National Storage REIT

.png)

NSR Details

Boosting capital position:National Storage REIT (ASX: NSR) is buying 29 properties in six states for a total sum of $190 million. It has further agreed to acquire 30 facilities in multiple deals for a combined $301 million. The primary purchase is the Southern Cross portfolio of 26 storage facilities, which it manages and partly owns through a joint venture with Heitman, in a $285 million deal. The transactions will be funded through a combination of debt and $260 million in equity raising. NSR will raise $101 million through an institutional placement of new, stapled securities and $159 million via entitlement offer. In all, 63.6 million new shares are being offered at $1.58 each. The entitlement offer also lists shares at $1.58 each. Meanwhile, the acquisition would expand NSR’s portfolio to 523000 square meters and 56000 units in Australia and New Zealand.

The company continues to maintain a strong pipeline of potential acquisitions with over $100 million of assets and advance negotiation of $30 million is underway. Trading at a strong dividend yield, the stock has generated 5.25% return this year to date (as of August 16, 2016). We rate the stock as “Speculative Buy” at the current price of $1.60

NSRDaily Chart (Source: Thomson Reuters)

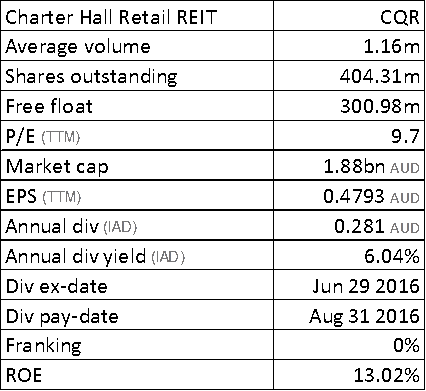

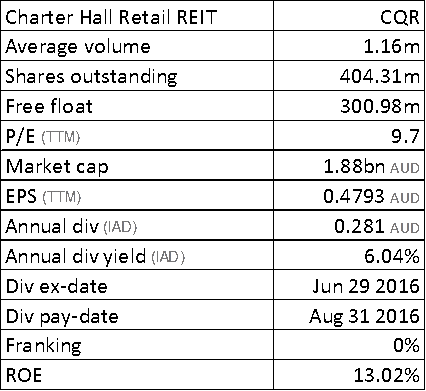

Charter Hall Retail REIT

CQR Details

Enhancing balance sheet flexibility:Charter Hall Retail REIT (ASX: CQR) has bought the Coles distribution center in Melbourne for just over $100 million. The company aims to grow its long WALE (weighted average Lease Expiry) and focus on high quality assets with strong tenant covenants. The company plans to list a Charter Hall Long Wale REIT with a portfolio size of $1 billion plus with an average lease term exceeding 12 years. For March quarter 2016, the occupancy rate was 98.3%. The company sold two non-core properties for $20.3 million in Western Australia and the funds would be used to pay down the REIT’s revolving bank debt facility.

The stock has generated 14.25% return over a period of one year (as of August 16, 2016) and has a decent dividend yield. The company is paying final dividend on August 31, 2016. We recommend investors to “Hold” the stock at the current price of $4.61

CQRDaily Chart (Source: Thomson Reuters)

Scentre Group

.png)

SCGDetails

Business expansion efforts:Scentre Group (ASX: SCG) announced that it has purchased the David Jones Market Street building at Sydney jointly with Cbus Property for $360 million. SCG’s share in purchase is $182.5 million while Cbus will have $177.5 million. David Jones would continue to occupy the site till late 2019 under a lease agreement and during the lease back period, the co-owners will obtain the necessary approvals to redevelop the site when David Jones vacate the property. On completion, the redeveloped 77 Market street site will comprise approx. 10,000 sq meters of luxury retail space integrated with Westfield Sydney. For March quarter, SCG’s retail sales were up 4.5% in Australia to $10,905 psm and 6.3% in New Zealand to NZ$12,257 psm while company’s portfolio is >99.5% leased. SCG also began developments at Westfield Chemside and Westfield North Lakes with combined value of $495million (SCG share $ 425 million).

.png)

Projects’ highlights (Source: Company Reports)

The company is paying interim dividends on August 31, 2016 and has redeemed $0.6bn of $1.2bn Property Linked Notes recently. We recommend a “Hold” on the stock at the current price of $5.06

SCG Daily Chart (Source: Thomson Reuters)

Stockland Corporation Ltd

.png)

SGPDetails

Growth in FFO: Stockland Corporation Ltd (ASX: SGP) posted a $889 million of FY16 profit with a 1.6% drop over FY15. This decent result was driven at the back of record property settlements. On the other hand, Funds from Operations (FFO) grew 12.5% while FFO per security witnessed 11.1% growth. The company maintained strong balance sheet.

