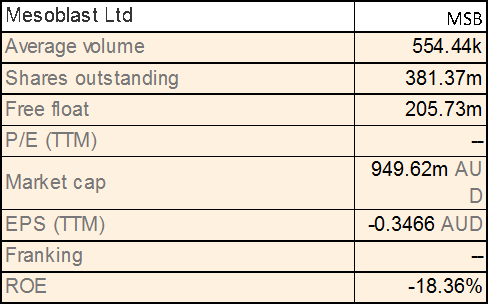

Mesoblast Ltd

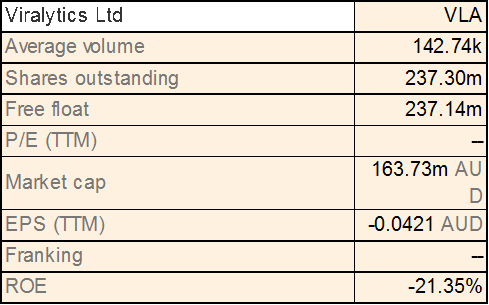

MSB Details

Successful clinical trial and new launches to drive growth:Mesoblast Ltd (ASX: MSB) recently finished its clinical phase 2 trial on knee osteoarthritis disease, which would enable it to address US market. Additionally, the United States Patent and Trademark Office has granted a key patent covering the use of the MSB’s proprietary Mesenchymal Precursor Cells (MPCs) for the treatment or prevention of a broad range of rheumatic conditions, including rheumatoid arthritis. MSB’s licensee in Japan, JCR Pharmaceuticals Co. Ltd., had launched its mesenchymal stem cell product TEMCELL for the treatment of acute graft versus host disease in children and adults in Japan. Under its agreement with JCR, Mesoblast is entitled to receive royalties and other payments at predefined thresholds of cumulative net sales. Mesoblast has more than 661 patents across at least 72 patent families, which provide substantial competitive advantages for the commercial development of cell-based therapeutic products using mesenchymal lineage cells.

Although the stock has fallen 4.21% in the last five days (as at April 19, 2016) at the back of the news on release of 15,298,837 shares from voluntary escrow in May 2016, the solid development pipeline aims to have a positive impact on earnings growth going forward. Accordingly, we recommend a “Buy” at the current market price of $2.35

.PNG)

MSB Daily Chart (Source: Thomson Reuters)

Sirtex Medical Ltd

.png)

SRX Details

Adding value and growth: Sirtex Medical Ltd (ASX: SRX) reported 40% growth in revenues to $112.6 million on the back of 15.7% rise in dose sales for H1FY16. Net profit was at $25.9 million, up 46.9%. The company’s growth drivers are maximizing the value of its products, increase spend on R&D to bring new platform technologies with multiple applications and merger and acquisition to acquire commercial ready technologies to add value and grow business. The company has also received positive endorsement for primary liver cancer from NICE for its Y-90 resin microspheres.

.png)

First half of 2016 performance (Source: Company reports)

This has opened the door for UK HCC patients to have access to SIR-Spheres Y-90 resin microspheres as a well-tolerated alternative to other standard therapies.

The company has completed patient recruitment for RESIRT study on SIR-Spheres Y-90 resin microspheres for the treatment of primary renal cell carcinoma. Going forward, we believe that the group’s penetrating market coupled with impressive financials would drive the stock. Accordingly, we give the stock a “Buy” at the current price of $30.75

.PNG)

SRX Daily Chart (Source: Thomson Reuters)

Prana Biotechnology Ltd

.png)

PBT Details

Clinical trials updates: Prana Biotechnology Ltd (ASX: PBT) recently announced for regaining compliance with NASDAQ Listing requirements. On the other hand, PBT’s revenue decreased to $77,328 for the first half of 2016 against $92,581 in H1FY15 due to the decrease in amounts of cash being carried in interest bearing accounts. It has incurred a loss of $2.85 million as compared to $1.25 during the period on the back of decreased gain on foreign exchange, and a decrease in other income related to the R&D Tax Incentive. PBT was also removed from all Ordinaries index during March 2016 quarterly rebalance.

On the other hand, the US Food and Drug Administration (FDA) had placed its PBT2 on Partial Clinical Hold which limit the dose of PBT2 to be used in future trials. The phase I clinical trial of PBT434 is also under way. The key driver would be a successful completion of clinical trials and approval from the US FDA. Based on the foregoing, we recommend the stock as “Speculative Buy” at the current price of $0.076

PBT Daily Chart (Source: Thomson Reuters)

Starpharma Holdings Ltd

.png)

