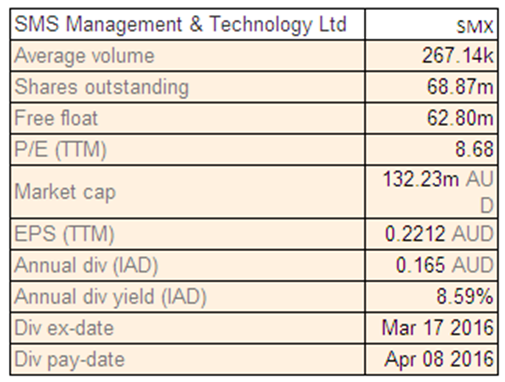

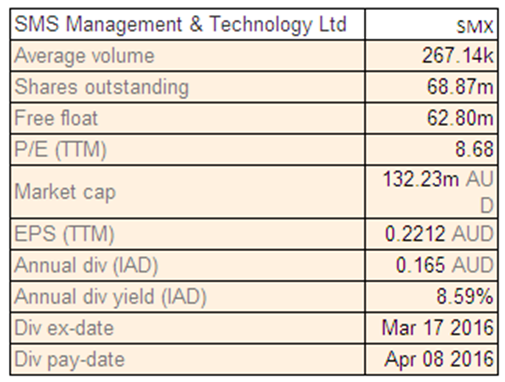

SMS Management & Technology Ltd

SMX Dividend Details

Weak half year performance: SMS Management & Technology Ltd (ASX: SMX) announced weak financial results for the half year ended December 31, 2015 with the company revenues down by 5% at $168.1 million compared to the previous corresponding period. The earnings before interest, tax, depreciation and amortization (EBITDA) stood at $11 million, a significant 19% decrease. The drop in revenues was mainly because of the 10.2% decrease in the SMS Consulting segment revenues which was a result of termination of a large transformation project, delays in managed service engagements and delays with contract finalization during the transition to the new organizational structure.

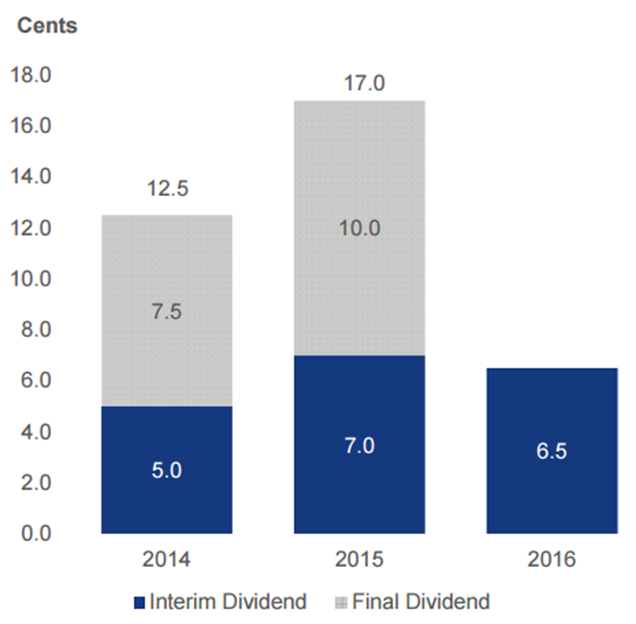

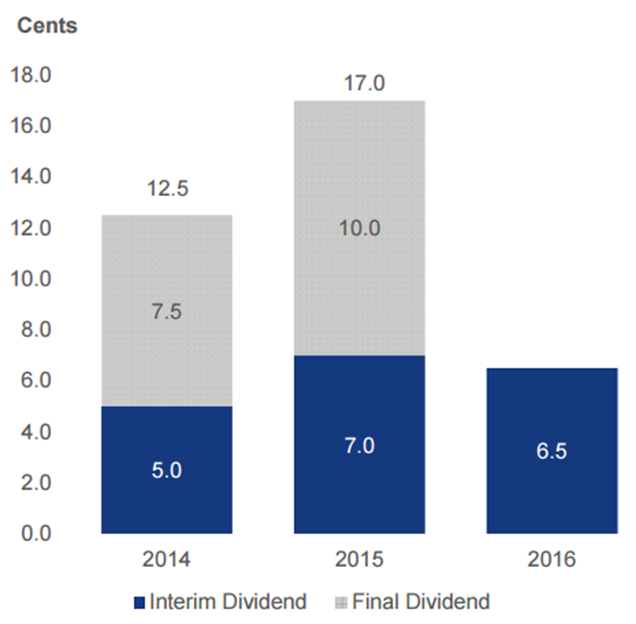

Decrease in dividend (Source: Company Reports)