.png)

Result Highlights (Source: Company Reports)

SGP had recently secured new long-dated US private placement (USPP) loan worth $398 million to be used in three tranches in US Dollars of 10, 12, and 15 years totaling US$265 million and a 12 year $50 million tranche in Australian Dollar. The company has also acquired remaining 50% stake in Stockland Bundaberg for $61.5 million in April 2016. The company will pay dividends on August 31, 2016. We give a “Hold” on the stock at the current market price of $4.87

SGPDaily Chart (Source: Thomson Reuters)

Arena REIT No. 1

.png)

ARFDetails

Organic growth plus diversification of income sources: Arena REIT No. 1 (ASX: ARF) have revalued its healthcare and childcare portfolio for FY16 and the revaluation uplift to the value of investment properties was $50.7 million as on June 30, 2016. The group declared interim dividend of 2.775 cents and upgraded the dividend guidance to 10.9 cents per share. The Group has an agreement with State of Victoria to construct six ELCs at a net cost of $15 million.

.png)

Property related details (Source: Company Reports)

By FY17, the group would complete five more project developments of the total pipeline of 15 projects of approximately $ 60 million and one in FY18. The yield on cost for two completed developments is 9.2%. The group has also sold two vacant properties at book value.

Portfolio occupancy is at 100%. ARF has RoE of 26.6% for H1FY16 and the stock is trending upward and have generated returns of 37.58% over a period of one year (as of August 16, 2016). We recommend investors to “Hold” the stock at the current market price of $2.19, ahead of its FY16 annual results due on August 25, 2016.

ARF Daily Chart (Source: Thomson Reuters)

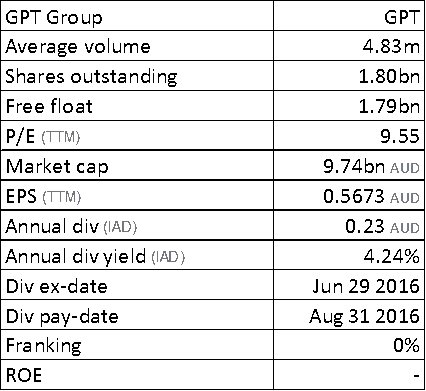

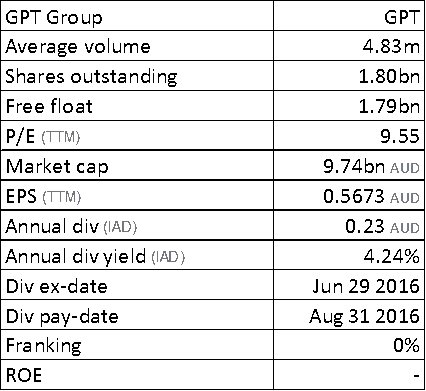

GPT Group

GPTDetails

Robust Interim result: GPT Group (ASX: GPT) reported 1HFY16 NPAT growth of 39% to $586.4m and 6.1% growth in FFO per security. GPT with Frasers Property Australia is seeking to sell their jointly owned Southbank tower, Melbourne for ~$300 million. GPT holds 50% stake bought at $115 million. Meanwhile, GPT has entered into a facilitation and property right deed with Centuria Capital Ltd in June 2016 and with Growthpoint Properties Australia in July 2016 which restricts GPT Management from encouraging competing parties.

Moreover, GPT also sold 12.98% stake in GPT Metro Office Fund to Growthpoint Properties Australia for $2.45 per unit. The stock is gradually nearing its 52-week high price with about 8.18% rise in six months (as at August 16, 2016). We give an “Expensive” recommendation on this dividend yield stock at the current market price of $5.44

GPT Daily Chart (Source: Thomson Reuters)

Viva Energy REIT

Interest swap agreement: Viva Energy REIT Ltd (ASX: VVR) has entered into interest rate swap agreements with its lending syndicate for all of its initial debt of $736.7 million. Furthermore, Viva Energy is the exclusive licensee for shell products in Australia and Viva Energy REIT owns 425 service stations which it would lease to Viva Energy.

But this could be a risk to the group also if the Viva Energy business is challenging given the volatile commodity markets. Even though, Viva Energy REIT is expected to earn revenues of $155 million and profit of $118 million for FY17, the stock seems to be “Expensive” at the current price of $2.56

VVRDaily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...