SPL Details

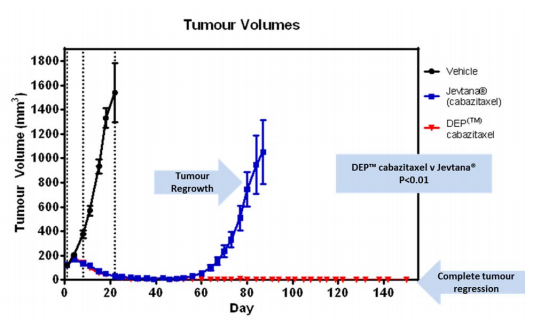

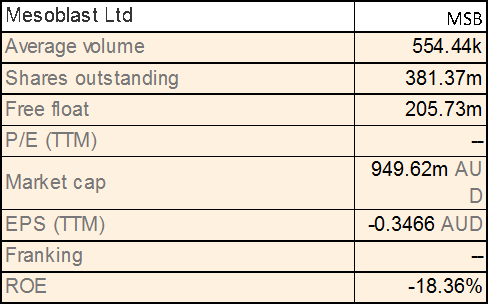

Product development and marketing tie-ups: Starpharma Holding Ltd (ASX: SPL) announced results for its most recent DEP™ candidate, DEP™ cabazitaxel used in human breast cancer model. It had also announced the licensing by Adama of Starpharma's Priostar® dendrimer technology for development and commercialization of an enhanced, proprietary 2, 4-D herbicide for the US market. Under the license, Starpharma would get royalties on sales and agreement to expand license into additional territories.

Efficacy of DEP™ candidate (Source: Company reports)

The group also made a License and Supply Agreement with Aspen Pharmacare Australia Pty Ltd for the sales and marketing of VivaGel® BV in Australia and New Zealand. It had also signed multiproduct drug delivery license with AstraZeneca with potential milestones payments of up to US$126M, plus royalties. Starpharma Holdings even signed MoU to manufacture and sell the VivaGel® condom targeting the Chinese Government sector. Furthermore, US patent is granted for VivaGel® BV with 7-year extension of term.

Meanwhile, for H1FY16, the company reported revenues of $3.7 million against $0.7 million in H1FY15. Given a strong product pipeline and 7.94% surge in stock price in the last three months (as at April 19, 2016), we believe the stock is a “Speculative Buy” at the current market price of $0.67

SPL Daily Chart (Source: Thomson Reuters)

