G8 Education Ltd

.png)

GEM Details

Solid track record: G8 Education Ltd (ASX: GEM) intends to continue to expand their business via acquisitions, and accordingly, intends to acquire firms in the range of $50 million and $150 million while maintaining the net debt to EBITDA at or under 2x. The company expects to have net debt to EBITDA to be 2.1x at December 31, 2016. Moreover, GEM is continually investing in its facilities to provide the tools for its educators for quality education. GEM added 44 new centers and has 13,697 licensed places in 2015. The firm has 471 centers in Australia and 18 centers in Singapore leading to over 35,221 licensed places as of December 31

st, 2015.

.png)

G8 Education’s market share (Source: Company Reports)

Meanwhile, GEM stock rose over 9.37% in last six months (as of August 03, 2016), and still generates a good dividend yield. We maintain a “Buy” recommendation on the stock at the current price of $3.63

.PNG)

GEM Daily Chart (Source: Thomson Reuters)

Mortgage Choice Limited

.png)

MOC Details

Strong revenue growth in FP Division: Mortgage Choice Limited’s (ASX: MOC) Financial Planning (FP) division had delivered its first profitable monthly result in February 2016.

.png)

Division performance (Source: Company Reports)

Moreover, MOC Financial Planning division has reported revenue growth of 63% in the 1H 2016 as compared to 1H 2015. Recently, the group clarified the ASX price query raised on them. MOC stock has risen 26.19% in the last three months (as at August 03, 2016). We give a “Hold” recommendation on the stock at the current price of $2.14

MOC Daily Chart (Source: Thomson Reuters)

Collection House Limited

.png)

CLH Details

Recovering sentiment on the stock: Collection House Limited (ASX: CLH) surged over 21.1% in the last four weeks (as of August 03, 2016) due to recovering hopes on the stock. CLH has sustained the improvement in Purchased Debt Ledger (PDL) collections in the March quarter 2016. Investors have also been positive on their new Chief Executive Officer, Anthony Rivas who is an experienced credit and collections senior executive.

For FY 17, CLH is expecting Collection Services business to generate $4 - $5 million in revenue. Additionally, CLH has rebranded financial brokerage “Cashflow Financial Advantage” under the consumer brand “ThinkMe” that has been launched to the external market in mid-2016. We give a “Speculative Buy” recommendation on the stock at the current price of $1.375

CLH Daily Chart (Source: Thomson Reuters)