SMX announced a reduced interim dividend of 6.5 cents per share (cps), down from 7 cps in the previous corresponding period. Therefore, the stock has been down by 16.88% in the previous one month (as of March 17, 2016) mainly because of the bleak financial results and the weak growth prospects of the company in the short term. We believe that the stock is “Expensive” at the current price of $1.87

.PNG)

SMX Daily Chart (Source: Thomson Reuters)

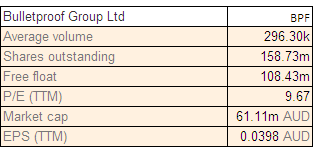

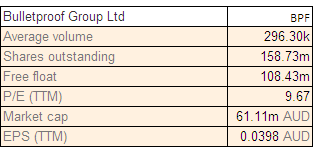

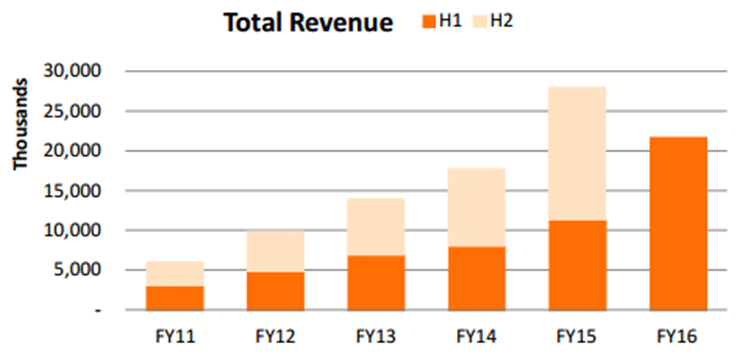

Bulletproof Group Ltd

BPF Details

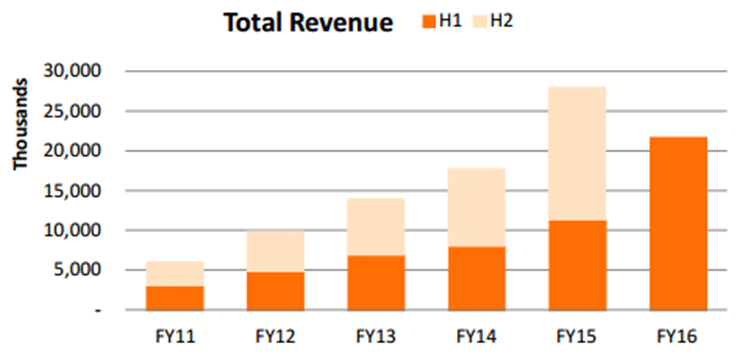

End-to-end services strategy showing results: Bulletproof Group Ltd (ASX: BPF) delivered very strong financial results for the half year ended December 31, 2015 with a 90% increase in revenues to $21.6 million against previous corresponding period. The underlying earnings before interest, tax, depreciation and amortization (EBITDA) was up by 82% and stood at $2.1 million. The company delivered strong growth across all business segments, with a 71.6% growth for Managed Cloud Services, 317% increase for Professional Services and a significant customer and service growth.

Consistent growth in revenues (Source: Company Reports)

The acquisition of Infoplex, which was completed in October 2015, will help BPF grow in corporate and government private cloud offerings. BPF also acquired New Zealand’s (NZ) Cloud House in February 2016, which would provide access to the rapidly growing NZ cloud services market. The correction in the stock by 22.22% (As of March 17, 2016) in the past month placed BPF at low price to earnings ratio (P/E). With the growth of the company expected to be above the market rates of 25-30% compound annual growth rate (CAGR), we recommend a “Speculative Buy” for the stock at the current price level of $0.395

BPF Daily Chart (Source: Thomson Reuters)

Altium Ltd

.png)

ALU Dividend Details

Strong growth across geographies: Altium Ltd (ASX: ALU) announced solid financial results for the six months ended December 31, 2015 with revenues increasing by 13% to about US$42.6 million. The sales to customers grew by a significant 22% while profit after tax (PAT) increased by 35% to reach about US$9.15 million. The revenues in Americas and Europe, the Middle East, Africa and Russia (EMEA) grew by 25% and 18% respectively and were in line with ALU’s pursuit of market leadership in printed circuit board (PCB) software design. In view of growth by acquisitions being one of the focus of the company, it acquired Octopart and Ciiva to bolster its competitive advantage, while it also partnered with Dassault Systemes Solidworks.