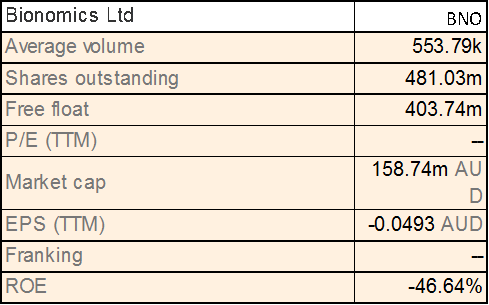

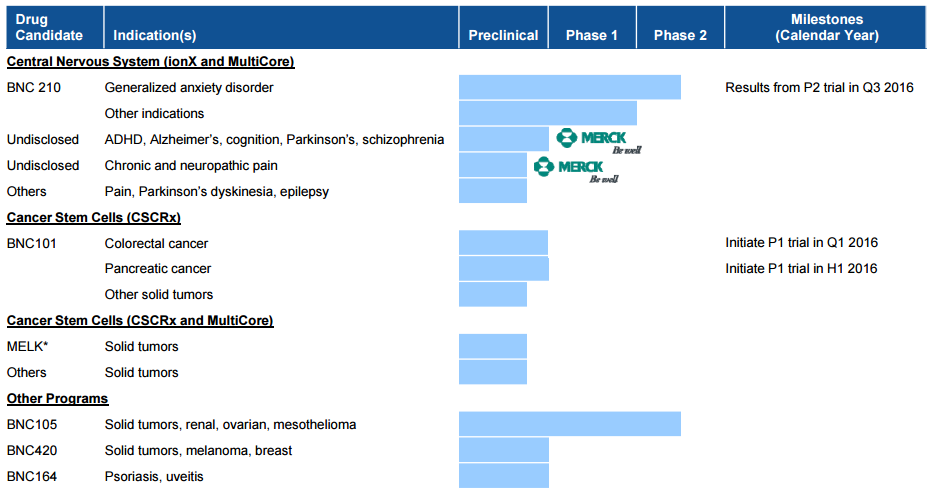

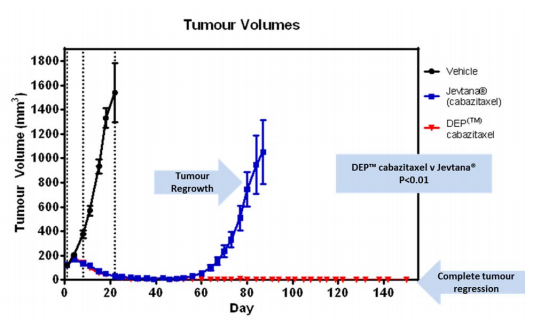

Bionomics Ltd

BNO Details

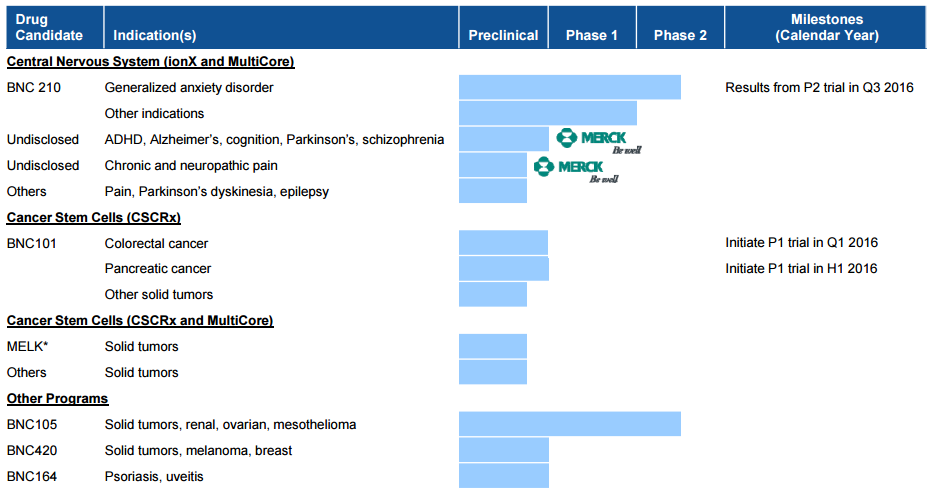

Strong revenues performance:Bionomics Limited (ASX: BNO) reported revenues of $10.21 million for first half of 2016 as compared with $7.32 million in the prior corresponding period (pcp) but reported a loss $9.69 million against $5.68 million in pcp. Accordingly, the group’s stock fell over 36.54% in the last six months (as of April 19, 2016). On the other hand, the group has a strong balance sheet with cash at the end of the half-year being $51.41 million. Meanwhile, the group had initiated Phase I clinical study for its anti-cancer stem cell drug candidate - BNC101. Merck & Co has invested US$9 million and have two partnerships focused on the development of new treatments for pain and cognitive impairment. The partnerships have validated Bionomics’ platform technologies for drug discovery. With the robust pipeline, major validating partnerships with Merck & Co, and clinical progress across key programs we believe that the stock has the potential to rise.

Drug Pipeline (Source: Company Reports)

BNO surged 1.515% on April 19, 2016 at the back of the release of new pre-clinical and clinical data from studies of vascular disrupting agent BNC105 developed for the treatment of solid cancers. Given the above, we put a “Speculative Buy” recommendation on the stock at the current price of $0.335

BNO Daily Chart (Source: Thomson Reuters)

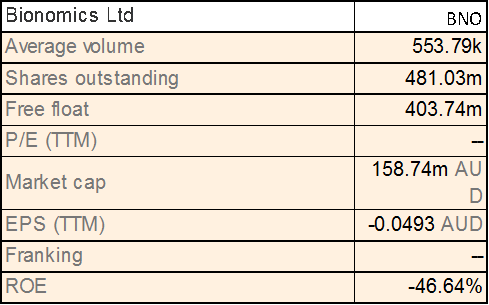

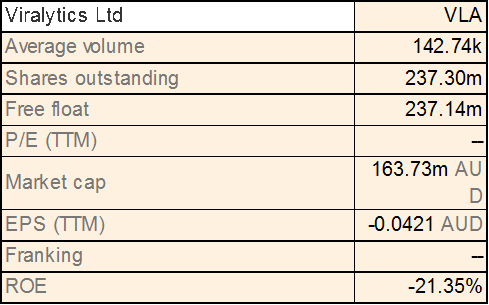

Viralytics Ltd

VLA Details

Fund raising to advance clinical programme: Viralytics Limited (ASX: VLA) recently presented positive initial data for its ongoing clinical trials on CAVATAK with checkpoint inhibitor YERVOY® in late stage melanoma patients. CAVATAK has also indicated anti-cancer immune activity increase as per CALM extension study. Accordingly, the stock surged 17.4% on April 19, 2016. VLA had some time back announced for positive data from the CANON1 clinical trial of its lead drug candidate, CAVATAK and entered into collaborative agreement with subsidiaries of Merck & Co to conduct a clinical trial focused on the combination of CAVATAK with MSD’s KEYTRUDA. During December, the company also raised $28 million through placement. It further raised $4 million via Share purchase plan. This $32 million would be invested towards more rapid advancement of the clinical program.

It further received $2.9 million towards R&D Tax Incentive Programme which would be used for advancing the clinical trial programme in the US and UK assessing CAVATAK. For H1FY16, company reported revenue of $0.21 million and loss of $6.1 million. The success of its lead drug Cavatek is the growth trigger for the company’s future outlook. We believe that the stock is a “Speculative Buy” at the current price of $0.81

VLA Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

AU

.PNG)

.png)

.png)

.PNG)

.png)

.png)

Please wait processing your request...

Please wait processing your request...