Dicker Data Limited

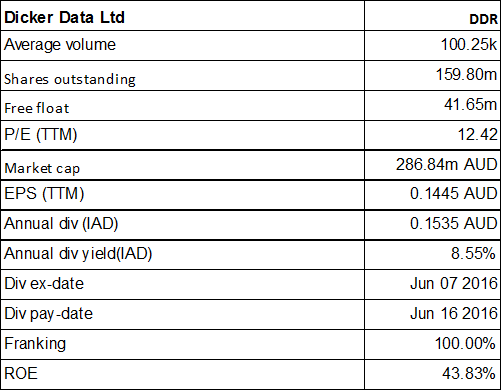

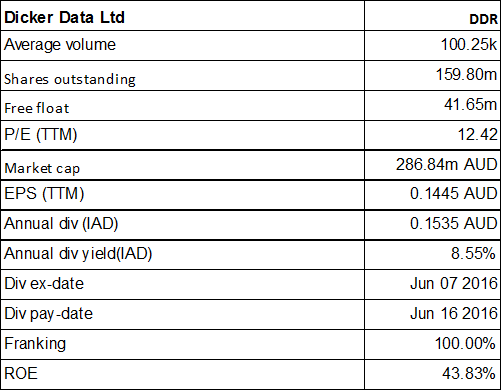

DDR Details

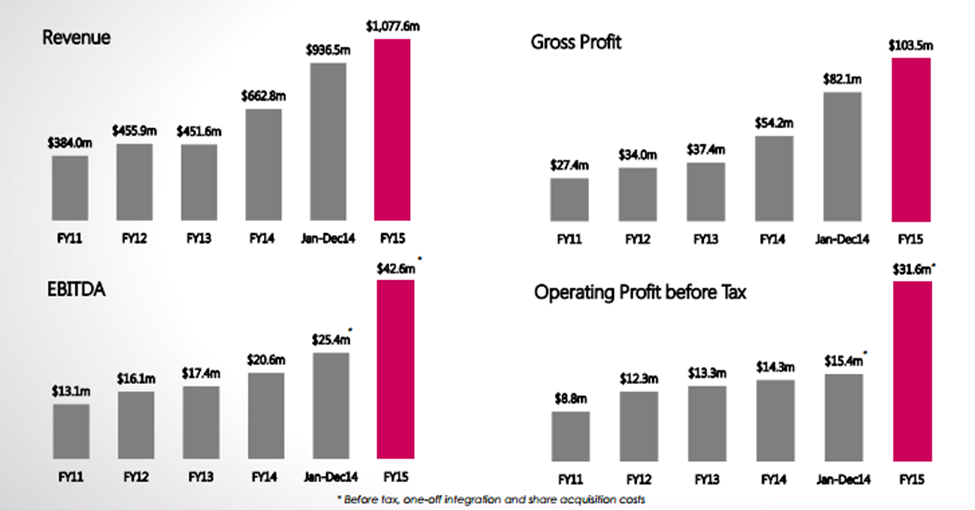

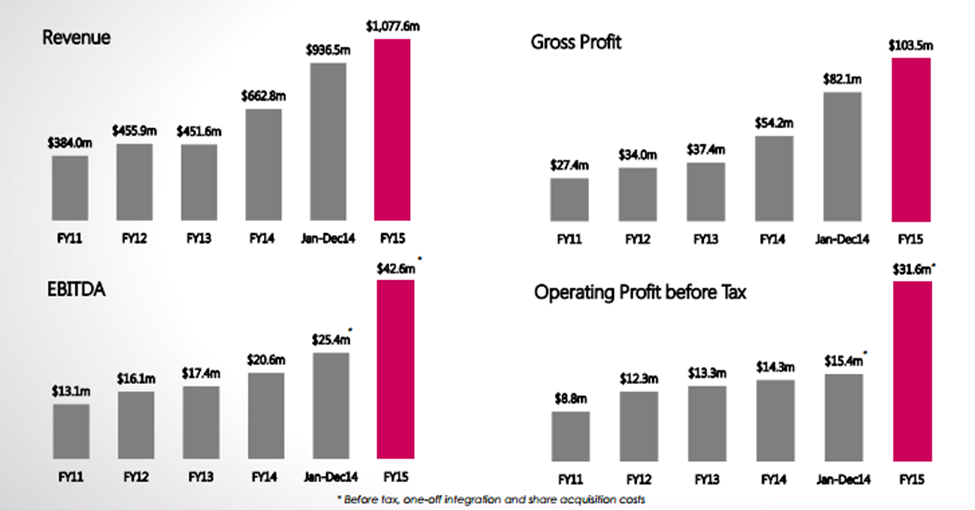

Enhanced distribution capacity and product expansion: Dicker Data Ltd (ASX: DDR) has been appointed as distributer of Logitech commercial and gaming products effective August 02, 2016. The company is expanding its products and recently extended its agreement with ShoreTel to launch ShoreTel Hosted Voice in Australia. The group is also launching an automated subscription-based Autodesk product through their cloud platform, CloudPortal which would help in managing the overall increase in order volume and help in the transition to term based offerings.

Solid FY15 results (Source: Company Reports)

On the other side, the stock has risen over 19.67% in the last six months (as of August 03, 2016). The stock generates an outstanding dividend yield and is trading at a reasonable P/E. We give a “Buy” recommendation on the stock at the current price of $1.785

DDR Daily Chart (Source: Thomson Reuters)