.png)

Strong growth across geographies (Source: Company Reports)

ALU certainly looks on-track to reach its goal of $100 million in revenue for 2017. The stock of the company has increased by 14.64% (as of March 17, 2016) in the past three months, in line with the company’s growing prospects. With decent annual dividend yield and a low price to earnings ratio (P/E), we recommend investors to “Hold” the stock at the current price levels of $5.61

ALU Daily Chart (Source: Thomson Reuters)

Migme Limited

.png)

MIG Details

Breakthrough results and key strategic initiatives: Migme Limited (ASX: MIG) announced the issue of 11.65 million ordinary fully paid shares to mobile application developer Meitu Investment Limited, raising $6.99 million in working capital. This will also help MIG to add significant engagement value to its platform since Meitu has over 900 million users across its portfolio of products. In March 2016, MIG also signed with leading entertainment and sports agency Creative Artists Agency to further its artist relationships with a focus on India.

This follows MIG’s partnerships with Sony Music India in July 2015 and creative multichannel network Qyuki in August 2015, clearly with a focus on India. MIG announced financial results for the full year ended December 31, 2015 with revenue increasing by a staggering 525% to $12.2 million and monthly users growing by 220% to 32 million. Active artists and verified users grew to 620, an increase of 313%. The results and recent initiatives show MIG’s focus on building user base, while will help in growing revenues in the coming years. Hence, we recommend a “Buy” on this stock at the current price level of $0.62

MIG Daily Chart (Source: Thomson Reuters)

Melbourne IT Ltd

.png)

MLB Dividend Details

Competitive pressure in core small and medium businesses segment: Melbourne IT Ltd (ASX: MLB) announced its financial results for the year ending 31 December, 2015 with a 21% increase in revenue over previous year to $150.3 million. The earnings before interest, tax, depreciation and amortization (EBITDA) increased by 29% and stood at $16.5 million. The integration of acquired business Uber Global and Outware Systems added scale in the core SMB business and capability in Enterprise services, offsetting the competitive pressure on the organic growth. MLB also announced the acquisition of InfoReady, a leading data and analytics provider for the enterprise and government market, while it sold its International Domain Names Business to Tucows, a domain name registrar and mobile access company. MLB is also raising $15 million of new equity via an underwritten institutional placement.

The stock of the company has gained 46.52% over the previous year (as at March 15, 2016) and is trading at a premium with a high price to earnings ratio (P/E). Despite the strong performance of the company, considering the competitive market scenario and the high price of the stock, we believe the stock is “Expensive” at the current price level of $2.03

MLB Daily Chart (Source: Thomson Reuters)

Ainsworth Game Technology Ltd

.png)

AGI Dividend Details

Impressive growth in Americas: Ainsworth Game Technology Ltd (ASX: AGI) delivered strong financial results for the six months ended December 31, 2015, with revenues of $141.9 million, an increase of almost 27% from the previous corresponding period and profit after tax of $33.1 million. The diversification strategy of the company seems to be paying off, with the international revenues growing by 57% to $91.6 million. The company is coping well with the challenging and competitive domestic market since its offshore sales now constitute 65% of the total revenues. The acquisition of Nova Technologies, which was completed in January 2016, would boost the US market. AGI is opening its new facility in April 2016 in Las Vegas which will further drive performance in the US. AGI also delivered significant growth in Latin America with 64% increase in sales and 115% increase in profitability over the previous corresponding period.

.png)

Strong growth in Americas and Rest of World (Source: Company Reports)

We also note the removal of the stock from the S&P/ASX All Australian 200 Index as per the March quarter announcement by S&P Dow Jones Indices. Despite the news that Chairman Len Ainsworth would be selling his 53% stake in AGI to Novomatic, we believe that the company would continue delivering strong results in the coming months. The stock declined by 18.60% in the past six months (as of March 17, 2016) and is currently at a very attractive price to earnings ratio. Hence, we recommend investors to “Buy” this stock at the current price of $2.25

.PNG)

AGI Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.PNG)

.png)

.png)

.png)

.png)

.png)

.png)

.PNG)

Please wait processing your request...

Please wait processing your request...