) Aboriginal Corporation to guide the development of a co-management model.

In FY23, FMG reported a revenue of USD 16,871mn, down 3% over FY22 revenue of USD 17,390, because of lower realised prices. Its underlying net profit declined by 11% annually to USD 5,522mn vs USD 6,197 mn in FY22.

FMG’s Technical Analysis:

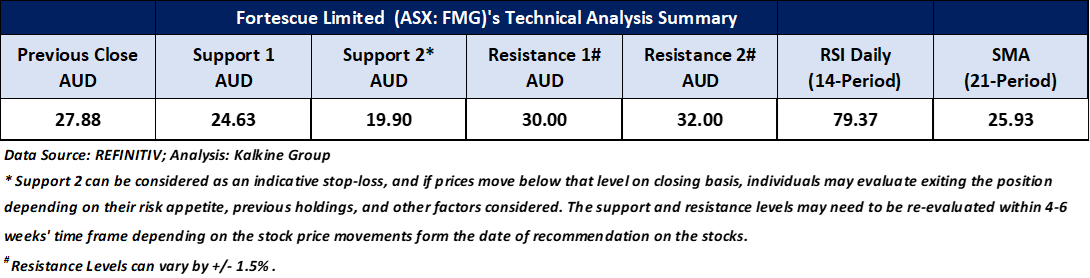

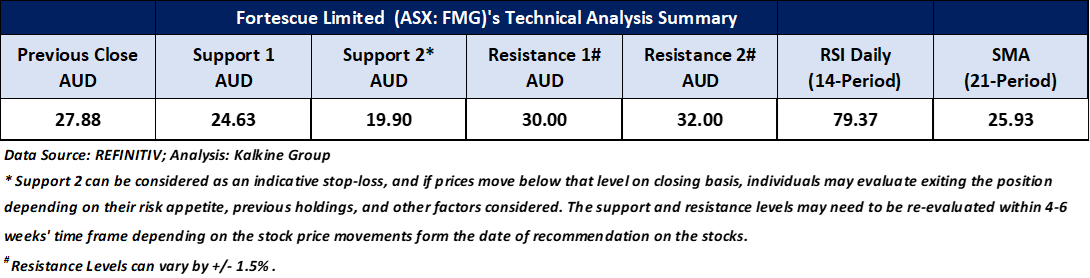

On the daily chart, FMG's stock price is forming an uptrend characterized by higher highs and higher lows, signalling a positive trend. In contrast, the RSI (14-period) is trading deep in its overbought region, anticipating for a potential minor correction. Prices are trading above both the 21-period and 50-day SMAs, which may potentially function as dynamic support levels for the stock; in contrast, the stock’s most recent high might act as a resistance level. Critical support for the stock is positioned at AUD 24.63, while key resistance is placed at AUD 30.00.

Daily Technical Chart – FMG

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest, taking into consideration the risk-reward scenario.

Considering the stock’s current price levels forming higher peaks and higher troughs, and momentum oscillator analysis, a “Watch” recommendation is given on the stock. The stock was analysed as per the closing price of AUD 27.88 per share as on 20 December 2023, down by 0.75%. Fortescue Limited (ASX: FMG) was last covered in a report dated ’05 January 2023’.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: Investment decision should be made depending on an individual’s appetite for upside potential, risks, and any previous holdings. This recommendation is purely based on technical analysis, and fundamental analysis has not been considered in this report.

Note 3: Related Risks: This report may be looked at from high-risk perspective and recommendations are provided are for a short duration. Recommendations provided in this report are solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

The reference date for all price data, currency, technical indicators, support, and resistance levels is December 20, 2023. The reference data in this report has been partly sourced from REFINITIV.

Technical Indicators Defined:

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The Green colour line reflects the 21-period moving average. SMA helps to identify existing price trends. If the prices are trading above the 21-period, prices are currently in a bullish trend (Vice – Versa).

The Blue colour line reflects the 50-period moving average. SMA helps to identify existing price trends. If the prices are trading above the 50-period, prices are currently in a bullish trend (Vice – Versa).

The Orange/ Yellow colour line represents the Trendline.

The Purple colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period), which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status, while a reading of 30 or below suggests an oversold status.

AU

Please wait processing your request...

Please wait processing your request...