Thorn Group Ltd

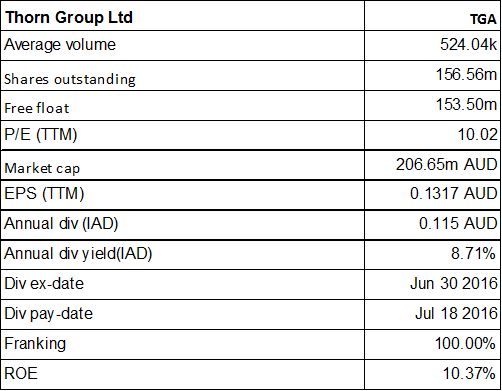

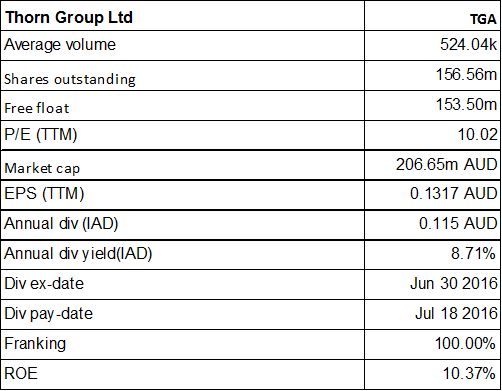

TGA Details

Solid performance by business finance: Thorn Group Ltd (ASX: TGA) stock has fallen 27.07% in the six months (as of August 03, 2016) as the group’s Radio Rentals division was affected in FY16. However, overall revenue was up 3.5% and underlying profit after tax is steady at $30.3 million. Rising regulatory requirements led to higher costs from more extensive credit qualification assessments. National Credit Management Ltd. (NCML) revenue fell 21.7% to $14.7 million on the back of changing business practices with some long standing clients. Overall, TGA’s significant one-off items totaled $10.3 million after tax in 2016 due to the closure of the TFS Consumer Loan business, write off of the NCML goodwill and the provisioning for historic customer credit refunds in Consumer Leasing. The business finance doubled in revenue (from $15m to $30.5m) and earnings (to $14m).

The heavy correction in the stock placed them at cheap valuations with the stock trading at a reasonable P/E. The stock could recover in the coming months and we give a “Speculative Buy” recommendation on the stock at the current price of $1.30

TGA Daily Chart (Source: Thomson Reuters)

Seymour Whyte Ltd

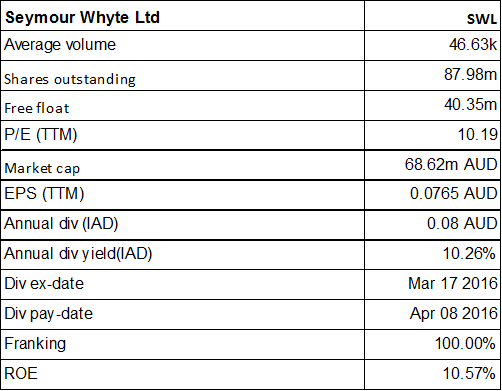

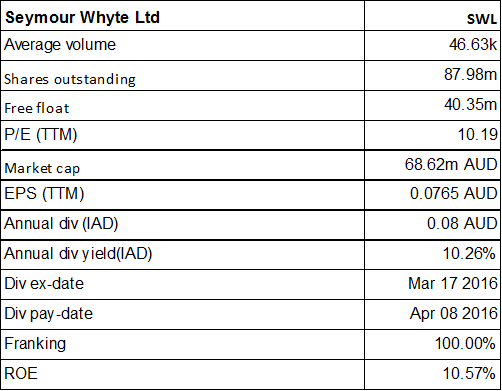

SWL Details

Increase in order book: Seymour Whyte Ltd (ASX: SWL) has been awarded a $63 million contract to deliver early works for the Woolgoolga to Ballina (W2B) Pacific Highway upgrade in northern New South Wales. Moreover, SWL has recently got contracts for two airport sector projects awarded by new client Brisbane Airport Corporation and current client Sydney Airport Corporation Limited. SWL received order for Peak Downs Highway Timber Bridge Replacement Project in central Queensland, the two utility infrastructure projects in Western Australia that require specialist conventional and trenchless civil works and Townsville Northern Access Intersection Upgrade Project in north Queensland.

Therefore, SWL has total new contracts of $119 million which increased the group’s order book to $465 million. We give a “Speculative Buy” recommendation on the stock at the current price of $0.77

SWL Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.PNG)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...