KULR Technology Group, Inc. (NYSE: KULR) is an energy management platform focused on developing, manufacturing, and licensing carbon fiber-based thermal management technologies for batteries and electronic systems.

Recent Business and Financial Updates

- Revenue Growth: KULR Technologies reported a revenue of $3.19 million for the third quarter ending September 30, 2024, marking an increase from the $3.04 million reported in the same period of the previous year. This growth reflects the company's continued progress in its core business operations.

- Cash and Accounts Receivable Position: As of September 30, 2024, KULR maintained a combined cash and accounts receivable balance of $3.60 million, ensuring a solid financial foundation as the company continues to expand its business activities.

- Improved Gross Margins: The company achieved a gross margin of 71% in the third quarter of 2024, significantly higher than the 44% gross margin posted during the same period in 2023. This improvement in margin is a result of better cost management and operational efficiencies.

- Reduction in SG&A Expenses: Selling, General, and Administrative (SG&A) expenses decreased substantially, from $4.61 million in Q3 2023 to $2.74 million in the third quarter of 2024. This reduction in SG&A expenses contributed to the company's improved financial performance.

- R&D Expense Reduction: Research and Development (R&D) expenses were reduced to $1.23 million in the third quarter of 2024, down from $1.82 million in the same period of the previous year. This decrease in R&D investment reflects the company's efforts to optimize its spending while maintaining innovation in its technology offerings.

- Operational and Net Loss Improvements: KULR Technologies reported an operating loss of $1.71 million for the third quarter of 2024, a significant improvement from the $5.10 million operating loss in the same period last year. The reduction in operating losses was attributed to the lower SG&A and R&D expenditures. Additionally, the company reported a net loss of $2.00 million, or $0.01 per share, compared to a net loss of $5.56 million, or $0.05 per share, in Q3 2023.

- Management’s Outlook: KULR’s Chief Financial Officer, Shawn Canter, expressed pride in the company’s performance, highlighting the record revenue quarter and the impact of the team’s dedication. Canter also underscored the importance of the newly announced license agreement for KULR Xero Vibe (KXV), which he believes will drive the company’s growth by opening new business opportunities. Furthermore, he emphasized the company’s role in supporting the global aerospace and defense sectors and the growing electrification trends, offering solutions for high-intensity power applications such as AI and cryptocurrency servers.

- Key Corporate Developments: During the third quarter of 2024, KULR secured several important business milestones. The company entered into a landmark licensing agreement for its proprietary vibration reduction technology, KULR Xero Vibe, valued at $2.35 million. This deal includes a $1.1 million minimum guaranteed license and royalty fee, along with further revenue opportunities based on technology upgrades and volume. Additionally, KULR expanded its partnership with the U.S. Army, securing a $2.4 million battery contract, which paves the way for the production of the KULR ONE Guardian Battery in 2025. The company also released an updated investor presentation, providing a comprehensive overview of its financial and operational progress.

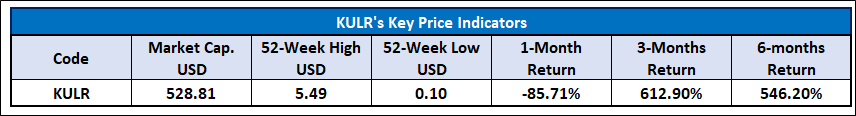

Technical Observation (on the daily chart):

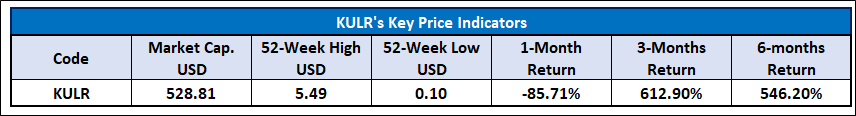

KULR's stock has turned bearish on the daily chart following a significant rally over the past six months, as it has dropped below its 20-Day EMA and is now hovering around the 50-Day EMA. The stock has declined by approximately 43% in the last week, with the 14-Day RSI, a key momentum indicator, sitting in a neutral zone and trending toward oversold conditions. Additionally, the stock has fallen below the 0.382 Fibonacci retracement level. However, the daily chart shows the formation of a dragonfly doji pattern, and the stock is finding support at the 0.236 Fibonacci retracement level.

KULR Technologies has delivered a strong financial performance in Q3 2024, marked by record revenues, improved profitability, and enhanced operational efficiency. The recent licensing deal for KULR Xero Vibe technology and the expanded U.S. Army contract provide a solid foundation for future expansion, particularly in the high-growth sectors of electrification and aerospace. While the stock is currently experiencing a decline, key technical indicators suggest potential support at the 0.236 Fibonacci retracement level, which may stabilize the price. Given the company’s strategic advancements, stock’s recent pullback could offer a potential buying opportunity, especially if it finds support at the 0.236 Fibonacci retracement level.

Considering the company's loss-making profile, recent strategic developments, and the decline below key Fibonacci support levels in KULR's stock, a "Watch" rating has been assigned to KULR Technology Group, Inc. (NYSE: KULR) at the market closing price of USD 2.21 as of January 13, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 13,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...